by Calculated Risk on 9/03/2009 10:00:00 AM

Thursday, September 03, 2009

ISM Non-Manufacturing Index Shows Contraction in August

The August 2009 Manufacturing ISM report showed expansion, but the non-manufacturing sector was still contracting in August.

From the Institute for Supply Management: August 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in August, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector was still contracting in August, although contracting at a slightly slower pace than in July.

... "The NMI (Non-Manufacturing Index) registered 48.4 percent in August, 2 percentage points higher than the 46.4 percent registered in July, indicating contraction in the non-manufacturing sector for the 11th consecutive month but at a slower rate. The Non-Manufacturing Business Activity Index increased 5.2 percentage points to 51.3 percent. This is the first time this index has reflected growth since September 2008. The New Orders Index increased 1.8 percentage points to 49.9 percent, and the Employment Index increased 2 percentage points to 43.5 percent. The Prices Index increased 21.8 percentage points to 63.1 percent in August, indicating a substantial increase in prices paid from July. According to the NMI, six non-manufacturing industries reported growth in August. Respondents' comments are mixed about business conditions and the overall economy; however, there is an increase in comments indicating that there are signs of improvement going forward."

emphasis added

No recovery yet in the service sector ...

Weekly Unemployment Claims: Stuck at High Level

by Calculated Risk on 9/03/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 570,000:

In the week ending Aug. 29, the advance figure for seasonally adjusted initial claims was 570,000, a decrease of 4,000 from the previous week's revised figure of 574,000. The 4-week moving average was 571,250, an increase of 4,000 from the previous week's revised average of 567,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 22 was 6,234,000, an increase of 92,000 from the preceding week's revised level of 6,142,000.

Click on graph for larger image in new window.

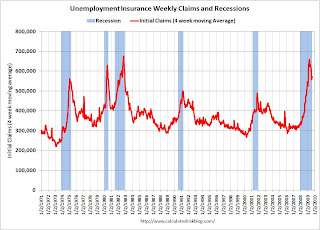

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 4,000 to 571,250, and is now 87,500 below the peak in April.

It appears that initial weekly claims have peaked for this cycle. However it seem that weekly claims are stuck at a very high level; weekly claims have been around 570,000 for the last 8 weeks. This indicates continuing weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

Wednesday, September 02, 2009

The Accidental Landlords and Shadow Inventory

by Calculated Risk on 9/02/2009 11:15:00 PM

We've been discussing accidental landlords for a couple of years. Here is another article about homeowners becoming landlords out of necessity, from the WSJ: The Reluctant Landlords

With housing prices still in the dumps, many Americans are finding themselves in the uncomfortable position of landlord.The article discusses a few hapless homeowners, and I'll give the same advice as last year:

...

Hard data are scant on how many homeowners are renting out their homes, but anecdotal evidence suggests numbers are up. In one indication of the trend: More homeowners are converting their homeowners insurance to landlord policies that cover the additional risks of leasing out a home. Allstate Corp., the second largest home insurer in the U.S., reported a 27% increase in conversions in the first quarter from the previous year.

[T]hese accidental landlords are looking at prices from a few years ago, and deciding to wait to sell. In general this is a mistake. Owners should analyze the rent or sell decision based on current prices - and consider the probability that nominal prices will move lower or at best stay flat for several years.And on the shadow inventory, here is an excerpt from: The Surge in Rental Units

This is part of the shadow inventory that will eventually be sold and will help keep inventory levels high for years.

The supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

...

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Whatever the reason for the conversion, many of these 3.2 million units are part of the shadow housing inventory. Especially the properties owned by accidental landlords, who will sell as soon as possible.

Gordon Brown's $1.1 Trillion G20 Consensus Unraveling

by Calculated Risk on 9/02/2009 08:21:00 PM

From The Times: Gordon Brown’s $1 trillion global rescue package unravels

Alistair Darling is scrambling to plug a gaping hole in the $1.1 trillion global rescue package agreed by G20 leaders in London — hailed at the time as Gordon Brown’s biggest success.Although discussing a policy exit strategy makes sense, it would seem premature to scale back the package. One or two quarters of GDP growth isn't a recovery.

Some countries, led by Germany, are even calling for the bailout to be scaled back amid fears that it risks burdening economies with too much debt and could encourage inflation.

The breakdown of unity reflects the different speeds at which countries are emerging from recession and conflicting views about the outlook for the global economy.

Besides, in the August Fed minutes released today, the U.S. is clearly relying on foreign economic growth to offset domestic weakness:

Consumer spending had been on the soft side lately. The new estimates of real disposable income that were reported in the comprehensive revision to the national income and product accounts showed a noticeably slower increase in 2008 and the first half of 2009 than previously thought. By themselves, the revised income estimates would imply a lower forecast of consumer spending in coming quarters. But this negative influence on aggregate demand was roughly offset by other factors, including higher household net worth as a result of the rise in equity prices since March, lower corporate bond rates and spreads, a lower dollar, and a stronger forecast for foreign economic activity.

Wilbur Ross: 500 More Banks to Fail by End of 2010

by Calculated Risk on 9/02/2009 05:23:00 PM

From CNBC: 500 More Banks to Fail By End of 2010: Wilbur Ross

“I’m not surprised that the [FDIC’s] list is continuing to grow,” Ross told CNBC. “I think there’s going to be at least 500 more banks fail between now and end of next year.”See video at link.

...

“The first wave of the big banks were the securitizations," he said. "The regional banks are the ones now going down. They mostly didn’t have much in the way of securitization but they all have construction loans, they have development loans, they all have loans on little shopping centers and they’ve got that kind of portfolio very heavily.”

...

“Yesterday, the FDIC held an auction for $1.3 billion of Alt-A loans, or liars loans, coming out of the failed Franklin Bank,” he said. “So that’s the first time FDIC has had an auction with them providing leverage to distressed investors. So we were bidders on it...I think it’s a good system that they’ve developed for getting rid of these assets.”

Hotel: More than Half Off

by Calculated Risk on 9/02/2009 03:01:00 PM

Remember all the half off sales? It is getting worse ...

From the WSJ: Hotel, 68% Off (ht James)

First Banks Inc. ... recently hired Atlas Hospitality Group to find buyers for the 179-room Lexington Plaza Waterfront Hotel. The asking price is nearly $19 million, just a third of the $58.4 million in debt, contractors' liens and unpaid taxes on the property.Twenty five percent? Can they even afford to pay their utility bills?

...

The report from the property's court-appointed receiver in May, the latest available, pegged the hotel's occupancy at 25%.

And in Hawaii: Maui Prince Hotel Faces Foreclosure

Mortgage-holders led by Wells Fargo Bank sued last week to foreclose on the 310-room [Maui Prince Hotel], following the owners' failure to pay the resort's $192.5 million mortgage when it came due in July. The foreclosure threatens to wipe out the $227.5 million in mezzanine debt held by a UBS fund and the $250 million in equity that Morgan Stanley and its partners put into the property.When the occupancy rates fall far enough, forget about paying the debt - worry about meeting payroll. A quote from the article:

"We do not have funding for payroll, but we are getting some funding for our accounts payable and basic operating expenses," said Donn Takahashi, president of Prince Resorts Hawaii ... "We cannot operate a top-notch resort in this fashion."I suspect we will see many more stories like these two.

FOMC Minutes: Consumer Spending Softer than Expected

by Calculated Risk on 9/02/2009 02:00:00 PM

Here are the August FOMC minutes. Economic outlook:

In the forecast prepared for the August FOMC meeting, the staff's outlook for the change in real activity over the next year and a half was essentially the same as at the time of the June meeting. Consumer spending had been on the soft side lately. The new estimates of real disposable income that were reported in the comprehensive revision to the national income and product accounts showed a noticeably slower increase in 2008 and the first half of 2009 than previously thought. By themselves, the revised income estimates would imply a lower forecast of consumer spending in coming quarters. But this negative influence on aggregate demand was roughly offset by other factors, including higher household net worth as a result of the rise in equity prices since March, lower corporate bond rates and spreads, a lower dollar, and a stronger forecast for foreign economic activity. All told, the staff continued to project that real GDP would start to increase in the second half of 2009 and that output growth would pick up to a pace somewhat above its potential rate in 2010. The projected increase in production in the second half of 2009 was expected to be the result of a slowing in the pace of inventory liquidation; final sales were not projected to increase until 2010. The step-up in economic activity in 2010 was expected to be supported by an ongoing improvement in financial conditions, which, along with accommodative monetary policy, was projected to set the stage for further improvements in household and business sentiment and an acceleration in aggregate demand.Added:

The staff forecast for inflation was also about unchanged from that at the June meeting. Interpretation of the incoming data on core PCE inflation was complicated by changes in the definition of the core measure recently implemented by the Bureau of Economic Analysis, as well as by unusually low readings for some nonmarket components of the price index. After accounting for these factors, the underlying pace of core inflation seemed to be running a little higher than the staff had anticipated. Survey measures of inflation expectations showed no significant change. Nonetheless, with the unemployment rate anticipated to increase somewhat during the remainder of 2009 and to decline only gradually in 2010, the staff still expected core PCE inflation to slow substantially over the forecast period; the very low readings on hourly compensation lately suggested that such a process might already be in train.

emphasis added

The future path of the federal funds rate would continue to depend on the Committee's evolving outlook, but, for now, given their forecasts for only a gradual upturn in economic activity and subdued inflation, members thought it most likely that the federal funds rate would need to be maintained at an exceptionally low level for an extended period. With the downside risks to the economic outlook now considerably reduced but the economic recovery likely to be damped, the Committee also agreed that neither expansion nor contraction of its program of asset purchases was warranted at this time.The Fed Staff still sees an immaculate recovery. That seems unlikely to me. But the FOMC seems a little less optimistic.

ABI: Personal Bankruptcy Filings up 24 Percent compared to August 2008

by Calculated Risk on 9/02/2009 11:46:00 AM

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings up 24 Percent over Last Year

The 119,874 consumer bankruptcy filings in August represented a 24 percent increase over last year’s monthly total, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Although an increase over the previous year, the August 2009 consumer filings represented a 5 percent decrease from the July 2009 total of 126,434. Chapter 13 filings constituted 28.3 percent of all consumer cases in August, unchanged from the July rate.Note that there is some month to month variability, so the decline from July is probably noise.

"Consumers are continuing to turn to bankruptcy as a shield from the sustained financial pressures of today’s economy," said ABI Executive Director Samuel J. Gerdano. "As a result, we expect consumer filings to top 1.4 million this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 928 thousand personal bankrutpcy filings through Aug 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Other Employment Reports

by Calculated Risk on 9/02/2009 08:31:00 AM

ADP reports:

Nonfarm private employment decreased 298,000 from July to August 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from June to July was revised by 11,000, from a decline of 371,000 to a decline of 360,000.Note: the BLS reported a 254,000 decrease in nonfarm private employment in July (-247,000 total nonfarm), so once again ADP was only marginally useful in predicting the BLS number - and last month ADP was too pessimistic.

On the Challenger job-cut report from Reuters: US Planned Layoffs Fall in August: Challenger Report

Planned layoffs at U.S. firms fell in August, suggesting less stress on the labor market and improvements in consumer spending and the broader economy in the coming months, a report released on Wednesday showed.The BLS reports Friday, and the consensus is for just over 200,000 net job losses for August.

Planned job cuts announced by U.S. employers fell to 76,456 last month, down 21 percent from 97,373 in July, according to a report released by global outplacement consultancy Challenger, Gray & Christmas.

While the rate of layoffs has slowed, the cumulative number of job cuts has climbed to 1.07 million from January through August, 60 percent higher than the same period a year earlier.

Tuesday, September 01, 2009

First Time Home Buyer NAR Numbers

by Calculated Risk on 9/01/2009 09:35:00 PM

Just a few numbers ... and somewhat random thoughts.

The first time home buyer tax credit applies to purchases that close in 2009 before Dec. 1, 2009.

The NAR has reported 2.81 million existing home sales through July. There will probably be around 4.4 to 4.5 million sales that close by before Dec 1st.

The NAR projects that 1.8 to 2.0 million buyers will claim the first time home buyer tax credit.

So about 40% to 45% of all purchases will qualify for the tax credit.

Yet ... the NAR reported that "An NAR practitioner survey showed first-time buyers purchased 30 percent of homes in July ..."

And for June and May: "An NAR practitioner survey in June showed first-time buyers accounted for 29 percent of transactions, unchanged from May ..."

And back in April: "An NAR practitioner survey in March showed first-time buyers accounted for 53 percent of transactions, based largely on contracts offered before the $8,000 first-time home buyer tax credit became available."

Now there are different definitions of "first-time": for the tax credit "First-time" homebuyers are defined as anyone who hasn't owned a primary residence for the last 3 years (not really "first-time").

But the NAR is now saying that about 40% to 45% of all homebuyers this year (before Dec 1st) will be first time buyers. And another large percentage of buyers are investors.

With regards to the tax credit, what really matters is the cost per additional home sold. And as I pointed out earlier today, even using the NAR numbers, the cost per additional home sold is $43.4 thousand.

Here is the math: 1.9 million buyers qualify for the credit (the NAR estimates between 1.8 and 2.0 million) = $15.2 billion.

The NAR estimates the tax credit resulted in 350 thousand additional purchases. So divide $15.2 billion by 350 thousand = $43,000 per additional home. And the numbers will get worse if the program is extended.