by Calculated Risk on 5/25/2009 12:29:00 AM

Monday, May 25, 2009

Late Night Cranes

The U.S. Markets are closed Monday for Memorial Day (enjoy with your friends and family!). This will be a busy week for housing data: Case-Shiller house prices on Tuesday, existing home sales on Wednesday, and new home sales on Thursday. Should be interesting ...

The Asian markets are mixed tonight.

This video fits with an earlier post: Lost Vegas. This video is from about a year and a half ago ... but the Vegas skyline looked similar a few months ago when I was driving through Nevada ... maybe not Dubai (or Beijing) but still crazy!

Sunday, May 24, 2009

NY Times: We're All Subprime Now!

by Calculated Risk on 5/24/2009 09:24:00 PM

From Peter Goodman and Jack Healy at the NY Times: Job Losses Push Safer Mortgages to Foreclosure (ht shaun)

In the latest phase of the nation’s real estate disaster, the locus of trouble has shifted from subprime loans ... to the far more numerous prime loans issued to those with decent financial histories.

...

From November to February, the number of prime mortgages that were delinquent at least 90 days, were in foreclosure or had deteriorated to the point that the lender took possession of the home increased more than 473,000, exceeding 1.5 million, according to a New York Times analysis of data provided by First American CoreLogic, a real estate research group. Those loans totaled more than $224 billion.

During the same period, subprime mortgages in those three categories increased by fewer than 14,000, reaching 1.65 million. The number of similarly troubled Alt-A loans — those given to people with slightly tainted credit — rose 159,000, to 836,000.

Over all, more than four million loans worth $717 billion were in the three distressed categories in February, a jump of more than 60 percent in dollar terms compared with a year earlier.

Geithner Blames Borrowers and more, but not Regulators for Bubble

by Calculated Risk on 5/24/2009 05:38:00 PM

A WaPo interview with Secretary Geithner ...

WaPo's Lois Romano: "You mentioned that Americans borrowed beyond their means. When you look at the collapse of the housing market, who do you think bears the greatest responsibility? Is it the banks for pushing these loans? Is it the consumer for borrowing over their means? The regulators? Where do you see the fault lines there?"

Geithner: "For something this big and damaging to happen it takes a lot of mistakes over time. And it is that combination of things. Interest rate here and around the world were kept too low for too long. Investors made - took a bunch of risks without understanding the risks. They were betting on the expectation that house prices would continue to go up - to go up forever. Rating agencies failed to rate these products adequately. Supervisors failed to underwrite loans with sufficiently conservative standards. So those basic checks and balances failed. And people borrowed too much. It took all those things for it to happen."

CR Note: (short transcript by CR). Although there were many factors in the housing and credit bubble, the two keys were: 1) rapid innovation in the mortgage industry (securitization, automated underwriting, rapidly expanded wholesale lending, etc), and 2) a complete lack of oversight by regulators. As the late William Seidman wrote in his memoir (published in 1993): "Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid."

Geithner failed to mention the rapid changes in lending and the failure of government oversight as the two critical causes of the bubble. Either Geithner misspoke or he still doesn't understand what happened - and that is deeply troubling.

VIDEO Here (embedding was causing problems)

Lost Vegas

by Calculated Risk on 5/24/2009 01:13:00 PM

"These are times completely different than anything I have experienced in my lifetime. I didn't see this coming, and when it hit it hit virtually overnight."According to the Las Vegas Convention and Visitors Authority, vistor volume is off 6.5% from last year, room rates are off 31.6%, and convention attendance is off 30%.

Mayor Oscar Goodman told CNN, from John King: Luck running low in Las Vegas

This puts RevPAR (Revenue per available room) off 36%!

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows visitor volume and convention attendance since 1970. Vistors are back to 1998 levels, however the number of rooms has increased 28.5% since then - from 109,365 rooms in 1998 to 140,529 in 2008. Ouch.

Note: 2009 is estimated based on data through March.

In addition to building too many hotel rooms, there is an oversupply of office and retail space too. From Voit Real Estate Services on Offices:

The Las Vegas office market continued to report increased vacancies, weaker demand and reduced pricing through the first quarter of 2009. An imbalance in the commercial office sector has clearly emerged as selected portions of the market reported vacancies well beyond historical high points.And Voit on retail:

...

