by Calculated Risk on 7/30/2009 01:51:00 PM

Thursday, July 30, 2009

Regulator: GSEs Unlikely to Fully Repay Bailout

From the WSJ: GSEs Unlikely to Repay U.S. in Full

... "My view is that some assets in the senior preferred will have to be left behind as they come out of conservatorship," Federal Housing Finance Agency Director James B. Lockhart said Thursday in response to a question at a panel discussion in Washington. "That will mean that some of the losses will never be repaid."I'm shocked!

The Treasury has agreed to pump $200 billion into each company in order to keep them solvent. In exchange, the government receives senior preferred stock that pays a 10% dividend. So far, it has injected $85 billion in total into the companies, but Lockhart said that figure was likely to rise in the coming months.

Fannie and Freddie together own or guarantee $5.4 trillion in mortgages. ...

Mr. Lockhart said Fannie and Freddie would likely see their reserves continue to decline next year, but could return to strong profits in two to three years.

Minnesota: Lenders Gone Wild

by Calculated Risk on 7/30/2009 12:26:00 PM

The Star Tribune has a series on small banks in trouble: Lenders Gone Wild

There are three parts:

Part 1: Minnesota’s small banks on the brink

In Minnesota, regulators have seized and closed two banks since 2008 and have ordered 16 others to clean up their balance sheets. Another 65 of the state's 430 banks and thrifts are on a secret watch list, and state banking officials expect more to fail as they are pulled down by bad real estate loans.That is more than the rumored (and denied) comment about 500 bank failures attributed to FDIC Chairman Bair.

...

Foresight Analytics estimates that the nation's 8,000 community banks will suffer losses of $60 billion related to commercial real estate in the next two to three years, and that about 713 banks across the country will fail. Under that scenario, about 19 banks in Minnesota will fail and commercial real estate losses could total more than $2 billion.

And this is a great warning:

Bank consultant Robert Viering, principal of River Point Group Inc. in Monticello, had that lesson drilled into him when he was a regional credit officer at the former Norwest Bank. A credit manual, circa 1990, warned him and his colleagues: "The pivotal issue in CRE lending is knowing when to stop. Restraint must be initiated by bankers because historically borrowers have been unable to recognize the warning signs. Commercial real estate lending should not be viewed as the cornerstone of a loan portfolio."Absolutely. The CRE developers just go crazy at the end of every boom; restraint must be initiated by bankers.

Part 2: Credit unions: where the credit flowed too freely

And Part 3 tomorrow: As loans grew, regulators shrank

Hotel RevPAR Off 16.3 Percent YoY

by Calculated Risk on 7/30/2009 10:28:00 AM

From HotelNewsNow.com: STR reports US performance for week ending 18 July 2009

In year-over-year measurements, the industry’s occupancy fell 7.9 percent to end the week at 67.0 percent. Average daily rate dropped 9.1 percent to finish the week at US$98.13. Revenue per available room for the week decreased 16.3 percent to finish at US$65.77.

Click on graph for larger image in new window.

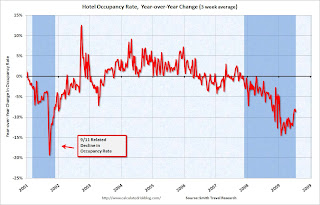

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.7% from the same period in 2008.

The average daily rate is down 9.1%, and RevPAR is off 16.3% from the same week last year.

Comments: This is a multi-year slump. Although the occupancy rate was off 7.9 percent compared to last year, the occupancy rate is off about 12 percent compared to the same week in 2006 and 2007.

Also, business travel is off much more than leisure travel - so the summer months are not as weak as other times of the year. September will be the real test for business travel.

Weekly Unemployment Claims

by Calculated Risk on 7/30/2009 08:30:00 AM

Note: Earlier this month, the seasonally adjusted weekly claims were distorted by changes in the patterns of auto layoffs this year. That is now over.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 25, the advance figure for seasonally adjusted initial claims was 584,000, an increase of 25,000 from the previous week's revised figure of 559,000. The 4-week moving average was 559,000, a decrease of 8,250 from the previous week's revised average of 567,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending July 18 was 6,197,000, a decrease of 54,000 from the preceding week's revised level of 6,251,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 8,250, and is now 99,750 below the peak of 16 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen fairly quickly - but is still very high (over 580K), indicating significant weakness in the job market.

