by Calculated Risk on 3/12/2011 07:48:00 PM

Saturday, March 12, 2011

Japan Update

From the NY Times: Japan Pushes to Rescue Survivors as Quake Toll Rises

Entire villages in parts of Japan’s northern Pacific coast have vanished under a wall of water, many communities are cut off, and a nuclear emergency was unfolding at two stricken reactors as Japanese tried to absorb the scale of the destruction after Friday’s powerful earthquake and devastating tsunami.Earlier on U.S. economy: Summary for Week ending March 11th

... Much of the northeast was impassable, and by late Saturday rescuers had not arrived in the worst-hit areas. ... More than 300,000 people have been evacuated, including tens of thousands fleeing the zone around the nuclear plants in Fukushima Prefecture even before news that problems at one plant appeared to be escalating quickly.

Summary for Week ending March 11th

by Calculated Risk on 3/12/2011 11:21:00 AM

My thoughts are with the Japanese today.

There are several downside risks for the U.S. economy including high oil prices and the possibility of a supply disruption, spillover from the European financial crisis, cutbacks at the state and local government level, drag from Federal government fiscal policy, ongoing housing issues and inflation concerns. I am watching all of these issues and I'll touch on a few today ...

As expected, the European financial crisis is now front page news again. The debt ratings for both Greece and Spain were lowered again this week, and there was speculation that Portugal would seek a bailout soon. As a result, the yields on government bonds for Ireland, Greece, Portugal and several other European countries moved higher again this week. However, late Friday night, the Euro-zone leaders reached agreement to provide additional support for certain countries (here is the text of the agreement).

The Middle East and North Africa remain unsettled, with a civil war in Libya. There were large demonstrations in Yemen last night that ended with protestors being shot. However, the so-called “Day of rage” in Saudi Arabia barely materialized.

U.S. oil prices declined slightly to $101 per barrel on Friday. This is up about 20% compared to last March, and the increase in oil prices contributed to a higher trade deficit in January (see below), and probably contributed to the decline in consumer sentiment in the preliminary March Reuters / University of Michigan survey (graph below).

There were also two key housing reports last week. CoreLogic reported that 11.1 million residential properties with a mortgage were in negative equity at the end of Q4 (23.1% of properties with a mortgage), and they also reported that house prices were at a new post-bubble low in January.

On the positive side, retail sales were solid in February – and sales in January were revised up. Also small business optimism improved slightly in February.

Below is a summary of economic data last week mostly in graphs:

• Retail Sales increased 1.0% in February

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales increased 1.0% from January to February(seasonally adjusted, after revisions), and sales were up 8.9% from February 2010. The December 2010 to January 2011 percent change was revised from +0.3% to +0.7%. This was at expectations, and including the upward revision to January retail sales, this was a solid report.

• Trade Deficit increased in January to $46.3 billion

The Department of Commerce reported exports were up sharply, but imports surged in January. "January exports were $4.4 billion more than December exports of $163.3 billion. January imports were $10.5 billion more than December imports of $203.6 billion."

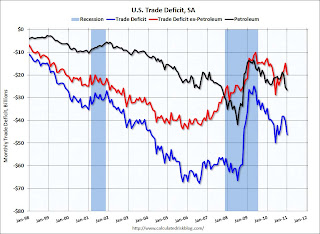

This graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit increased in January as both quantity and import prices continued to rise - averaging $84.34 in January, up from $79.78 in December. Prices will be even higher in February and March. The trade deficit with China was $23.3 billion (NSA) in January. Once again oil and China deficits are essentially the entire trade deficit (or even more).

• CoreLogic: House Prices declined 2.5% in January, Prices at New Post-bubble low

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.7% over the last year, and off 32.8% from the peak.

This is the sixth straight month of year-over-year declines, and the seventh straight month of month-to-month declines. The index is now 1.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

• CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

CoreLogic released the Q4 2010 negative equity report this week "showing that 11.1 million, or 23.1 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2010, up from 10.8 million, or 22.5 percent, in the third quarter. Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

About 10% of homeowners with mortgages have more than 25% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.

