by Calculated Risk on 3/17/2010 09:29:00 PM

Wednesday, March 17, 2010

Comparing New Home Sales and Housing Starts

Click on graph for larger image in new window.

Click on graph for larger image in new window.

A frequently asked question is how do new home sales compare to single family housing starts (both series from the Census Bureau). This graph shows the two series - although they track each other, the two series cannot be directly compared.

For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. From the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series. We categorize new residential construction into four intents, or purposes:However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The Q4 quarterly report showed that there were 71,000 single family starts, built for sale, in Q4 2009, and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA).

Built for sale (or speculatively built): the builder is offering the house and the developed lot for sale as one transaction this includes houses where ownership of the entire property including the land is acquired ("fee simple") as well as houses sold for cooperative or condominium ownership. These are the units measured in the New Residential Sales series.

Contractor-built (or custom-built): the house is built for the landowner by a general contractor, or the land and the house are purchased in separate transactions.

Owner-built: the house is built entirely by the landowner or by the landowner acting as his/her own general contractor.

Built for rent: the house is built with the intent that it be placed on the rental market when it is completed.

Q4 was the 9th consecutive quarter with homebuilders selling more homes than they start.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders do build spec homes and many builders were stuck with some “unintentional spec homes” because of cancellations during the bust.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased. For the last 9 quarters, starts have been below sales – and new home inventories have been falling.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased. For the last 9 quarters, starts have been below sales – and new home inventories have been falling.It is possible that the streak will be broken in Q1, and that the builders started more single family homes, built for sale, than they sold. This is because a number of builders started some extra spec homes in anticipation of a "buying rush" in April before the tax credit expires. To qualify for the tax credit, the homes have to be finished before June 30th - and it takes close to 6 months to build a home - so some builders started a few extra homes in January that they hope will sold in Q2.

REO: Agencies vs. Private Label

by Calculated Risk on 3/17/2010 06:15:00 PM

CR Note: the following is from housing economist Tom Lawler (posted with permission):

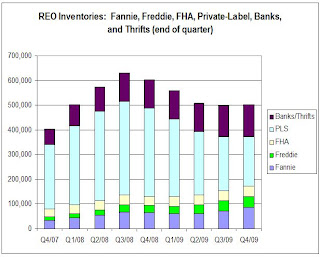

Last month I showed data on trends in the REO inventories of Fannie, Freddie, and FHA, highlighting how while total REO inventory estimates appear to have fallen, REO at “the F’s” has increased notably over the last year. A few folks questioned how there could be reports of sharply lower REO inventories in many parts of the country if the F’s REO’s were up so much.

Well, the answer mainly in REO inventories in the “non-agency” space, and especially REO inventories held by trusts for private-label mortgage-backed securities. Here is a chart (courtesy of Amherst) showing REO inventories for private-label securities tracked by LoanPerformance, which folks estimate accounts for about 85-90% of the private-label market.

As the above chart indicates, REO inventory from private-label MBS (where mortgage credit performance started to deteriorate sharply well before the ‘prime” market began to deteriorate in a big way) increased at a rapid clip from end of 2007 through the fall of 2008, peaking in October. It then began to decline as servicers accelerated the pace of REO sales last winter and early Spring, often by slashing prices – thus resulting in the “de-stickification” of home prices observed this cycle relative to past cycles.

Most areas where one hears that REO inventories have plunged over the last year are in areas that had a high share of “risky” mortgages and a disproportionately high share of loans that were packaged into private-label securities.

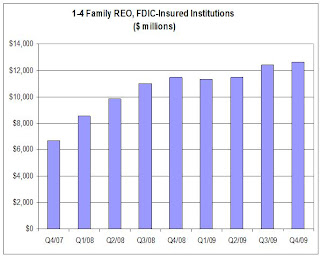

On the depository institution front, data on the book value of FDIC-insured institutions’ holdings of 1-4 family REO – in $’s, but not units – is shown below.

Second, over the last few years the % of mortgages held by banks and thrifts that are FDIC insured has increased. E.g., according to Fed data vs. FDIC data, the ratio of 1-4 family mortgages held by FDIC-insured institutions to 1-4 family mortgages held by all bank and savings institutions went from 89.3% at the end of 2007 to 92.9% at the end of 2009 – implying that the above chart for REO trends overstates a tad the increase in all banks and thrifts.

