by Calculated Risk on 6/11/2010 01:20:00 PM

Friday, June 11, 2010

Report: FBI to "arrest hundreds of people" next week for Mortgage Fraud

From the Financial Times: FBI to target mortgage fraud

The FBI is preparing to arrest hundreds of people across the US as early as next week for offences including encouraging borrowers to falsify income on mortgage applications, misleading home owners about foreclosure rescue programmes, and inflating home appraisals ... The FBI is scheduled to release its 2009 mortgage report on June 17.The FBI usually only arrests people engaged in fraud for profit and not fraud for housing - they typically don't arrest borrowers who misrepresented their income - they arrest mortgage brokers who encouraged people to falsify their income. Although the distinction was blurred during the bubble ...

excerpt with permission

Tanta wrote a great piece on this in 2007: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. ...The FBI will probably be busy for years.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. ...

The problem with this traditional distinction is that, recently, we seem to have an epidemic of predator meeting predator and forming an alliance: a borrower willing to commit fraud for housing meets up with a seller or lender willing to commit fraud for profit, and the thing gets jacked up to a whole new level of nastiness.

Here is another scam in Florida from Sally Kestin at the Sun Sentinel: Squatters take over S. Fla. homes in what police call latest fraud in housing crisis (ht Ray).

Manufacturing and Trade Inventory-to-Sales Ratio: Inventory Adjustment Over

by Calculated Risk on 6/11/2010 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed that the inventory adjustment is over:

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,354.3 billion, up 0.4 percent (±0.1%) from March 2010, but down 2.8 percent (±0.3%) from April 2009.

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of April was 1.23. The April 2009 ratio was 1.43.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the inventory to sales ratio. This has declined sharply to 1.23 (SA) from the peak of 1.48 back in Jan 2009. This could decline further - the trend is definitely down over time - but clearly the inventory adjustment is over.

This is important because the change in inventory added significantly to Q4 GDP growth and some to Q1 GDP. See BEA line 13: the contribution to GDP in Q4 2009 from 'Change in private inventories' was 3.79 of the 5.9 percent annualized increase in Q4 GDP. In Q1 2010. the 'change in private inventories' was 1.65 of the 3.0 percent annualized increase.

Any boost to Q2 GDP from inventory changes will be minor.

It now appears the inventory adjustment is over. Further growth in inventories will depend on increases in underlying demand. This is part of the 2nd half slowdown forecast.

Retail Sales decline in May

by Calculated Risk on 6/11/2010 08:30:00 AM

On a monthly basis, retail sales decreased 1.2% from April to May (seasonally adjusted, after revisions), and sales were up 6.9% from May 2009 (easy comparison).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

Retail sales are up 8% from the bottom, but still off 4.6% from the pre-recession peak. The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.6% on a YoY basis (6.9% for all retail sales). The year-over-year comparisons are easy now since retail sales collapsed in late 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $362.5 billion, a decrease of 1.2 percent (±0.5%) from the previous month, but 6.9 percent (±0.7%) above May 2009.This is just one month, but this is a weak report.

Thursday, June 10, 2010

Senate Bill would extend Housing Tax Credit Closing Deadline

by Calculated Risk on 6/10/2010 11:59:00 PM

From Dina ElBoghdady at the WaPo: Bill would extend home buyers' deadline for tax credit

Home buyers hoping to take advantage of a lucrative federal tax credit would get three extra months to complete their purchases under a proposal introduced in the Senate on Thursday.I've wasted enough posts explaining why this was a poor use of taxpayers' money .. but a three month extension to close? Geesh ... that is ridiculous.

Hotel Occupancy Increases

by Calculated Risk on 6/10/2010 08:32:00 PM

From HotelNewsNow.com: STR: Economy segment tops occupancy increases

Overall, in year-over-year measurements, the industry’s occupancy increased 1.0 percent to 57.1 percent. Average daily rate dropped 2.3 percent to US$93.93. Revenue per available room decreased 1.3 percent to US$53.61.Note: This was a difficult comparison because of the timing of Memorial Day.

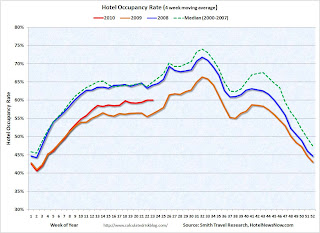

The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate - higher in the summer because of leisure/vacation travel.

The occupancy rate collapsed in the 2nd half of 2008 (blue line), and 2009 was the worst year since the Great Depression.

For the last three months, the occupancy rate has been running above the same period in 2009 - but still well below the normal level.

Last year leisure travel (summer) held up better than business travel, now it appears business travel is recovering - and we will soon see if leisure travel will also pick up this year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Update on European Bond and CDS Spreads

by Calculated Risk on 6/10/2010 05:54:00 PM

Here are two graphs from the Atlanta Fed weekly Financial Highlights released today (graph as of June 9th):

UPDATE: As I noted, this data is as of June 9th (or earlier). The spreads narrowed today. Nemo has links to the data on the sidebar of his site. "The 10-year Obligacion del Estado fell to 4.48%, for a spread of 187 bps ... [lower than the] 211 bps the Atlanta Fed cited." Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Following a decline after the initial reports of the EU/IMF €750 billion package and ECB bond purchases, peripheral euro area bond spreads (over German bonds) have widened.

In particular, the bond spreads for Italy and Spain have widened the most relative to their levels before the rescue package was unveiled.

