by Calculated Risk on 1/28/2010 01:16:00 PM

Thursday, January 28, 2010

Hotel RevPAR off 10.3%

The good news for hotels is it appears the occupancy rate might be near the bottom. This week Smith Travel Research reported the occupancy rate was "virtually flat with an 0.9-percent decrease" compared to the same week in 2009.

The bad news for hotels is the average daily rate (ADR) is still falling because the occupancy rate is so low. Therefore RevPAR (revenue per available room) is still falling.

From HotelNewsNow.com: Boston leads occ., RevPAR increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.9-percent decrease to 46.8 percent, average daily rate dropped 9.4 percent to US$93.87, and RevPAR for the week fell 10.3 percent to finish at US$43.89.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. Business travel is the key over the next few months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Delinquencies Increase Sharply in December

by Calculated Risk on 1/28/2010 11:04:00 AM

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 3.87% in December 2009, up from 3.72% in November - and up from 1.72% in December 2008.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they become permanent.

Fannie Mae should report soon ...

Chicago Fed: Economic Activity Moved Lower in December

by Calculated Risk on 1/28/2010 08:55:00 AM

From the Chicago Fed: Index shows economic activity moved lower in December

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.61 in December, down from –0.39 in November. Three of the four broad categories of indicators that make up the index moved lower, although both the production and income category and the sales, orders, and inventories category made positive contributions.

...

In contrast to the monthly index, the index’s three-month moving average, CFNAI-MA3, increased slightly to –0.61 in December from –0.68 in November. December’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend; but the level of activity remained in a range historically consistent with the early stages of a recovery following a recession.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures. ... The critical question is: how early does the CFNAI-MA3 reveal this turning point? For four of the last five recessions, this happened within five months of the business cycle trough."Although the CFNAI-MA3 improved slightly in December, the index is still negative. According to Chicago Fed, it is still early to call the official recession over.

Weekly Initial Unemployment Claims: 470,000

by Calculated Risk on 1/28/2010 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 23, the advance figure for seasonally adjusted initial claims was 470,000, a decrease of 8,000 from the previous week's revised figure of 478,000. The 4-week moving average was 456,250, an increase of 9,500 from the previous week's revised average of 446,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 16 was 4,602,000, a decrease of 57,000 from the preceding week's revised level of 4,659,000.

Click on graph for larger image in new window.

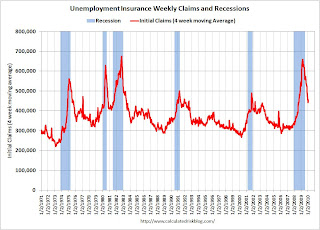

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 9,500 to 456,250.

The level of the 4-week average is still relatively high and suggests continued job losses in January.

Wednesday, January 27, 2010

Jon Stewart: Obama takes on Bankers

by Calculated Risk on 1/27/2010 10:45:00 PM

NOTE: here is the New Home sales post from early this morning.

Now for a little fun ... this was last night (link here)

ALSO another great segment with Elizabeth Warren.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Obama Takes On Bankers | ||||

| www.thedailyshow.com | ||||

| ||||

President Obama: SOTU Address at 9 PM ET

by Calculated Risk on 1/27/2010 08:36:00 PM

NOTE: here is the New Home sales post from early this morning.

Here is the WhiteHouse.gov live feed.

Here is the CNBC feed.

And a live feed from C-SPAN.

From the NY Times: Text: Obama’s State of the Union Address

Unemployment Rate and Presidential Disapproval

by Calculated Risk on 1/27/2010 06:31:00 PM

From Pew Research: It's All About Jobs, Except When It's Not

Recent history shows that the public response to all presidents has been shaped to some degree by rising or falling unemployment. However, only Ronald Reagan's ratings in his first term have borne as close a connection as have Obama's to changes in the unemployment rate.

In fact, the relationship between unemployment and presidential approval varies from crystal clear to murky. Indeed since 1981 there have been a number of times when the ties between changes in joblessness rates and public judgments of the president have been weak or even indiscernible. But the link is strongest when unemployment rises precipitously. And it weakens, or even disappears entirely, when other concerns -- such as national security -- become dominant public issues.

Click on graph for larger image in new window.

This graph shows the relationship between the unemployment rate and approval rating. The report also breaks it down by each President starting with Reagan.

Although other factors matter - like 9/11 or the Iran-Contra scandal - it mostly is "the unemployment rate, stupid!", especially when the unemployment rate is high.

DataQuick on California: Record Notices of Default filed in 2009

by Calculated Risk on 1/27/2010 03:54:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009 in California from DataQuick.

There were a record number of NODs filed in California last year, however the pace slowed in the 2nd half.

From DataQuick: Another Drop in California Mortgage Defaults

The number of California homes entering the foreclosure process declined again during fourth quarter 2009 amid signs that the worst may be over in hard-hit entry-level markets, while slowly spreading to more expensive neighborhoods. There are mixed signals for 2010: It's unclear how much of the drop in mortgage defaults is due to shifting market conditions, and how much is the result of changing foreclosure policies among lenders and loan servicers, a real estate information service reported.In terms of units, the peak of the foreclosure crisis may be over, but the mid-to-high end foreclosures are increasing - and the values of these properties is much higher than the low end starter properties. This suggests that prices may have bottomed in some low end areas, but we will see further price declines in many mid-to-high end areas.

A total of 84,568 Notices of Default ("NODs") were recorded at county recorder offices during the October-to-December period. That was down 24.3 percent from 111,689 for the prior quarter, and up 12.4 percent from 75,230 in fourth-quarter 2008, according to San Diego-based MDA DataQuick.

NODs reached an all-time high in first-quarter 2009 of 135,431, a number that was inflated by activity put off from the prior four months. In the second quarter of last year, NODs totaled 124,562. The low of recent years was in the third quarter of 2004 at 12,417, when housing market annual appreciation rates were around 20 percent.

"Clearly, many lenders and servicers have concluded that the traditional foreclosure process isn't necessarily the best way to process market distress, and that losses may be mitigated with so-called short sales or when loan terms are renegotiated with homeowners," said John Walsh, DataQuick president.

While many of the loans that went into default during fourth quarter 2009 were originated in early 2007, the median origination month for last quarter's defaulted loans was July 2006, the same month as during the prior three quarters. The median origination month during the last quarter of 2008 was June 2006. This means the foreclosure process has moved forward through one month of bad loans during the past 12 months.

"Mid 2006 was clearly the worst of the 'loans gone wild' period and it's taking a long time to work through them. We're also watching foreclosure activity start to move into more established mid-level and high-end neighborhoods. Homeowners there were able to make their payments longer than homeowners in entry-level neighborhoods, but because of the recession and job losses, that's changing. Foreclosure activity is a lagging indicator of distress," Walsh said.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.0 percent of all default activity a year ago. In fourth-quarter 2009 that fell to 34.9 percent. ...

emphasis added

FOMC Statement: No Change

by Calculated Risk on 1/27/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in December suggests that economic activity has continued to strengthen and that the deterioration in the labor market is abating. Household spending is expanding at a moderate rate but remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software appears to be picking up, but investment in structures is still contracting and employers remain reluctant to add to payrolls. Firms have brought inventory stocks into better alignment with sales. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.I think the most important point in the FOMC statement was that they reiterated the ending dates for the Fed facilities and MBS purchases. The Fed is giving advance warning that these facilities will expire as previously announced. It would take a major credit or economic event to change these dates at this point.

With substantial resource slack continuing to restrain cost pressures and with longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter. The Committee will continue to evaluate its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of improved functioning of financial markets, the Federal Reserve will be closing the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility on February 1, as previously announced. In addition, the temporary liquidity swap arrangements between the Federal Reserve and other central banks will expire on February 1. The Federal Reserve is in the process of winding down its Term Auction Facility: $50 billion in 28-day credit will be offered on February 8 and $25 billion in 28-day credit wil be offered at the final auction on March 8. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30 for loans backed by new-issue commercial mortgage-backed securities and March 31 for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury when the Fed stops buying MBS. It could be more or less ...

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared in November or December. They just removed the language on housing:

Jan, 2010: No comment.

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Nov, 2009: "Activity in the housing sector has increased over recent months"

One-month Treasury Bill Rates turn Negative

by Calculated Risk on 1/27/2010 12:58:00 PM

While we wait for the FOMC, there are signs of more economic weakness ... (update: this isn't a sign of a "flight to quality" or a panic - just too much money looking for a parking place).

From Bloomberg: U.S. One-Month Bill Rate Negative for First Time Since March (ht jb)

Treasury one-month bill rates turned negative for the first time in 10 months, as issuance declines while investors seek the most easily-traded securities amid a renewal of risk aversion.The Ten Year yield is back down to 3.61%.

The rate on the four-week security dropped to negative 0.0101 percent, the lowest since it reached negative 0.015 percent on March 26. The Treasury sold $10 billion of four-week bills on Jan. 26 at a rate of zero percent ...

And from the Chicago Fed: Midwest Manufacturing Output Decreased in December