by Calculated Risk on 7/26/2009 09:33:00 PM

Sunday, July 26, 2009

Herald Tribune: Lenders Ignored Mortgage Fraud Red Flags

From the Herald Tribune series on mortgage fraud in Florida: Lenders failed to heed red flags

Fraudulent property flippers had an unlikely accomplice during the real estate boom -- the lending industry."It is difficult to get a man to understand something, when his salary depends upon his not understanding it!"

A yearlong Herald-Tribune investigation into thousands of suspicious Florida flip deals found that lenders of all kinds approved risky deals and ignored obvious red flags for mortgage fraud.

...

What makes the flipping fraud so egregious is not just that it happened, but that it would have been so easy to stop.

Using public records and Internet searches, the Herald-Tribune identified hundreds of deals that exhibited classic red flags for fraud. They include sales between family members and business partners in which prices increased $100,000 or more overnight. In other cases, flippers repeatedly traded properties from their company to their own name, each time increasing the price and the amount they borrowed.

Lenders knew they were writing bad loans, but did it anyway because they were making so much money on underwriting fees, said Jack McCabe, a Deerfield Beach-based real estate consultant ...

Upton Sinclair, 1935, "I, Candidate for Governor: And How I Got Licked"

Economy: A Little Sunshine

by Calculated Risk on 7/26/2009 04:14:00 PM

This will be a very busy week for economic news, and some of the key data will be new home sales for June released on Monday, the Case-Shiller home price index for May released on Tuesday, and Q2 GDP from the BEA on Friday.

At the beginning of this dark and dreary1 economic year, I was looking for a little sunshine. I argued that three key data series would find a bottom in 2009, and that the drag on employment and GDP from these industries would slow or stop.

This doesn't mean green shoots - just the end of cliff diving. So it is probably time for a review ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA.

Sales in June were at a 9.7 million at a Seasonally Adjusted Annual Rate (SAAR), up from 9.1 million in February.

Although this increase barely shows up on the graph, this is a fairly significant rebound, and I expect light vehicle sales over 10 million SAAR later this year. Total housing starts were at 582 thousand (SAAR) in June, up sharply over the last two months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 582 thousand (SAAR) in June, up sharply over the last two months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 470 thousand (SAAR) in June; 31 percent above the record low in January and February (357 thousand).

Although I don't expect much of a pickup from here (and I expect starts in July to be slightly lower than June based on permit activity), it appears likely that housing starts have bottomed. For more on housing starts, see Housing Starts: A Little Bit of Good News  The third graph shows New Home Sales vs. recessions for the last 45 years. New one-family house sales in May 2009 were 342 thousand SAAR.

The third graph shows New Home Sales vs. recessions for the last 45 years. New one-family house sales in May 2009 were 342 thousand SAAR.

Sales were barely above the record low of 329 thousand SAAR in January. Of the three key series, this is the one that is still closest to the bottom - and the June numbers (Monday) will be interesting.

Here is what I wrote at the beginning of the year:

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.And on the dark side, CRE is still getting crushed - resulting in the seizure of many regional and local banks, house prices are still falling (that is my view) and the unemployment rate is still rising. But there is a little sunshine.

... my guess is all three of these series [housing starts, new home sales, new vehicle sales] will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

1 From Longfellow ...

The day is cold, and dark, and dreary

It rains, and the wind is never weary;

The vine still clings to the mouldering wall,

But at every gust the dead leaves fall,

And the day is dark and dreary.

My life is cold, and dark, and dreary;

It rains, and the wind is never weary;

My thoughts still cling to the mouldering Past,

But the hopes of youth fall thick in the blast,

And the days are dark and dreary.

Be still, sad heart! and cease repining;

Behind the clouds is the sun still shining;

Thy fate is the common fate of all,

Into each life some rain must fall,

Some days must be dark and dreary.

Henry Wadsworth Longfellow, 1842

Credit Card Debtors "Embracing the Darkness of Default"

by Calculated Risk on 7/26/2009 12:49:00 PM

From David Streitfeld at the NY Times on credit card debt: When Debtors Decide to Default

[T]there is a small but increasingly noticeable group of strapped consumers who ... are deciding they will simply stop paying.Streitfeld is writing about the growing wave of ruthless credit card defaults, but this also raises question about the credit card industry in general. Why aren't consumers being educated on the dangers of not paying off their credit card balance each month? Maybe that will be a good role for the new consumer financial protection agency. And why are transaction costs for retailers still so high with all the innovation and advances in technology?

