by Calculated Risk on 8/20/2009 07:36:00 PM

Thursday, August 20, 2009

CRE: ABI and Nonresidential Structure Investment

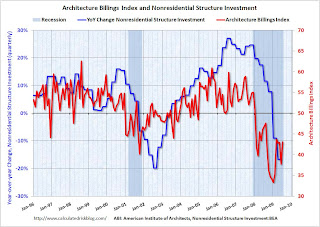

The American Institute of Architects (AIA) releases the Architecture Billings Index (ABI) monthly, and the AIA chief economist Kermit Baker frequently mentions there is an "approximate nine to twelve month lag time between architecture billings and construction spending." Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ABI with the quarterly data on nonresidential construction investment from the Bureau of Economic Analysis.

Although there is only data back to 1996, it appears that after the ABI falls consistently below 50 (contraction of billings on mostly commercial projects), then nonresidential structure investment declines on a YoY basis about one year later.

And YoY investment increases about one year after the ABI surpasses 50.

This suggests that nonresidential structure investment will decline through most of 2010, with no bottom in sight (since the ABI is still well below 50).

Right now I'm expecting another major slump in nonresidential structure investment towards the end of this year (following the ABI slump at the end of 2008), and for nonresidential structure investment to decline throughout 2010.

U.S. Mortgage Market and Seriously Delinquent Loans by Type

by Calculated Risk on 8/20/2009 04:12:00 PM

A little more information from the MBA Q2 delinquency report (and market graph below): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the U.S. mortgage market by type. There are about 45 million loans included in the MBA survey, and that is about 85% of the U.S. market.

This is a general breakdown, and apparently Alt-A is included in Prime (it would be helpful to break that out). The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

Clearly subprime is disproportionately represented (much higher delinquency rate), but now over half the loans in this category are Prime - and the delinquency rate is growing faster for Prime. This is now a Prime foreclosure crisis.

For more, please see earlier posts:

MBA Forecasts Foreclosures to Peak at End of 2010 (several graphs)

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2 Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Hotel RevPAR off 16.2 percent

by Calculated Risk on 8/20/2009 02:46:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 15 August 2009

In year-over-year measurements, the industry’s occupancy fell 6.9 percent to end the week at 63.9 percent. Average daily rate dropped 9.9 percent to finish the week at US$96.70. Revenue per available room for the week decreased 16.2 percent to finish at US$61.80.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.0% from the same period in 2008.

The average daily rate is down 9.9%, and RevPAR is off 16.2% from the same week last year.

Note: This is a multi-year slump. Although the occupancy rate was off 6.9 percent compared to last year, the occupancy rate is off about 11 percent compared to the same week in 2007.

As previously mentioned, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for 2009 was probably four weeks ago at 67%. Also, business travel was off much more than leisure travel earlier this year, so the summer months are not as weak as other times of the year. September will be the real test for business travel.

FDIC: DIF Update, may soften Private Equity Rules

by Calculated Risk on 8/20/2009 01:32:00 PM

First there has been some discussion of the status of the Deposit Insurance Fund (DIF).

Bloomberg has some details: FDIC May Add to Special Fees as Mounting Failures Drain Reserve

... The fund had $13 billion on March 31, the lowest since 1992 when it was $178.4 million, the FDIC said. The 56 bank collapses since March 31 cost an estimated $16 billion.This special assessment is on top of the Q2 "emergency fee of 5 cents for every $100 of assets". So the FDIC still has resources to pay all insurance claims.

... the Federal Deposit Insurance Corp. to impose a special fee as soon as next month to boost reserves by $5.6 billion. ...

If the fund is drained, the FDIC also has the option of tapping a line of credit at the Treasury Department that Congress extended in May to $100 billion, with temporary borrowing authority of $500 billion through 2010.

And from the WSJ: FDIC to Soften Private-Equity Curbs

... The FDIC is expected to retreat from its July proposal that private-equity firms have a Tier 1 capital ratio of at least 15% in order to bid on failed banks, and instead require such investors to maintain ratios of at least 10% ...

The FDIC also is expected to ease parts of its proposal that would have required buyout firms to guarantee that they'd provide financial support to any of their banking subsidiaries. ... Buyout firms are still expected to complain about mandates that they hold on to bank charters for at least three years, which would constrain the firms from turning quick profits on the deals.

MBA Forecasts Foreclosures to Peak at End of 2010

by Calculated Risk on 8/20/2009 11:21:00 AM

On the MBA conference call concerning the "Q2 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: The MBA data shows about 5.8 million loans delinquent or in the foreclosure process nationwide. I believe the MBA surveys covers close to 90% of the mortgage market. Many of these loans will cure, but the foreclosure pipeline is still building.

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about 65.5% of all loans).

The second graph shows just fixed rate prime loans (about 65.5% of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

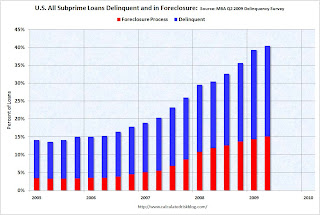

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

The fourth graph shows the delinquency and foreclosure rates by state (add: and D.C. and Puerto Rico!).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).Although most of the delinquencies are in a few states - because of a combination of high delinquency rates and large populations - the crisis is widespread.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2

by Calculated Risk on 8/20/2009 10:08:00 AM

From the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb, Foreclosures Flat in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.24 percent of all loans outstanding as of the end of the second quarter of 2009, up 12 basis points from the first quarter of 2009, and up 283 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.We're all subprime now!

