by Calculated Risk on 2/16/2010 08:30:00 AM

Tuesday, February 16, 2010

NY Fed: Manufacturing Conditions Improve in February

The headline number showed improvement, but two key numbers to watch are new orders and inventories. The new order index fell, and the inventory index rose sharply - and the declining gap between new orders and inventory points to a possible future slowdown in production.

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved at a healthy pace in February. The general business conditions index climbed 9 points, to 24.9. The new orders index fell, though it remained positive, and the shipments index inched downward as well. The inventories index rose sharply, to 0.0, its highest reading in considerably more than a year.Below is the general business conditions index. Note that the data only goes back to July 2001 (chart from Jan 2002). Any reading above zero is expansion, so this index shows manufacturing was expanding since August. (chart from NY Fed)

...

Employment indexes were positive for a second consecutive month, although at relatively low levels.

Monday, February 15, 2010

Housing Reports: Another Wave of Distressed Sales

by Calculated Risk on 2/15/2010 10:25:00 PM

James Hagerty at the WSJ reports on two studies, one from John Burns Real Estate Consulting Inc., and another from Standard & Poor's Financial Services LLC that both forecast most modification efforts will eventually fail - and that mods have just delayed foreclosures. The Burns forecast is for another 5 million distressed sales over the next few years. See the WSJ: Foreclosures Seen Still Hitting Prices

Hagerty reports that Burns study suggests prices will be mostly flat unless the economy turns down, and the S&P study forecasts further price declines.

S&P says current trends suggest that 70% of [modified loans] eventually will redefault.This will be the year of the short sale.

...

Loan servicers ... seem to have "nearly exhausted the supply of plausible candidates for loan modifications" and will find that many loans are "unredeemable," the S&P study says.

As a result, servicers increasingly are looking to arrange "short sales," in which homes are sold for less than their loan balances.

Juncker: Greece has March 16 Deadline to Show Progress

by Calculated Risk on 2/15/2010 07:15:00 PM

Based on reports from Dow Jones: Juncker: Euro Zone Ready To Support Greece If Needed and the BBC: Greece 'may cut spending further', here are some comments from Jean-Claude Juncker, Luxembourg's prime minister and chairman of the 16 euro-zone finance ministers:

It looks like this will be an issue next month (or tomorrow - you never know).

Predictions on Mortgage Rates after the Fed Stops Buying

by Calculated Risk on 2/15/2010 03:51:00 PM

From Carolyn Said at the San Francisco Chronicle: Mortgage rates poised to jump as Fed cuts funds. The following predictions are excerpts from her article:

And a couple earlier predictions:Guy Cecala, publisher of Inside Mortgage Finance. "My opinion is that rates will go up a full percentage point initially," meaning that 30-year fixed conforming loans, now hovering around 5 percent, would hit 6 percent. Keith Gumbinger, vice president of HSH Associates, which compiles mortgage loan data, thinks that rates will slowly rise to about 5.75 percent after the Fed withdraws. Julian Hebron, branch manager at RPM Mortgage's San Francisco office, anticipates a bump up to around 5.5 percent by summer ... Christopher Thornberg, principal at Beacon Economics in Los Angeles [said] "Clearly, when they stop printing all that money, it's going to be a shock to the system. I have to assume that when they pull back on it, it will cause a 100- to 200-basis-points rise" to rates of 6 percent or 7 percent ...

My own estimate is for an increase in the spread - relative to the 10 Year Treasury - of about 35 bps (maybe 50 bps).

Labor Underutilization Rate by Household Income

by Calculated Risk on 2/15/2010 01:52:00 PM

The following chart is based on data from a research paper by Andrew Sum and Ishwar Khatiwada at the Center for Labor Market Studies, Northeastern University (ht Ann):

"Labor Underutilization Problems of U.S. Workers Across Household Income Groups at the End of the Great Recession: A Truly Great Depression Among the Nation’s Low Income Workers Amidst Full Employment Among the Most Affluent"

Update: Bob Herbert at the NY Times wrote about this paper last week: The Worst of the Pain and so did Ryan McCarthy at Huffington Post: 'No Labor Market Recession For America's Affluent,' Low-Wage Workers Hit Hardest: STUDY  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the labor underutilization rates by household income based on the author's research and calculations.

"At the end of calendar year 2009, as the national economy was recovering from the recession of 2007-2009, workers in different segments of the income distribution clearly found themselves in radically different labor market conditions. A true labor market depression faced those in the bottom two deciles of the income distribution, a deep labor market recession prevailed among those in the middle of the distribution, and close to a full employment environment prevailed at the top. There was no labor market recession for America’s affluent."A few notes:

emphasis added

Unemployed Underemployed Labor force reserve or hidden unemployment: "workers who express a desire for immediate employment but are not actively looking for work and thus are not counted as unemployed."

Some Morning Greece

by Calculated Risk on 2/15/2010 11:18:00 AM

A few articles this morning ...

From Bloomberg: Europe Economy Chief Calls for More Steps by Greece

The European Union’s top economic official said Greece should take more measures to cut the region’s largest budget deficit as evidence emerged that the nation may have used swaps to mask its swelling debt.From The Times: Greece refuses EU austerity measures demand

... Olli Rehn, the new EU Commissioner for Economic and Monetary Affairs said: "Our view is that risks... are materialising, and therefore there is a clear case for additional measures.”And on the swaps from Simon Johnson at Baseline Scenario: Goldman Goes Rogue – Special European Audit To Follow

...

[George Papaconstantinou, Greece's Finance Minister] said: “If we announce today new measures, will that stop markets attacking Greece?

"My guess is that what will stop markets attacking Greece at the moment is a further more explicit message that makes operational what has been decided last Thursday at the European council."

Remember Greece is a small country with about 10 million people. And they have a special problem because the previous government published false data on the size of their debt and deficit. The larger problem is how a single currency works when different countries have different issues ...

From Paul Krugman: The Making of a Euromess

I’ve been troubled by reporting that focuses almost exclusively on European debts and deficits ... For the truth is that lack of fiscal discipline isn’t the whole, or even the main, source of Europe’s troubles — not even in Greece, whose government was indeed irresponsible (and hid its irresponsibility with creative accounting).

No, the real story behind the euromess lies not in the profligacy of politicians but in the ... policy [of] adopting a single currency well before the continent was ready for such an experiment.

NY Times: Worries Grow as Government Housing Support "Winds Down"

by Calculated Risk on 2/15/2010 08:42:00 AM

From David Streitfeld at the NY Times: U.S. Housing Aid Winds Down, and Cities Worry

Streitfeld discusses the Fed's MBS purchase program (95% complete and scheduled to end next month), the housing tax credit (contracts must be signed by the end of April, and deals closed by the end of June), and the slight tightening of FHA requirements.

Here is a list compiled in December of many Government housing support programs. Some have already ended (like the extension of the HAMP trial mods on Jan 31, 2010), and, as Streitfeld noted, others will end over the next few months.

One program that is being ramped up is Home Affordable Foreclosure Alternatives (HAFA: short sales and deed-in-lieu) that starts on April 5, 2010.

Retail Vacancy Rate: "Improvement by Subtraction"

by Calculated Risk on 2/15/2010 12:20:00 AM

Here is a solution for some of the vacant retail space ...

From the Columbus Dispatch: Razing cuts retail vacancy rate

Fewer storefronts were empty last year in Columbus than the year before, but only because two white-elephant malls were torn down ... The demolition of the Columbus City Center mall Downtown and Consumer Square East in the Brice Road area took 1.1 million square feet of empty retail space out of the market. That cut retail vacancies to 15.1 percent in 2009 from 16.9 percent in 2008.That helped a little, but the forecast is for the vacancy rate to stay in the 14% to 15% range through 2012. Maybe they can demolish a few more malls ...

Sunday, February 14, 2010

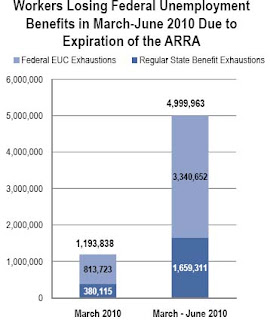

Five Million Workers to Exhaust Unemployment Benefits by June

by Calculated Risk on 2/14/2010 08:48:00 PM

Note: Scroll down or click here for a look ahead and weekly summary.

Back in December, the qualification dates for existing tiers of unemployment benefits were extended for an additional two months. Time is up at the end of February.

Now another extension is needed or millions of workers will lose benefits over the next few months.

The National Employment Law Project (NELP) released a new report last week showing that ...

1.2 million jobless workers will become ineligible for federal unemployment benefits in March unless Congress extends the unemployment safety net programs from the American Recovery and Reinvestment Act (ARRA). By June, this number will swell to nearly 5 million unemployed workers nationally who will be left without any jobless benefits.

...

Currently, 5.6 million people are accessing one of the federal extensions (34-53 weeks of Emergency Unemployment Compensation; 13-20 weeks of Extended Benefits, a program normally funded 50 percent by the states).

This table shows the NELP's projections:

This table shows the NELP's projections: Of the almost 1.2 million workers facing a cut off of benefits in March alone:The following graph is based on the January employment report and shows the number of workers unemployed for 27 weeks or more ...380,000 workers will exhaust their 26 weeks of state benefits without accessing the temporary EUC extension program or the permanent federal program of Extended Benefits. Another 814,000 workers will not be eligible to continue receiving EUC past their current tier of benefits.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 6.31 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.1% of the civilian workforce. (note: records started in 1948).

The current qualification dates extension being considered is for another three months. Cynics might argue that some Senators want to limit the extension to an additional three months, so they can use the popular benefit extension in May to once again extend the homebuyer tax credit - hopefully the cynics are wrong!

Housing Market Index, Housing Starts and the Expiring Tax Credit

by Calculated Risk on 2/14/2010 04:43:00 PM

The NAHB Housing Market Index for February, and Housing Starts for January will both be released this week, see: Weekly Summary and a Look Ahead.

As a review, here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the December data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index declined in January (it is released a month ahead of starts), we usually wouldn't expect much of an increase in January single family housing starts.

However there might be an increase in starts (single family) in January since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. It takes about six months to build an average home, so the builders can't wait until the expected buying rush in April to start building a home - they have to close by the end of June.

Here are some comments from the Feb 2nd D.R. Horton conference call:

In [Q2 2010], we expect strong closings since homes must close by June 30th for the extended tax credit. ... We expect [Q3] will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.”Residential investment1 is one of the best leading indicators for the economy, and the best indicators for RI are the NAHB HMI, housing starts, and new home sales. Usually housing starts lead changes in unemployment too - see Housing Starts, Vacant Units and the Unemployment Rate - so the sideways movement in the NAHB HMI and housing starts suggest unemployment will stay elevated for some time.

...

We are prepared for the spring selling season and for current demand created by the Federal home buyer tax credit with our current spec level.

We will continue to manage our spec levels very closely as we move closer to the April 30th sales contract deadline for the home buyer tax credit.

Note 1: The largest components of residential investment are new home construction, and home improvement. This also includes brokers' commissions and some minor categories.