All of these borrowers are at high risk for foreclosure.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

In Nevada, over 65% of homeowners with mortgages owe more than their homes are worth. Arizona and Florida are around 50%. Michigan, Georgia and California are all over 30%.

• NFIB: Small Business Optimism Index increases in February

From National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index -- Slow and Steady: Continues Gradual Rise in February

From National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index -- Slow and Steady: Continues Gradual Rise in February

This graph shows the small business optimism index since 1986. The index increased to 94.5 in February from 94.1 in January.

Although still fairly low, this is the highest level for the index since December 2007.

• Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

The Federal Reserve released the Q4 2010 Flow of Funds report this week: Flow of Funds.

Here are a couple of graphs based on data in the report:

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

The next graph shows household real estate assets and mortgage debt as a percent of GDP.

The next graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt has now declined by $542 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt.

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Consumer Sentiment declines sharply in March

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010. This was well below the consensus forecast of 76.5.

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010. This was well below the consensus forecast of 76.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

My initial guess is this decline was because of higher gasoline prices.

• Other Economic Stories ...

• BLS: Job Openings decline in January, Low Labor Turnover

• From Jon Hilsenrath at the WSJ: Fed Unlikely to Remove Its Economic Stimulus Just Yet

• From MarketWatch: Moody’s cuts Greece rating, stokes debt fears

• From Bloomberg: Portugal 5-Year Yield at Euro-Era Record on Bailout Speculation

• From Bloomberg: Spain's Rating Downgraded to Aa2 by Moody's Over Bank Cost Concerns

• AAR: Rail Traffic increases in February compared to February 2010.

• Ceridian-UCLA: February PCI Continues to Signal Slow Growth

• From Chris Foote, Kris Gerardi and Paul Willen at the Atlanta Fed: The seductive but flawed logic of principal reduction

• California Realtors: Only three out of five short sale transactions close

• Unofficial Problem Bank list increases to 964 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 964 Institutions

by Calculated Risk on 3/12/2011 08:36:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 11, 2011.

Changes and comments from surferdude808:

The week included failures and new additions to the Unofficial Problem Bank List. In all, there were two removals and four additions.

The List has 964 institutions with assets of $420.7 billion, which represents the second highest asset level since the List has been published. So far, the peak in assets occurred on September 24, 2010 at $422.4 billion.

The removals only include one of the failures this week -- Legacy Bank, Milwaukee, WI ($190 million); and an action termination -- Eastern Federal Bank, Norwich, CT ($166 million).

The additions were First American Bank, Fort Dodge, IA ($1.5 billion); Florida Bank, Tampa, FL ($840 million); Greer State Bank, Greer, SC ($456 million Ticker: GRBS); and Frontier Bank, FSB, Palm Desert, CA ($313 million). Next week, we anticipate the OCC will release its actions through mid-February 2011, so the List will likely continue its climb to 1,000 institutions.

Friday, March 11, 2011

Report: "Eurozone debt deal struck"

by Calculated Risk on 3/11/2011 09:18:00 PM

The Financial Times is reporting: Eurozone debt deal struck

The heads of the eurozone’s 17 governments came to an unexpected deal on short-term measures to lower borrowing costs of struggling peripheral economies, agreeing to give more financial backing to the bloc’s €440bn rescue fund and lowering the interest rates on Greece’s bail-out loans.According to the Financial Times, the EFSF will be allowed to intervene in the primary bond market - and the term for the Greek loans will be extended to 7.5 years. However there will be no interest rate cut for Ireland.

excerpt with permission

Earlier today:

• Retail Sales increased 1.0% in February.

• Consumer Sentiment declined sharply in March.

• BLS: Job Openings decline in January, Low Labor Turnover.

Bank Failure #24 in 2011: The First National Bank of Davis, Davis, Oklahoma

by Calculated Risk on 3/11/2011 06:59:00 PM

From the FDIC: The Pauls Valley National Bank, Pauls Valley, Oklahoma, Assumes All of the Deposits of The First National Bank of Davis, Davis, Oklahoma

As of December 31, 2010, The First National Bank of Davis had approximately $90.2 million in total assets and $68.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $26.5 million. ... The First National Bank of Davis is the 24th FDIC-insured institution to fail in the nation this year, and the second in Oklahoma.The FDIC is back at work.

