by Calculated Risk on 12/11/2009 04:00:00 PM

Friday, December 11, 2009

San Francisco Bank: "Not-so-smart" CRE Loans

Since it is Friday, here are a couple of articles from San Francisco Magazine on some "not-so-smart" apartment loans ... the first on the lender, the second on the borrower.

From David Johnson: When smart money said "no more," not-so-smart Marin bank loaned the Lembis $41 million. (ht Eric)

The Lembi real-estate implosion (see “War of Values,” December 2009) is on the verge of claiming another casualty: little Tamalpais Bank of San Rafael, which lent $41 million to the Lembi family and has now declared virtually its entire portfolio of commercial mortgages to be in default.And from Danelle Morton: War of values

... Walter and Frank Lembi, the father and son behind the CitiApartments rental behemoth, used more than $1 billion in financing from international investment banks and purchased more than 170 San Francisco apartment buildings between 2003 and 2008, bringing the total number of buildings they owned to 300 ...

Tamalpais Bank made most of the Lembi loans between December 2007 and April 2008. ... by this past September, the Lembis had defaulted on all except one of their loans, leaving Tamalpais Bank with a $38 million hole in its portfolio. The size of the loans was equivalent to more than 75 percent of the bank’s total capital.

“Lending that much of the bank’s capital to a single borrower is inherently reckless, imprudent, and simply unsafe and unsound,” said Richard Newsom, a retired San Francisco bank regulator. “Originating such a huge concentration of credit to one borrower in that period is beyond unsafe and unsound, because the commercial real-estate market was already starting to crack at that time.”

emphasis added

Since 2003, the [Lembi] family, through its various corporate entities, had acquired more than 170 properties—close to $1 billion in real estate—on top of the 130 or so they’d already owned. This briefly made them the largest private landlord in a city where 65 percent of residents are tenants.This is similar to the strategy of the buyers of Peter Cooper Village and Stuyvesant Town in New York; the plan was to somehow remove the rent controlled tenants and increase the rents significantly. It worked about the same.

There seemed to be no pattern to their acquisitions. They bought everything from grande dames, like the Park Lane on Nob Hill, to ratty dumps in the Tenderloin.

...

The Lembis were primarily interested in properties built before 1979: In other words, buildings covered by rent control. The reason is spelled out in a confidential document prepared by the investment bank Credit Suisse in winter 2008. The document focuses on the group of 24 properties that included the Carlomagno buildings. It shows, unit by unit, how the Lembis planned to replace 85 percent of the tenants. The family had set aside $9 million for “relocation costs,” and another $13 million for renovations. Once the apartments were fixed up, the document states, CitiApartments planned to raise rents by an average of 59 percent.

House Approves Bank Reform

by Calculated Risk on 12/11/2009 02:33:00 PM

Note: Mortgage cram downs were defeated.

From CNBC: What's In the House Financial Services Reform Bill

From the NY Times: House Votes to Tighten Regulation of Wall Street

Q3 2009: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 12/11/2009 11:30:00 AM

Note: This is not MEW data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2009, the Net Equity Extraction was minus $91 billion, or negative 3.3% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined in Q3, and this was partially because of debt cancellation per foreclosure sales, and some from modifications, like Wells Fargo's principal reduction program, and partially due to homeowners paying down their mortgages as opposed to borrowing more. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be negative.

Equity extraction was very important in increasing consumer spending during the housing bubble (some disagree with this, but I think they are wrong). Atif Mian and Amir Sufi of the University of Chicago Booth School of Business wrote a piece earlier this year: Guest Contribution: Housing Bubble Fueled Consumer Spending

Findings in our research suggest ... the rise in house prices from 2002 to 2006 was a main driver of economic growth during this time period, and the subsequent collapse of house prices is likely a main contributor to the historic consumption decline over the past year.Don't expect the Home ATM to be reopened any time soon - so any significant increase in consumer spending will come from income growth, not borrowing.

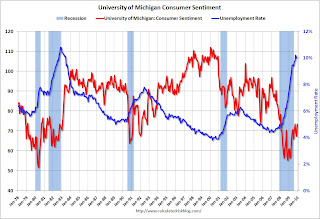

University of Michigan Consumer Sentiment

by Calculated Risk on 12/11/2009 10:01:00 AM

From MarketWatch: Consumer sentiment soars in early Dec

Consumer sentiment improved markedly in early December, according to media reports on Friday of the Reuters/University of Michigan index. The consumer sentiment index rose to 73.4 in early December from 67.4 in November. ... This is the highest level of consumer sentiment since September.Although this is being reported as "soars" and above expectations, sentiment is still low - at recesssion levels - and this is just a rebound to the September level.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

This graph shows consumer sentiment and the unemployment rate. There are other factors impacting sentiment too - like gasoline prices - but it is no surprise that consumer sentiment is still very low.

Retail Sales increase in November

by Calculated Risk on 12/11/2009 08:30:00 AM

On a monthly basis, retail sales increased 1.3% from October to November (seasonally adjusted), and sales are up 1.9% from November 2008.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been only a little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 1.9% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $352.1 billion, an increase of 1.3 percent (±0.5%) from the previous month and 1.9 percent (±0.5%) above November 2008. Total sales for the September through November 2009 period were down 2.1 percent (±0.3%) from the same period a year ago. The September to October 2009 percent change was revised from +1.4 percent (±0.5%) to +1.1 percent (±0.2%).It appears retail sales have bottomed, and there might be a little pickup in final demand.

Thursday, December 10, 2009

WaPo: New TARP Rules to Aid Small Businesses?

by Calculated Risk on 12/10/2009 10:30:00 PM

From David Cho at the WaPo: Joblessness plan revamps rules on bank bailouts (ht Mr. Ridgeback goes to Washington)

The Obama administration is developing a major initiative to tackle ... unemployment by getting federal bailout funds into the hands of small businesses.Another SIV proposal, this time to lend TARP money that isn't ... uh, TARP money? Why does this remind me of Hank Paulson?

The proposal involves spinning off a new entity from the Troubled Assets Relief Program that could give banks access to the government money without restrictions, such as limits on executive pay, as long as they use it to make loans to small businesses. ... No dollar figures have yet been attached to the new small-business lending effort, which is still in development, the sources said.

... [a "special-purpose vehicle"] would be financed by rescue funds and would lend to banks that provide small-business loans. In theory, this structure would free banks of the TARP conditions because they would be getting the money from a separate entity. They could also avoid being labeled as a TARP recipient.

I'd definitely like to see the plan for the next stimulus package, instead of focusing on these contortions to get it funded.

Retail Sales: "Looks like the middle of August out there"

by Calculated Risk on 12/10/2009 08:19:00 PM

November retail sales will be released tomorrow morning, but December is apparently off to a slow start ...

From the WSJ: Sales Lull Has Retailers Worried

The first week of December, typically a lackluster time in the wake of Black Friday, was particularly slow. ... "After solid traffic the first couple of days, it looks like the middle of August out there," said Stephen Baker, vice president of industry analysis for retail watcher NPD Group.And on a key category: Videogames Sales Fall Again in November

Combined November videogame software and hardware revenue fell 7.6% from a year earlier to $2.69 billion, data tracker NPD said Thursday. But revenue from videogame sales fell a surprising 3.1% amid expectations of mild growth in the mid-single-digit percentage range.Without growth in consumer spending, the recovery will be sluggish at best.

HAMP Questions

by Calculated Risk on 12/10/2009 05:19:00 PM

If there were 143,276 cumulative HAMP trial modifications in June - and the maximum length of a trial was extended to five months - how come there were only 31,382 permanent mods and 30,650 disqualified modifications by the end of November?

What happened to the other 82,244 modifications? Have they been extended?

And of the 697,026 active trial modifications, are all the borrowers current? That data seems to be missing from this release (HAMP report here)

My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

HAMP: 31,382 Permanent Mods

by Calculated Risk on 12/10/2009 02:48:00 PM

Update: Treasury link now working, graphic added.

From Diana Olick at CNBC: First Look: Inside The $75 Billion Plan to Save Housing

Of the 759,058 modifications started, 697,026 are still in the three month trial phase. ... Treasury reports that 31,382 trial modifications are now permanent. ... 30,650 modifications were disqualified.Olick has much more.

Click on graph for larger image in new window.

Click on graph for larger image in new window.That is about a 50% failure rate during the trial period - and only a fraction of the eligible borrowers even bother.

Here is the link at Treasury. See here for a list of reports.

Fed Q3 Flow of Funds Report

by Calculated Risk on 12/10/2009 11:59:00 AM

The Fed released the Q3 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.9 Trillion from the peak in 2007, but up $4.9 trillion from the trough earlier this year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles!  This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 38% from the all time low of 33.5% earlier this year. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt.

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 38% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $70 billion - but will have to decline substantially (as a percent of GDP) to reach more normal levels.