by Calculated Risk on 8/25/2009 06:46:00 PM

Tuesday, August 25, 2009

Will Mortgage Insurers Limit the Housing Market?

From Matt Padilla at the O.C. Register: Housing demand could snag on mortgage insurance

Matt quotes an article from the National Mortgage News:

The GSEs can purchase single-family mortgages with loan-to-value ratios higher than 80% only if the homebuyer gets mortgage insurance. The FHFA Mortgage Market Note issued a few days after Mr. Lockhart’s departure projects that the demand for such high LTV loans could hit $230 billion in 2009. The ability of the MIs to meet that level of demand is “remote,” FHFA report says. “The industry’s ability to build and maintain sufficient capital to meet the needs of the enterprises over the short term without some federal assistance or an infusion of private capital is unclear,” the report concludes.Another goverment program?

emphasis added

Misc: A possible 1991 House Price Headline, and Falling Rents in NYC

by Calculated Risk on 8/25/2009 04:05:00 PM

Imagine a headline in June 1991 (if Case-Shiller was around):

"House Prices increase at 11.6% annualized rate in June!"

The horrible price declines were over ... right? Nope. Real house prices declined for almost another 5 years. Just something to remember.

From Bloomberg: NYC Apartment Rents Fall as Tenants Gain Leverage

In buildings attended by doormen, rents on one-bedroom apartments dropped 10 percent from a year earlier to an average of $3,274 a month, according to a report by the Real Estate Group of New York. Studio prices fell 7 percent at those properties to $2,329 and two-bedrooms declined almost 6.9 percent to $5,161.Falling rents means a further decline in house prices to lower the price-to-rent ratio.

And a market graph from Doug Short. This matches up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Case-Shiller House Prices and Stress Test Scenarios

by Calculated Risk on 8/25/2009 02:25:00 PM

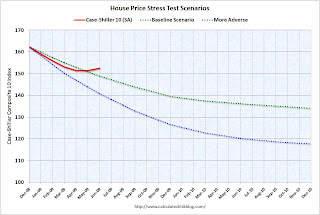

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, June: 152.55

Stress Test Baseline Scenario, June: 148.82

Stress Test More Adverse Scenario, June: 140.71

Unlike with the unemployment rate (worse than both scenarios), house prices are performing better (from the perspective of the banks) than the the stress test scenarios. I believe there will be further price declines later this year, because I think the Case-Shiller seasonal adjustment is insufficient, and because I expect the first-time home buyer frenzy to slow just as more distressed supply comes on the market - even if an extension to the tax credit is passed.

Philly Fed State Coincident Indicators: Still a Widespread Recession in July

by Calculated Risk on 8/25/2009 11:30:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty six states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 35 states in June, and was unchanged in 8 states. Here is the Philadelphia Fed state coincident index release for July.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2009. In the past month, the indexes increased in seven states (Louisiana, Mississippi, North Dakota, South Carolina, South Dakota, Vermont, and Wisconsin), decreased in 35, and remained unchanged in eight (Hawaii, Indiana, Nebraska, New Jersey, Oklahoma, Rhode Island, Tennessee, and Virginia) for a one-month diffusion index of -56. Over the past three months, the indexes increased in three states (Mississippi, North Dakota, and Vermont), decreased in 46, and remained unchanged in one (South Carolina) for a three-month diffusion index of -86.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states showed declining activity in July. Still a widespread recession in July by this indicator ...

House Prices: Real Prices, Price-to-Rent, and Price-to-Income

by Calculated Risk on 8/25/2009 10:01:00 AM

Here are three key measures of house prices: Price-to-Rent, Price-to-Income and real prices based on the Case-Shiller quarterly national home price index.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q2 2009 using the Case-Shiller National Home Price Index (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is mostly behind us as of Q2 2009 on a national basis. However this ratio could easily decline another 10% or so.

It is important to note that rents are now falling and this has not shown up in the OER measure yet. The OER lags REIT rents, and I expect OER to declines later this year. And declining rents will impact the price-to-rent ratio.

Price-to-Income:

The second graph shows the price-to-income ratio: This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

Real Prices This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

Nominal prices are adjusted using CPI less Shelter.

The Case-Shiller real prices are still significantly above prices in the '90s and perhaps real prices will decline another 10% to 20%.

Summary

These measures are useful, but somewhat flawed. These measures give a general idea about house prices, but there are other important factors like inventory levels and credit issues. All of this data is on a national basis and it would be better to use local area price-to-rent, price-to-income and real prices.

It appears that house prices - in general - are still too high. However prices depend on the local supply and demand factors. In many lower priced bubble areas supply has declined sharply (as banks are currently slow to foreclose), and demand is very strong (first-time home buyer frenzy, and cash flow investors). This is pushing up low end prices.

However in the mid-to-high end of the bubble areas - with significant supply and little demand - prices are probably still too high.

Case-Shiller House Price Index Increases in June

by Calculated Risk on 8/25/2009 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for June this morning.

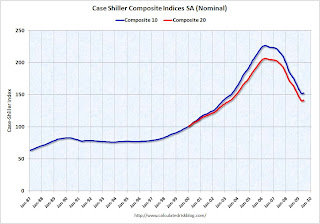

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - others report the NSA data. Note: I have more on the quarterly national index soon. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up about 9% (annualized) in June.

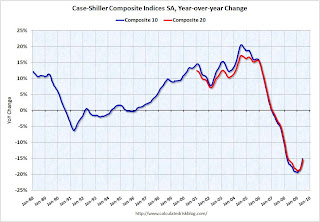

The Composite 20 index is off 31.4% from the peak, and up in June. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 15.1% over the last year.

The Composite 20 is off 15.4% over the last year.

This is still a very strong YoY decline.

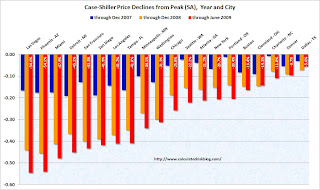

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

NOTE: updated 3rd graph. Two cities have price increases for 2009, and hopefully this graph shows the change better. Prices increased (SA

Prices increased (SA NSA) in 15 of the 20 Case-Shiller cities in June. In Las Vegas, house prices have declined 54.6% from the peak. At the other end of the spectrum, prices in Dallas are only off about 5.6% from the peak - and up in 2009. Prices have declined by double digits almost everywhere.

Let the debate begin - seasonal issues of mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, etc. - but this does show a price increase in June.

I'll compare house prices to the stress test scenarios soon.

FOIA: Court Orders Fed to Disclose Loan Program Details

by Calculated Risk on 8/25/2009 08:33:00 AM

From Bloomberg: Court Orders Federal Reserve to Disclose Emergency Loan Details

The Federal Reserve must for the first time identify the companies in its emergency lending programs after losing a Freedom of Information Act lawsuit.There is going to be some interesting information available soon.

...

The Fed has refused to name the financial firms it lent to or disclose the amounts or the assets put up as collateral under 11 programs, most put in place during the deepest financial crisis since the Great Depression, saying that doing so might set off a run by depositors and unsettle shareholders.

...

The judge said the central bank “improperly withheld agency records” ... She gave the Fed five days to turn over documents it told the reporters it located ...

The case is Bloomberg LP v. Board of Governors of the Federal Reserve System, 08-CV-9595, U.S. District Court, Southern District of New York (Manhattan).

Banks to Raise more Tier 1 Capital

by Calculated Risk on 8/25/2009 12:43:00 AM

Some people knew this was coming ...

From Reuters: Deutsche Bank plans Tier 1 issue, reopens market

Deutsche Bank AG plans to raise new Tier 1 debt ... as banks seek to rebuild balance sheets in the wake of the financial crisis.And SunTrust hints at raising new capital, from Bloomberg: U.S. Banks Face More Loan Losses, SunTrust Chief Says

The German bank confirmed it planned to issue euro fixed-rate perpetual notes, with annual call dates beginning from March 2015, and said it was managing the issue. ... the first of an expected series of new Tier 1 notes to hit the market in coming months from banks ... The deal would be smaller than 1 billion euros as the bank was seeking to test the market's appetite ...

“The industry is a long way from declaring any sort of victory, especially regarding credit issues,” Chief Executive Officer James Wells III said today in a speech to the Rotary Club of Atlanta. “This credit cycle has yet to play itself out. We do not expect things to improve for the banking industry in the very near future.”Ahhh ... just prudent balance sheet management!

...

“The industry has moved from a potentially cataclysmic scenario to one that is merely very difficult,” Wells said. “The industry is back from the brink of a potential global financial-system meltdown.” ... “Even if the economy begins to improve modestly, commercial real estate conditions will probably deteriorate until 2010.”

...

Wells said SunTrust may repurchase $4.9 billion in preferred shares sold through the U.S. Troubled Asset Relief Program “as soon as possible,” without being more specific.

Monday, August 24, 2009

Obama to Reappoint Bernanke

by Calculated Risk on 8/24/2009 10:13:00 PM

From CNBC: Obama to Reappoint Bernanke as Fed Chief

U.S. President Barack Obama will reappoint Ben Bernanke for a second term as chairman of the Federal Reserve on Tuesday, a senior administration official said on Monday.As Fed Governor Bernanke supported the flawed policies of Alan Greenspan - he never recognized the housing bubble or the lack of oversight - and there is no question, as Fed Chairman, Bernanke was slow to understand the credit and housing problems. And I'd prefer someone with better forecasting skills.

...

"The man next to me, Ben Bernanke, has led the Fed through one of the worst financial crises that this nation and this world have ever faced," Obama will say in a statement to the media at 9 am New York time.

However once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed's role to provide appropriate liquidity. Bernanke met that challenge, and I think he is a solid choice for a 2nd term (not my first choice, but solid).

Hotels: A "Perfect Storm" in San Francisco

by Calculated Risk on 8/24/2009 08:06:00 PM

From the SF Gate: Hotel losses mount, hurting city's coffers (ht Michael)

In June, the average room rate in San Francisco was $134, the lowest it has been since 2005 and well below the $162 peak in June 2008 ... For a while, managers filled rooms by offering lower rates, but the number of visitors also has begun to slide, and in June, occupancy tumbled to 73 percent, down from 85 percent the same time last year.A 17% decline in room rates, and a 14% decline in occupancy rates, suggests about a 30% decline in RevPAR (Revenue Per Available Room).

Add to the troubled mix the fact that many hotel owners, in San Francisco and across the state, financed purchases or refinanced loans between 2005 and 2007 - when the hotel values were at their peak. Since then, hotels statewide have lost 50 to 80 percent of their value, meaning that many owners owe far more than their asset is worth.Actually this is a perfect storm everywhere for hotels. Too much supply - and more coming online every day. Too much debt. And too few guests.

Hospitality industry analyst Alan Reay calls the situation a "perfect storm" that won't improve any time soon ...