...

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.30 percent, an increase of 45 basis points from the first quarter of 2009 and 155 basis points from one year ago. The combined percentage of loans in foreclosure and at least one payment past due was 13.16 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

...

“While the rate of new foreclosures started was essentially unchanged from last quarter’s record high, there was a major drop in foreclosures on subprime ARM loans. The drop, however, was offset by increases in the foreclosure rates on the other types of loans, with prime fixed-rate loans having the biggest increase. As a sign that mortgage performance is once again being driven by unemployment, prime fixed-rate loans now account for one in three foreclosure starts. A year ago they accounted for one in five....” said Jay Brinkmann, MBA’s Chief Economist.

emphasis added

More to come ...

Philly Fed: "Some signs of stabilizing"

by Calculated Risk on 8/20/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector is showing some signs of stabilizing ....

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -7.5 in July to 4.2 this month. This is the highest reading of the index since November 2007. The percentage of firms reporting increases in activity (27 percent) was slightly higher than the percentage reporting decreases (23 percent). Other broad indicators also suggested improvement. The current new orders index edged six points higher, from -2.2 to 4.2, also its highest reading since November 2007. The current shipments index increased 10 points, to a slightly positive reading.

Labor market conditions remain weak. Firms continue to report declines in employment and work hours, but overall job losses were not as large this month. The current employment index increased from a weak reading of -25.3 to -12.9, its highest level in 11 months. Twenty-three percent of firms reported declines in employment this month, down from 30 percent in the previous month. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index was been negative for 19 of the previous 20 months, before turning slightly positive this month. Employment is still weak.

Weekly Unemployment Claims Increase, Workers Exhausting Extended Benefits

by Calculated Risk on 8/20/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims increased to 576,000:

In the week ending Aug. 15, the advance figure for seasonally adjusted initial claims was 576,000, an increase of 15,000 from the previous week's revised figure of 561,000. The 4-week moving average was 570,000, an increase of 4,250 from the previous week's revised average of 565,750.The advance number for seasonally adjusted insured unemployment during the week ending Aug. 8 was 6.24 million.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 4,250 to 570,000, and is now 88,750 below the peak of 19 weeks ago. It appears that initial weekly claims have peaked for this cycle - but the average has increased 22,000 from the low of two weeks ago.

The number of initial weekly claims is still very high (at 576,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

It is difficult to calculate the number of workers who have exhausted their extended claims, but that number is expected to rise sharply over the next few months. From the O.C. Register: Estimate doubles for jobless losing benefits Sept. 1 (ht Keith)

An estimated 143,000 unemployed workers in California will exhaust their jobless benefits by Sept. 1, according to new figures released by the state Employment Development Department.

That's more than double the 61,906 state officials estimated a month ago. The number is based on workers who will exhaust the basic 26 weeks of benefits plus the three extensions approved by Congress.

If Congress does not approve a fourth extension in benefits, EDD projects that 264,000 Californians will be kicked off the unemployment rolls by the end of the year.

UK: BofE Forecasts Suggests Recession is Over

by Calculated Risk on 8/20/2009 12:11:00 AM

From The Times: City taken by surprise as Bank of England’s figures herald end of recession

Britain has emerged from the worst recession since the Second World War, new Bank of England figures suggested yesterday ...Note that the GDP figures in Britain are not annualized (0.4 percent is about 1.6 percent as reported in the U.S.)

Detailed forecasts published by the Bank showed that gross domestic product (GDP) will rise by 0.2 per cent between July and September, marking the first economic expansion since the first three months of last year. The Bank expects the economy to continue to expand in the fourth quarter, by 0.4 per cent, and sustain the recovery throughout next year.

The recession has apparently ended in Japan, Germany, and France.

Wednesday, August 19, 2009

FDIC to Discuss Off-balance-sheet Risk-based Capital Guidelines next week

by Calculated Risk on 8/19/2009 08:39:00 PM

On the agenda for the FDIC board meeting next week:

Memorandum and resolution re: Final Statement of Policy of Qualifications for Failed Bank Acquisitions.The first item is important because this is the issue supposedly limiting bids from private equity firms for failed banks. See from MarketWatch: FDIC chills private-equity bank bidders

Memorandum and resolution re: Final Rule on the Extension of the Transaction Account Guarantee Program.

Memorandum and resolution re: Notice of Proposed Rulemaking Regarding Risk-Based Capital Guidelines; Impact of Modifications to Generally Accepted Accounting Principles; Consolidation of Asset-Backed Commercial Paper Programs; and Other Related Issues.

On the second issue, from Reuters: US to study impact of new off-balance-sheet rules (ht jb)

U.S. regulators plan to gauge how severe of a hit banks will take from an accounting change that will force them to bring more than $1 trillion of assets back on their books.There is much more in the article.

Next week regulators expect to propose a rule that seeks input on whether banks need more time to build capital cushions against the assets that were once held by off-balance-sheet trusts.

Banks will still have to move the assets back on to their books on Jan. 1, 2010, but regulators want feedback on the impact of the accounting change and whether it might be prudent to phase in the risk-weighted capital that must be held against the assets.