by Calculated Risk on 7/12/2010 04:08:00 PM

Monday, July 12, 2010

Distressed Sales: Sacramento as an Example, June 2010

The Sacramento Association of REALTORS® has been breaking out short sales for over a year now. They report monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the June data.

Total June sales were up from May, and up from June 2009. Of course June was the scheduled closing deadline to qualify for the Federal homebuyer tax credit (closing date since extended), and also the California tax credit played a role. Sales should collapse in July.

The year-over-year (YoY) increase in June sales break a 12 month streak of declining YoY sales. But that was because of the tax credit, and sales will be off YoY in July.

Short sales were up 66% YoY (Year of the Short Sale!), and REO sales were down by 30%.

Note: This data is not seasonally adjusted. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is now at a high for this brief series.

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is now at a high for this brief series.

In June, 62.4% of all resales (single family homes and condos) were distressed sales.

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter). Also there appears to be a higher percentage of conventional sales associated with the tax credit.

On financing, 54.6% percent were either all cash (21.3%) or FHA loans (33.3%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

With the tax credit (mostly) over, I expect total sales to decline and the percent of distressed sales (Short and REO) to increase.

FHFA attempting to recoup some losses of Fannie and Freddie

by Calculated Risk on 7/12/2010 02:15:00 PM

From the Federal Housing Finance Agency: FHFA Issues Subpoenas for PLS Documents

FHFA, as Conservator of Fannie Mae and Freddie Mac (the Enterprises), has issued 64 subpoenas to various entities, seeking documents related to private-label mortgage-backed securities (PLS) in which the two Enterprises invested. The documents will enable the FHFA to determine whether PLS issuers and others are liable to the Enterprises for certain losses they have suffered on PLS. If so, the Conservator expects to recoup funds, which would be used to offset payments made to the Enterprises by the U.S. Treasury.Many of the originators of the PLS mortgages are no longer in business (New Century, etc.), however most of the PLS issuers still exist.

...

Before and during conservatorship, the Enterprises sought to assess and enforce their rights as investors in PLS, in an effort to recoup losses suffered in connection with their portfolios. Specifically, the Enterprises have attempted to determine whether misrepresentations, breaches of warranties or other acts or omissions by PLS counterparties would require repurchase of loans underlying the PLS by the counterparties and whether other remedies might be appropriate. However, difficulty in obtaining the loan documents has presented a challenge to the Enterprises’ efforts. FHFA has therefore issued these subpoenas for various loan files and transaction documents pertaining to loans securing the PLS to trustees and servicers controlling or holding that documentation.

Bankruptcy and 2nd Liens

by Calculated Risk on 7/12/2010 11:12:00 AM

From Catherine Curan writing at the NY Post: Liening on banks

Underwater homeowners are jumping onto an unexpected financial life raft that lets them escape crippling second mortgage debts and keep their homes -- Chapter 13 bankruptcy.For many borrowers, this makes a Chapter 13 bankruptcy a better choice than a foreclosure. With a foreclosure, the borrower loses the house - and the 2nd lien holder might still pursue the borrower (unless they release the lien for some compensation, like under HAFA).

...

How it works is this: If the home is appraised at less than the value of the first mortgage, the owner can apply for permission in bankruptcy court to reclassify the second mortgage debt. That changes it from a secured debt, which must be repaid, into an unsecured debt, which does not have to be paid in full. The homeowner can then focus on paying off the first mortgage.

"This is the only time where you see such a huge percentage of houses worth less than the first loan, allowing us to basically get rid of the second loan," says [New York City bankruptcy attorney David Shaev of Shaev & Fleischman], who estimates that 20 percent of his Chapter 13 clients who own homes qualify for this type of workout. "We're at a unique place in history."

With a bankruptcy - under certain circumstances - the borrower keeps the house, and the 2nd lien is converted to unsecured debt and does not have to be paid in full. This is probably part of the reason for sharp increase in bankruptcy filings.

Part 3. What are the Market Estimates of the Probabilities of Default?

by Calculated Risk on 7/12/2010 08:50:00 AM

CR Note: This series is from reader "some investor guy".

There are a number of ways of looking at chances of default and/or expected losses, including: bond yields vs a low or no default bond in the same currency, credit default swap prices, bond ratings, and analysis of underlying financial factors.

