by Calculated Risk on 1/08/2011 05:41:00 PM

Saturday, January 08, 2011

Commercial Real Estate Delinquencies Rising

CR Note: This is a very sad day for all with the shootings in Arizona ... my thoughts are with the victims and their families.

On the economy from Eric Wolff at the North County Times: REAL ESTATE: Commercial delinquencies rising as landlords struggle

The owners of Temecula Town Center, a mall at Rancho California and Ynez roads, have a problem some homeowners can relate to ---- they are behind on their loans.Even though it appears the office and mall vacancy rates have stabilized, vacancies are at a very high level - so many owners are under pressure, and commercial real estate mortgage delinquencies are still rising.

Way behind: The mall's owners owe $67 million, and they haven't made a payment in more than 90 days, according to commercial real estate analyst Trepp LLC in New York City.

...

In San Bernardino and Riverside counties, borrowers with $1.4 billion in loans are at least 30 days behind on their payments. That's 20.2 percent of the two counties' total loan balance.

In San Diego County, borrowers with loans worth $755 million are delinquent, about 7.7 percent of total commercial loan dollars. Nationally, late payers compose 9.2 percent of total loan balances. All three rates more than doubled since October 2009.

Schedule for Week of January 9th

by Calculated Risk on 1/08/2011 02:30:00 PM

The key report this week will be December retail sales on Friday.

12:40 PM ET: Atlanta Fed President Dennis Lockhart speaks on the economic outlook.

7:30 AM: NFIB Small Business Optimism Index for December. This index has been showing some small increases in optimism.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in November (highest since December 2007), it is still at recessionary levels according to NFIB Chief Economist Bill Dunkelberg.

8:30 AM ET: Philadelphia Fed President Charles Plosser speaks on the economic outlook.

9:00 AM ET: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for December (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 1.0% increase in inventories.

2:00 PM ET: Minneapolis Fed President Narayana Kocherlakota speaks before the Wisconsin Banker's Association Annual Economic Forecast Luncheon.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been at a low level for months suggesting weak home sales early in 2011.

1:00 PM ET: Dallas Fed President Richard Fisher speaks on the "The Limits of Monetary Policy".

2:00 PM ET: The Fed Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for a decrease to 402,000 from 409,000 last week.

8:30 AM: Producer Price Index for November. The consensus is for a 0.8% increase in producer prices.

8:30 AM: Trade Balance report for November from the Census Bureau. The consensus is for the U.S. trade deficit to be around $41 billion, up from $38.7 billion in October.

8:30 AM: Retail Sales for December. The consensus is for a 0.8% increase from November. (0.7% increase ex-auto).

8:30 AM: Consumer Price Index for December. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.1%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for December.

This graph shows industrial production since 1967. Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.The consensus is for a 0.5% increase in Industrial Production in December, and an increase to 75.6% (from 75.2%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January. The consensus is for an increase to 75.5 from 74.5 in December.

10:00 AM: Manufacturing and Trade: Inventories and Sales for November. The consensus is for a 0.7% increase in inventories.

12:00 PM: Richmond Fed President Jeffrey Lacker speaks on the economic outlook.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Seasonal Retail Hiring: Rebound in 2010

by Calculated Risk on 1/08/2011 11:05:00 AM

According to the BLS employment report - and combining October through December - retailers hired seasonal workers at well above last year, and somewhat close to the pre-crisis levels.

Click on graph for larger in graph gallery.

Click on graph for larger in graph gallery.

Here is a graph of the historical net retail jobs added for October, November and December by year (not seasonally adjusted).

This really shows the collapse in retail hiring in 2008 and modest rebound in 2009.

Retailers hired 646 thousand workers (NSA) net during the 2010 holiday season. This is well above the 501 hired in 2009, but still below the pre-crisis average of 720 thousand for the same three months.

This suggests retailers were definitely more optimistic about the recent holiday season.

That is the good news. Here is a repeat of a depressing graph.

That is the good news. Here is a repeat of a depressing graph.

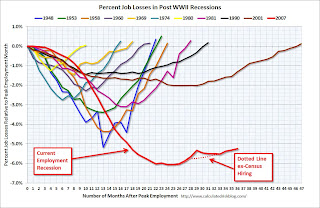

This graph is in percentage terms. In actual numbers, there are 7.24 million fewer jobs now than in December 2007.

If the economy adds 100,000 jobs per month, it will take about 72 months (6 years) to return to the December 2007 level. At 200,000 per month, it will take 36 months. At 300,000 per month(unlikely any time soon) it will take 2 years.

I'm going to need a bigger graph ...

And that doesn't include the need for about 125,000 job per month to offset population growth. It will be a long long uphill climb.

Employment posts yesterday:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

• Employment Graph Gallery

Unofficial Problem Bank list at 932 Institutions

by Calculated Risk on 1/08/2011 07:48:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 7, 2011.