After initially declining four weeks ago, sovereign debt spreads have begun widening for peripheral euro area countries. As of June 9, the 10-year bond spread stands at 554 basis points (bps) for Greece, 258 bps for Ireland, 265 bps for Portugal, and 211 bps for Spain.

The spread to Italian bonds has increased 76 bps since May 11, from 1% to 1.75%, while Portuguese bond spreads are 112 bps higher during the same period. U.K. bond spreads are essentially unchanged.

Similarly, CDS spreads have widened after the initial response to the stabilization package.After declining following the policy response, the bond and CDS spreads have resumed their steady climb.

Is this what IMF Managing Director Dominique Strauss-Kahn meant by "contained"?

Debt Problem "Contained" in Europe, Market and Short Sale Fraud

by Calculated Risk on 6/10/2010 04:00:00 PM

Quote of the day via Bloomberg (ht Bob_in_MA):

We do believe the recovery is strong,” Dominique Strauss-Kahn said in an interview with Bloomberg HT television in Istanbul. While rising debt levels are a risk to growth, mainly in Europe, authorities in the region “are now really committed to solve it” and “the problem has been contained,” he said.And this reminds us of Fed Chairman Bernanke's testimony on March 28, 2007:

"[T]he impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained."Uh oh, not another problem "contained"!

And a market graph from Doug Short of dshort.com (financial planner).

This graph shows the ups and downs of the market since the high in 2007.

And on short sale fraud, from Bloomberg: Banks Face Short-Sale Fraud as Home ‘Flopping’ Rises (ht Mike in Long Island, Brian, Alex)

Two Connecticut real estate agents ... are scheduled to be sentenced in Hartford’s federal court in August after pleading guilty to fraud. Their crime involved persuading lenders to approve the sale of homes for less than the balance owed --known as a short sale -- without disclosing that there were better offers. They then flipped the houses for a profit.There are many versions of short sale fraud. Here is a story I recently heard from a reliable source:

A homeowner in California's Inland Empire bought for $350,000, refinanced during the boom for over $700,000 (cash out), and put in a pool, fixed up the house, and bought some toys. After house prices collapsed, and his loan reset to the fully amortizing rate, he talked his bank into a short sale (the homeowner is a real estate agent) - to his cousin for $350,000! The previous homeowner is now leasing the home from his cousin ...

The house was listed on the MLS for one minute at midnight (to satisfy the bank). And then listed as pending. These one minute listings are a red flag for possible fraud. Whether the transaction is not arms length (as above), or the listing agent is just trying to get both sides of the commission - this is not the best deal for the lenders (and frequently taxpayers).

This is a classic agency problem. As part of a short sale agreement, I think the bank should hire the listing agent - and also require the property to be listed openly for a minimum period.

Q1 Flow of Funds: Household Net Worth off $11.4 Trillion from Peak

by Calculated Risk on 6/10/2010 11:59:00 AM

The Federal Reserve released the Q1 2010 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.4 Trillion from the peak in 2007, but up $6.3 trillion from the trough in Q1 2009. A majority of the decline in net worth is from real estate assets with a loss of about $6.4 trillion in value from the peak. Stock market losses are still substantial too. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices collapsed in 2007 and 2008.

In Q1 2010, household percent equity (of household real estate) was up to 38.2% from the all time low of 33.3% last year. The increase was due to both an increase in the value of household real estate and a $99 billion decline in mortgage debt.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.2% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP decreased slightly in Q1 as the value of real estate assets declined slightly, and GDP increased.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP decreased slightly in Q1 as the value of real estate assets declined slightly, and GDP increased.

Mortgage debt declined by $99 billion in Q1. Mortgage debt has now declined by $377 billion from the peak.

Ceridian-UCLA: Diesel Fuel index increases sharply in May

by Calculated Risk on 6/10/2010 11:20:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: PCI Strikes Optimistic Note For U.S. Economy with 3.1 Percent Gain in May

With a monthly increase not seen since February 1999, the Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management climbed 3.1 percent in May. The increase represents the strongest indicator yet from the PCI that the U.S. economy is on the upswing.

...

“Absent good news from the usual recovery indicators – consumer optimism expressed by buying homes and cars, and business optimism expressed by hiring – the spike in the PCI is indeed very welcome news for the economy,” said Ed Leamer, the PCI’s chief economist. “One month does not make a trend, but at least we are back in a recovery groove.”

The May result makes up for April’s decline of 0.3 percent and for the PCI’s flat, overall performance during the first four months of 2010.

...

The PCI is based on an analysis of real-time diesel fuel consumption data ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999.

Note: This index appears to lead Industrial Production (IP), but there is a significant amount of monthly noise. This is a new index and might be interesting to follow along with the Trucking and Railroad data.

Here is a video of Leamer's comments on the report. After a few months of almost no growth, this index increased sharply in May.

Trade Deficit increases slightly in April

by Calculated Risk on 6/10/2010 09:07:00 AM

The Census Bureau reports:

[T]otal April exports of $148.8 billion and imports of $189.1 billion resulted in a goods and services deficit of $40.3 billion, up from $40.0 billion in March, revised. April exports were $1.0 billion less than March exports of $149.8 billion. April imports were $0.8 billion less than March imports of $189.9 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through April 2010.

On a year-over-year basis, exports are up 20% and imports are up 24%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased slightly to $77.13 in April - and are up 97% from the low of February 2009 (at $39.22). Oil import volumes were down in April.

Although both imports and exports were off slightly in April, both have been increasing sharply - but are still below the pre-crisis levels. Once again China and oil are the major contributors to the trade deficit.