... They are upset — at the unyielding banks and often at their free-spending selves — and are pre-emptively defaulting. ... “You reach a point where you embrace the darkness of default,” said Adam Levin, chairman of the financial products Web site Credit.com.

The lending industry term for these people is “ruthless defaulters.” In a miserable economy where paychecks, savings and expectations are all diminished, their numbers will surely grow.

“They’ve done the math on their account and they’re very angry,” said Corey Calabrese, a Fordham Law student who is an administrator of the school’s walk-in clinic for debtors at Manhattan Civil Court. Public sentiment is on their side, she added: “For the first time, Americans are no longer blaming the borrower but are looking at the credit card companies.”

The Bernanke ReappointmentTour

by Calculated Risk on 7/26/2009 09:21:00 AM

Fed Chairman Ben Bernanke kicks off his reappointment tour with a town hall meeting today in Kansas City, Mo. Jim Lehrer will host.

From Don Lee at the LA Times: Chairman Ben Bernanke confronts challenges to Federal Reserve's record

With his term expiring Jan. 31 and his reappointment a question mark, Bernanke makes a rare public appearance today in a nationally televised forum that has all the earmarks of a reelection campaign.Roubini says Bernanke should be reappointed: The Great Preventer

At a town hall meeting in Kansas City, Mo., the soft-spoken, longtime economics professor can be expected to defend the Fed's record, explaining why the controversial bailouts and other efforts to revive moribund credit markets were necessary. ... He will take questions from news host Jim Lehrer and an invited audience ...

"This is an extraordinary time," he told The Times. "It's important for me to hear from people outside of Washington. And I want to answer the questions that I know people have about the economy, the Fed and the Fed's actions during this crisis."

...

[Laurence Meyer, a Washington economist and former Fed governor] and many others ... say odds favor Bernanke to be reappointed by Obama. Bernanke has strong backing from economists and is well regarded in the White House ...

Ben Bernanke ... deserves to be reappointed. Both the conventional and unconventional decisions made by this scholar of the Great Depression prevented the Great Recession of 2008-2009 from turning into the Great Depression 2.0.Anna Schwartz say no: Man Without a Plan

...

[A]n endorsement of Mr. Bernanke’s reappointment comes with many caveats. Mr. Bernanke, a Fed governor in the early part of this decade, supported flawed policies when Alan Greenspan pushed the federal funds rate (the policy rate set by the Fed as its main tool of monetary policy) too low for too long and failed to monitor mortgage lending properly, thus creating the housing and credit and mortgage bubbles.

...

Still, when a liquidity and credit crunch emerged in the summer of 2007, Mr. Bernanke engineered a U-turn in Fed policy that prevented the crisis from turning into a near depression.

As Federal Reserve chairman, Ben Bernanke has committed serious sins of commission and omission — and for those many sins, he does not deserve reappointment.Mark Thoma at Economist's View agrees with Roubini: Should Bernanke Be Reappointed?

Here's how I see it. It's true that [Bernanke] failed to notice that the patient was getting sick. The signs of disease were there, but [Bernanke] either didn't see the signs or they were misdiagnosed. In fact, there's a case to be made that [Bernanke] saw some of the changes in the patient as signs of improving health. Had [Bernanke] made the correct diagnosis early enough, maybe we could have prevented the patient from getting sick ...Here is what I wrote about Bernanke last month (when he was being heavily criticized):

And once the patient showed up in the office and was clearly sick, [Bernanke] didn't get it right initially either. [Bernanke] thought the patient needed fluids - liquidity as they say - and the patient did need some of that, but [Bernanke] didn't immediately see that there were also some key nutrient deficiencies and chemical imbalances that were threatening to cause further problems.

But [Bernanke] kept at it with tests and other diagnostics, and eventually got a handle on the problem. ... The patient will get better, the deterioration was rapid and turning it around will be difficult - it won't happen fast enough to suit any of us - but what has been done prevented a complete collapse, and is helping to move the patient towards recovery.

So I'm with Nouriel, Bernanke should be reappointed.

Given all the recent attacks, I'd be remiss if I didn't write something about Bernanke ...I believe the attacks on Bernanke's personal integrity were unfair and unjustified. But I'm not sure he should be reappointed.

I've been a regular critic of Ben Bernanke. I thought he missed the housing and credit bubble when he was a member of the Fed Board of Governors from 2002 to 2005. And I frequently ridiculed his comments when he was Chairman of the President Bush's Council of Economic Advisers from June 2005 to January 2006.

... once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed's role to provide appropriate liquidity.