Changes and comments from surferdude808:

The FDIC got back to work closing some banks and updating their structure database, which contributed to most of the seven removals this week. Also, there were four additions this week. The net changes leave the Unofficial Problem Bank List standing at 932 institutions with aggregate assets of $410 billion.

The removals include two failures -- First Commercial Bank of Florida, Orlando, FL ($598 million); and Legacy Bank, Scottsdale, AZ ($151 million); four unassisted mergers -- Bank of Smithtown, Smithtown, NY ($2.3 billion Ticker: PBCT); The Bank of Currituck, Moyock, NC ($173 million); Century Bank, Parma, OH ($128 million); and Texas Country Bank, Lakeway, TX ($54 million); and one action termination -- Savings Bank of Maine, Gardiner, ME ($861 million).

The additions were MetaBank, Storm Lake, IA ($1.0 billion Ticker: CASH); Tidelands Bank, Mount Pleasant, SC ($566 million Ticker: TDBK); Community First Bank, Boscobel, WI ($244 million); and Americantrust Federal Savings Bank, Peru, IN ($105 million).

The OCC may release its actions through mid-December 2010 next week, but since the 15th falls on Saturday it would not surprise if they did not release it until the 21st of January.

Friday, January 07, 2011

Oil Prices Update

by Calculated Risk on 1/07/2011 11:01:00 PM

From Ronald White at the LA Times: Gasoline prices' rise evokes 2008

"It's just ridiculous. Every day it's another big bite out of my income. I've gone from $40 for a fill-up to $60 for a fill-up in just the past several weeks," said Eric Ott, a 47-year-old Valley Glen resident.Back in early 2008 we saw clear signs of demand destruction. No obvious signs yet in 2011, but I had a similar reaction as Mr. Ott when I filled up my tank this week - ouch!

...

Oil closed Friday at $88.03 a barrel in New York futures trading.

...

"[W]e cannot expect brisk economic growth with oil at $120, $130, $140 a barrel and gasoline at $4 a gallon and higher ... Those kind of prices can spawn a tremendous amount of demand destruction." said Tom Kloza, chief oil analyst for the Oil Price Information Service

Jim Hamilton discussed this last month: Worrying about oil prices

Earlier Employment posts:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

Bank Failure #2 for 2011: Legacy Bank, Scottsdale, Arizona

by Calculated Risk on 1/07/2011 07:28:00 PM

Assets evaporated

I am Legacy

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, St. Louis, Missouri, Assumes All of the Deposits of Legacy Bank, Scottsdale, Arizona

As of September 30, 2010, Legacy Bank had approximately $150.6 million in total assets and $125.9 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27.9 million. ... Legacy Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Arizona

Bank Failure #1 for 2011: First Commercial Bank of Florida, Orlando, Florida

by Calculated Risk on 1/07/2011 06:12:00 PM

First Commercial Bank Failure

Inauspicious start.

by Soylent Green is People

From the FDIC: First Southern Bank, Boca Raton, Florida, Assumes All of the Deposits of First Commercial Bank of Florida, Orlando, Florida

As of September 30, 2010, First Commercial Bank of Florida had approximately $598.5 million in total assets and $529.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $78.0 million. ... First Commercial Bank of Florida is the first FDIC-insured institution to fail in the nation this year, and the first in Florida.And so it begins ...

Employment: The Declining Participation Rate

by Calculated Risk on 1/07/2011 02:12:00 PM

An interesting question is why the unemployment rate fell so sharply, even with relatively few payroll jobs added (103,000 jobs added in December).

First, it is important to remember that there are two separate surveys for the Employment Situation Summary. The unemployment rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The payroll jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of "approximately 140,000 businesses and government agencies representing approximately 410,000 worksites". See this post for a discussion of the two surveys.

The following table is based on the Household survey (all seasonally adjusted):

| Household Survey (000s) | November | December | Change |

|---|---|---|---|

| Civilian noninstitutional population (16 and over) | 238,715 | 238,889 | 174 |

| Civilian labor force | 153,950 | 153,690 | -260 |

| Employed | 138,909 | 139,206 | 297 |

| Unemployed | 15,041 | 14,485 | -556 |

| Participation Rate | 64.49% | 64.34% | -0.16% |

| Unemployment Rate | 9.77% | 9.42% | -0.35% |

The household survey measures percentages for the 60,000 households (unemployment rate, participation rate) and then the BLS derives the other numbers based on the population estimate.

So the estimated number of unemployed dropped by 556,000. Some of this decline was due to higher employment, but some was also due to the decline in participation - even while the population increased.

The table helps explain why the reported unemployment rate fell from 9.8% to 9.4%. A key reason was the decline in the participation rate. If the participation rate had held steady at 64.5%, then the unemployment rate would have only declined to 9.64%.

So almost 2/3rds of the decline in the unemployment rate was related to the decline in the participation rate. Some of the decline might be from workers going back to school, but some is probably due to people just giving up.

A large portion of the decline in the participation rate was for people in the 16 to 24 age group. According to the BLS, the 16 to 24 civilian labor force declined by 244 thousand. Most of these people will probably return to the labor force as the economy improves - and that will put upward pressure on the unemployment rate.