Just a reminder ... after earlier recessions (like '81), weekly claims fell quickly, but in the two most recent recessions, weekly claims declined a little and then stayed elevated for some time. I expect weekly claims to stay elevated following the current recession too.

Wednesday, July 29, 2009

WSJ: FDIC to Split Failed Banks Hoping to find Buyers

by Calculated Risk on 7/29/2009 09:07:00 PM

Think Corus and Guaranty (Texas) ...

From the WSJ: FDIC Poised to Split Banks to Lure Buyers (ht jb)

The Federal Deposit Insurance Corp. ... is poised to start breaking failed financial institutions into good and bad pieces in an effort to drum up more interest from prospective buyers.The article quotes Jiampietro as saying the process is "pretty far along" and that a transaction could happen soon. As I said, think Corus and Guaranty Financial. Both will probably be seized as soon as bidders can be found.

The strategy ... is aimed at selling the most distressed hunks of failed banks to private-equity firms and other types of investors who may be more willing than traditional banks to take a flier on bad assets. The traditional banks could then bid on the deposits, branches and other bits of the failed institution that are appealing.

"We want banks to participate in the resolution process, but we know it's a tough time for banks to participate in the resolution process," said Joseph Jiampietro, a senior adviser to FDIC Chairman Sheila Bair. ... "There are certain situations when assets are so distressed and make up a significant percentage of the balance sheet that strategic buyers are hesitant to participate in the process," said Mr. Jiampietro.

This suggests an RTC type entity might also be formed. Interesting times.

Report: June Surge in Lender Repossessions in Seattle, Las Vegas and Phoenix

by Calculated Risk on 7/29/2009 06:34:00 PM

Three stories from DataQuick:

June Seattle MSA Home Sales and Median Prices

Last month 16.9 percent of all resales were houses or condos that had been foreclosed on in the prior 12 months, down from 19.2 percent in May and a peak of 23.9 percent in January this year.Phoenix June Home Sales, Median Prices Up

However, there are more foreclosure resales on the way, and they will continue to weigh on home prices for the foreseeable future. In June, lender repossessions spiked: Nearly 863 houses and condos were lost to foreclosure in the three-county Seattle region, up nearly 37 percent from May and up 119 percent from a year ago. It was the highest monthly total since foreclosures began to surge in 2006. The figures are based on the number of trustees deeds filed with the county recorder's office.

emphasis added

In June, 60.8 percent of the Phoenix-area houses and condos that resold had been foreclosed on in the prior 12 months, down from 64 percent in May and the lowest since such foreclosure resales were 58.6 percent of all resales last November. Foreclosure resales hit a high of 66.2 percent this March ...Las Vegas June home sales higher; median $ steady

Absentee buyers made up 39.6 percent of all purchases – a relatively high percentage in the West. ...

For the foreseeable future, the Phoenix region will continue to have many foreclosures to recycle, and that inventory of lender-owned property will weigh on home prices. In June, lender repossessions spiked: Nearly 5,800 houses and condos were lost to foreclosure in the two-county Phoenix region, up nearly 38 percent from May and up 40.8 percent from a year ago. It was the highest monthly total since foreclosures began to surge in 2006.

About 70 percent of the Las Vegas-area houses and condos that resold in June were foreclosure resales, meaning those homes had been foreclosed on in the prior 12 months. That was up from 59 percent in June 2008 but the lowest for any month since it was 68.9 percent last December. Foreclosure resales peaked in April at 73.7 percent of total resales ...Las Vegas and Phoenix have far more foreclosure resales than Seattle, but all three cities are seeing a surge in foreclosures.

Looking ahead, the Las Vegas region will still have many foreclosures to burn off, and that inventory of distressed property will weigh on home prices. In June, lender repossessions spiked: Nearly 3,600 houses and condos were lost to foreclosure in Clark County, up 54 percent from May and up 34 percent from a year ago. It was the second-highest monthly total, behind 3,718 this February, since foreclosures began to surge in 2006.

I spoke with a SoCal developer yesterday, and he said there are some positive signs in the California Inland Empire, but he is worried about another flood of REOs. Every bank he has spoken with (he does some consulting for banks on their real estate holdings) is sitting on a pile of REOs and homes in the foreclosure process.

