by Calculated Risk on 3/11/2011 05:15:00 PM

Friday, March 11, 2011

Distressed House Sales using Sacramento data

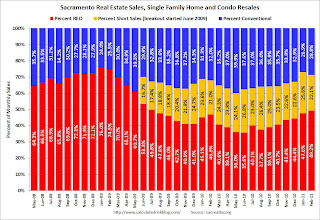

I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both.

In February 2011, 71.2% of all resales (single family homes and condos) were distressed sales. This is the 2nd highest level of distressed sales since Sacramento started breaking out short sales - last month was the highest. And this is the highest level of REO since July 2009.

Also one-third of all homes were sold for cash, up from 31.3% last month.

A high level of distressed sales suggests falling prices, and this data from Sacramento suggests further price declines in February. The CoreLogic House Price index hit a new post-bubble low in January, and my guess is the Case-Shiller index will fall to a post-bubble low when the January data is released on March 29th.