Another group that saw a decline in the participation rate was men in the key 25 to 54 age group. I wonder if these people are just giving up?

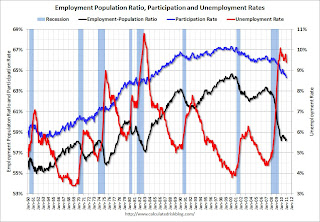

Click on graph for larger image.

Click on graph for larger image.Here is a repeat of the graph showing the unemployment rate (red), the participation rate (blue), and the employment-population ratio (black).

The participation rate has fallen sharply from 66% at the start of the recession to 64.3% in December. That is almost 4 million workers who are no longer in the labor force and not counted as unemployed in U-3, although most are included as "discouraged workers" or "Marginally Attached to Labor Force" in U-6.

A decline in the unemployment rate mostly due to a decline in the participation rate is not good employment news.

Earlier Employment posts:

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

Massachusetts court voids Foreclosures

by Calculated Risk on 1/07/2011 12:53:00 PM

From Bloomberg: Banks Lose Pivotal Massachusetts Foreclosure Case

The state Supreme Judicial Court today upheld a judge’s decision saying two foreclosures were invalid because the banks didn’t prove they owned the mortgages, which he said were improperly transferred into two mortgage-backed trusts.The concurring opinion by Justice Cordy helps clarify the situation:

“We agree with the judge that the plaintiffs, who were not the original mortgagees, failed to make the required showing that they were the holders of the mortgages at the time of foreclosure,” Justice Ralph D. Gants wrote.

I concur fully in the opinion of the court, and write separately only to underscore that what is surprising about these cases is not the statement of principles articulated by the court regarding title law and the law of foreclosure in Massachusetts, but rather the utter carelessness with which the plaintiff banks documented the titles to their assets. There is no dispute that the mortgagors of the properties in question had defaulted on their obligations, and that the mortgaged properties were subject to foreclosure. Before commencing such an action, however, the holder of an assigned mortgage needs to take care to ensure that his legal paperwork is in order. Although there was no apparent actual unfairness here to the mortgagors, that is not the point. ...These are important points:

The type of sophisticated transactions leading up to the accumulation of the notes and mortgages in question in these cases and their securitization, and, ultimately the sale of mortgaged-backed securities, are not barred nor even burdened by the requirements of Massachusetts law. The plaintiff banks, who brought these cases to clear the titles that they acquired at their own foreclosure sales, have simply failed to prove that the underlying assignments of the mortgages that they allege (and would have) entitled them to foreclose ever existed in any legally cognizable form before they exercised the power of sale that accompanies those assignments. The court's opinion clearly states that such assignments do not need to be in recordable form or recorded before the foreclosure, but they do have to have been effectuated.

• The "assignments do not need to be in recordable form or recorded before the foreclosure". That is a key point.

• This case is really about the "utter carelessness with which the plaintiff banks documented the titles to their assets".

And this means that

• These issues are curable, but will be costly for the banks. As Tanta frequently argued, the upfront "cost savings" would be paid for in arrears!

• This does not appear to be a systemic risk.

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 1/07/2011 10:01:00 AM

Here are a few more graphs based on the employment report ...

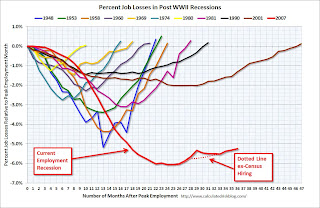

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time from the start of the recession.

In the previous post, the graph showed the job losses aligned at the bottom.

The dotted line shows payroll employment excluding temporary Census workers.

This is by far the worst post WWII employment recession.

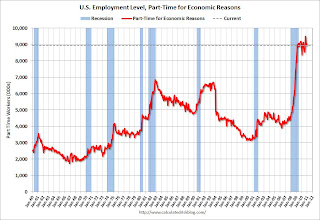

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (some-times referred to as involuntary part-time workers) was essentially unchanged in December at 8.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 8.931 million in December. This has been around 9 million since early 2009 - a very high level.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 16.7% in December. Still very grim.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.441 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.328 million in November. It appeared the number of long term unemployed had peaked, however the increases over the last three months are very concerning.

Summary

This was a mixed report.

The best news was the decline in the unemployment rate to 9.4% from 9.8% in November. However this was partially because the participation rate declined to 64.3% - a new cycle low, and the lowest level since the early '80s. Note: This is the percentage of the working age population in the labor force (here is the graph in the galleries of the participation rate).

The 103,000 payroll jobs added was below expectations of 140,000 jobs, however payroll for October payroll was revised up 38,000 and November was revised up

The increase in the long term unemployed, and the high level of part time workers for economic reasons are ongoing concerns. The average workweek was steady at 34.3 hours, and average hourly earnings ticked up 3 cents.

• Earlier Employment post: December Employment Report: 104,000 Jobs, 9.4% Unemployment Rate