by Calculated Risk on 5/20/2010 03:45:00 PM

Thursday, May 20, 2010

Market Update

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in March 1998; over 12 years ago.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

As an aside, once again the Shanghai composite index appeared to lead both the S&P 500 and oil prices. Not only are there issues in Europe, but China is slowing ...

Freddie Mac: Near Record Low Mortgage Rates

by Calculated Risk on 5/20/2010 02:45:00 PM

From Freddie Mac: Long- and Short-Term Mortgage Rates Fall Again This Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.84 percent with an average 0.7 point for the week ending May 20, 2010, down from last week when it averaged 4.93 percent. Last year at this time, the 30-year FRM averaged 4.82 percent. Once again, the 30-year FRM has not been lower since the week ending December 10, 2009, when it averaged 4.81 percent.The record low was 4.71% for the week of Dec 3, 2009 (series started in 1971).

The decline in mortgage rates is being driven by the decrease in the Treasury yield. The Ten Year treasury yield is currently at 3.26%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 30 year mortgage rates from the Freddie Mac survey, and the ten year Treasury yields, since January 2008.

The spread between the two series has widened slightly since the program ended.

From Bloomberg:

The difference between yields on the Fannie Mae securities and 10-year Treasuries widened 0.03 percentage point to 0.81 percentage point, Bloomberg data show. The spread reached 0.59 percentage point on March 29, the lowest on record ... The gap climbed to 0.86 percentage point May 6, after holding near that low in April.As an aside, the euro has strengthened a little and is close to 1.26 dollars today - up from 1.23 yesterday.

FDIC Q1 Banking Profile: 775 Problem Banks

by Calculated Risk on 5/20/2010 11:51:00 AM

The FDIC released the Q1 Quarterly Banking Profile today. The FDIC listed 775 banks with $431 billion in assets as “problem” banks in Q1, up from 702 banks with $403 billion in assets in Q4, and 305 banks and $220 billion in assets in Q1 of 2009.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 725 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

All data is year end except Q1 2010.

The 775 problem banks reported at the end of Q1 is the highest since June 30, 1993, when the number of "problem" institutions totaled 793.

The FDIC is still on pace for 1,000 problem banks by the end of the year, although it also depends on how many banks are removed from the list.  The second graph shows the assets of "problem" banks since 1990.

The second graph shows the assets of "problem" banks since 1990.

The assets of problem banks are the highest since June 30, 1993 when the assets of "problem" institutions were $467 billion.

Philly Fed Index increases slightly in May, New orders index declines

by Calculated Risk on 5/20/2010 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

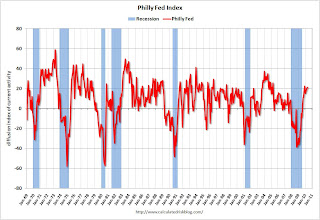

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased slightly from 20.2 in April to 21.4 this month. The index has now edged higher for four consecutive months and has remained positive for the ninth consecutive month (see Chart). Although still positive and suggesting growth, indexes for new orders and shipments showed a mixed pattern this month: The new orders index fell 8 points, while the shipments index increased 10 points. The current inventory index decreased 10 points and fell into negative territory, suggesting declines in inventories. Indexes for unfilled orders and delivery times were both negative this month, suggesting some weakening in activity from April.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for nine months now, after being negative or zero for 21 straight months.

The internals suggest manufacturing conditions are softening a little, as also suggested earlier by the New York Empire State manufacturing index.

Weekly Initial Unemployment Claims Increase 25,000

by Calculated Risk on 5/20/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 15, the advance figure for seasonally adjusted initial claims was 471,000, an increase of 25,000 from the previous week's revised figure of 446,000. The 4-week moving average was 453,500, an increase of 3,000 from the previous week's unrevised average of 450,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 8 was 4,625,000, a decrease of 40,000 from the preceding week's revised level of 4,665,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 3,000 to 453,500.

The dashed line on the graph is the current 4-week average. The 4-week average first declined to this level at the end of December 2009, and has been at this level for almost five months. The current level of 471,000 (and 4-week average of 453,500) is still high, and suggests ongoing weakness in the labor market.

Wednesday, May 19, 2010

Summary: Busy Day

by Calculated Risk on 5/19/2010 09:44:00 PM

1) Press Release from the MBA: Delinquencies, Foreclosure Starts Fall in Latest MBA National Delinquency Survey

2) Comments from MBA conference call.

3) Two key graphs: Mortgage Delinquencies by Period and by State

The Euro is back up a little to 1.23 dollars.

And CNBC Pre-Market Data shows the S&P 500 futures off

Moody's: CRE Prices Decline 0.5% in March

by Calculated Risk on 5/19/2010 06:49:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 0.5% in March. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

Commercial real estate values are now down 25% over the last year, and down 42% from the peak in August 2007.

