by Calculated Risk on 3/05/2010 06:12:00 PM

Friday, March 05, 2010

Bank Failure #24 & #25: Illinois and Maryland

Bankers sneer at citizens:

Our loss,... your burden.

February rain.

March green shoots did not flower

These banks push daisies.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Bank of Illinois, Normal, Illinois

Bank of Illinois, Normal, Illinois, was closed today by the Illinois Department of Financial Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: FDIC Creates a New Depository Institution to Assume the Operations of Waterfield Bank, Germantown, Maryland

As of December 31, 2009, Bank of Illinois had approximately $211.7 million in total assets and $198.5 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $53.7 million. ... Bank of Illinois is the 24th FDIC-insured institution to fail in the nation this year, and the third in Illinois. The last FDIC-insured institution closed in the state was George Washington Savings Bank, Orland Park, on February 19, 2010.

Waterfield Bank, Germantown, Maryland, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...No one wanted Waterfield ...

As of December 31, 2009, Waterfield Bank had $155.6 million in assets and $156.4 million in deposits. At the time of closing, the amount of deposits exceeding the insurance limits totaled about $407,000. ...

The FDIC estimates that the cost to its Deposit Insurance Fund will be $51.0 million. Waterfield Bank is the 25th bank to fail in the nation this year and the first in Maryland. The last FDIC-insured institution to fail in the state was Bradford Bank, Baltimore, on August 28, 2009.

Bank Failure #23: Sun American Bank, Boca Raton, Florida

by Calculated Risk on 3/05/2010 05:36:00 PM

Huddled masses cry "Relief!"

Cash burn warms bankers.

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina Assumes All of the Deposits of Sun American Bank, Boca Raton, Florida

Sun American Bank, Boca Raton, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of December 31, 2009, Sun American Bank had approximately $535.7 million in total assets and $443.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $103.8 million. ... Sun American Bank is the 23rd FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was Marco Community Bank, Marco Island, on February 19, 2010.

Update on Post Bubble Real Estate Swindle in San Diego

by Calculated Risk on 3/05/2010 03:36:00 PM

This is an update on a great series by Kelly Bennett of Voice of San Diego.

First a little background: According to Kelly, in 2008 - after the bubble burst - James McConville bought distressed condos from developers in bulk, and then sold them to straw buyers at inflated prices (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

McConville promised to rent the properties, and pay the mortgages from the rental income. Good luck!

This was happening in 2008.

And the update from Kelly Bennett at Voice of San Diego: A Year Later, Losses Pile Up in Complexes Ravaged by Swindle

All of the 81 condos from the Sommerset Villas, Sommerset Woods and Westlake Ranch complexes involved in the scam have been repossessed. Twenty-four have yet to find new buyers. But the other 57 have resold for prices drastically lower than the mortgages were worth, let alone the initial purchase prices.There is much more in the article, but this ties into another article today from Bloomberg: Fannie, Freddie Ask Banks to Eat Soured Mortgages

The U.S. taxpayer is paying for the mounting losses. Across the complexes, the cost to taxpayers is at least $7.8 million.

When the units were just in the beginning stages of foreclosure, it was too soon to tell whether the government-sponsored mortgage companies, Freddie Mac and Fannie Mae, had definitely purchased the shaky loans.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.

That’s the estimate of Oppenheimer & Co. analyst Chris Kotowski, who says U.S. banks could suffer losses of $7 billion this year when those loans are returned and get marked down to their true value.

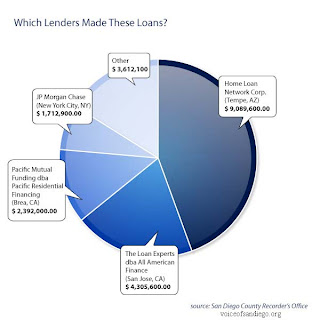

Click on graph for larger image.

Click on graph for larger image.Kelly provided me with this graphic on the San Diego swindle. This shows the lenders that were swindled. Since most of these loans were sold to Fannie and Freddie, there is a good chance the loans will be pushed back on the lenders - if they still exist. We know JPMorgan is still around!

More from Bloomberg:

The banks have to buy back the loans at par, and then take an impairment, because borrowers usually have stopped paying and the price of the underlying home has plunged. JPMorgan said in a presentation last month that it loses about 50 cents on the dollar for every loan it has to buy back.The losses will be much higher than 50 cents on the dollar on these loans.

Frank: Fannie Freddie Investments not Risk Free, Treasury Clarifies

by Calculated Risk on 3/05/2010 01:16:00 PM

UPDATE: From CNBC: Frank Denies Saying No Guarantee on Fannie, Freddie

From Zachary Goldfarb at the WaPo: Rep. Frank questions safety of Fannie Mae, Freddie Mac investments

"People who own Fannie and Freddie debt are not in the same legal position as [those who own] Treasury bonds and I don't want them to be," [Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee] said in an interview Thursday.and from Reuters: U.S. Treasury says stands behind Fannie, Freddie

...

In restructuring the companies, Frank said he wants "to preserve the right to give people haircuts." He added, "I don't want to preclude that."

"As we said in December, there should be no uncertainty about Treasury's commitment to support Fannie Mae and Freddie Mac as they continue to play a vital role in the housing market during this current crisis," the statement from the Treasury said.I think Frank was referring to some future structure of Fannie and Freddie, but the market took his comments as suggesting that current bondholders might take a haircut.

Treasury has reiterated their commitment to Fannie and Freddie (although I wish Treasury would put out statements on their press room site).

Diffusion Index and Temporary Help

by Calculated Risk on 3/05/2010 11:24:00 AM

First - David Leonhardt at the NY Times Economix asks: Is the Recovery Losing Steam?

How you view today’s jobs report depends on snow.We won't know which "snow" view is correct for another month - or maybe even months.

...

If the storms indeed had a big effect — if they cut even 100,000 jobs from payrolls — then today’s report counts as very good news.

...

If the snow effect was close to zero ... the recovery is losing steam — as the peak impact of the stimulus is now past and consumers and businesses still aren’t spending aggressively.

Which of these two situations — the optimistic or pessimistic one — is more plausible? You’ll hear a lot of strong arguments today, but no one really knows. The uncertainty about the snow effect is too big, as the Labor Department did a nice job of acknowledging.

My guess is that recovery has indeed lost some steam in the last couple of months.

But here are a couple more graphs based on data in the employment report - and both of these are little more positive ...

Temporary Workers

From the BLS report:

In February, temporary help services added 48,000 jobs. Since reaching a low point in September 2009, temporary help services employment has risen by 284,000.

This graph is a little complicated.

This graph is a little complicated.The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months. When we discussed this graph last year, temporary help suggested positive job growth in December 2009. But with revisions - the graph has been shifted a few months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution. For more, including some cautionary comments from a BLS economist on using temporary help, see Tom Abate's article in the San Francisco Chronicle.

Also - the temporary hiring for the Census should probably be excluded from this graph in the future (remember the Census will boost payroll jobs by maybe 100 thousand in March, and up to 500 thousand in May - but all those jobs will be lost over the following 6 months).

Diffusion Index

The BLS diffusion index for total private employment increased to 48.0 from 44.2 in January. This is the highest level since March 2008.

The BLS diffusion index for total private employment increased to 48.0 from 44.2 in January. This is the highest level since March 2008.For manufacturing, the diffusion index is at 54.9, the first time above 50 since November 2007.

Think of this as a measure of how widespread job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The diffusion index had been trending up, meaning job losses are becoming less widespread.

However a reading of 48.0 is still below the balance level, and I'd expect the diffusion index to be at or above 50 when the economy starts adding net jobs.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 3/05/2010 09:47:00 AM

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased slightly to 64.8% (the percentage of the working age population in the labor force). This is at the level of the early 80s.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) increased from 8.3 to 8.8 million in February, partially offsetting a large decrease in the prior month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million.

The all time record of 9.2 million was set in October. The increase this month might have been weather related.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.13 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 4.0% of the civilian workforce, a slight decrease from the 6.3 million and 4.1% record set last month. (note: records started in 1948)

The number of long term unemployed is one of the key stories of this recession.

Overall there were some positives in the report: the unemployment rate was steady, and the employment-population ratio ticked up slightly (after plunging sharply). Although average hours worked decreased slightly, and part time workers increased - those were probably both impacted by the weather (usually hours worked is impacted more than the headline number by snow storms).

I'll have even more later ...

Earlier employment post today:

Employment Report: 36K Jobs Lost, 9.7% Unemployment Rate

by Calculated Risk on 3/05/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment was little changed (-36,000) in February, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and information, while temporary help services added jobs. Severe winter weather in parts of the country may have affected payroll employment and hours; however, it is not possible to quantify precisely the net impact of the winter storms on these measures.

...

Major winter storms affected parts of the country during the February reference periods for the establishment and household surveys.

In the establishment survey, the reference period was the pay period including February 12th. In order for severe weather conditions to reduce the estimate of payroll employment, employees have to be off work for an entire pay period and not be paid for the time missed. About half of all workers in the payroll survey have a 2-week, semi-monthly, or monthly pay period. Workers who received pay for any part of the reference pay period, even one hour, are counted in the February payroll employment figures. While some persons may have been off payrolls during the survey reference period, some industries, such as those dealing with cleanup and repair activities, may have added workers.

In the household survey, the reference period was the calendar week of February 7-13. People who miss work for weather-related events are counted as employed whether or not they are paid for the time off.

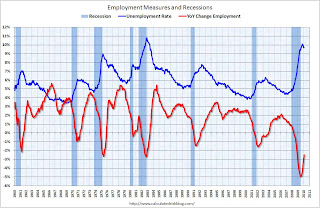

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: the impact of the weather on the survey is unknown, but was probably minimal. Census hiring was 15,000 (NSA).

I'll have much more soon ...

Thursday, March 04, 2010

Bank Failure Friday Preview

by Calculated Risk on 3/04/2010 11:08:00 PM

While everyone is thinking snow and (un)employment ... this is just a reminder that the weather is nice in Puerto Rico. It is very possible that the FDIC will close a bank there tomorrow, see: Reports on Possible Imminent Bank Failures.

Also Dow Jones had some interesting speculation today (no link) about the differences between the assets of the number of banks with formal actions or capital deficiencies, and the assets of the banks on the FDIC's problem bank list.

[W]hat's known about the list, combined with data about banks known to have capital deficiencies, suggests one or more regional banks, those with maybe $20 billion or more in assets, are deemed to be in danger.So it is possible that a fairly large regional bank has been added to the list.

I think it's quite possible that someone in that size range is on the list," said Bert Ely, an independent banking consultant.

Dow Jones Newswires found 653 banks with some outward indication of a capital deficiency--that is, banks below regulators' "well-capitalized" thresholds on one or more key capital ratios or subject to a formal order from regulators requiring them to improve or monitor their capital. The numbers were compiled using data from SNL Financial, a financial-information company. [CR Note: Our Unofficial list has 644 banks].

Most of these banks are likely on the FDIC's problem list. The total is close to the 702 tallied by the FDIC. But the 653 banks have total assets of $313.2 billion--far below the $402.8 billion of the FDIC list.

The Very Expensive Home Buyer Tax Credit

by Calculated Risk on 3/04/2010 06:58:00 PM

First a quote from a Bloomberg story: U.S. Economy: Pending Sales of Existing Homes Decline

“When you take away all the support from the housing market, the underlying demand for housing is a lot weaker than we thought,” said Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “We clearly pushed some demand forward, and there wasn’t that much demand to pull forward anyway. The housing recovery is going to be very, very slow.”This is no surprise and suggests that the extension and expansion of the home buyer tax credit will probably cost taxpayers over $100,000 for each additional home sold.

Just about every economist opposed the tax credit as expensive and ineffective. Here are some quotes from a post last September from an article by Patrick Coolican in the Las Vegas Sun: Economists say extending tax credit for first-time homebuyers is bad policy

It’s terrible policy,” says Mark Calabria of the libertarian Cato Institute.The only good news is the tax credit supporters have promised "practically in blood" that they will not ask for another extension.

“It’s awful policy,” says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.”

...

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,” Jakabovics says.

...

“A heck of a lot of people would have bought the house anyway,” says Ted Gayer, an economist at the Brookings Institution.

...

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.

Gayer also questions whether moving people from renting to owning is really all that useful ...

The tax credit is one, albeit very expensive, way to create more households, but rental vouchers to get people out of their parents’ basements should also be considered, economists say.

Fed Balance Sheet and MBS Purchases

by Calculated Risk on 3/04/2010 04:36:00 PM

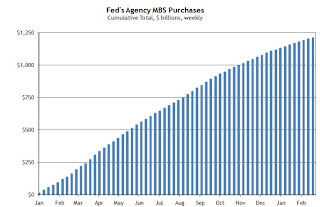

Here is the Federal Reserve balance sheet break down from the Atlanta Fed weekly Financial Highlights released today (as of last week): Click on graph for larger image in new window.

Click on graph for larger image in new window.

Graph Source: Altanta Fed.

From the Atlanta Fed:

The balance sheet expanded $9.7 billion, to $2.3 trillion, for the week ended February 24.Holdings of agency debt and mortgage backed securities, which rose by $8 billion, accounted for the majority of the expansion of the balance sheet and continue to replace lending to nonbank credit markets and short-term lending to financials. The balance sheet is expected to peak during the first half of this year after the MBS purchase program is completed and purchases settle on the balance sheet.

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed:

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed: The NY Fed purchased an additional net $10 billion in MBS for the week ending ending March 3rd. This puts the total purchases at $1.220 trillion or almost 98% complete. Just $30 billion more to go ...The Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 24, bringing its total purchases up to $1.210 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 97% complete).

The Fed's balance sheet released today shows "only" $1.027 trillion in MBS. The difference is that the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. Most of the agency MBS market is "To-Be-Announced" trading, and many of the contracts will not settle for a couple of months.

To understand ""To-Be-Announced", here is a discussion from SIFMA (ht Windward.Broach):

"To-Be-Announced" Trading of Agency Passthrough Securities

Much of the volume in the agency MBS market today is in the form of “To-Be-Announced” (TBA) trading. A TBA is a contract for the purchase or sale of agency mortgage-backed securities to be delivered at a future agreed-upon date; however, the actual pool identities or the number of pools that will be delivered to fulfill the trade obligation or terms of the contract are unknown at the time of the trade.

...

For example, in a typical trade, a buyer may ask to purchase $100 million of 30 year Fannie Mae MBS with a 6% coupon for delivery next month. The buyer does not know the exact bonds that will be delivered. According to industry practice, two days before the contractual settlement date of the trade, the seller will communicate to the buyer the exact details of the MBS pools that will be delivered. It takes some time for the purchases to settle, and this has confused some people. The NY Fed number is the one to follow when tracking the Fed MBS purchase program. The Fed's MBS balance sheet holdings will continue to expand even after the MBS purchase program ends on March 31st as contracts settle.