During the quarter, new supply entered the market as existing product reported a net loss in occupancies. The valley-wide average vacancy rate reached 19.6 percent, which represented a 2.0-point increase from the preceding quarter (Q4 2008). Compared to the prior year (Q1 2008), vacancies were up 4.9 points from 14.7 percent. As a point of reference, average vacancies bottomed out in the third quarter of 2005 at 8.1 percent.

emphasis added

By the close of the first quarter of 2009, the Las Vegas retail market continued to be impacted by a softening economic climate, reduced consumer spending and a number of corporate restructurings for retailers. Overall vacancies climbed to 9.3 percent, which represented a 1.9-point rise from the preceding quarter. Compared to the same quarter of the prior year, vacancies were up 3.7 points from 5.6 percent.And, of course, Las Vegas had a huge housing bubble too:

Market expansions continued to despite the downturn as a number of retail centers were well under construction by late-2008. Approximately 812,900 square feet completed construction, bringing total market inventory to 51.3 million square feet. As of March 31, 2009, a total of 2.5 million square feet was in some form of construction. It is worth noting a couple of major retail projects have stalled construction (1.7 million square feet) ...

The market reported negative demand for the second consecutive quarter with 221,000 square feet of negative net absorption.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.Prices almost doubled from January 2003 to the peak in early 2006 - and now are off almost 50% from the peak!

And don't forget the condos ...

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.And ManhattanWest isn't the only halted project in Las Vegas (From the Las Vegas Review-Journalin March: ManhattanWest latest casualty of crisis):

Last year, Mira Villa condos and Vantage Lofts stopped construction and went into bankruptcy. Sullivan Square had barely begun excavation before the project was canceled. Spanish View Towers was the first high-rise project to stop construction after partially building an underground parking garage.

House Price Round Trip

by Calculated Risk on 5/24/2009 10:43:00 AM

This is another "Deal of the Week" from Zach Fox at the North County Times (San Diego): New construction, same discount.

August 2000: $310,000 (new)

January 2006: $620,000

March 2009: $339,000

Zach describes the house: 'four bedrooms, two-and-a-half baths, 2,231 square feet and a lot some might compare to a postage stamp.'

Saturday, May 23, 2009

Fed Vice Chairman Kohn on Economy

by Calculated Risk on 5/23/2009 07:30:00 PM

From Federal Reserve Vice Chairman Donald Kohn: Interactions between Monetary and Fiscal Policy in the Current Situation

A few excerpts:

[I]n the current weak economic environment, a fiscal expansion may be much more effective in providing a sustained boost to economic activity. With traditional monetary policy currently constrained from further reductions in the target policy rate, and with many analysts forecasting lower-than-desired inflation and a persistent, large output gap, agents may anticipate that the target federal funds rate will remain near zero for an extended period. In this situation, fiscal stimulus could lead to a considerably smaller increase in long-term interest rates and the foreign exchange value of the dollar, and to smaller decreases in asset prices, than under more normal circumstances. Indeed, if market participants anticipate the expansionary fiscal policy to be relatively temporary, and the period of weak economic activity and constrained traditional monetary policy to be relatively extended, they may not expect any increase in short-term interest rates for quite some time, thus damping any rise in long-term interest rates.And on the transition back to normal monetary policy:

emphasis added

An important issue with our nontraditional policies is the transition back to a more normal stance and operations of monetary policy as financial conditions improve and economic activity picks up enough to increase resource utilization. These actions will be critical to ensuring price stability as the real economy returns to normal. The decision about the timing of a turnaround in policy will be similar to that faced by the Federal Open Market Committee (FOMC) in every cyclical downturn--it has to choose when, and how quickly, to start raising the federal funds rate. In the current circumstances, the difference will be that we will have to start this process with an unusually large and more extended balance sheet.Kohn argues:

In my view, the economy is only now beginning to show signs that it might be stabilizing, and the upturn, when it begins, is likely to be gradual amid the balance sheet repair of financial intermediaries and households. As a consequence, it probably will be some time before the FOMC will need to begin to raise its target for the federal funds rate. Nonetheless, to ensure confidence in our ability to sustain price stability, we need to have a framework for managing our balance sheet when it is time to move to contain inflation pressures.

