by Calculated Risk on 11/22/2009 10:36:00 PM

Sunday, November 22, 2009

WWII Slogan Makes a Comeback

Earlier posts ...

Summary and a Look Ahead (A busy week for housing data!)

Fed's Bullard Backs Extension of MBS Purchases

Possible Changes to FHA Insured Mortgages

From the NY Times: Calming Sign of Troubled Past Appears in Modern Offices

To propel themselves through this economic downturn, media and advertising executives are turning to a phrase meant to soothe another troubled populace: the British during World War II.Image from Wikipedia.

“Keep calm and carry on,” a British government propaganda poster created in 1939, is now decorating offices.

Hey ... Keep Calm and Carry On!

Fed's Bullard Backs Extension of MBS Purchases

by Calculated Risk on 11/22/2009 07:26:00 PM

From the WSJ Real Time Economics: Fed’s Bullard: Asset Buying Efforts Should Remain Active (ht (Bob_in_MA)

“I have advocated to keep the asset purchase program open but at a very low level, and wait and see what happens, and as information comes in about the economy we can adjust that program while the federal funds rate remains at zero,” [Federal Reserve Bank of St. Louis President James] Bullard told Dow Jones Newswires in an interview Sunday ahead of a conference in New York. He added “no decision has been made” about the program’s fate.Bullard will be a voting member of the FOMC next year.

...

Citing the current level of the Fed’s overnight interest rate target, Bullard said “as long as we are at zero (percent) we’d be able to send signals to the markets about what we are thinking about the economy, and how much accommodation the economy needs at various points, by adjusting the asset purchases.”

Here are the slides from Bullard's speech today. Here are a few excerpts:

KEY PROBLEM: TOO BIG TO FAIL The crisis showed that large financial institutions worldwide were “too big to fail.” (TBTF) Really, “too big to fail quickly.” If we let large financial firms fail suddenly, global panic ensues. Again, these firms are not necessarily banks. Reform efforts must focus on getting this intolerable situation under control. TBTF is very costly to the macroeconomy as well as unfair. We need laser-like focus on this problem. ACTUAL PROPOSALS Proposals addressing TBTF: Systemic risk regulation: A council with the Fed having implementation responsibility. A resolution regime for large financial firms. Split up large firms. There are important global coordination issues. Difficulties in design suggests a “go slow” approach. The crisis will not soon be forgotten.

Possible Changes to FHA Insured Mortgages

by Calculated Risk on 11/22/2009 04:10:00 PM

Kenneth Harney at the SF Chronicle lists a few possible changes: FHA looking for ways to pump up its reserves. Harney lists four possible changes:

Currently, FHA charges an "up-front" mortgage insurance premium of 1.75 percent of the loan amount. Most borrowers roll that into their loan and finance it. FHA also charges an annual premium, paid in monthly installments, of either 0.5 percent or 0.55 percent, depending on the down payment. To rebuild reserves, FHA could ... raise the up-front premium to 2 percent or as high as the current statutory maximum of 2.25 percent. It could also raise the annual fee...

FHA is by far the most lenient and flexible player when it comes to evaluating applicants' creditworthiness.I think the most likely changes are higher insurance premiums, lower seller concessions, and tougher standards.

Summary and a Look Ahead

by Calculated Risk on 11/22/2009 12:15:00 PM

This will be a busy week for housing news starting with October existing home sales on Monday, Case-Shiller house prices on Tuesday, and New Home sales on Wednesday.

Existing home sales will probably be very high - close to a 5.8 million SAAR - because of the rush of first-time home buyers to receive the tax credit (before it was extended). This high level of activity is not good economic news - although some people might be fooled. The more important housing number will be New Home sales on Wednesday.

In other economic news, the Q3 GDP revision will be released on Tuesday, and the October Personal Income and Spending report will be released Wednesday.

Also the Q3 FDIC Quarterly Banking Report will probably be released this week. This report will likely show close to 500 problem banks at the end of Q3 (the Unofficial Problem Bank list is up to 513 banks), and the report will also show that the Deposit Insurance Fund (DIF) was at zero or negative. Note: this doesn't mean the FDIC is "bankrupt" or even out of cash - the DIF balance includes reserves against future losses.

And a summary ...

The increase in October was mostly a rebound from the decline in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been little increase in final demand.

This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).

This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).From the Fed: Industrial production and Capacity Utilization

Note: y-axis doesn't start at zero to better show the change.

This is just one month, but the recovery in industrial production slowed in October.

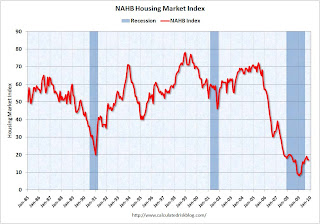

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 17 in November. October was revised down from 18 to 17. The record low was 8 set in January. This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

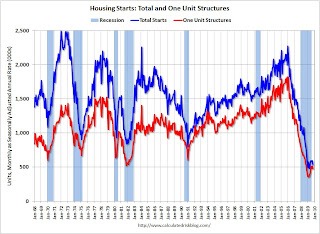

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.Single-family starts were at 476 thousand (SAAR) in October, down 6.8% from the revised September rate, and 33 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for five months.

And some other economic stories

This graph shows the delinquency and 'in foreclosure' rates for all prime mortgage loans. Prime loan delinquencies are clearly a growing problem.

This graph shows the delinquency and 'in foreclosure' rates for all prime mortgage loans. Prime loan delinquencies are clearly a growing problem.MBA Chief Economist Jay Brinkmann said he expects the unemployment rate to peak in Q1 or Q2 2010, and delinquencies to peak sometime after the unemployment rate peaks. He now expects foreclosures to peak in early 2011 because a longer trailing effect than usual as the unemployment rate stays fairly high, and prime borrowers hang on before defaulting.

Bank Failures

The FDIC closed one bank on Friday, bringing the total for 2009 to 124.

Best wishes to all.

CRE Owners Seeking Property Tax Relief

by Calculated Risk on 11/22/2009 09:34:00 AM

From Carolyn Said at the San Francisco Chronicle: S.F. commercial properties seek tax relief

Landmark skyscrapers, signature hotels and upscale retailers glitter in the San Francisco skyline and enhance its cachet. But with commercial real estate slumping, they soon may subtract badly needed cash from the city's coffers.This is another impact of the CRE bust. I would think the city would have had a large budget surplus when property values - and property taxes - were soaring.

...

Collectively, those office towers, hotels, shopping centers and apartment buildings have an assessed value of $21.25 billion - but their owners say they're worth about half that amount. If those claims stand, that could wipe $115.78 million off the property taxes the city collects.

...

The potential property tax reductions come at the worst possible time for a city already grappling with budget cuts and deficits. San Francisco's controller warned last week that the city faces a potential half-billion-dollar deficit in its next fiscal year.

Saturday, November 21, 2009

More on Strategic Defaults

by Calculated Risk on 11/21/2009 09:22:00 PM

From Lew Sichelman at the LA Times: Owners' willingness to 'strategically default' on loans depends largely on how far underwater they are (ht Ann)

Most of the LA Times article is based on the paper by Guiso, Sapienza and Zingales that I covered in June: Moral and Social Constraints to Strategic Default on Mortgages (pdf)

Sichelman adds some comments from real estate agents on the ethics of strategic defaults:

Nellie Arrington of Long & Foster Real Estate in Columbia, Md., says it is "morally wrong, legally wrong and just plain wrong" for an owner to walk away from a mortgage he can afford simply because the balance exceeds the value of the underlying property.And on the other side:

Bob Hunt of Keller Williams O.C. Coastal Realty in San Clemente says the moral duty to protect your family outweighs the moral duty to repay the loan.

"Promise keeping is not the highest moral value," said Hunt, who before his real estate career taught ethics and logic at the University of Redlands. "If I promised to lend you my gun and you are now in a clearly dangerous psychotic stage, breaking my promise would be the right thing to do, not the wrong thing."

The Fed and Mortgage Rates

by Calculated Risk on 11/21/2009 03:20:00 PM

Meredith Whitney expressed concern about what will happen when the Fed stops buying GSE MBS by the end of the first quarter 2010. From Bloomberg: Meredith Whitney Says Bank Stocks Are ‘Grossly’ Overvalued

The Federal Reserve has begun slowing purchases in the $5 trillion market for so-called agency mortgage-backed securities after announcing in September that it would extend the timeline for its $1.25 trillion program to March 31 from year-end. Whitney said that banks are only originating home loans that they can sell to Fannie Mae and Freddie Mac.This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates? I looked at this a couple of months ago: The Impact on Mortgage Rates of the Fed buying MBS and here is an update:

“If Fannie and Freddie can’t sell to an end buyer, i.e. the U.S. government steps back, the mortgage market at minimum contracts, rates go higher, and banks are poised with more writedowns,” said Whitney, founder of Meredith Whitney Advisory Group. “This is probably the issue that scares me most across the board.”

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.356%, this suggests a 30 year mortgage rates of 5.33% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey Thursday:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.83 percent with an average 0.7 point for the week ending November 19, 2009, down from last week when it averaged 4.91 percent. Last year at this time, the 30-year FRM averaged 6.04 percent.This suggests morgage rates are about 50 bps below the expect level ...

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).Although this is a limited amount of data - and the yellow triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 to 50 bps relative to the Ten Year treasury.

It isn't that Fannie and Freddie "can’t sell to an end buyer", it is that the GSEs will be selling for a lower price (higher yield) when the Fed completes the MBS purchase program. At that time mortgage rates will probably rise by about 35 bps to 50 bps (relative to the Ten Year) in order to attract other buyers. Alone that isn't all that "scary".

But combined with the growing problems at the FHA, the distortions in the housing market caused by the first-time home buyer tax credit, rising delinquencies, the uncertainty of the modification programs, and likely further house price declines in many bubble states - there are serious problems ahead for the housing market.

FDIC Bank Failure Update

by Calculated Risk on 11/21/2009 11:01:00 AM

Note: The FDIC will probably release the Q3 Quarterly Banking Profile next week. The report will show the number of banks on the problem bank list, and the status of the Deposit Insurance Fund (DIF).

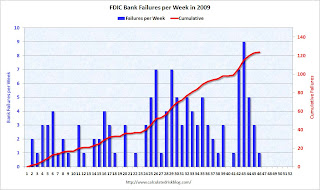

The FDIC closed another bank on Friday, and that brings the total FDIC bank failures to 124 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The bank failures seem to come in bunches, and with 6 weeks to go it seems 140 to 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934). This is the most failures per year since 1992 (181 failures).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now close to $50 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Fed Watch: "The Fed in a Corner"

by Calculated Risk on 11/21/2009 09:02:00 AM

From Tim Duy: The Fed in a Corner

Over the years, I have warned a seemingly countless number of undergraduates that Fed's hold on monetary independence was tenuous at best. Independence is not guaranteed by the Constitution. Congress made the Fed, and Congress can unmake the Fed. The Fed could only maintain the privilege of independence if policymakers pursued policy paths that fostered maximum, sustainable growth. Deviating from such paths would have consequences.There is much more in the piece.

The Fed is quickly learning the extent of those consequences, as Congress launches an assault on the Fed's independence.

...

The Fed earns accolades from academics for its handling of the crisis, in particular since the Lehman failure. Fair enough; I have few quibbles with policy since last fall. But what about the years before Lehman, when the crisis was building? Where was the Fed then? Did they abdicate regulatory responsibility? How did banks develop such incredible exposure to off-balance sheet SIV's? How could the Fed ignore increasingly predatory lending in the mortgage market? What exactly was Timothy Geithner, then president of the all important New York Fed, regulating and supervising? Clearly not Citibank.

Clearly the Fed (and other regulators) failed to properly supervise financial firms. We need to understand how and why this happened. (See The Failure of Regulatory Oversight)