Bond ratings move more slowly than bond yields or CDS prices. Ratings often are lowered only after a major problem has been realized and is already incorporated into yields or CDS prices. While bond prices can be useful, there are an assortment of problems of trying to extract default probabilities. One is the yield curve, and that for many sovereigns there aren’t all that many maturities outstanding. Trying to get a 5 year probability of default from a dataset including only a 2 year and 20 year maturity presents some analytic problems. Bond prices also have a surprising amount of differences due solely to liquidity. For example see Longstaff.

“We find a large liquidity premium in Treasury bonds, which can be more than fifteen percent of the value of some Treasury bonds. This liquidity premium is related to changes in consumer confidence, the amount of Treasury debt available to investors, and flows into equity and money market mutual funds. This suggests that the popularity of Treasury bonds directly affects their value.”

Yes, that’s 15 percent between different US Treasuries and a series of bonds explicitly guaranteed by the US govt, the 1990s Resolution Trust. Even on the run and off the run US treasuries have different yields due to liquidity.

Because it provides daily information for almost all large sovereigns, and calculates cumulative probabilities of default (CPD), we use data from CMAVision to estimate sovereign default probabilities.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This chart shows outstanding debt with the (CPD) for each country. Despite it having a moderate 8.3% probability of default, Japan’s huge outstanding bond portfolio makes it the largest contributor to expected sovereign losses. However, it’s unlikely that any country would only have a default on a small group of bonds. If Japan defaulted, it is likely that most or all of its outstanding debt would be restructured (e.g., different interest rate, extended payment, a haircut on principal).

CPDs from 3/31/10 and 6/30/10 are shown in the next chart. The red bars are Q2, the orange bars are from Q1. Obviously, some credit default swap prices moved substantially in those three months, like Greece, Portugal, Spain and Belgium.

As of June 30, 2010, the weighted average expected default rate is 7.4%. When weighted by value of debt outstanding, CDS pricing worldwide points to 7.4% of it defaulting within 5 years. If the outstanding sovereign debt was still $34 trillion as reported at 12/31/09, that’s $2.5 trillion of defaulted debt. If the trend of increased borrowing has continued to $36 trillion at 6/30/10, it’s about $2.7 trillion of defaulted debt.

As of June 30, 2010, the weighted average expected default rate is 7.4%. When weighted by value of debt outstanding, CDS pricing worldwide points to 7.4% of it defaulting within 5 years. If the outstanding sovereign debt was still $34 trillion as reported at 12/31/09, that’s $2.5 trillion of defaulted debt. If the trend of increased borrowing has continued to $36 trillion at 6/30/10, it’s about $2.7 trillion of defaulted debt.

Before you run out and start shorting sovereigns or panic over your retirement, remember that bondholders seldom lose all of their money on defaulted bonds. Sometimes recovery rates are quite good. Others, not so much.

CR Note: This is from "Some investor guy". Over the next week or so, some investor guy will address several questions: What are total estimated losses on sovereign bonds due to default? What happens if things go really badly and what are the indirect effects of default?

Later this week: Part 4. What are Total Estimated of Losses on Sovereign Bonds Due to Default?

Series:

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?

Sunday, July 11, 2010

Deflation and the Fed

by Calculated Risk on 7/11/2010 11:59:00 PM

From Paul Krugman: Trending Toward Deflation

Inflation has been falling, but how close are we to deflation? I found myself wondering that after observing John Makin’s combusting coiffure, his prediction that we might see deflation this year.And in the NY Times: The Feckless Fed

...

What I take from this is that deflation isn’t some distant possibility — it’s already here by some measures, not far off by others. And of course there isn’t some magic boundary effect when you cross zero; falling inflation is raising real interest rates and making debt problems worse as we speak.

