by Calculated Risk on 6/25/2010 09:45:00 PM

Friday, June 25, 2010

Year of the Short Sale, and Deed in lieu

From Kenneth Harney in the WaPo: Foreclosure alternative gaining favor (ht ghostfaceinvestah)

There are two programs in Home Affordable Foreclosure Alternatives (HAFA), short sales and deed in lieu of foreclosure.

Harney writes:

Some of the largest mortgage servicers and lenders in the country are gearing up campaigns to reach out to carefully targeted borrowers with cash incentives that sometimes range into five figures, plus a simple message: Let's bypass the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home, and we'll call it a deal. ...The deal can be quick, and the first lender will agree not to pursue a deficiency judgment. However 2nds are a problem, and "deed in lieu" transactions still hit the borrower's credit history.

Borrowers with 2nds considering a "deed in lieu" transaction should contact the 2nd lien holders. HAFA offers a payout to 2nd lien holders in deed in lieu transactions who agree to release borrowers from debt (see point 4 here for payouts under deed in lieu).

Under the HAFA deed in lieu program, the borrower needs to be proactive with 2nd lien holders.

The deed in lieu program is gaining in popularity, from Harney:

Bank of America, has mailed 100,000 deed-in-lieu solicitations to customers in the past 60 days, and its volume of completed transactions is breaking company records, according to officials. ... To sweeten the pot, Bank of America is offering cash incentives that range from $3,000 to $15,000 ... [Matt Vernon, Bank of America's top short sale and deed-in-lieu executive] said.On the credit impact, from Carolyn Said at the San Francisco Chronicle:

[Craig Watts, a spokesman for FICO] said it is a "widespread myth" that short sales and deeds in lieu of foreclosure have less impact on credit scores than do foreclosures.And a video from HAMP / HAFA: "Your Graceful Exit"

"Generally speaking, when you can't pay your mortgage, in the eyes of the FICO score what matters is that you were not able to fill your obligation as you originally agreed and that failure is highly predictive of future risk," he said.

Bank Failure #86: High Desert State Bank, Albuquerque, New Mexico

by Calculated Risk on 6/25/2010 07:04:00 PM

Road running deposits flee

Wiley banker struck

by Soylent Green is People

From the FDIC: First American Bank, Artesia, New Mexico, Assumes All of the Deposits of High Desert State Bank, Albuquerque, New Mexico

As of March 31, 2010, High Desert State Bank had approximately $80.3 million in total assets and $81.0 million in total deposits. ...That makes three today ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... High Desert State Bank is the 86th FDIC-insured institution to fail in the nation this year, and the second in New Mexico. The last FDIC-insured institution closed in the state was Charter Bank, Santa Fe, on January 22, 2010.

Bank Failures #84 & #85: Florida and Georgia

by Calculated Risk on 6/25/2010 06:24:00 PM

Ringed on three sides by water

Way out blocked by Feds

Savannah shut down

Sheila's Summer season starts

Sad situation.

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, Assumes All of the Deposits of Peninsula Bank, Englewood, Florida

As of March 31, 2010, Peninsula Bank had approximately $644.3 million in total assets and $580.1 million in total deposits. ...From the FDIC: The Savannah Bank, National Association, Savannah, Georgia, Assumes All of the Deposits of First National Bank Savannah, Georgia

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $194.8 million. Compared to other alternatives, ... Peninsula Bank is the 84th FDIC-insured institution to fail in the nation this year, and the fourteenth in Florida. The last FDIC-insured institution closed in the state was Bank of Florida – Southwest, Naples, on May 28, 2010.

As of March 31, 2010, First National Bank had approximately $252.5 million in total assets and $231.9 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $68.9 million. Compared to other alternatives, ... First National Bank is the 85th FDIC-insured institution to fail in the nation this year, and the ninth in Georgia. The last FDIC-insured institution closed in the state was Satilla Community Bank, Saint Marys, on May 14, 2010.

FDIC: May Enforcement Actions

by Calculated Risk on 6/25/2010 04:45:00 PM

Just a BFF (Bank Failure Friday) preview. It looks like surferdude808 will be busy updating the Unofficial Problem Bank list today ... the FDIC released their May Enforcement Actions.

There are eight Prompt Corrective Actions (PCA) for last month ... and that seems especially high.

ATA Truck Tonnage Index declines in May

by Calculated Risk on 6/25/2010 12:59:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.6 Percent in May

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.6 percent in May, which was the first month-to-month drop since February of this year. This followed an upwardly revised 1 percent increase in April. The latest reduction put the SA index at 109.6 (2000=100).

...

Compared with May 2009, SA tonnage increased 7.2 percent, which was the sixth consecutive year-over-year gain. In April, the year-over-year increase was 9.5 percent. Year-to-date, tonnage is up 6.2 percent compared with the same period in 2009.

ATA Chief Economist Bob Costello said that truck freight tonnage is going to have ups and downs, but the trend continues in the right direction. “Despite the month-to-month drop in May, the trend line is still solid. There is no way that freight can increase every month, and we should expect periodic decreases. This doesn’t take away from the fact that freight volumes are quite good, especially considering the reduction in truck supply over the last couple of years.”

This graph from the ATA shows the Truck Tonnage Index since Jan 2006 (no larger image).

This graph from the ATA shows the Truck Tonnage Index since Jan 2006 (no larger image). This index has only shown a gradual increase since December.

Rail traffic was also soft in May.