It is unclear how big this surge will be, but here it comes.

The Return of Cram-Downs, Condo Reconversions and More

by Calculated Risk on 7/29/2009 04:00:00 PM

First a graph from Effective Demand on Ventura County sales and inventory by price (Effective Demand covers Ventura and the San Fernando Valley in LA) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph from Ventura County Demand versus Inventory - July 2009

Most of the activity is at the low end, and inventory is pretty low. This is true for many of the low-to-mid end areas. There are more foreclosures coming, but the timing is uncertain - will it be a flood, or will the banks just bleed the foreclosures into the market?

But for the mid-to-high end - expect bad news! Not only is financing tight, but there is a dearth of move-up buyers.

And from Bloomberg: ‘Cram-Down’ May Be Revived Unless Lenders Modify More Mortgages

[House Financial Services Committee Chairman Barney] Frank said he will re-attach the cram-down provisions to any new legislation requested by the industry, “unless we see a significant increase in mortgage modifications and foreclosure- avoidance.”Not much on Corus or Guaranty Bank (Texas), although both will probably be seized by the FDIC soon. Talk about seizing: Corus Bank seizes Aventine apartments

...

Cram-downs let federal judges lengthen terms, cut interest rates and reduce mortgage balances of bankrupt homeowners, even if the lender objects.

A company affiliated with Corus Bank seized the 216-unit Aventine at Boynton Beach apartment complex.Looks like another property with the value cut in half - and more apartments back on the market (aka "reconversions"). And here is another condo project being converted to apartments: Novato's Millworks condos switch to rentals after only two of 124 units are bought (ht Rich and others)

In a July 16 filing in Palm Beach County Circuit Court, Aventine Marketing released Boynton Pinehurst from the $25 million remaining on its mortgage with the Chicago-based bank in exchange for the deed to the property. ...

Boynton Pinehurst ... planned to convert Aventine into condos when it took a $37.2 million mortgage from Corus Bank in 2006. It paid $48 million for the property that year.

Millworks, a 420,882-square-foot residential/commercial project at De Long and Reichert avenues, had a grand opening in May but has only sold two of 124 condominiums situated above a Whole Foods grocery store slated to open next spring.The condo reconversions and new condos being rented is part of the reason there has been a surge in rental units in recent years, pushing the rental vacancy rate to record levels.

...

Starting this week, the condos will be rented on sixth-month and one-year leases for about two years before Signature intends to crank up sales efforts again, Ghielmetti said.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Fed's Beige Book: "Economic activity continued to be weak" in Summer

by Calculated Risk on 7/29/2009 02:00:00 PM

From the Fed: Beige Book

Reports from the 12 Federal Reserve Districts suggest that economic activity continued to be weak going into the summer, but most Districts indicated that the pace of decline has moderated since the last report or that activity has begun to stabilize, albeit at a low level.And on real estate:

...

Most Districts reported sluggish retail activity.

emphasis added

Commercial real estate leasing markets were described as either "weak" or "slow" in all 12 Districts, although the severity of the downturn varied somewhat across Districts. While the office vacancy rate was up and rents were down in the Dallas District, market fundamentals there remained stronger than the national average. Market conditions in the New York District are significantly worse than one year ago, on average, but have been relatively stable in recent weeks and some parts of the District report improving fundamentals. Office vacancy rates continued to climb in the Atlanta, Boston, Kansas City, Minneapolis, Philadelphia, Richmond, and San Francisco Districts, as well as in Manhattan, resulting in sizable leasing concessions and/or declines in asking rents. ... Commercial real estate sales volume remained low, even "non-existent" in some Districts, reportedly due to a combination of tight credit and weak demand. Construction activity was limited and/or declining in most Districts, although exceptions were noted for health and institutional construction in the St. Louis District, public sector construction in the Chicago District, and the reconstruction of the World Trade Center in Manhattan. Tight credit was cited as an ongoing factor in the dearth of new construction activity. The commercial real estate outlook was mixed, both within and across Districts. Some contacts expect commercial real estate markets to improve within two quarters and others predict further market deterioration for the remainder of 2009 and possibly through late 2010.It is the usual pattern for Commercial real estate (CRE) to follow residential off the cliff, but I'm surprised anyone thinks CRE will recovery in a couple of quarters. I think CRE will be crushed this year and next.

