by Calculated Risk on 10/29/2010 08:30:00 AM

Friday, October 29, 2010

Q3 Advance Report: Real Annualized GDP Grew at 2.0%

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2010, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. The current recovery is very weak - the 2nd half slowdown continues.

A few key numbers:

Without the boost in inventories, GDP would have been barely positive in Q3.

This was a little stronger than expected, and PCE will probably slow over the next couple of quarters.

As expected, residential investment declined sharply after the Q2 tax credit boost.

Overall this was a weak report and will not derail QE2 next wednesday (further easing from the Fed).

Thursday, October 28, 2010

Foreclosure-Gate: Title Insurers Drop Demands

by Calculated Risk on 10/28/2010 09:49:00 PM

From Elizabeth Razzi at the WaPo: Title insurers drop demands on mortgage lenders in foreclosure cases

Three major title insurance companies - First American Financial, Old Republic International and Stewart Information Services - told Wall Street analysts in conference calls Thursday that they had decided not to demand written indemnifications from lenders re-selling foreclosed homes. Combined, the three companies account for 52 percent of the title insurance market.This is means that the buyers of REO (lender Real Estate Owned) will be able to obtain title insurance, and that the new owner can sell the property. There was some concern that buyers would shy away from REOs.

House Prices have corrected to what year?

by Calculated Risk on 10/28/2010 05:45:00 PM

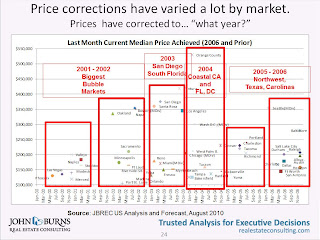

Housing consultant John Burns presented this slide as part of the UCLA Anderson Forecast this week:

John Burns used median prices for this slide. It shows that the "biggest bubble markets" are back to 2000 to 2002 median prices, whereas some areas are still at 2006 prices.

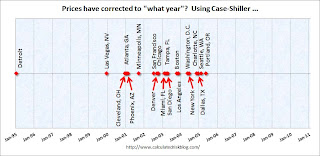

And here is a timeline for the 20 Case-Shiller cities:

There is no y-axis because this is based on a price index (not median prices).

There is no y-axis because this is based on a price index (not median prices).

Detroit is back to 1995 prices, and some cities like Dallas, Portland and Seattle are only back to 2005 or 2006 prices (the bubble arrived later in the Northwest).

Housing Bust impacting Manager Mobility

by Calculated Risk on 10/28/2010 02:31:00 PM

From Challenger, Gray & Christmas: Job Seeker Relocation Drops to Record Low

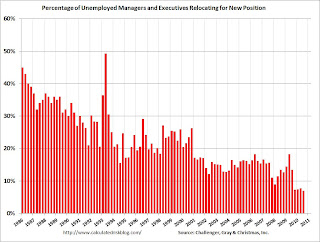

The percentage of unemployed managers and executives relocating for a new position fell to a record low in the third quarter of 2010, as a slightly improved job market and greatly depreciated home values combined to eliminate this option for most job seekers.

Just 6.9 percent of job seekers who found employment in the third quarter relocated for the new position. That was down from a relocation rate of 13.4 percent in the same quarter a year ago ...

“Continued weakness in the housing market is undoubtedly the biggest factor suppressing relocation. Job seekers who own a home – even if they are open to relocating for a new job – are basically stuck where they are if they are unable or unwilling to sell their homes without incurring a significant loss,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is the quarterly data from Challenger, Gray. Mobility has been trending down for some time, but really declined over the last year.

It is tough to move when you can't sell your home. Sometimes the new employer will pick up the short fall for key executives and managers, but it is probably too expensive in many cases now.

This is no surprise. Here is what I wrote in 2007:

Less worker mobility [due to negative equity] is kind of like arteriosclerosis of the economy. It lowers the overall growth potential.One of the strengths of the U.S. labor market has been the flexibility associated with labor mobility at all levels of employment - households could easily move from one region to another for better employment. The sharp decline in house prices, leaving homeowners with significant negative equity, appears to be limiting this flexibility.

Perhaps as many as 15 to 20 million households will be saddled with negative equity by 2009. Even if most of these homeowners don't "walk away", there might still be a negative impact on the economy due to less worker mobility.

Update: PIMCO's Bill Gross has called end of bond rally before

by Calculated Risk on 10/28/2010 01:42:00 PM

Yesterday I mentioned that Bill Gross was calling the end "of a great 30-year bull market in bonds". I thought he was changing his view, but this isn't the first time (ht Erik):

From Bloomberg on March 27, 2010: Pimco’s Bill Gross Says Bonds Have Seen Best Days

“Bonds have seen their best days,” Gross said in a Bloomberg Radio interview ... Yields on two-year U.S. Treasury notes are likely to rise to 1.25 percent to 1.5 percent from 1.08 percent in the next year as the economy strengthens and the Federal Reserve begins to increase interest rates, Gross said.On March 26, 2010 the Ten Year Treasury yield was 3.86% (now 2.65%)

And from Reuters in June 2007: Pimco's Gross says he's now a "bear market manager"

Gross forecast that benchmark Treasury yields will range higher than previously thought, prompting him to acknowledge he is now a "bear market manager" after a quarter of a century as the global bond market's most powerful bull.On June 7, 2007, the ten year Treasury yield was 5.1%.