Professor Thoma's analogy to a doctor who kept getting it wrong - but never gave up trying new possible cures - is pretty good. Is that the kind of doctor I'd want?

I'd like a doctor who never gave up trying for a cure, but I'd prefer someone with better diagnostic skills. I don't oppose Bernanke for a second term, but I think there are better choices.

(San Francisco Fed President Janet Yellen, as an example, recognized what was happening much earlier than Bernanke).

Saturday, July 25, 2009

California Budget: Good until the next drop in Revenue

by Calculated Risk on 7/25/2009 08:25:00 PM

From the San Diego Union: Calif. officials concerned about new budget woes

"It's entirely likely we will ultimately see further declines in revenue, which will almost certainly require further budget action," said Assembly Minority Leader Sam Blakeslee, a Republican from San Luis Obispo.Of course, one of the key elements of the new California budget is to have the state use money that is normally allocated to cities. So I expect layoffs at the local level in addition to the possibility of further state revenue declines.

...

Officials will also be watching monthly revenue reports from the Department of Finance and the controller's office to look for signs of new trouble in the months ahead.

New Home Sales, Single Family Starts and Housing Market Index

by Calculated Risk on 7/25/2009 03:46:00 PM

New Home sales for June are scheduled to be released on Monday morning by the Census Bureau. The consensus forecast is for 350 thousand sales on a Seasonally Adjusted Annual Rate (SAAR) basis, up slightly from the 342 thousand SAAR in May.

Since we already have the NAHB Housing Market Index (HMI) through July and single family housing starts through June - and since both series have increased recently - I thought it might be interesting to compare all three series. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale).

Both the new home sales and single family starts series are very noisy (month-to-month variability is high), so it is hard to use starts to predict sales on a monthly basis. However this does suggest a possible increase in sales over the next few months.

When comparing the HMI to single family starts, r-squared is 0.60.

For HMI to new home sales, r-squared is 0.42.

For single family starts to new home sales, r-squared is 0.85 (pretty high).

It looks like builder optimism (as measured by the HMI) is a little more related to building than selling. (Just a joke).

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Growth Forecasts after the Great Recession

by Calculated Risk on 7/25/2009 12:49:00 PM

From David Altig at Macroblog: A look at the recovery

Earlier this week my boss, Atlanta Fed President Dennis Lockhart, weighed in with his views about the shape of the economic recovery to come while speaking at a meeting of the Nashville, Tenn., Rotary Club:Dr. Altig then compares current forecasts for the recovery with previous recoveries."The economy is stabilizing and recovery will begin in the second half. The recovery will be weak compared with historic recoveries from recession. The recovery will be weak because the economy must make structural adjustments before the healthiest possible rate of growth can be achieved."

Click on graph for larger image in new window.

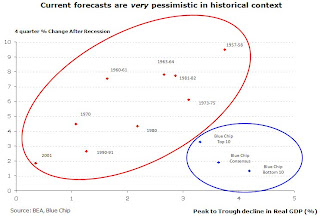

Click on graph for larger image in new window.The red dots are actual recessions, the blue dots are forecast following the current recession.

The Y-axis on this graph is the four quarter percent change in GDP following the end of a recession. The X-axis is the depth of the recession (measure in change in GDP from peak to trough).

Note that the blue dots don't line up because the forecasters have different views as to the eventual depth of the recession.

From Altig:

The chart plots the four-quarter growth rate of gross domestic product (GDP) from the trough of a recession against the depth of the corresponding contraction, as measured by the cumulative loss of GDP over the course of the downturn. The points within the red circle represent all previous postwar recessions, and they form a nice, neat, easily discernible pattern. That is, the pace of growth in the first year after a recession has, in our history, been reliably related to how bad the recession was. The deeper the recession, the faster the recovery.I think this recession (and sluggish recovery) will continue to make history, and that most of these forecasts are actually too optimistic (the bottom 10 blue chip is about my view).

The points within the blue circle are based on forecasts of GDP growth from the third quarter of this year through the third quarter of 2010, obtained from the latest issue of Blue Chip Economic Indicators (which reports survey results from "America's leading business economists"). From top left of the circle to bottom right, the points represent the 10 lowest forecasts of the most optimistic members of the 50 Blue Chip forecasting panel, the panel's consensus (or average) forecast, and the 10 highest forecasts of the most pessimistic panel participants.