Update: And #25 ...

From the FDIC: Seaway Bank and Trust Company, Chicago, Illinois Assumes All of the Deposits of Legacy Bank, Milwaukee, Wisconsin

As of December 31, 2010, Legacy Bank had approximately $190.4 million in total assets and $183.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $43.5 million. ... Legacy Bank is the 25th FDIC-insured institution to fail in the nation this year, and the third in Wisconsin.

Distressed House Sales using Sacramento data

by Calculated Risk on 3/11/2011 05:15:00 PM

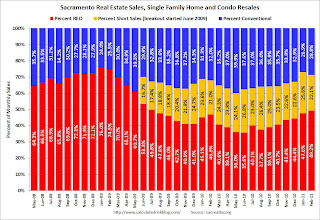

I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both.

In February 2011, 71.2% of all resales (single family homes and condos) were distressed sales. This is the 2nd highest level of distressed sales since Sacramento started breaking out short sales - last month was the highest. And this is the highest level of REO since July 2009.

Also one-third of all homes were sold for cash, up from 31.3% last month.

A high level of distressed sales suggests falling prices, and this data from Sacramento suggests further price declines in February. The CoreLogic House Price index hit a new post-bubble low in January, and my guess is the Case-Shiller index will fall to a post-bubble low when the January data is released on March 29th.

Portugal Bailout Speculation

by Calculated Risk on 3/11/2011 02:39:00 PM

From Bloomberg: Portugal 5-Year Yield at Euro-Era Record on Bailout Speculation

When asked whether his country was preparing to request a bailout, Finance Minister Fernando Teixeira Dos Santos said European leaders must understand the “seriousness” of the region’s debt crisis.Here are the 2 year, 5 year and 10 year Portuguese bond yields from Bloomberg. The 5 year yield is up to almost 8%, the 2 year yield is at 6.5%, up from 4.5% earlier this week.

...

The minister’s comments “might indicate that financial support for Portugal will be discussed at the weekend,” said Michael Leister, a fixed-income analyst at WestLB AG in Dusseldorf, Germany. “Yields show that the market is concerned, and is waiting for something,” he said.

Meanwhile, Greek Prime Minister George Papandreou and Irish Prime Minister Enda Kenny are apparently asking for better terms.

Note: The Greek ten year yield is at 12.8%. The Irish ten year yield is 9.6%. Here are the Ten Year yields for Spain, and Belgium.

BLS: Job Openings decline in January, Low Labor Turnover

by Calculated Risk on 3/11/2011 11:41:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.8 million job openings on the last business day ofThe following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

January 2011, the U.S. Bureau of Labor Statistics reported today. The

job openings rate (2.1 percent), hires rate (2.8 percent), and total

separations rate (2.7 percent) were little changed over the month.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In January, about 3.555 million people lost (or left) their jobs, and 3.712 million were hired (this is the labor turnover in the economy) adding 157 thousand total jobs.

In general job openings (yellow) has been trending up - and are up 15% from January 2010 - although openings have declined over the last two months.

The overall turnover remains low with a record low number of "quits" in January. There has been little pickup in hiring over the last 18 months - just a decline in "quits" and total separations.

Consumer Sentiment declines sharply in March

by Calculated Risk on 3/11/2011 09:55:00 AM

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was well below the consensus forecast of 76.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

My initial guess is this decline was because of higher gasoline prices.

Retail Sales increased 1.0% in February

by Calculated Risk on 3/11/2011 08:30:00 AM

On a monthly basis, retail sales increased 1.0% from January to February(seasonally adjusted, after revisions), and sales were up 8.9% from February 2010. The December 2010 to January 2011 percent change was revised from +0.3% to +0.7%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 8.0% on a YoY basis (8.9% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $387.1 billion, an increase of 1.0 percent (±0.5%) from the previous month, and 8.9 percent (±0.7%)above February 2010. ... The December 2010 to January 2011 percent change was revised from +0.3 percent (±0.5%)* to +0.7 percent (±0.3%).This was at expectations for a 1.0% increase. Retail sales ex-autos were up 0.7%; also at expectations of a 0.7% increase. Including the upward revision to January retail sales, this was a solid report.