by Calculated Risk on 10/26/2009 03:30:00 PM

Monday, October 26, 2009

SF Fed: Recent Developments in Mortgage Finance

From San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Although Krainer doesn't mention it, notice the increase in bank portfolio loans in early 2007 - that was probably because the banks were stuck with loans when the securitization market seized up.

...

In the present day, when Ginnie Mae's activities are included, the three GSEs are providing unprecedented support to the housing market—owning or guaranteeing almost 95% of the new residential mortgage lending.

Krainer concludes:

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.Note: Tanta wrote this last year on the naming of the GSEs: On Maes and Macs. An excerpt:

Trivia buffs will know that once upon a time there were three "agencies": the Government National Mortgage Association, the Federal National Mortgage Association, and the Federal Home Loan Mortgage Corporation. It didn't take all that long for market participants to start coming up with pronunciations for the abbreviations GNMA (Ginnie Mae), FNMA (Fannie Mae), and FHLMC (Freddie Mac, which makes no sense whatsoever except that nobody liked "Filly Mac." ... Old farts whose favorite childhood treat was a box of Pixies will remember the old-time candy company Fannie May, whose name is said to have inspired the whole thing, probably in the throes of a major sugar rush.

Report: First Time Homebuyer Tax Credit to be Phased Out

by Calculated Risk on 10/26/2009 01:01:00 PM

Update: The Reid/Baucus proposal is to extend the tax credit and phase it out over 2010. The credit would be $8,000 through the end of Q1 2010, and decline $2,000 per quarter after that ... ($6,000 in Q2, $4,000 in Q3, $2,000 in Q4 2010)

From Bloomberg: Housing Tax Credit Probably Won’t Be Extended in U.S., ISI Says

“There could be an agreement reached as early today on the Reid/Baucus amendment that would PHASE OUT (not extend, as we originally understood when the idea was first proposed last week) the home buyer tax credit,” ISI analysts said in the note.We should know more soon. Most economists oppose an extension of the tax credit because it is poorly targeted, very expensive per additional home sold, there was little job creation, fraud was widespread, and there are many serious unintended consequences.

ATA Truck Tonnage Index Declines in September

by Calculated Risk on 10/26/2009 11:28:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Slipped 0.3 Percent in September Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...Trucking has benefited from some inventory restocking, and exports - two key positive areas for the economy, however further growth will probably be "modest" and "choppy" until there is a pickup in domestic end demand.

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008. In August, the index was down 7.5 percent from a year earlier.

ATA Chief Economist Bob Costello said that the latest reading fits with the premise that the recovery will be moderate and choppy. “The trucking industry should not be alarmed by the very small decrease in September,” Costello noted. “We took two steps forward in July and August and this was a miniscule step backward.” He added that the industry should be prepared for ups and downs in the months ahead, but the general trend should be modest improvement. ...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

Chicago Fed Index: Near Pre-Recession Levels

by Calculated Risk on 10/26/2009 08:50:00 AM

From the Chicago Fed: Index shows economic activity approaching pre-recessionary levels

The Chicago Fed National Activity Index was –0.81 in September, down from –0.65 in August. Three of the four broad categories of indicators made negative contributions to the index in September, but the production and income category made a positive contribution for the third consecutive month.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"At –0.63 in September (up from –0.96 in the previous month), the index’s three-month moving average, CFNAI-MA3, suggests that growth in national economic activity was below its historical trend. However, the CFNAI-MA3 in September improved to a level greater than –0.7 for the first time since the early months of this recession. For the four previous recessions, the first month when the CFNAI-MA3 was above –0.7 coincided closely with the end of each recession as eventually determined by the National Bureau of Economic Research."

This index suggests that the official recession might be over. However the index is still fairly weak.

ING to Raise $11.3 Billion, Lloyds to Raise $38 Billion

by Calculated Risk on 10/26/2009 08:37:00 AM

Two articles from the NY Times Dealbook:

ING to Split in Two Amid $11.3 Billion Rights Issue

ING Group, the Dutch financial services company, said Monday that it planned to break up its insurance and banking businesses and raise up to 7.5 billion euros, or $11.3 billion, in a stock issue, after reaching a deal with the government to repay ahead of schedule half the money it received in a bailout last year, The New York Times’s Chris V. Nicholson reported.Lloyds Said Set to Raise $38 Billion

ING was propped up with 10 billion euros in emergency funds from the Dutch government in October 2008, which helped cushion the company’s core Tier One capital, a measure of financial strength, during the global financial crisis.

Lloyds Banking Group plans to will announce within days a 23 billion pound ($38 billion) fundraising plan to shore up its balance sheet and avoid a U.K. government debt insurance program, The Times of London reported.Some pretty amazing numbers ... obviously some banks think now is the time to raise capital.

...

The fundraising comes as Lloyds seeks to escape taking part a costly government insurance scheme, that would give the British government a controlling 60 percent stake in the bank ...

Sunday, October 25, 2009

Capmark Files Bankruptcy

by Calculated Risk on 10/25/2009 07:39:00 PM

No surprise ...

Press Release: Capmark Financial Group Inc. Seeks To Restructure Balance Sheet Through Chapter 11 Reorganization Process

Capmark Financial Group Inc. ("Capmark") today announced that Capmark and certain of its subsidiaries have filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. Capmark intends to use the reorganization process to implement a restructuring that reduces its corporate debt and maximizes value for its stakeholders. Capmark`s businesses are continuing to operate in the ordinary course.More from Bloomberg: Lender Capmark Financial Group Files for Bankruptcy

Capmark Bank, which recently received $600 million of new equity from Capmark, is not part of the filing.

Summary and more ...

by Calculated Risk on 10/25/2009 02:49:00 PM

It will be a busy week ... a few coming highlights:

A few articles and graphs from last week:

Click on graph for larger image in new window.

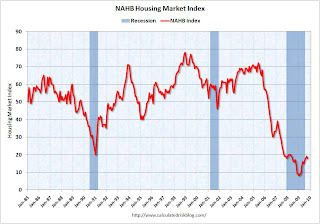

Click on graph for larger image in new window.This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From NAHB: Builder Confidence Decreases Slightly in October

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.

This graph shows a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. CRE prices only go back to December 2000.The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

From Bloomberg: U.S. Commercial Property Values Fall 3% in August

The Moody’s/REAL Commercial Property Price Indices fell 3 percent in August from July, bringing the market’s decline to almost 41 percent since its peak in October 2007, Moody’s Investors Service said in a statement today.From Moody’s: CRE Prices Off 41 Percent from Peak, Off 3% in August

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From Housing Starts in September: Moving Sideways

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of 2010, if not longer.

From AIA: Architectural Billings Index Shows Contraction

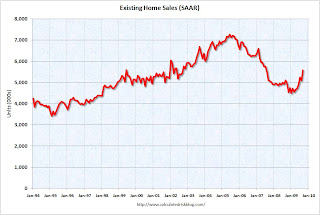

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From Existing Home Sales Increase in September

From Philly Fed State Coincident Indicators Show Widespread Weakness in September

More on the "Job Loss" Recovery

by Calculated Risk on 10/25/2009 11:29:00 AM

From Carolyn Lochhead at the San Francisco Chronicle: Experts see rebounding economy shedding jobs

Forget a jobless recovery. The economy may be entering a recovery with job losses.As I noted earlier this week, so far the current recovery is even worse than "jobless"; it is a "job-loss" recovery.

...

"It's not even a jobless recovery; it's a recovery with more job losses," said UCLA economist Lee Ohanian. "The idea of having essentially no net job creation after a remarkably severe recession is a real pathology for the U.S. economy."

...

Alarms are ringing at the White House and in Congress. But with a mind-boggling $1.4 trillion deficit this year, Democrats have used up their bullets. The word stimulus has such a bad connotation that the term has been banished from new efforts to goose the economy and help workers, such as extending unemployment benefits, sending $250 checks to seniors and a program the White House announced to help small businesses get loans.

This will be hot topic over next couple of months. Maybe the forecasts will be too pessimistic, but without jobs, it isn't much of a recovery.

Seattle Times: "Reckless strategies doomed WaMu"

by Calculated Risk on 10/25/2009 08:33:00 AM

From Drew DeSilver at the Seattle Times: Reckless strategies doomed WaMu

This is the first of two parts. Here is a section on loose lending:

"The big saying was 'A skinny file is a good file,' " said Nancy Erken, a WaMu loan consultant in Seattle. She recalled helping credit-challenged borrowers collect canceled checks, explanatory letters and other documentation that they could afford their loans.And on risk management:

"I'd take the files over to the processing center in Bellevue and they'd tell me 'Nancy, why do you have all this stuff in here? We're just going to take this stuff and throw it out,' " she said.

In time, WaMu even began allowing low- or no-documentation option ARMs, piling risk on risk. The loose standards spread through the company like a flu virus.

In an internal newsletter dated Oct. 31, 2005, and obtained by The Seattle Times, risk managers were told they needed to "shift (their) ways of thinking" away from acting as a "regulatory burden" on the company's lending operations and toward being a "customer service" that supported WaMu's five-year growth plan.Ouch. There is much more in the article - on Option ARMs, switching to originate-to-sell and more ... WaMu was definitely "doomed".

Risk managers were to rely less on examining borrowers' documentation individually and more on automated processes, Melissa Martinez, WaMu's chief compliance and risk oversight officer, wrote in the memo.

...

"The whole tone it set was that 'Maybe the next file I review I should pull back, hold off on downgrading (a loan), not take a sharp pencil to what production was doing,' " [Dale George, a former senior credit-risk officer in Irvine, Calif.] said.

"They weren't going to have risk management get in the way of what they wanted to do, which was basically lend the customers more money."

Saturday, October 24, 2009

Hutton: "Mervyn King is right"

by Calculated Risk on 10/24/2009 11:55:00 PM

From Will Hutton at the Observer: Mervyn King is right – the time has come to break up the megabanks (ht Jonathan)

Will Hutton reviews the competing proposals to reform the banking system and suggests a combination of the two ...

The first proposal, championed by BofE Governor Mervyn King and former Fed Chairman Paul Volcker is to break up the banks and separate the commercial parts from the "casino banking":

If the status quo is untenable and unfair because it leaves us with banks so big they have to be bailed out in a crisis, and if the proposed increases in bank capital advanced by the government are unlikely to act as a restraint, then there is only one course of action left: we have to break up the megabanks. The speculative, risky parts of banks must be separated from the commercial parts which lend to business, consumers and home buyers.The second proposal, championed by Lord Turner in the U.K., and I believe favored by the Obama Administration in the U.S., is to have capital requirements based on the riskiness of the business:

This, after all, is what the Americans did after the 1929-33 crash. Under the famous Glass-Steagall Act, commercial banks were forbidden to offer any form of collateral, underwriting or loan that financed stocks and shares. The same could be done today. The banking the economy needs – so-called narrow banking – could be closely regulated and casino banking could be left to its separate, freewheeling devices.

The way forward, [Lord Turner] repeated, is more capital, especially more capital for the casino parts of any bank's business. On top, banks should make "living wills", setting out how they would wind themselves up without any cost to the taxpayer.Either way - I think the time has for action.