I chose the third quarter as the reference point because nearly two-thirds of the Blue Chip respondents indicate that, in their view, the recession will indeed end in the third quarter of this year. Assuming this occurs, this recovery would appear to be a big outlier. Either we are about to continue making history—and not in a good way—or current guesses about the medium-term economy are way too pessimistic.

emphasis added

The Taylor Rule Debate

by Calculated Risk on 7/25/2009 09:11:00 AM

From Bloomberg: Taylor Says Fed Gets Rule Right, Goldman Doesn’t

Economists from Goldman Sachs Group Inc., Macroeconomic Advisers LLC, Deutsche Bank Securities Inc. and even the San Francisco Federal Reserve Bank argue the Taylor Rule, a pointer for finding the correct level for interest rates, suggests the Fed should be doing a lot more to stimulate the economy.And from Goldman's Hatzius (June 2nd, no link):

Taylor said his measure shows just the opposite: that Fed policy is appropriate, that central bankers are right to be considering how to withdraw their unprecedented monetary stimulus and that critics who say otherwise are misinterpreting his rule. The formula is designed to show the best rate for spurring growth without stoking inflation.

“They say they’re using the Taylor Rule, but they’re not,” Taylor, an economist at Stanford University in Stanford, California, said in an interview. “My rule does suggest a long time before we raise rates. But it also does suggest an earlier rate increase than you would think.”

[S]everal highly respected voices have weighed in on this debate, with arguments that imply a smaller need for Fed balance sheet expansion than suggested by our calculations. The first challenge came from Professor John Taylor—father of the eponymous rule—at an Atlanta Fed conference (see “Systemic Risk and the Role of Government,” May 12, 2009). Taylor argued that his rule implies a fed funds rate of +0.5%. He specifically attacked a reported Fed staff estimate of an “optimal” Taylor rate of -5% as having "... both the sign and the decimal point wrong.”Back in May, using then current data, Professor Taylor argued his rule implied a fed funds rate of plus 0.5 percent. Now Dr. Taylor argues current data suggest a rate of negative 0.955 percent.

What’s going on? The answer can be seen in a note published by Glenn Rudebusch of the San Francisco Fed [in May]; it justifies the Fed’s -5% figure and reads like a direct reaction to Taylor’s criticism, even though it does not reference his speech (see “The Fed’s Monetary Policy Response to the Current Crisis,” FRBSF Economic Letter 2009-17, May 22, 2009). The difference is fully explained by two choices. First, Taylor uses his “original” rule with an assumed (but not econometrically estimated) coefficient of 0.5 on both the output gap and the inflation gap, while the Fed uses an estimated rule with a bigger coefficient on the output gap. Second, Taylor uses current values for both gaps, while the Fed’s estimate of a -5% rate refers to a projection for the end of 2009, assuming a further rise in the output gap and a decline in core inflation.

Rudebusch uses a much larger coefficient for the output gap, and his method - with 9.5% unemployment - would suggest a -5.0% Fed Funds Rate currently. Since his method is also forward looking and assumes a higher unemployment rate later this year (very likely) Rudebusch approach suggests an even lower Fed Funds rate.

For the Fed Funds rate, with a zero bound, this debate doesn't matter right now - but it will matter in the future. But the debate does matter now for the Fed's other policies, as noted in the Bloomberg article:

Since the Fed can’t lower rates to less than zero, the Taylor rule means the central bank has to pump money into the economy through other methods, such as purchases of Treasuries, mortgage securities and agency bonds.Taylor argues the Fed doesn't need to use these other methods - at least not much - Rudebusch would argue these other methods are needed.

Note: Here is a spreadsheet for Rudebusch's Taylor rule method.

'Cash for Clunkers' Rules Released

by Calculated Risk on 7/25/2009 12:45:00 AM

From the LA Times: 'Cash for clunkers' rules are released, sparking a rush

The law creating the $1-billion program went into effect July 1, but many dealers were reluctant to participate until they got a look at the rules. The arrival of the 100-plus-page document Friday morning sparked a registration rush that overwhelmed the government's computers, resulting in waits of two hours or more, the National Automobile Dealers Assn. reported.The article mentions several rules to avoid fraud, and a requirement that the "clunker" be crushed. This should give a some boost to auto sales over the next few months.

The program is also exciting a fair amount of interest among consumers. Online auto information provider Edmunds.com said its traffic has been at record levels in recent weeks. Part of that comes from what may be the beginnings of a rebound in car sales, but the clunkers program is helping.

Friday, July 24, 2009

Video: Warren Buffett On CIT

by Calculated Risk on 7/24/2009 09:18:00 PM

It looks like seven was the winner barring a late seizure ... here are some comments from Buffett on CIT this morning: