by Calculated Risk on 6/12/2009 04:00:00 PM

Friday, June 12, 2009

BFF and Market

Some stats: There have been 37 FDIC bank failures in 2009 (about 1.6 per week). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the bank failures per week through the first 23 weeks of 2009.

There have been six weeks with no failures, and two weeks with four failures.

Note: Corus Bankshares Inc. faces a June 18th deadline imposed by bank regulators to raise capital or find a buyer. I wouldn't be surprised if Corus is seized next week. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Setser: Who bought all the recently issued Treasuries?

by Calculated Risk on 6/12/2009 03:03:00 PM

From Brad Setser at Follow the Money: Just who bought all the Treasuries the issued in late 2008 and early 2009?

... the Fed’s flow of funds data leaves little doubt that — at least during the first quarter — the rise in public borrowing was fully offset by a fall in private borrowing.

Who bought all the Treasuries the US government has issued in the last four quarters of data (q2 2008 to q1 2009)? Foreign demand for Treasuries — as we have discussed extensively — hasn’t disappeared, unlike foreign demand for other kinds of US debt. But foreign demand hasn’t increased at the same pace as the Treasury’s need to place debt. The gap was filled largely by a rise in demand for Treasuries from US households.

Before the crisis, foreign purchases formerly accounted for almost all new Treasury issuance. Over the last 12 months, foreign demand accounted for more like half of total issuance even as foreigners bought a record sum of Treasuries. And from what we know about the second quarter, I don’t think the basic story has changed.And for a great series of charts comparing the current recession to prior recessions (from Paul Swartz): The Recession in Historical Context

Credit Indicators

by Calculated Risk on 6/12/2009 12:28:00 PM

Here is another look at a few credit indicators:

From Dow Jones: Key US Dollar Libor Rate Falls To Record Low

The cost of borrowing longer-term U.S. dollars in the London interbank market fell Friday, with the three-month rate reaching its lowest level since the advent of British Bankers Association Libor fixings back in 1986 as funding pressures continued to ease.

Data from the BBA showed three-month dollar Libor, seen as a key gauge of the effectiveness of the Federal Reserve's monetary policy, dropped to 0.62438% from Thursday's 0.62938%.

The three-month rate peaked at 4.81875% on Oct. 10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There has been improvement in the A2P2 spread. This has declined to 0.55. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread is now down to the normal range of 46.21. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

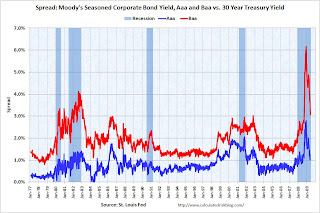

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply, but the spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined steadily.

University of Michigan Consumer Sentiment

by Calculated Risk on 6/12/2009 10:10:00 AM

From MarketWatch: Consumer sentiment rises to 69 in June

U.S. consumer sentiment rose in June, but remained at relatively low levels, according to media reports of a survey released Friday by the University of Michigan and Reuters. The consumer sentiment index rose to 69 in mid-June from 68.7 in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

But it does give me an excuse for a graph ...

Right now consumer sentiment is still very weak.

UK: One in Ten Homeowners with Negative Equity

by Calculated Risk on 6/12/2009 08:49:00 AM

From The Times: One in ten homeowners fall into negative equity

One in ten homeowners fell into negative equity during the first three months of the year, the highest proportion for 15 years, the Bank of England said today.The UK has about 10 million homeowners with mortgages; the U.S. has about 51.6 million.

The Bank estimated that between 7 and 11 per cent of homeowners with a mortgage owed more to their lender than their property was worth, the equivalent of 700,000 to 1.1 million householders.

...

Around 200,000 buy-to-let investors were also estimated to owe more on their mortgage than their property was worth ...

The research said that the overall number of those in negative equity during the first quarter of 2009 was comparable with those who suffered the problem in the mid-1990s, during the last housing market correction.

The Bank said house prices had fallen by around 20 per cent between the autumn of 2007 and the spring of 2009, the largest nominal fall in property values on record. In contrast, it took six years for house prices to fall by 15 per cent between 1989 and 1995.

Moody's has estimated there 14.8 million homeowners with negative equity in the U.S. (just under 30% of homeowners with mortgages) so the problem seems more severe in the U.S.

NY Times: U.S. Better Off than Europe

by Calculated Risk on 6/12/2009 12:34:00 AM

Update: This is ugly from the Irish Times: Annual deflation rate hits 4.7% (ht Brian)

Prices fell 4.7 per cent in the year to May, the steepest rate since 1933, according to new data from the Central Statistics Office (CSO).From Nelson Schwartz at the NY Times: U.S. Recovery Could Outstrip Europe’s Pace

The Consumer Price Index (CPI) fell 4.7 per cent on an annual basis and by 0.5 per cent in the month. This compares to an increase of 0.8 per cent recorded in May 2008.

Some private economists are even predicting that the American economy will resume growth in the fourth quarter, while Europe’s economy is expected to remain in recession well into 2010, after contracting an estimated 4.2 percent this year compared with an expected 2.8 percent decline in the United States.Not much to say - misery loves company.

“The shock originated in the U.S., but Europe is paying a higher price,” said Jean Pisani-Ferry, a former top financial adviser to the French government who is now director of Bruegel, a research center in Brussels.

...

“I think America is further ahead in terms of fixing problems with the banks,” said Mr. Pisani-Ferry, “and countries like Germany have been hurt tremendously by the decline in world trade.”

Figures released this week showed that German exports plunged 28.7 percent in April from a year earlier, the steepest drop since the government began keeping records in 1950.

...

Underscoring the risk that hopes for a quick turnaround anywhere may be premature, the World Bank said Thursday that it expected the global economy to shrink by nearly 3 percent in 2009, far deeper than the 1.7 percent contraction it predicted just over two months ago.

And both Europe and the United States face the specter of rapidly rising unemployment, even if a rebound is beginning.

Thursday, June 11, 2009

Hamilton on CDS Trade: "A fool and his money ..."

by Calculated Risk on 6/11/2009 08:20:00 PM

I was going to post something on this CDS trade, but Professor Hamilton did a much better job than I could: How to lose on a sure-fire bet

Read Hamilton's take ...

Here are the details of the trade from the WSJ: A Daring Trade Has Wall Street Seething

The trade involved credit-default swaps and securities backed by subprime mortgages. The original securities ... were backed by $335 million of subprime mortgages mostly on homes in California made at the housing bubble's peak in 2005 ...

Following a wave of refinancing and defaults, only $29 million of the loans were left outstanding by March 2009, half of which were delinquent or in default...

Believing the securities would become worthless, traders at J.P. Morgan bought credit-default swaps over the past year from Amherst ... Other banks including RBS Securities ... and BofA also bought swaps on the securities from different trading partners.

The banks ... paid as much as 80 to 90 cents for every dollar of insurance, the going rate last fall according to dealer quotes, expecting to receive a dollar back when the securities became worthless ...

At one point, at least $130 million of bets had been made on the performance of around $27 million in securities ...

In late April, traders at some banks were shocked to find out from monthly remittance reports that the bonds they had bet against had been paid off in full. Normally an investor can't pay off loans like that but if the amount of outstanding loans falls to less than 10% of the original pool, the servicer ... can buy them and make bondholders whole.

That's what happened in this case. In April, a servicer called Aurora Loan Services at the behest of Amherst purchased the remaining loans and paid off the bonds.

Households with Mortgages: Approximately 20 Percent Equity

by Calculated Risk on 6/11/2009 05:11:00 PM

One of the headlines from the Fed's Flow of Funds report this morning was that household percent equity had fallen to a record low 41.4%.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows homeowner percent equity since 1952.

This is a simple calculation: divide home mortgages ($10,464 billion) by household real estate assets ($17,870 billion) gives us the percent mortgage debt (58.6%). Subtract from one gives us the percent homeowner equity (41.4%).

But what does this tell us?

What we really want to know is the percent equity for homeowners with mortgages. According to the Census Bureau, 31.6% of all U.S. owner occupied homes had no mortgage in 2007 (most recent data). These homeowners tend to be older, or more risk adverse, and few of them will probably borrow from their home equity.

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68.4%. But we can construct a model based on data from the 2007 American Community Survey.

Note: See data at bottom of this post. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2007.

By using the mid-points of each range, and solving for the price of the highest range to match the then Fed's estimate of household real estate assets at the end of 2007: $20.5 Trillion, we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2007, with mortgages was $15.1 Trillion or 73.6% of the total. The value of houses without mortgages was $5.4 Trillion or 26.4% of the total U.S. household real estate.

Assuming 73.6% of current total assets is for households with mortgages (so $13.2 trillion of $17.87 trillion total), and since all of the mortgage debt ($10.464 trillion) is from the households with mortgages, these homes have an average of 20.4% equity. It's important to remember this includes some homes with 90% equity, and millions of homes with zero or negative equity.

Data from 2007 American Community Survey:

United States | ||

Estimate | Margin of Error | |

|---|---|---|

Total: | 75,515,104 | +/-227,236 |

With a mortgage: | 51,615,003 | +/-152,731 |

Less than $50,000 | 2,037,849 | +/-21,748 |

$50,000 to $99,999 | 6,443,236 | +/-45,023 |

$100,000 to $149,999 | 8,023,775 | +/-48,465 |

$150,000 to $199,999 | 7,318,809 | +/-43,489 |

$200,000 to $299,999 | 9,538,216 | +/-46,625 |

$300,000 to $499,999 | 10,196,919 | +/-44,000 |

$500,000 or more | 8,056,199 | +/-35,865 |

Not mortgaged: | 23,900,101 | +/-91,776 |

Less than $50,000 | 3,577,700 | +/-30,890 |

$50,000 to $99,999 | 4,665,031 | +/-35,455 |

$100,000 to $149,999 | 3,765,972 | +/-28,355 |

$150,000 to $199,999 | 2,968,680 | +/-24,691 |

$200,000 to $299,999 | 3,227,661 | +/-23,430 |

$300,000 to $499,999 | 3,080,889 | +/-21,963 |

$500,000 or more | 2,614,168 | +/-17,619 |

Hotel RevPAR off 22.9 Percent

by Calculated Risk on 6/11/2009 03:40:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 6 June 2009

In year-over-year measurements, the industry’s occupancy fell 13.9 percent to end the week at 56.6 percent. Average daily rate dropped 10.5 percent to finish the week at US$95.90. Revenue per available room [RevPAR] for the week decreased 22.9 percent to finish at US$54.24.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.8% from the same period in 2008.

The average daily rate is down 10.5%, so RevPAR is off 22.9% from the same week last year.

CRE "Partial Interest Only Loans" Coming Due

by Calculated Risk on 6/11/2009 03:01:00 PM

From Bloomberg: Bondholders Face Losses From Commercial Mortgages(th Ron)

Investors in bonds that packaged $62 billion of debt for U.S. offices, hotels and shopping malls are bracing for more loan defaults through 2010 as Bank of America Merrill Lynch says landlords’ monthly payments may jump 20 percent or more.Hey, Option ARMs for commercial real estate ... hoocoodanode prices would fall?

Principal is coming due on the so-called partial interest only loans ... About $179 billion of such loans were written between 2005 and 2007 and bundled into bonds ... About 87 percent of mortgages sold as securities in 2007 allowed owners to put off paying principal for several years or until maturity, compared with 48 percent in 2004