Having said that, it’s pretty clear that REO inventories at depositories grew at a decent clip (though much slower than REO at PLS) from the end of 2007 to the end of 2008, went down a “scooch” in the first half of 2009 (mainly, I believe, reflecting certain foreclosure moratoria), and then increased a bit in the second half of last year – though less rapidly than at the GSEs.

Note that this is still a “work in progress, and some of the assumptions I’ve made on depositories could be wrong. However, for those who wondered “how could REO have fallen so much if REO at ‘the F’s’ had gone up so much,” here is your answer. Once you factor in the private label market, it is not so “F’ing” hard to understand.

CR Note: The post was from economist Tom Lawler.

Bernanke on Bank Supervision

by Calculated Risk on 3/17/2010 02:52:00 PM

Fed Chairman Ben Bernanke: The Federal Reserve's role in bank supervision

Professor Hamilton supports Bernanke's view: Bank supervision and the Federal Reserve

The Fed employs hundreds of extremely bright and very well-informed economists. On my visits to the Federal Reserve, I've been amazed at how well the staff work together to assimilate information and perspectives. In my experience, you can ask any one of them a question about pretty much anything, and although the person you're talking with may not know the answer, he or she will know the name of the person within the Fed who does know. I've interacted with lots of different institutions over the years, and have never seen another one that functions so effectively as a single, cohesive neural processor. Certainly the objective record of Federal Reserve forecasts is pretty impressive; see for example the assessments by Christina and David Romer and Faust and Wright.From CR: The Fed has a number of roles and they are all somewhat related: monetary policy, lender of last resort, bank supervision and consumer financial protection.

Doubtless others will be skeptical, trotting out the Fed's spectacular underestimation of financial problems during 2005-2007. That criticism is of course well taken, and both the Fed and the economics profession as a whole have much more work to do in terms of recognizing exactly what should have been done differently. But let's be practical. What other institution did a better job? Where in Washington today do you see an agency with the intellectual resources to get this right?

Clearly something went wrong with bank supervision during the recent bubble and bust. And here are the improvements Bernanke outlined today:

To improve both our consolidated supervision and our ability to identify potential risks to the financial system, we have made substantial changes to our supervisory framework. So that we can better understand linkages among firms and markets that have the potential to undermine the stability of the financial system, we have adopted a more explicitly multidisciplinary approach, making use of the Federal Reserve's broad expertise in economics, financial markets, payment systems, and bank supervision to which I alluded earlier. We are also augmenting our traditional supervisory approach that focuses on firm-by-firm examinations with greater use of horizontal reviews that look across a group of firms to identify common sources of risks and best practices for managing those risks. To supplement information from examiners in the field, we are developing an off-site, enhanced quantitative surveillance program for large bank holding companies that will use data analysis and formal modeling to help identify vulnerabilities at both the firm level and for the financial sector as a whole. This analysis will be supported by the collection of more timely, detailed, and consistent data from regulated firms.I think the key question is: How much sooner would these changes have caught the lending problems? I think the answer might be 2007 - and that was already too late.

Many of these changes draw on the successful experience of the Supervisory Capital Assessment Program (SCAP), also known as the banking stress test, which the Federal Reserve led last year. As in the SCAP, representatives of primary and functional supervisors will be fully integrated in the process, participating in the planning and execution of horizontal exams and consolidated supervisory activities.

Improvements in the supervisory framework will lead to better outcomes only if day-to-day supervision is well executed, with risks identified early and promptly remediated. Our internal reviews have identified a number of directions for improvement. In the future, to facilitate swifter, more-effective supervisory responses, the oversight and control of our supervisory function will be more centralized, with shared accountability by senior Board and Reserve Bank supervisory staff and active oversight by the Board of Governors. Supervisory concerns will be communicated to firms promptly and at a high level, with more-frequent involvement of senior bank managers and boards of directors and senior Federal Reserve officials. Greater involvement of senior Federal Reserve officials and strong, systematic follow-through will facilitate more vigorous remediation by firms. Where necessary, we will increase the use of formal and informal enforcement actions to ensure prompt and effective remediation of serious issues.

Hamilton asks who did a better job? Unfortunately all the regulators missed the problems.

Squatter Stimulus: No Mortgage Payment for Three Years and Counting

by Calculated Risk on 3/17/2010 12:33:00 PM

Note: I didn't mean "Squatter Stimulus" as a put down. Many of these people are in limbo and facing serious uncertainty. This is a term that is being bandied about ... and I didn't mean to make fun of the plight of some homeowners.

