by Calculated Risk on 8/19/2009 10:00:00 AM

Wednesday, August 19, 2009

Financial Reform: Don't hold your breath

From Bloomberg: Scholes, Merton Says Banks Should Value Assets Better (ht Brian)

Financial institutions should use mark-to-market accounting or list the hard-to-value securities on public exchanges whenever possible, Scholes said in a Bloomberg Radio interview yesterday. ...Don't hold your breath.

“I’d like to see us encourage many more securities held on the books of the banks be migrated to exchanges if possible,” he said. Doing so would “allow for market discovery and market pricing as much as possible,” Scholes added.

...

“This is not the way forward,” [Merton, Robert Kaplan and Scott Richard] wrote. “While regulators and legislators are keen to find simple solutions to complex problems, allowing financial institutions to ignore market transactions is a bad idea.”

And from the SEC: Sample Letter Sent to Public Companies on MD&A Disclosure Regarding Provisions and Allowances for Loan Losses (ht LDM)

Clear and transparent disclosure about how you account for your provision and allowance for loan losses has always been critically important to an investor’s understanding of your financial statements. ... Finally, although determining your allowance for loan losses requires you to exercise judgment, it would be inconsistent with generally accepted accounting principles if you were to delay recognizing credit losses that you can estimate based on current information and events. Where we believe a financial institution’s financial statements are inconsistent with GAAP, we will take appropriate action.Don't hold your breath.

emphasis added

And from the Jackson Hole conference in 1987: Restructuring the Financial System. Concluding remarks from Gerald Corrigan:

Clearly there is a broad-based consensus that something has to be done about restructuring our financial system. There is even a broadbased consensus as to why it has to be done. I certainly would count myself among those who put considerable urgency behind the task of getting it done.Nothing was done. Hopefully no one held their breath.

AIA: Architecture Billings Index shows Contraction in July

by Calculated Risk on 8/19/2009 07:43:00 AM

From Reuters: U.S. architecture billings index up in July: AIA

... The Architecture Billings Index rebounded more than 5 points last month to a reading of 43.1, reversing a similar decline in June, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008 ...

Credit remains tight and government stimulus funds have had little visible impact on project activity, AIA Chief Economist Kermit Baker said.

"There has been too much contraction in recent months to get overly optimistic about business conditions," Baker said.

...

Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. The AIA's Billings Index, which began in 1995, is considered a measure of construction spending nine to 12 months in the future.

emphasis added

Click on graph for larger image in new window.

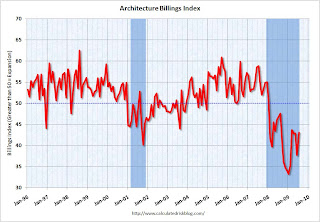

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment later this year and next.

New Appraisal Process Shifts Power

by Calculated Risk on 8/19/2009 12:02:00 AM

From David Streitfeld at the NY Times: In Appraisal Shift, Lenders Gain Power and Critics

Mike Kennedy, a real estate appraiser in Monroe, N.Y., was examining a suburban house a few years ago when he discovered five feet of water in the basement. The mortgage broker arranging the owner’s refinancing asked him to pretend it was not there.Streitfeld discusses the origins of the HVCC and the current situation (only the appraisal management companies and lenders are happy). Interesting story.

Brokers, real estate agents and banks asked appraisers to do a lot of pretending during the housing boom, pumping up values while ignoring defects. While Mr. Kennedy says he never complied, many appraisers did, some of them thinking they had no choice if they wanted work. A profession that should have been a brake on the spiral in home prices instead became a big contributor.

On May 1, a sweeping change took effect that was meant to reduce the conflicts of interest in home appraisals while safeguarding the independence of the people who do them.

Brokers and real estate agents can no longer order appraisals. Lenders now control the entire process.

The Home Valuation Code of Conduct is setting off a bitter battle. Mortgage brokers, lenders, real estate agents, regulators and appraisers are all arguing over whether an effort to fix one problem has created many new ones.

Tuesday, August 18, 2009

Update on Bank Bids: Guaranty (Texas) and Corus

by Calculated Risk on 8/18/2009 09:32:00 PM

From Reuters: Guaranty Financial draws bid -- sources

A consortium that is led by financial services executive Gerald Ford and includes several private equity firms submitted a bid for troubled bank Guaranty Financial, despite uncertainty over U.S. regulation guidelines, sources familiar with the matter said on Tuesday.Today was the deadine for bids for the assets of Guaranty ($14.4 billion in assets as of Q1). My guess is the bank will be seized this week.

It was unclear how many offers were submitted in total by Tuesday's deadline for bids, but sources said that there were also expected to be bids from other parties.

From Nick Timiraos at the WSJ: Corus Bids Enter the Final Stretch

New York developer the Related Cos. and Lubert-Adler Partners LP, a Philadelphia real-estate investment firm, have teamed up to bid on the assets of condo lender Corus Bank, joining a rival offer from Los Angeles private-equity fund Colony Capital LLC and iStar Financial Inc., the New York commercial-mortgage real-estate investment trust.From other reports, it appears the bidding on the assets of Corus will be open until Sept 3rd (Corus had $7.6 billion in assets as of Q1).