Back in 2002, a professor turned Federal Reserve official by the name of Ben Bernanke gave a widely quoted speech titled “Deflation: Making Sure ‘It’ Doesn’t Happen Here.” Like other economists, myself included, Mr. Bernanke was deeply disturbed by Japan’s stubborn, seemingly incurable deflation, which in turn was “associated with years of painfully slow growth, rising joblessness, and apparently intractable financial problems.” This sort of thing wasn’t supposed to happen to an advanced nation with sophisticated policy makers. Could something similar happen to the United States?And an interesting point from Mike Bryan, vice president and senior economist at the Atlanta Fed: How close to deflation are we? Perhaps just a little closer than you thought

CPI will be released on Friday, and expectations are for another slight decline in the headline number. Persistent deflation (like in Japan) would be a serious problem. Perhaps if rents are increasing slightly, as recent reports suggests, the U.S. might avoid deflation without further Fed action (I'm not confident that rents have bottomed given the high vacancy and unemployment rate - especially if I'm correct about growth slowing in the 2nd half of 2010).

Note: Last week I asked "What might the Fed do?" and I excerpted from Bernanke's 2002 speech. If the trend towards deflation continues, I think the FOMC - based on Bernanke's speech - might set "explicit ceilings for yields on longer-maturity Treasury debt".

Trillions of Bank Debt coming due

by Calculated Risk on 7/11/2010 05:35:00 PM

Here is the Weekly Summary and a Look Ahead (it will be a busy week).

And some more on bank debt coming due (yesterday the WSJ has a brief article on this) ...

From Jack Ewing at the NY Times: Crisis Awaits World’s Banks as Trillions Come Due

Banks worldwide owe nearly $5 trillion to bondholders and other creditors that will come due through 2012, according to estimates by the Bank for International Settlements. About $2.6 trillion of the liabilities are in Europe.And an answer to some questions on sovereign default:

Last week:

Weekly Summary and a Look Ahead

by Calculated Risk on 7/11/2010 12:49:00 PM

First, more on sovereign debt issues this morning: Part 2B: More on Historic Sovereign Default Research

This will be a busy week. The key economic report this week will be June retail sales to be released on Wednesday.

On Monday, the June Ceridian-UCLA Pulse of Commerce Index (based on diesel fuel consumption) will be released. Also on Monday at 10 AM ET, Fed Chairman Ben Bernanke will open the Fed’s small business forum: Addressing the Financing Needs of Small Businesses.

On Tuesday, the National Association of Independent Business (NFIB) will release the small business optimism survey for June at 7:30 AM. The May Trade Balance report will be released at 8:30 AM by the Census Bureau. The consensus is for a slight decrease in the U.S. trade deficit to $39 billion (from $40.3 billion). Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for May will be released at 10 AM by the BLS. This report has been showing very little turnover in the labor market.

On Wednesday, the June Advance Monthly Retail Trade Report will be released by the Census Bureau at 8:30 AM. The consensus is for a 0.2% decline in retail sales (flat ex-autos). Also on Wednesday, the MBA will release the mortgage purchase applications index. This has been very weak after the expiration of the tax credit, although refinance activity has picked up significantly as mortgage rates have fallen.

Also on Wednesday, the May Manufacturing and Trade Inventories and Sales report from the Census Bureau will be released at 10 AM. This has been suggesting that the inventory adjustment is mostly over. At 2 PM the Fed will release the minutes of the June 23rd FOMC meeting.

On Thursday, the initial weekly unemployment claims will be released. Consensus is for a decline to 445K from 454K last week. The Producer Price index will be released at 8:30 AM. Consensus is for a slight increase in the PPI. The July Empire State manufacturing survey will also be released at 8:30 AM. The consensus is for a slight decrease from the June reading.

Also on Thursday the Federal Reserve will release the June Industrial Production and Capacity Utilization report at 9:15 AM. Expectations are for production to decrease slightly and capacity utilization to fall to 74.0% from 74.7% in May. If so, this will be the first decline since June 2009. The Philly Fed Business Outlook Survey for July will be released at 10 AM, and the consensus is for a slight increase.

On Friday, the June Consumer Price Index will be released at 8:30 AM. Expectations are for a slight decrease of 0.1% in the CPI. At 9:55 AM the July Reuters / University of Michigan's Consumer sentiment index will be released. The consensus is for a slight decrease in the index.

Also this week, the June rail traffic report from the Association of American Railroads (AAR) and June LA port traffic will probably be released and the FDIC will probably be busy ...

Three posts on Sovereign debt:

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The June ISM Non-manufacturing index was at 53.8%, down from 55.4% in May - and below expectations of 55. The employment index showed contraction in June at 49.7%.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The employment index is showing contraction again after one month of expansion.

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The four-week average of weekly unemployment claims decreased this week by 1,250 to 466,000.

The dashed line on the graph is the current 4-week average.

Initial weekly claims have been at about the same level since December 2009.

The MBA reports: The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier.

The MBA reports: The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier. "The Purchase Index has decreased eight of the last nine weeks."

This graph shows the MBA Purchase Index and four week moving average since 1990.

There has been a mini-refi boom because of the low mortgage rates, but the purchase index has fallen sharply to the levels of 1996.

Best wishes to all.

Part 2B: More on Historic Sovereign Default Research

by Calculated Risk on 7/11/2010 08:30:00 AM

CR Note: This series is from reader "some investor guy". Part 2B is in response to some questions in the comments.

A number of posters mentioned research which was originally part of later sections in the series. I’ve moved some of this research to this ubernerd post.

Some researchers, especially Reinhart and Rogoff, assert that “this time is not different”, and that rather similar things occur before and after defaults throughout the world and over a period of many centuries. Politicians might or might not know the history. However, one wonders to what extent bond traders and CDS market participants agree with the academics.

Within the bond market, CDS market, and the governments themselves, there is also a chance that someone knows important information regarding the chance of default that others do not. For example, an official misstating government revenues, reserves, or borrowing.

There is a very active effort in many countries to convince voters or investors that “everything will be fine” or “all debts will be paid on schedule”. Often, these claims are correct. If interest rates on government bonds and liquidity are set based on perception of risk, the spin might save a sovereign billions of dollars in reduced funding costs. If the spin loses all credibility, a particular government official might be regarded as “The Baghdad Bob of Bonds” (Term derived from the nickname for Saddam Hussseins’s Information Minister, “Baghdad Bob”).

The Research

Paolo Manasse and Nouriel Roubini studied sovereign default risk and concluded that many guidelines used for estimating when default was likely did not perform well when used in isolation, primarily because those guidelines looked at separate risks. For example, total government debt exceeding 200% of GDP is often used to indicate stress. However, some circumstances may make the problems much less severe, others might make it much worse (“Rules of Thumb” for Sovereign Debt Crises, Paolo Manasse and Nouriel Roubini):

“The analysis has one important, albeit simple, implication for sustainability analysis. It shows that unconditional thresholds, for example for debt-output ratios, are of little value per se for assessing the probability of default. One country may be heavily indebted but have a negligible probability of default, while a second may have moderate values of debt ratios while running a considerable default risk. Why? Because the joint effects of short maturity, political uncertainty, and relatively fixed exchange rates make a liquidity crisis in the latter much more likely than a solvency crisis in the former, particularly if the large external debt burden goes together with monetary stability, a large current account surplus, and sound public finances.”

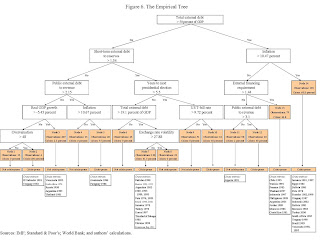

Click on graph for larger image in new window.

Click on graph for larger image in new window.Chart source Predicting Sovereign Debt Crises, page 30. For specific countries, default probabilities from this model could be updated as often as the relevant economic data are updated.

In the earlier paper for the IMF, they found (Predicting Sovereign Debt Crises, Paolo Manasse, Nouriel Roubini, and Axel Schimmelpfennig):

“The empirical evidence suggests that a number of macroeconomic factors predict a debt crisis and the entry into a debt crisis. Measures of debt “solvency” matter: high levels of foreign debt (relative to a measure of the ability to pay, such as GDP) increase the probability of a default and entry into default. Measures of illiquidity, particularly short-term debt (relative to foreign reserves), and measures of debt servicing obligations also matter in predicting debt crises, consistent with the view that some recent crises had to do with illiquidity and/or the interaction of illiquidity and insolvency.Another line of research comes from Carmen Reinhart and Kenneth Rogoff. They have several relevant works, including This Time is Different: Eight Centuries of Financial Crises.

Other macroeconomic variables suggested from the analytical literature on debt sustainability also significantly matter for predicting debt crises: low GDP growth; current account imbalances; low trade openness; tight liquidity and monetary conditions in the Group of seven countries; monetary mismanagement (in the form of high inflation); policy uncertainty (in the form of high volatility of inflation); and political uncertainty leading to economic uncertainty (years of presidential elections).”

“We find that serial default is a nearly universal phenomenon as countries struggle to transform themselves from emerging markets to advanced economies. Major default episodes are typically spaced some years (or decades) apart, creating an illusion that “this time is different” among policymakers and investors. A recent example of the “this time is different” syndrome is the false belief that domestic debt is a novel feature of the modern financial landscape. We also confirm that crises frequently emanate from the financial centers with transmission through interest rate shocks and commodity price collapses.”Eight Centuries of Financial Crises also contains quite a bit of data on inflation, which the authors view as a second way to default (if the bonds are denominated in the issuer’s native currency), and exchange rate problems.

Historically, we will see that the average percent of sovereigns in default or restructuring have sometimes been quite large (source: Eight Centuries of Financial Crises, page 4).

Historically, we will see that the average percent of sovereigns in default or restructuring have sometimes been quite large (source: Eight Centuries of Financial Crises, page 4). Rogoff also has analysis of what happens with high debt levels when there is not default. Some readers will enjoy their paper from early 2008, “Is the 2007 U.S. Sub-Prime Financial Crisis So Different?”

We will revisit both sets of authors when looking at the indirect effects of default later in the series. Numerous posters have mentioned Rogoff research showing a possible dropoff in growth above a threshold of 90% debt to GDP (CR Note: this level is disputed).

CR Note: This is from "Some investor guy". Over the next week or so, some investor guy will address several questions: What are market estimates of the probabilities of default? What are total estimated losses on sovereign bonds due to default? What happens if things go really badly and what are the indirect effects of default?

Coming Monday: Part 3. What are the Market Estimates of the Probabilities of Default?

Series:

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?

Saturday, July 10, 2010

Euro and European Bond Spreads

by Calculated Risk on 7/10/2010 06:57:00 PM

Related to the earlier post on sovereign debt: Part 2. How Often Have Sovereign Countries Defaulted in the Past?

Here is a graph from the Atlanta Fed weekly Financial Highlights released today (graph as of July 7th): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Most peripheral European bond spreads (over German bonds) have narrowed or stabilized over the past two weeks, though they remain elevated.Note: The Atlanta Fed data is a few days old. Nemo has links to the current data on the sidebar of his site.

After rising steadily through May and most of June, the 10-year Greece-to-German bond spread has narrowed 38 basis points (bps) (from 8.01% to 7.63%), through July 6. Most other European peripherals’ spreads have narrowed, too, with Portugal’s down 28 bps. However, Spain (up 18 bps) and Italy (8 bps higher) were the exceptions.

Here are the spread for the 10-year relative to the German bonds:

| Country | Spreads July 7th | Spreads June 16th | Spreads June 2nd |

|---|---|---|---|

| Greece | 7.64% | 6.40% | 5.03% |

| Portugal | 2.75% | 2.74% | 1.95% |

| Ireland | 2.62% | 2.83% | 2.19% |

| Spain | 2.06% | 2.09% | 1.62% |

The second graphs shows the number of dollars per euro since Jan 1, 1999.

The second graphs shows the number of dollars per euro since Jan 1, 1999.The euro has rebounded recently after dipping below 1.20 dollars per euro.

The dashed line is the current exchange rate. The euro is currently at 1.26 dollars.

WSJ: "$1.65 trillion Euro zone bank debt coming due in 2010 and 2011"

by Calculated Risk on 7/10/2010 01:50:00 PM

From Mark Whitehouse at the WSJ Real Time Economics: Number of the Week: Euro Zone Debt Is Coming Due (ht jb)

$1.65 trillion: Euro zone bank debt coming due in 2010 and 2011.The results of the stress tests will be released on July 23rd.

...

As investors fret about European banks’ exposures to Greece and other financially troubled countries, those banks’ borrowing costs are rising sharply. ... This year and next, some $1.7 trillion in euro-area bank debt will come due, far more than among banks in the U.S., the U.K. or elsewhere.