KB Home: "Month of May was particularly challenging" for housing industry

by Calculated Risk on 6/25/2010 11:33:00 AM

On the conference call this morning, Jeffrey Mezger, president and chief executive officer of KB Home said the month of May was "particularly challenging" for the housing industry.

Paraphrasing ..

Q&A just started ...

On the current quarter (ended May 31st) from MarketWatch: KB Home shares fall on 'disappointing' results

Q1 GDP revised down to 2.7%

by Calculated Risk on 6/25/2010 08:32:00 AM

The Q1 real GDP rate was revised down again (third estimate) to 2.7% from the 2nd estimate of 3.0%.

Consumer spending was weaker in Q1 than originally estimated. PCE growth (personal consumption expenditures) was revised down to 3.0% in Q1 from the previous estimate of 3.5%.

Some more from Reuters: Economy Grew Slower in First Quarter than Expected, Up 2.7%

... business spending, which only rose at a 2.2 percent rate instead of 3.1 percent as reported last month. This was as a spending on structures was revised down to show a slightly bigger decline than reported last month. Growth in software and equipment investment was also lowered to a 11.4 percent rate from 12.7 percent.The "Change in private inventories" was revised up to a contribution of 1.88 percentage points from the previous estimate of 1.65. So inventory adjustment accounted for over two-thirds of the GDP growth in Q1 - and the inventory adjustment appears over. This is a weak third estimate.

...

Another drag on growth came from exports whose growth was eclipsed by a rise in imports, resulting in a trade deficit that subtracted from GDP.

... real final sales to domestic purchasers, considered a better measure of domestic demand, rose at a 1.6 percent rate instead of the 2.0 percent pace reported last month.

Thursday, June 24, 2010

Late Night Reading

by Calculated Risk on 6/24/2010 11:59:00 PM

Just a couple of depressing articles ...

From Paul Krugman in the NY Times: The Renminbi Runaround

As of Thursday, the currency was only about half a percent higher than its typical level before the announcement. And all indications are that watching the future movement of the renminbi will be like watching paint dry: Chinese officials are still making statements denying that a rise in their currency will do anything to reduce trade imbalances, and prices in the forward market, in which traders agree to exchange currencies at various points in the future, suggest a rise of only about 2 percent in the renminbi by the end of this year. This is basically a joke.From Michael Pettis: What might history tell us about the Greek crisis?

Update: Unemployment Benefits, Housing Tax Credit

by Calculated Risk on 6/24/2010 07:32:00 PM

From Lori Montgomery at the WaPo: Senate again rejects emergency spending package

The Senate on Thursday rejected a package of tax cuts, state aid and emergency jobless benefits ... [try again] after the July 4 recess. By then, more than 2 million people will have seen their unemployment benefits cut off, according to the U.S. Department of Labor.What this means is that anyone receiving extended unemployment benefits (there are several tiers) will not be eligible for the next tier when their unemployment benefits expire.

This bill also contains the extension of the closing date for the homebuyer tax credit. As of right now, homebuyers must close by June 30th to receive the tax credit.

But of course the housing industry wants even more. From Zach Fox at SNL Financial: Analysts: Record low new-home sales could lead to another tax credit

Even though he is not in favor of another tax credit, [Michael Widner, an analyst with Stifel Nicolaus & Co.] said May's exceptionally low number means plenty of industry insiders will push for one.Hopefully there will not be another housing tax credit. And hopefully the change in eligibility date for extended unemployment benefits will be approved.

"On the one hand, I know that the phones are ringing off the hook in D.C. right now for people clamoring for a new tax credit," Widner said. "So the shock value of an all-time low is going to be a lot of people saying: 'Oh my God, we gotta do more to stimulate housing.' ... And on the other hand, you're going to get people, who frankly I side with more, saying: 'You know, look, obviously the tax credit did nothing but pull demand forward, and in the wake of the tax credit you see the void left behind.'"

Misc: Quote of the Day, Greece Bond Spreads increase Sharply, and Market Update

by Calculated Risk on 6/24/2010 04:00:00 PM

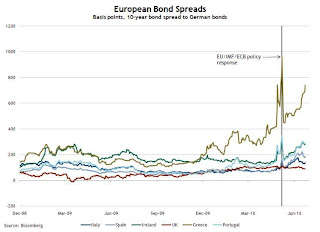

Here is a graph from the Atlanta Fed weekly Financial Highlights released today (graph as of June 23rd): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Greek bond spreads (over German bonds) have risen recently, near the highs seen before the European policy package was announced in early May.Note: The Atlanta Fed data is one day old. Nemo has links to the current data on the sidebar of his site.

Other euro zone countries’ bond spreads are also elevated during the same period.

Since tightening in early May, the 10-year Greece-to-German bond spread has risen to nearly 300 basis points (bps) (from 4.38% to 7.39%) through June 22. Other European peripherals’ spreads are elevated, with Portugal up 138 bps over the period, Ireland up 111 bps, and Spain 86 bps higher.

The spreads have widened further today: Greece is up sharply to 781 bps today.

Click on graph for interactive version in new window.

The graph has tabs to look at the different bear markets - "now" shows the current market - and there is also a tab for the "four bears".

And here is the quote of the day from BofA (via Bloomberg, ht Bill):

"Given the depth of the nation’s recessionary impacts on homeowners, a considerable number of customers will transition from homeownership over the next two years.""Transition from homeownership ..." Ouch.

Barbara Desoer, president of Bank of America’s home-loan and insurance unit, said in testimony prepared for a congressional hearing June 24, 2010