So Gross has called the end of the bond rally before. Nevermind.

The end of the "bull market in bonds" really depends on if the economy strengthens, and I don't see a pickup in economic growth any time soon.

Regional Fed Manufacturing Surveys still show "moderate" expansion in October

by Calculated Risk on 10/28/2010 11:00:00 AM

The Kansas City Fed released their October manufacturing survey this morning:

Tenth District manufacturing activity continued to expand moderately in October, and producers were increasingly optimistic about future activity.This was the last of the regional Fed surveys for October.

...

The net percentage of firms reporting month-over-month increases in production in October was 10, down from 14 in September ... the new orders index jumped from 9 to 16, its highest level since early 2007, and the employment index also edged higher [to -1].

The following graph compares the regional Fed surveys with the ISM manufacturing survey, including the Kansas City survey released this morning:

Click on graph for larger image in new window.

Click on graph for larger image in new window.For this graph I averaged the New York and Philly Fed surveys (dashed green, through October), and averaged five Fed surveys (blue) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

Although the internals were mixed in the regional Fed surveys, this graph suggests the ISM index will still show expansion in October. The ISM Manufacturing index will be released on Monday November 1st.

Weekly Initial Unemployment Claims decrease

by Calculated Risk on 10/28/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 23, the advance figure for seasonally adjusted initial claims was 434,000, a decrease of 21,000 from the previous week's revised figure of 455,000. The 4-week moving average was 453,250, a decrease of 5,500 from the previous week's revised average of 458,750.

Click on graph for larger image in new window.

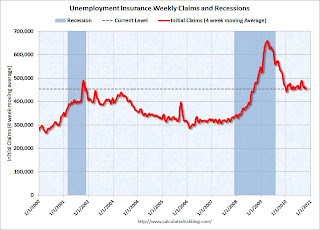

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 5,500 to 453,250.

This is the lowest level for weekly claims and the 4-week average since July, however the 4-week moving average has been moving sideways at an elevated level for almost a year - and that suggests a weak job market.

Wednesday, October 27, 2010

Report: Greece Falling Short of Rescue Package Deficit Goal

by Calculated Risk on 10/27/2010 10:28:00 PM

From Landon Thomas at the NY Times: Greece Said to Be Falling Short of Deficit-Cutting Goals

With economic conditions weaker than expected, tax revenue is coming up short of projections in parts of Europe.According to Bloomberg, the yield on the Greece 10-year bond jumped to 10.39% from 9.36% on Tuesday, and the yield on the Ireland 10-year bond increased to a new crisis closing high of 6.77%.

...

Greece ... looks as if it will run a budget deficit for 2010 greater than the 8.1 percent of gross domestic product it agreed to as part of a rescue package from the International Monetary Fund and the European Union ...

In Ireland, which is expecting its third consecutive year of economic contraction this year, the government says it will need an additional 15 billion euros in budget cuts to reduce its deficit from 32 percent of gross domestic product to 3 percent by 2014.

PIMCO's Gross: 30-year Bull Market in Bonds is Over

by Calculated Risk on 10/27/2010 06:46:00 PM

From PIMCO's Bill Gross: Run Turkey, Run

[W]hile next Wednesday’s [FOMC] announcement will carry our qualified endorsement, I must admit it may be similar to a Turkey looking forward to a Thanksgiving Day celebration.Gross has been a bond bull for as long as I can remember - I think even last year when many others were calling the end of the bond bull market.

...

Anyone for 1.10% 5-year Treasuries? Well, the Fed will buy them, but then what, and how will PIMCO tell the 500 billion investor dollars in the Total Return strategy and our equally valued 750 billion dollars of other assets that the Thanksgiving Day axe has finally arrived?

...

Ben Bernanke ... [y]ou are doing what you have to do, and it may or may not work. But either way it will likely signify the end of a great 30-year bull market in bonds ...

Freddie Mac: 90+ Day Delinquency Rate Declines Slightly in September

by Calculated Risk on 10/27/2010 03:59:00 PM

The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reports that the serious delinquency rate declined to 3.80% in September, from 3.83% in August.

Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent.

As modifications have become permanent, they are no longer counted as delinquent. Also, both Fannie Mae and Freddie Mac started foreclosing again (they have a record number of REOs) - and REO (real estate owned) is not counted in the delinquency rate.

The delinquency rate will probably start increasing again in October because of more foreclosure moratoriums, and possibly from falling house prices.