by Calculated Risk on 1/07/2011 08:30:00 AM

Friday, January 07, 2011

December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

From the BLS:

The unemployment rate fell by 0.4 percentage point to 9.4 percent inPayroll for October payroll was revised up 38,000, and November was revised up 32,000 (total of 70,000). (edit)

December, and nonfarm payroll employment increased by 103,000, the U.S. Bureau of Labor Statistics reported today.

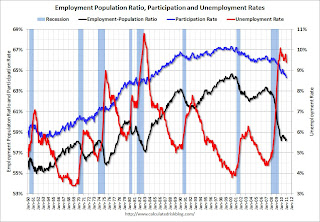

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate decreased to 9.4% (red line).

The Labor Force Participation Rate declined to 64.3% in December (blue line). This is the lowest level since the early '80s. (This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.)

The Employment-Population ratio increased to 58.3% in December (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was slightly below expectations, although the upward revision to October and November were signficant. I'll have much more soon ...

Thursday, January 06, 2011

Housing Bust: The New Declining Cities

by Calculated Risk on 1/06/2011 10:57:00 PM

From Alejandro Lazo at the LA Times: Housing bust creates new kind of declining city

"Some neighborhoods are going to suffer tremendously or are never going to come back or come back very, very slowly," said James R. Follain, senior fellow at the Rockefeller Institute of Government ...Here is the report: A Study of Real Estate Markets in Declining Cities

Potential candidates for long-term decline named by the study are the areas hit hardest by the drop in home prices in recent years. They include several inland California metropolitan areas that grew rapidly during the boom, including Stockton, Modesto, Fresno, Riverside and San Bernardino. Las Vegas and Miami also made the list.

A traditional city in decline is one that has suffered a sustained population drop, leaving behind empty houses, apartment buildings, offices and storefronts. Cleveland and Detroit, for instance, suffered from the erosion of manufacturing and the loss of residents, who left in search of jobs.

Instead of eroding a particular industry, however, the housing bust left a glut of homes because of overbuilding and the foreclosure crisis. Follain argues that the future of these cities is threatened in similar ways to that of Rust Belt cities.

There is a "particular industry" gone in these new declining cities - construction!

Earlier: Employment Report Preview

Survey: Small Business Hiring Likely to Improve in 2011

by Calculated Risk on 1/06/2011 07:29:00 PM

From National Federation of Independent Business (NFIB): Small Business Hiring Stagnant in December; Likely to Improve in 2011

“Reports of net job creation continued to oscillate around the “0” line in December. Asked about changes in total employment over the last three months, 13 percent of owners reported increasing employment at their firms by an average of 3.5 workers while 14 percent reported (down two points from November) reducing total employment an average of 2.9 workers per firm. Clearly, December showed no surge in small business hiring. ... Still, the percentage of owners reporting higher employment levels is the second highest reading since December 2007...NFIB will release their December Small Business Optimism survey on Tuesday.

“The good news is that the two job creation indicators, job openings and job creation plans, both reached new recovery highs. The percent of owners reporting hard to fill job openings rose four points to 13 percent, the best reading in 24 months. Plans to create jobs gained two points, rising to a net 6 percent of all owners, the best reading in 27 months. These indicators point to a pickup in job creation activity for the first quarter of 2011. However, the small business sector continues to underperform on job creation in this recovery compared to other recovery periods.”

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy, so it is no surprise that hiring has lagged.

Employment Report Preview

by Calculated Risk on 1/06/2011 04:33:00 PM

The BLS will release the December Employment Report at 8:30 AM tomorrow. The consensus is for an increase of 140,000 payroll jobs in December, and for the unemployment rate to decline to 9.7% (from 9.8% in November).

Gregg Robb at MarketWatch reports there have been some upward revisions: Optimism over government’s job report grows

Economists polled by MarketWatch are now expecting 175,000 nonfarm jobs created in December, up from 143,000 just a few days ago.

The unemployment rate is expected to remain steady at 9.8%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for December is in blue.

Last month the BLS reported a disappointing 39,000 jobs added in November. That was significantly below expectations of 145,000 jobs.

However - as always - we should be careful not to read too much into any one month of data. A good example was in 1997. The economy added 280,000 jobs per month on average, but in August 1997 the BLS reported a decline of 18,000 jobs! Was the employment boom over? Nope. The following month the BLS reported a gain of 508,000 jobs.

And that also suggests the possibility of some bounce back from November (or an upward revision to the November payroll numbers).

Here is a look at a few of the recent employment related reports:

• ADP reported Private Employment increased by 297,000 in December, the largest gain ever for the ADP series (started in 2001). This was well above expectations of 100,000 private sector jobs - and there is widespread skepticism that the economy actually added anywhere near that number of jobs. Andrew Tilton at Goldman Sachs noted yesterday:

[W]e view the dramatic improvement shown in the ADP report with skepticism ... while we do expect a meaningful pickup in employment growth in 2011, we have not changed our forecast of a 100,000 increase in nonfarm payrolls in December.

• Weekly initial unemployment claims were down significantly over the last couple of months.

• Weekly initial unemployment claims were down significantly over the last couple of months.The average over the last 5 weeks was 413,000 initial claims per week.

This was down sharply from the October the average of 456,000, and the November average of 431,000.

• However the ISM indexes showed slower employment growth.

The ISM manufacturing manufacturing Employment Index registered 55.7 percent in December, 1.8 percentage points lower than the 57.5 percent reported in November. The ISM Non-manufacturing employment index showed slower expansion in December at 50.5%, down from 52.7% in November.

• The Job Openings and Labor Turnover Survey has been showing an increase in job openings.

• The Job Openings and Labor Turnover Survey has been showing an increase in job openings.This data is only through October.

The yellow line (job openings) has been increasing steadily since early last year.

Overall I think the labor market is improving. Anything less than the addition of 100,000 nonfarm payroll jobs would be disappointing, and there appears to be the potential for an upside surprise. However I expect little change in the unemployment rate.

EU Proposes Bank Failure Plan, European Bond Spreads Increase

by Calculated Risk on 1/06/2011 02:03:00 PM

From the WSJ: EU Proposes Plan for Bank Failure

The EU executive arm, the European Commission, Thursday released a hefty 100-plus page consultation paper open to public comments until March 3, which aims to abolish the excuse that a bank is too big to fail. It asks whether bank bond holders should share in paying for future bailouts ...Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Jan 4th):

[A] diplomat added: "The overriding objective is to make sure creditors bear the appropriate share of losses of a failing bank and these aren't immediately passed along to taxpayers."

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the Atlanta Fed:

Greek, Irish, and Portuguese bond spreads (over German bonds) continue to be elevated, rising since the December FOMC meeting.Note: the Atlanta Fed has added Belgium.

Since the December FOMC meeting, the 10-year Greek-to-German bond spread has widend by 105 basis points (bps) (from 8.85% to 9.90%) through January 4.

Similarly with other European peripherals’ spreads, Portugal’s is 38 bps higher, and Ireland’s spread is 88 bps higher.

The bond yields have increased today. The Portugal 10 year is at 6.96%, the Ireland 10-year bond yield is over 9%, and the Greece 10-year bond yield is at a record 12.64%.

Clearly investors are pricing in a haircut.

Hotels: RevPAR up 6.6% compared to same week in 2010

by Calculated Risk on 1/06/2011 11:55:00 AM

A weekly update on hotels from HotelNewsNow.com: STR: Luxury segment tops ADR weekly increases

Overall the U.S. hotel industry’s occupancy increased 4.2% to 47.4%, ADR was up 2.3% to US$102.76, and revenue per available room finished the week up 6.6% to US$48.75.The following graph shows the four week moving average for the occupancy rate as a percent of the median occupancy rate from 2000 through 2007.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Note: I've changed this graph. Since this is the percent of the median from 2000 to 2007, the percent can be greater than 100%.

The down spike in 2001 was due to 9/11. The up spike in late 2005 was hurricane related (Katrina and Rita).

This shows how deep the slump was in 2009 compared to the period following the 2001 recession. This also shows hotels are recovering, but the occupancy rates are still below normal.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims: 4-Week Average declines

by Calculated Risk on 1/06/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 1, the advance figure for seasonally adjusted initial claims was 409,000, an increase of 18,000 from the previous week's revised figure of 391,000. The 4-week moving average was 410,750, a decrease of 3,500 from the previous week's revised average of 414,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 3,500 to 410,750.

In general the four-week moving average has been declining and that is good news.

Wednesday, January 05, 2011

Reis: Apartment Vacancy Rates decline in Q4

by Calculated Risk on 1/05/2011 11:59:00 PM

From the WSJ: For Apartments, a Hot Winter

According to Reis data, the national apartment-vacancy rate was 6.6% in the fourth quarter, down from 7.1% in the third quarter and 8% in the fourth quarter a year ago.Also from Diana Olick at CNBC: One Bright Spark in US Housing — Apartments

...

Effective rent, the amount paid after discounts, rose 0.5% ...

This is a significant decline from the record vacancy rate set a year ago at 8%. This decline fits with the recent survey from the NMHC that showed lower apartment vacancies.

The vacancy rate for large apartment buildings bottomed a year ago, and this indicates the excess housing inventory (that includes both vacant homes and apartments) is being absorbed.

Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at 10.3% in Q3 2010.

Some background on Gene Sperling

by Calculated Risk on 1/05/2011 10:27:00 PM

Gene Sperling is expected to be named chairman of the Council of Economic Advisers on Friday - succeeding Larry Summers.

From the NY Times: Obama Turning to Experienced Hands as He Remakes Staff

Gene Sperling, a counselor to Treasury Secretary Timothy F. Geithner, was expected to be named on Friday as the director of the National Economic Council, the top economic policy job inside the White House. Mr. Sperling also held the position in the Clinton administration.And some background from David Leonhardt at Economix: Gene Sperling 101

The Brighter Outlook

by Calculated Risk on 1/05/2011 05:46:00 PM

Back in early 2009, one of the key reasons I thought there wouldn't be a "depression" (defined as a 10% decline in real GDP) was because the drag from several key sectors was slowing (see Feb, 2009: Looking for the Sun)

The logic was similar last year when I argued for sluggish growth but no double dip recession - I just didn't see a huge decline in residential investment. I noted that "usually a recession (or double-dip) is preceded by a sharp decline in Residential Investment (housing is the best leading indicator for the business cycle), and it [is] hard for RI to fall much further".

Now we can even go further. As I argued in Question #2 for 2011: Residential Investment, residential investment, and residential construction employment, will probably make positive contributions in 2011 to real GDP growth and payroll employment.

From the ADP employment report this morning:

Construction employment was unchanged in December, ending continuous monthly declines since June 2007. The decline in Construction employment, since its peak in January 2007, is 2,306,000.The tide is changing.

And there has even been some positive news for commercial real estate: Reis reported the vacancy rates for offices and malls didn't increase in Q4. Even if this is the peak, I still expect non-residential investment in structures to be a drag through the middle of this year - but that drag will slow too.

The real key will be employment growth. More jobs means more households, and if we see my forecast for job growth in 2011, we will probably see around 1 million more households in 2011. With the net increase to the housing stock at or near record lows in 2011, this would significantly help reduce the excess supply of vacant housing units.

There are still downside risks - notably from housing, state and local governments and possibly from Europe - and there are still drags from the financial crisis with excessive household debt and excess capacity in many sectors. But overall it appears the outlook for 2011 is brighter.

Here is the series I wrote over the last couple of weeks, Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy