by Calculated Risk on 7/16/2009 09:41:00 PM

Thursday, July 16, 2009

Housing: Sticky Prices

Earlier today, DataQuick reported that home sales increased in the California Bay Area. The report mentioned "a perception among potential buyers that prices have bottomed out."

First, a little history: When the housing bubble was inflating, the demand for housing surged with the widespread use of non-traditional mortgage products. Looking at a supply-demand diagram, this surge in demand pushed the curve to the right.

At the same time speculators were buying up properties, reducing the supply with the intention of selling later at a higher price. This activity shifted the supply curve to the left (this activity was classic storage).

So with the surge in demand, combined with speculators removing supply from the market, prices skyrocketed.

This is exactly what I described in April 2005: Housing: Speculation is the Key

Of course, once the bubble burst, the supply curve shifted back to the right with speculators unloading properties and all the distressed sales. At the same time, demand declined sharply as speculators disappeared and lenders tightened standards.

If housing was a perfect market, prices would have fallen rapidly to the market clearing price. However housing prices are sticky downward - as I described in 2005 post: "[R]eal estate prices display strong persistence and are sticky downward. Sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes."

This doesn't mean prices are stuck - just sticky. Prices have been falling in most areas for three years, and will probably fall further.

And this brings us back to the DataQuick article. Just because demand is picking up a little, doesn't mean prices have bottomed. Note: Ignore the median price in the article - that is rising because of the change in mix.

Assume the following diagram shows the current housing market supply and demand. With the current supply and demand curves, and a perfect market, prices would be at P0 and quantity Q0. However prices were actually at P1.

Note that demand doesn't fall to zero just because the price is above the market clearing price.

Now prices have fallen from P1 to P2. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This has increased the demand from Q1 to Q2.

I've drawn the diagram to show P2 is still above P0 (typo fixed). Naturally the current buyers think "prices have bottomed out", but they haven't for the market shown.

There are clues in the DataQuick report that prices are still too high. The volume of sales is still below normal, foreclosure resales are 37.3 percent of the resale market (a very high percentage) - and foreclosure activity "remains near record levels". And the foreclosure resale statistic don't include short sales, and the recent data from Sacramento suggest short sale activity is fairly strong.

There are other reasons to believe prices will fall further, but I just want to point out that the small pickup in demand doesn't suggest a price bottom.

Senator: FDIC's Bair says 500 Banks Could Fail

by Calculated Risk on 7/16/2009 08:56:00 PM

From Forbes: Bank Earnings: Beauty Is Skin-Deep (ht Brett)

The banking industry is bracing for continued losses from consumer loans, considering the rising unemployment rate, and an expected wave of commercial real-estate losses. At a Senate Banking Committee hearing in Washington on Thursday, Sen. Jim Bunning, R-Ky., related a comment to him by Federal Deposit Insurance Corp. Chairman Sheila Bair that another 500 banks could fail "unless something dramatic happens."Note that this is Bunning's recollection of a discussion with FDIC Chairman Sheila Bair - so this might not be exactly what Bair said.

UPDATE: FDIC spokesman, Andrew Gray, disputed Bunning’s recollection (ht we will not monetize):

“In both public and private settings, the chairman and the FDIC is always careful to not make predictions on the number of upcoming bank failures,” Gray said in an e-mail. “No estimate” was given during the meeting, which took place last week, Gray said.

“We would regret any miscommunication, but she did not say that,” Gray added.

LA Area Port Traffic in June

by Calculated Risk on 7/16/2009 06:31:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.2% below June 2008.

Outbound traffic was 19.2% below May 2008.

There had been some recovery in U.S. exports over the last few months (the year-over-year comparison was off 30% from December through February). And this showed up in the in the May trade report, but the port data suggests exports were a little weaker in June.

Market Precis and More News

by Calculated Risk on 7/16/2009 04:05:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From the Journal Sentinel: Judge denies Guaranty Bank's request to halt insurance payments

A federal judge has denied Guaranty Bank's request that it be allowed to halt payments to an insurance company despite Guaranty's contention that continuing to pay millions of dollars in premiums each month threatened the bank's survival.From the WSJ: CIT Bondholders Hash Out Their Options and Bloomberg: CIT Group’s Bondholders Said to Discuss Debt Swap

In February, Guaranty asked the court to let it stop paying premiums to Evanston Insurance Co. of Deerfield, Ill, but nonetheless keep the insurer's coverage on its home-equity loan portfolio intact. Guaranty also sought the return of $30 million in premiums paid since 2004, contending the policy was sold to the bank illegally under Wisconsin insurance law.

In a brief filed with the lawsuit, Guaranty asserted at the time: "This is a 'bet the bank' motion because the continued existence of Guaranty Bank rests on the outcome."

Mortgage insurer MGIC Investment Corp reported a wider quarterly loss and said it will stop writing new business as losses mount in the battered housing sector ...

The largest U.S. mortgage insurer said it will wind down its business and try to capitalize a fresh enterprise that would write new loans beginning next year.

Earlier Roubini report was titled: Roubini Now Says The Worst Of Economic Crisis Is Over

Nouriel Roubini, the economist whose dire forecasts earned him the nickname "Doctor Doom," is now saying that the worst of the economic and financial crisis may be over.

...

Roubini still warned that the US may need a second fiscal stimulus package of up to $250 billion by the end of the year to boost the deteriorating labor market, Reuters reported.

Report: CIT Bondholders Considering Debt for Equity Swap

by Calculated Risk on 7/16/2009 02:31:00 PM

From Bloomberg: CIT Bondholders Said to Consider Debt Swap as Bankruptcy Looms

CIT Group Inc. bondholders are holding calls today to discuss whether to swap some of their claims for equity to reduce the 101-year-old lender’s indebtedness ...Looks like PIMCO expected a bailout.

[PIMCO], CIT’s largest bondholder based on regulatory filings, plans to host a call ... [however] there may not be time to complete a debt exchange before CIT goes bankrupt.

DataQuick: California Bay Area home sales Increase

by Calculated Risk on 7/16/2009 02:10:00 PM

Note: Ignore the median price, especially during periods when the mix is changing rapidly.

From DataQuick: Bay Area home sales and median price rise

Home sales in the Bay Area jumped to their highest level in almost three years, the result of improved mortgage availability and a perception among potential buyers that prices have bottomed out. ...This is still far from a normal market with 37.3% of sales foreclosure resales. And prices will probably continue to fall for some time, especially in the higher priced areas since there are few move-up buyers.

A total of 8,644 new and resale houses and condos sold across the nine-county Bay Area in June. That was up 16.1 percent from 7,447 in May and up 20.4 percent from 7,178 in June 2008, according to San Diego-based MDA DataQuick.

Home sales have increased on a year-over-year basis the last ten months. June sales have varied from a low of 7,118 in 1993 to 15,735 in 2004 in DataQuick’s statistics, which go back to 1988. Last month was 16.1 percent below the 10,306 for an average June.

...

Financing with home loans above the old “jumbo” limit of $417,000 edged up to the highest level in almost a year. Last month 28.8 percent of all Bay Area mortgages were jumbos, the highest since 31.9 percent in August last year and well above the bottom of 17.1 percent last January. Two years ago jumbos accounted for more than 60 percent of all home purchase loans.

...

Last month 37.3 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 40.5 percent in May and the lowest since 36.0 percent in August 2008. The peak was 52.0 percent in February this year. By county, foreclosure resales ranged last month from 6.3 percent of all resales in Marin to 62.7 percent in Solano.

...

Foreclosure activity remains near record levels ...

NAHB: Builder Confidence Increases Slightly In July

by Calculated Risk on 7/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 17 in July from 15 in June. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added):

Builder confidence in the market for newly built, single-family homes notched up two points in July to its highest level since September 2008, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose two points to 17 in July as builders saw an improvement in current sales conditions but continued to express concerns about the future.

...

“Although today’s HMI is positive news that helps confirm the market is bouncing around a bottom, the gain was entirely contained in the component gauging current sales conditions, while the component gauging sales expectations for the next six months remained virtually flat for a fourth consecutive month,” noted NAHB Chief Economist David Crowe. “Builders recognize the recovery is going to be a slow one and that we are facing a number of substantial negative forces.”

More JPM Comments on Modifications and Foreclosures

by Calculated Risk on 7/16/2009 11:46:00 AM

A few more conference call comments on mods and foreclosures: (ht Brian)

“we definitely saw as all did a build up in loans that were delinquent in all of the delinquency statistics given that we suspended foreclosures during the moratoriums in the Fall and Spring of this year which are described on that side of the page. What I would say is that those will sit there longer in a delinquency bucket so our in prime and subprime you see elevated delinquency stats but we don't expect it to have meaningful accounting or Income Statement impact because as we came out of those moratoriums we originally written down those loans and made adjustments to the writedowns to take account of the longer timeliness to move them through into Real Estate owned and foreclosure, if appropriate, or modify them. So then on modifications, again, I said at the beginning we've approved 138,000 modifications for the Second Quarter here, but those don't have any meaningful impact on our Second Quarter stats, and that's because we have to see three-monthly payments under the terms of the new modification before we'll reunderwrite that loan and it comes out of delinquency and in the meantime, it just continues to roll through delinquency buckets as it otherwise would have per the contract of the term. When we do see, if we do see and we hope to see good success with these modifications perhaps next quarter and in future quarters we'll talk about just the success rate but given that these are largely speaking payment reduction modifications that are done reunderwritten with real income stats and so fourth, we are hopeful that we see some good rates of success in the trial period, but when we do modify, you just see the description at the bottom of how we take into account when we adjust our reserves at the time we modify the expected remaining losses including an assumption for redefault”Next quarter we should see the results of the modicifications.

“when you look at home equity prime and subprime, you'll see the charge-offs continue to trend higher versus prior periods and in a couple of the cases prime and subprime we up our future [loss] guidance but the second point is that across each of these portfolios, the flow into the early delinquency buckets and the dollar value of loans sitting in the early delinquency buckets has started to stabilize over the last 60-90 days across-the-board. That's a new trend versus what we've seen previously and obviously, we don't know if it's going to sustain itself but obviously if it did that would have good implications for future loss trends and could mean that we could be getting near the end of needing to add to reserves in these portfolios.”All the other data (like from the MBA) is showing rising delinquencies, especially for prime loans - so this will be something to watch too.

Philly Fed: "Region's manufacturing still experiencing weakness"

by Calculated Risk on 7/16/2009 10:00:00 AM

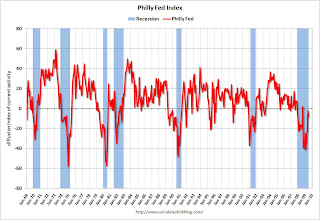

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector is still experiencing weakness ....

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from -2.2 in June to -7.5 this month. The index has been negative for 19 of the past 20 months, a span that corresponds to the current recession ...

Labor market conditions remain weak, and firms continue to report employment losses and declines in work hours. The current employment index declined to -25.3, from an already weak reading of -21.8. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 19 of the past 20 months, a span that corresponds to the current recession."

JPM's Dimon: CRE "Big deal for regional banks"

by Calculated Risk on 7/16/2009 09:16:00 AM

JPM Conference call comments on Commercial Real Estate (CRE): (ht Brian)

Analyst: Everyone is still concerned about commercial Real Estate and kind of how it's performing. You haven't really mentioned it as being a problem in the quarter highlighted it. Can you give any color as to how you're seeing general trends in the commercial Real Estate market?

Jamie Dimon: Commercial Real Estate in the United States of America is going to get worse consistently over the next several quarters. That should not be a surprise to anybody. We've got two major Real Estate exposures, we have what we call CTO which is multi-family smaller loans, it's performing fine and-- what we got from WaMu, that's the commercial bank, 30 Billion portfolio from WaMu -- it will get worse but we don't expect it to be significant, materially significant to our numbers, and we also have a more traditional Real Estate portfolio but I would say both the Bank One, JP Morgan and Chase, we've been so conservative of the last eight or nine years it's been doing nothing but in general shrinking other than the acquisition of WaMu [ it’s 12 billion] and losses are, charge-offs were for the Real Estate banking, 186 basis points and the commercial term lending was 36 and both will get worse but they aren't that big a number for us. It [commercial real estate] is a big deal for regional banks.

emphasis added