Residential real estate markets in most Districts remained weak, but many reported signs of improvement. The Minneapolis and San Francisco Districts cited large increases in home sales compared with 2008 levels, and other Districts reported rising sales in some submarkets. Of the areas that continued to experience year--over--year sales declines, all except St Louis--where sales were down steeply-- also reported that the pace of decline was moderating. In general, the low end of the market, especially entry-level homes, continued to perform relatively well; contacts in the New York, Kansas City, and Dallas Districts attributed this relative strength, at least in part, to the first--time homebuyer tax credit. Condo sales were still far below year--before levels according to the Boston and New York reports. In general, home prices continued to decline in most markets, although a number of Districts saw possible signs of stabilization. The Boston, Atlanta, and Chicago Districts mentioned that the increasing number of foreclosure sales was exerting downward pressure on home prices. Residential construction reportedly remains quite slow, with the Chicago, Cleveland, and Kansas City Districts noting that financing is difficult.

More beige shoots ...

Fed's Dudley: Recovery to be "Lackluster"

by Calculated Risk on 7/29/2009 12:12:00 PM

From NY Fed President William Dudley: The Economic Outlook and the Fed's Balance Sheet: The Issue of "How" versus "When"

Dudley discussed his economic outlook, and how the Fed will exit from the current policy stance. Dudley doesn't think the Fed's policy stance will change any time soon.

Here are some excerpt on his economic outlook:

[T]he economic contraction appears to be waning and it seems likely that we will see moderate growth in the second half of the year. The economy should be boosted by three factors: 1) a modest recovery in housing activity and motor vehicle sales; 2) the impact of the fiscal stimulus on domestic demand; and 3) a sharp swing in the pace of inventory investment. In fact, if the inventory swing were concentrated in a particular quarter, we could see fairly rapid growth for a brief period.The rest of the speech is on the "how" of unwinding current policy and is worth reading.

Regardless of the precise timing, there are a number of factors which suggest that the pace of recovery will be considerably slower than usual. In particular, I expect that consumption—which accounts for about 70 percent of gross domestic product—is likely to grow slowly for three reasons. First, real income growth will probably be weak by historical standards. There were a number of special factors that boosted real income in the first half of the year, helping to offset a sharp drop in hours worked and very sluggish hourly wage gains. These factors included the sharp drop in gasoline and natural gas prices; the large cost-of-living-allowance increase for Social Security recipients reflecting last year’s high headline inflation; a sharp drop in final tax settlements; a reduction in withholding tax rates; and a one-time payment to Social Security recipients. These factors provided a transitory boost to real incomes, which will be absent during the second half of the year. As a result, real disposable income is likely to decline modestly over this period.

Second, households are still adjusting to the sharp drop in net worth caused by the persistent decline in home prices and last year’s fall in equity prices. This suggests that the desired saving rate will not decline sharply. That means consumer spending is unlikely to rise much faster than income. In other words, weak income growth will be an effective constraint on the pace of consumer spending.

Moreover, some sectors such as business fixed investment in structures are likely to continue to weaken as existing projects are completed. In an environment in which vacancy rates are high and climbing, prices are falling, and credit for new projects is virtually nonexistent, this sector is likely to be a significant drag on the economy over the next year.

Perhaps most important, the normal cyclical dynamic in which housing, consumer durable goods purchases and investment spending rebound in response to monetary easing is unlikely to be as powerful in this episode as during a typical economic recovery. The financial system is still in the middle of a prolonged adjustment process. Banks and other financial institutions are working their way through large credit losses and the securitization markets are recovering only slowly. This means that credit availability will be constrained for some time to come and this will serve to limit the pace of recovery.

If the recovery does, in fact, turn out to be lackluster, the unemployment rate is likely to remain elevated and capacity utilization rates unusually low for some time to come. This suggests that inflation will be quiescent. For all these reasons, concern about “when” the Fed will exit from its current accommodative monetary policy stance is, in my view, very premature.

emphasis added

Note: Usually the NY Fed president is one of the most powerful Fed voices and has a permanent seat on the FOMC (the other Fed presidents serve on a rotating basis).