Several real-estate professionals see the Related-Lubert team as having the inside track to the bank's assets in a sale brokered by the Federal Deposit Insurance Corp., though other private-equity firms remain in the mix ...

These will be the 2nd and 4th largest failures of the year. Colonial had $25 billion in assets, and BankUnited had $12.8 billion in assets when they failed.

Judge: Banker "Culture of Corruption" was "Pernicious and pervasive"

by Calculated Risk on 8/18/2009 06:54:00 PM

The following article is about one of the ex-Credit Suisse brokers being found guilty of securities fraud. The judge's comments about the culture in financial services industry are on point ...

From Bloomberg: Ex-Credit Suisse Broker Eric Butler Guilty of Securities Fraud

U.S. District Judge Jack Weinstein ... asked lawyers for both Butler and the government, when they file sentencing papers, to put Butler’s acts in the context of “how pernicious and pervasive was the culture of corruption, lack of regulation” and “serious negligence in the financial services industry in supervising people like this.”Some of these operations made J.T. Marlin look legit (OK, another movie reference).

Market, Autos and Misc

by Calculated Risk on 8/18/2009 04:00:00 PM

Note: Google / Blogger is under a DDoS-style attack again - sorry for any inconvenience. Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Edmunds.com: “Cash for Clunkers” Sales on the Rapid Decline (ht Bob_in_MA)

The rush of automotive sales activity brought on by the "Cash for Clunkers" program is fading fast, according to Edmunds.com, whose latest study of car buyer behavior indicates that automotive purchase intent is down 31 percent from its peak in late July.And from a Guaranty Bank (Texas) NT 10-Q SEC filing:

“Now that there is plenty of money in the program and the most eager shoppers have already participated, the sense of urgency is gone, and the pace of intent decline is accelerating,” observed Edmunds.com CEO Jeremy Anwyl. "Inventories are getting lean and prices are climbing, giving consumers reasons to sit back."

Last week, activity was down 15 percent from the late July peak, and Edmunds.com analysts predict that in the coming days, purchase intent will return to levels seen before the launch of Cash for Clunkers. Purchase intent has proven to be a reliable leading indicator of sales to come in the following 90 days.

“Our research indicates that Cash for Clunkers buyers have come in three waves: the first was the informed, pent-up buyers who anxiously waited for the program to launch, while the second was the mass market who responded to advertising and other promotional coverage of the program,” recalls Edmunds.com Senior Analyst Jessica Caldwell. “Now the industry is largely servicing the third wave, which is generally made up of people who had to chase down copies of lost titles and other paperwork and are now able to finally participate. It is unclear where the customers will come from after this wave crests and breaks.”

As described in the July 23 8-K, the Company does not believe it is possible to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. Accordingly, the Company no longer believes that it will be able to continue as a going concern.Bids for Guaranty's assets were due today, and it is very likely that Guaranty will be seized this week by the FDIC. Guaranty keeps repeating the warning - and still the stock is trading above zero ...

The Company continues to cooperate with the Office of Thrift Supervision (the “OTS”) and the Federal Deposit Insurance Corporation (“FDIC”) as they pursue alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.

DataQuick: SoCal Sales Increase, Some Activity in High End Areas

by Calculated Risk on 8/18/2009 01:39:00 PM

From DataQuick: Southland home sales rise again as higher-cost areas awaken

Southern California homes sold last month at the fastest clip for a July in three years and the fastest pace for any month since December 2006. ...Last year sales were very low in the high end areas, so some year-over-year pickup isn't surprising. Unfortunately DataQuick didn't break out the actual numbers.

A total of 24,104 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 3.6 percent from 23,262 in June and up 18.6 percent from 20,329 a year ago, according to San Diego-based MDA DataQuick.

July’s sales total was 8.7 percent lower than the average number sold in July – 26,410 – since 1988, when DataQuick’s statistics begin. July home sales have ranged from a low of 16,225 in July 1995 to a peak of 38,996 in 2003.

Sales have increased year-over-year for 13 consecutive months. ...

Although sales of lower-cost foreclosures have tapered off, the high end of the housing market has awakened this summer from a long slumber, during which sales had been at or near record lows. July sales of existing single-family houses rose above a year ago in many coastal towns, including Manhattan Beach, Redondo Beach, Huntington Beach, Newport Beach, Carlsbad, Encinitas and La Jolla. Among the higher-cost Southland communities not posting such a gain were Malibu, Rancho Palos Verdes, Beverly Hills, Brentwood and Del Mar.

...

Last month 43.4 percent of the Southland houses and condos that resold had been foreclosed on in the prior year – the lowest level since June 2008. July’s foreclosure resales figure was down from 45.3 percent in June and from a peak 56.7 percent in February 2009.

...

“Have prices hit bottom? While some data continue to hint at that, it remains an especially risky call to make given the uncertainty over the magnitude of future job losses and foreclosures. The recent drop in foreclosure resales, coupled with the rise in high-end sales, has helped stabilize some of the regional home price measures. But there’s still quite a bit of distress out there, and plenty of unknowns with regard to how lenders and borrowers will choose to proceed,” said John Walsh, DataQuick president.

...

Investors and other absentee buyers, defined as those who will have their property tax bills sent to a different address, bought 19.4 percent of the Southland homes sold last month. That’s up from 15.5 percent a year ago and a monthly average since 2000 of about 15 percent. San Bernardino County had the highest share of absentee buyers in July: 27 percent.

...

Foreclosure activity remains near record levels ...

emphasis added

Close to 20% of properties are being bought by investors, and 43.4% are foreclosure resales. These numbers are still very high and will probably increase after the Summer.

Manhattan Office Buildings: Cap Rates More than Double

by Calculated Risk on 8/18/2009 12:06:00 PM

Here is an excerpt on cap rates in Manhattan ...

From Bloomberg: Manhattan Office Sales Ground to Halt in First Half

The scarcity of property sales has made it hard to calculate prices and yields, [CB Richard Ellis] said.The increase in cap rates suggests more than half off the peak prices of a few years ago - and probably even more since rents have fallen too (reducing operating income) and vacancy rates are rising sharply (pressuring rents more).

The so-called capitalization rate, or a property’s net operating income divided by purchase price, may have risen to about 7 percent for stable, prime Manhattan office buildings, CB Richard Ellis said.

During the peak, cap rates in Manhattan got as low as about 3 percent.

No wonder "buyers and sellers are far apart on bids"!

Comparing Housing Start Recoveries

by Calculated Risk on 8/18/2009 10:00:00 AM

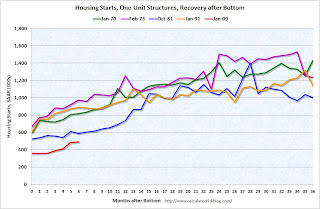

It appears that single-family housing starts bottomed in January of this year. Single-family starts in July were 37 percent above the January low - based on the seasonally adjusted annual rate (SAAR).

How does this compare to previous housing recoveries? Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the current recovery with four previous housing recoveries. The recoveries are labeled with the month that single-family housing starts bottomed.

Starts fell to record lows in the current housing bust (adjusted for changes in population, or number of households, would make the current bust even worse).

Usually housing starts increase steadily for the first two years following a housing bottom. The second graph shows the same data, normalized by setting the bottom for single-family housing starts to 100.

The second graph shows the same data, normalized by setting the bottom for single-family housing starts to 100.

This graph shows that housing starts usually double in the two years following the bottom. Starts increased 80 percent over two years in the recovery following the Jan 1991 bottom, and 136 percent in the recovery following the Jan 1970 bottom.

If starts doubled over the two years following the Jan 2009 bottom, single-family starts would recover to 715 thousand by Jan 2011. And looking at the first graph some people might think single-family starts might recover to a 1.1 million rate within 2 years. That seems very unlikely.

I started this year looking for the bottom in single family housing starts (and I think the bottom is in), but I expect the recovery to be sluggish because of all the excess housing units, and also because of the ongoing decline in the homeownership rate. I'll have more on this later - but hopefully these graphs show what many people expect.

Housing Starts Flat in July

by Calculated Risk on 8/18/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 581 thousand (SAAR) in July, off slightly from June, but up sharply over the last three months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 490 thousand (SAAR) in July, up slightly from June; 37 percent above the record low in January and February (357 thousand).

Permits for single-family units were 458 thousand in July, suggesting single-family starts might decline slightly in August.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:Note that single-family completions of 491 thousand are at the same level as single-family starts (490 thousand).

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 560,000. This is 1.8 percent (±1.4%) below the revised June rate of 570,000 and is 39.4 percent (±1.8%) below the July 2008 estimate of 924,000.

Single-family authorizations in July were at a rate of 458,000; this is 5.8 percent (±1.1%) above the revised June figure of 433,000.

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 581,000. This is 1.0 percent (±8.5%)* below the revised June estimate of 587,000 and is 37.7 percent (±5.1%) below the July 2008 rate of 933,000.

Single-family housing starts in July were at a rate of 490,000; this is 1.7 percent (±7.1%)* above the revised June figure of 482,000.

Housing Completions:

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 802,000. This is 0.9 percent (±10.1%)* below the revised June estimate of 809,000 and is 26.4 percent (±6.9%) below the July 2008 rate of 1,089,000.

Single-family housing completions in July were at a rate of 491,000; this is 4.1 percent (±8.9%)* below the revised June figure of 512,000.

It now appears that single family starts bottomed in January. However I expect starts to remain at fairly low levels for some time as the excess inventory is worked off.