The Irvine Housing Blog has an example of the squatter stimulus (homeowners living in their homes and not paying the mortgage): One Defaulting Owner’s Free Ride: Three Years and Counting (ht ghostfaceinvestah)

Freeloaders enjoying the entitled life are not confined to subprime areas. Today's featured property may be the worst case of housing entitlement in the country, and it is right here in Irvine.I've heard a number of stories of people living in their homes for a year or more without paying their mortgage - and without the bank foreclosing. It is difficult to get a handle on the actual number of long term delinquencies (say longer than 6 months without the bank foreclosing). Is this widespread or are these isolated incidents?

...

The owner of today's featured property paid $465,000 on 10/23/2003. She used a $372,000 first mortgage, a $93,000 second mortgage, and a $0 down payment.Consider what this woman accomplished:On 12/30/2004 she refinanced into an Option ARM for $486,500. Two months later on 2/3/2005 she opened a HELOC for $67,000. Total property debt is $553,500 plus 3 years of missed payments, negative amortization, and fees. Total mortgage equity withdrawal is $88,500. ...She put no money into the transaction. None. She extracted $88,500 in just over one year. That is nearly the median income in Irvine, and that money came to her without tax withholding. She has lived in the property since 2003, and in the full term of ownership, she has not made payments totaling what she pulled from the property.

The owner of this property stopped making payments sometime in late 2006. It has been over [three years] since this owner stopped paying, and she is still listed as the property owner, so one can assume she still occupies the property.

LA Times: More 'strategic defaults'

by Calculated Risk on 3/17/2010 10:02:00 AM

From Alana Semuels at the LA Times: More homeowners are opting for 'strategic defaults'

Joseph Shull, a 68-year-old marketing professor, said he's planning to walk away from the town house he bought in Moorpark in June 2006.This article is similar to David Streitfeld's article in the NY Times last month: No Aid or Rebound in Sight, More Homeowners Just Walk Away

"I'm angry, and there are a lot of people like me who are angry," he said.

He purchased the home for $410,000 and spent $30,000 renovating. Now the house is worth around $225,000.

Shull admits he overpaid for his property. But he said it fell in value in part because of "regulatory mismanagement."

"The bank stabbed me, but at least I got in a pinprick back," he said. "This is the new economy. The old rules don't apply any more."

I'm not sure if walking away is becoming more common or if there is a bubble in walking away articles. However there are consequences to walking away - possible tax consequences and some loans are recourse (people walk away from the house, but not the debt!). Perhaps the HAFA short sale program would be a better alternative for many homeowners ...

MBA: Mortgage Applications Decrease, Mortgage Rates Fall

by Calculated Risk on 3/17/2010 08:03:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.7 percent from the previous week and the seasonally adjusted Purchase Index decreased 2.3 percent from one week earlier. ...

The refinance share of mortgage activity increased to 67.3 percent of total applications from 67.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.91 percent from 5.01 percent, with points increasing to 1.30 from 0.82 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed-rate observed in the survey since mid-December of 2009, yet the effective rate was unchanged from last week due to the significant increase in points.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with mortgage rates below 5%, the 4 week average of the purchase index is still at the levels of 1997.

Geithner, Orzag, Romer: "We do not expect substantial further declines in unemployment this year"

by Calculated Risk on 3/17/2010 12:43:00 AM

From Treasury Secretary Timothy Geithner, White House budget director Peter Orszag and Christina Romer, chairman of the Council of Economic Advisers: Joint Statement. A few excerpts:

Because of normal growth in the population and the fact that some workers are likely to reenter the labor force as the economy improves, it typically takes employment growth of somewhat over 100,000 per month to bring the unemployment rate down. Because we do not expect job growth substantially over 100,000 per month over the remainder of the year, we do not expect substantial further declines in unemployment this year. Indeed, the rate may rise slightly over the next few months as some workers return to the labor force, before beginning a steady downward trend. ...

As the pace of job creation picks up in 2011 and 2012, there is likely to be greater progress in reducing unemployment. Nonetheless, because of the severe toll the recession has taken on the labor market, the unemployment rate is likely to remain elevated for an extended period. The forecast projects that in the fourth quarter of 2011, the unemployment rate will be 8.9 percent, and that by the fourth quarter of 2012, it will be 7.9 percent.

The unemployment rate at 8.9% in Q4 2011? And 7.9% in Q4 2012? Ouch ...