Mortgage Delinquencies by Period and by State

by Calculated Risk on 5/19/2010 04:01:00 PM

Much was made last quarter about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Unfortunately the seasonally adjusted 30 day delinquency rate increased in Q1 2010.

Note: there are some questions about the seasonal adjustment, especially for the 90 day bucket since we've never seen numbers this high before, but the adjustment for the 30 and 60 day periods are probably reasonable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loans 30 days delinquent increased to 3.45%, about the same level as in Q4 2008.

Delinquent loans in the 60 day bucket increased too, and are also close to the Q4 2008 level. This suggests that the pipeline is still filling up at a high rate, but slightly below the rates of early 2009.

The 90+ day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings - and the 90+ day delinquent bucket is very full. Also lenders have been slow to actually foreclose - and the 'in foreclosure' bucket is at record levels.

These seriously delinquent loans are the 4.3 million loans MBA Chief Economist Jay Brinkmann referred to as the "shadow inventory" on the conference call this morning. Not all are really "shadow inventory" since some of these loans will be modified, some will be cured (probably very few), and some are probably already listed as short sales. But it does suggest a significant number of distressed sales coming.  The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

This highlights a couple more points that Brinkmann made this morning: 1) the largest category of delinquent loans are fixed rate prime loans, and 2) this is not just a "sand state" problem. Brinkmann argued the foreclosure crisis is now being driven by economic problems as opposed to the bursting of the housing price bubble - and this is showing up in prime loans and all states. Although Florida and Nevada are very high, notice that the blue bar (new delinquencies) are higher in many other states.

Thirty four states and the District of Columbia have total delinquency rates over 10%. This is a widespread problem.

FOMC Minutes: On Greece and Housing

by Calculated Risk on 5/19/2010 02:00:00 PM

From the April 27-28, 2010 FOMC meeting.

On Greece:

[P]articipants saw the escalation of fiscal strains in Greece and spreading concerns about other peripheral European countries as weighing on financial conditions and confidence in the euro area. If other European countries responded by intensifying their fiscal consolidation efforts, the result would likely be slower growth in Europe and potentially a weaker global economic recovery. Some participants expressed concern that a crisis in Greece or in some other peripheral European countries could have an adverse effect on U.S. financial markets, which could also slow the recovery in this country.On Housing:

[T]he recovery in the housing market appeared to have stalled in recent months despite various forms of government support. Although residential real estate values seemed to be stabilizing and in some areas had reportedly moved higher, housing sales and starts had leveled off in recent months at depressed levels. Some participants saw the possibility of elevated foreclosures adding to the already very large inventory of vacant homes as posing a downside risk to home prices, thereby limiting the extent of the pickup in residential investment for a while.The FOMC is forecasting moderate growth however they expect the unemployment rate to remain elevated for some time:

In their discussion of the economic situation and outlook, meeting participants agreed that the incoming data and information received from business contacts indicated that economic activity continued to strengthen and the labor market was beginning to improve. Although some of the recent data on economic activity had been better than anticipated, most participants saw the incoming information as broadly in line with their earlier projections for moderate growth; accordingly, their views on the economic outlook had not changed appreciably. Participants expected the economic recovery to continue, but, consistent with experience following previous financial crises, most anticipated that the pickup in output would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion, in turn, would imply only a modest improvement in the labor market this year, with the unemployment rate declining gradually.

First American CoreLogic: House Prices Decline 0.3% in March

by Calculated Risk on 5/19/2010 12:31:00 PM

From LoanPerformance: CoreLogic Home Price Index Shows Second Consecutive Annual Increase

National home prices, including distressed sales, increased by 1.7 percent in March 2010 compared to March 2009, according to CoreLogic and its Home Price Index (HPI). This was an improvement over February’s year-over-year price increase of 0.8 percent.* Excluding distressed sales, year-over-year prices increased in March by 1.9 percent; an improvement over the February non-distressed HPI which fell by 0.2 percent year-over-year.

On a month-over-month basis, the national average home price index fell by 0.3 percent in March 2010 compared to February 2010, which was more moderate than the previous one month decline of 1.7 percent from January to February.

...

“March’s year-over-year increase in the HPI shows that the housing market is continuing to exhibit signs of stability,” said Mark Fleming, chief economist for CoreLogic. “The differences between trends, including and excluding distressed sales, indicate the strong influence of distressed activity remains, but the surge in home sales in March is giving the market a boost this spring. As the influence of the tail end of the tax credit and spring buying season fade, price growth will fade with it as we go into summer.”

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is up 1.7% over the last year, and off 30.5% from the peak.

House prices are off 4.8% from the recent peak in August 2009 (although some of the decline is seasonal). The index bottomed last March ... so the index is also up 1.7% from the recent low.

With all the distressed sales and government programs, it is hard to separate the seasonal factors from other distortions. However I expect that we will see lower prices on this index later this year.

Note: This is the house price index the Fed now uses for the Flow of Funds report.