Tuesday, March 16, 2010

Some previous FOMC forecasts

by Calculated Risk on 3/16/2010 09:32:00 PM

This is just a reminder to take FOMC forecasts with a grain of salt.

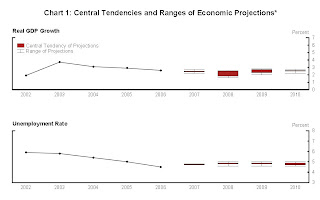

First, the NBER determined that the great recession started in December 2007, and the FOMC met that same month - so we can see what they were thinking. The participant were aware that the incoming data was weakening, but their outlook was still for growth in 2008 and beyond ...

From the December 2007 FOMC Minutes:

In their discussion of the economic situation and outlook, participants generally noted that incoming information pointed to a somewhat weaker outlook for spending than at the time of the October meeting. The decline in housing had steepened, and consumer outlays appeared to be softening more than anticipated, perhaps indicating some spillover from the housing correction to other components of spending. These developments, together with renewed strains in financial markets, suggested that growth in late 2007 and during 2008 was likely to be somewhat more sluggish than participants had indicated in their October projections. Still, looking further ahead, participants continued to expect that, aided by an easing in the stance of monetary policy, economic growth would gradually recover as weakness in the housing sector abated and financial conditions improved, allowing the economy to expand at about its trend rate in 2009.And here are the October projections mentioned in the December minutes:

Click on graph for larger image in new window.

Click on graph for larger image in new window.In October 2007, FOMC participants were forecasting GDP in the 2% range in 2008 with a return to trend growth in 2009, and the unemployment rate rising to perhaps 5%. How did that work out?

Of course this is nothing new. Here are a few quotes from Fed Chairman Alan Greenspan back in 1990 (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990Of course I started marking my graphs with recession blue bars in January 2008 (I had luckily predicted the December start to the recession). Although my current view is for sluggish and choppy growth in 2010, there are still some downside risks - especially in the 2nd half of the year. Right now I think Q1 GDP growth will be sluggish, and the impact from the stimulus will fade over the year.

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990

Distressed Sales: Sacramento as an Example, February Update

by Calculated Risk on 3/16/2010 06:49:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area. It will be especially interesting to track this after the Home Affordable Foreclosure Alternatives (HAFA) starts on April 5th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the February data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 68% of all resales (single family homes and condos) were distressed sales in February.

Note: This data is not seasonally adjusted, and the decline in sales from the end of last year is about normal. The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

Now that many HAMP trial modifications have been cancelled, I expect REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in February were off 24.3% compared to February 2009; the ninth month in a row with declining YoY sales.

On financing, over 60 percent were either all cash (30.7%) or FHA loans (30.2%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

DataQuick: SoCal Home Sales up slightly in February

by Calculated Risk on 3/16/2010 03:58:00 PM

From DataQuick: Southern California median price and sales volume up

Note: Ignore the median price. The repeat sales indexes from Case-Shiller and LoanPerformance are better measures. The median is impacted by the mix.

Southern California home sales in February were above year-ago levels for the 20th month in a row as buyers continued to snap up bargain properties with government-backed mortgages and tax incentives. ....DataQuick doesn't list the percentage of short sales, but the total distressed sales is probably over 50%. Also the 38.5% of buyers using FHA insured loans is way above normal levels.

A total of 15,359 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was virtually unchanged from 15,361 in January, and up 0.8 percent from 15,231 in February 2009, according to MDA DataQuick of San Diego.

[CR Note: this is the second month in a row the YoY increase was razor thin.]

The February sales average is 17,983 going back to 1988, when DataQuick’s statistics begin. The sales distribution remains tilted toward lower-cost distressed homes, although not as steeply as most of last year.

...

Foreclosure resales accounted for 42.3 percent of the resale market last month, up from 42.1 percent in January, and down from 56.7 percent a year ago, which was the all-time high.

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 38.5 percent of all home purchase loans in February.

Absentee buyers – mostly investors and some second-home purchasers – bought 18.9 percent of the homes sold in February. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 29.3 percent of February sales. In January it was a revised 29.7 percent – an all-time high. The 22-year monthly average for Southland homes purchased with cash is 13.8 percent.

When the first time homebuyer tax credit ends, I expect the percent of FHA insured loans to decline sharply - and probably for total sales to decline. The tax credit associated buying will end in April, but the sales are counted when escrow closes - and that could be in May or June.