Our expanded liquidity facilities have been explicitly designed to wind down as conditions in financial markets return to normal, because the costs of using these facilities are set higher than would typically prevail in private markets during more usual times.

The Phoenix Housing Boom

by Calculated Risk on 5/23/2009 05:38:00 PM

A couple of articles on Phoenix...

From David Streitfeld at the NY Times: Amid Housing Bust, Phoenix Begins a New Frenzy

With this sweltering desert city enduring one of the largest tumbles in housing prices for any urban area since the Depression, there is an unrelenting stream of foreclosures to choose from. On some days, hundreds are offered for sale at the auctions that take place on the plaza in front of the county courthouse.And from Nicholas Riccardi at the LA Times: Phoenix's housing bust goes boom

There is also a large supply of foreclosed families who can no longer qualify for a loan. And that is prompting a flood of investors like Mr. Jarvis, who wants to turn as many of these people as possible into rent-paying tenants in the houses they used to own.

...

The low end of the real estate market here — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.

One real estate agent was showing a foreclosed house to a prospective client when a passer-by saw the open door, came in and snapped up the property. Another agent says she was having the lock changed on a bank-owned home when a man happened by, found out from the locksmith that it was available, and immediately bought it. Bidding wars are routine.

After four years of renting because they were priced out of the real estate market, Jamia Jenkins and Scott Renshaw concluded the time had arrived for them to buy.It is important to note that this activity is at the low end, and many of these buyers are cash flow investors (assuming they can find renters).

They saw that home prices had dropped so fast here -- faster than in any other big city in the nation -- that mortgage payments would be less than the $900 they paid in rent. The city is littered with foreclosed houses, so the couple figured they could easily snatch up something in the low $100,000s.

Three months later, they're still looking.

They have submitted 13 offers and been overbid each time.

"It's just pathetic," said Jenkins, 53. "Investors are going out there and outbidding everyone."

“If Phoenix loses population,” Mr. Jarvis says, “then buying houses here is a bad bet.”But this is just at the low end. Since most of the activity is distressed sales - foreclosures and short sales - there are no move up buyers. As Mike Orr, a Phoenix real estate analyst notes in the LA Times:

Orr thinks mid- and high-priced properties still will lose value in the coming months.And Streitfeld concludes:

"I wouldn't be investing in luxury right now," he said.

As Mr. Jarvis scouts for houses, he sometimes finds a familiar one. In February, he saw a home that one of his brothers bought from a builder in 2005, camping out overnight for the opportunity. With its value now shrunk, the brother was letting it go to foreclosure.At the low end there is demand from first time buyers, renters and cash flow investors. The supply is coming from foreclosures and short sales - and when that activity eventually slows, the supply will probably come from these investors!

Mr. Jarvis’s daughter Jade also bought a house at the market’s peak — in her case to live in. The other day she asked for advice: should she keep paying the mortgage on something that had declined in value by 60 percent? His conclusion: “probably not.”

“Am I teaching my kids right by letting them walk away from something they made a commitment to?” Mr. Jarvis wonders.

But without move up buyers, where will the mid-to-high priced buyers come from? That is an important question.

For more, see House Price Puzzle: Mid-to-High End

Agricultural Land Prices Decline Sharply in Q1

by Calculated Risk on 5/23/2009 01:08:00 PM

From the Chicago Fed: Farmland Values and Credit Conditions

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.

Click on graph for larger image in new window.

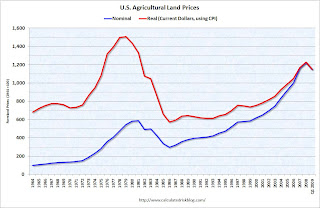

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

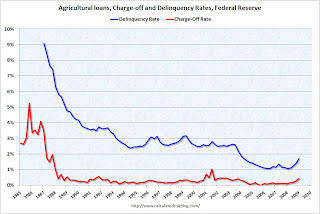

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.The charge-off data goes back to 1985, the delinquency data back to 1987.

Many farmers borrowed against the increase in land values in the '70s, and then couldn't make the payments after land prices collapsed in the early '80s; leading to higher agricultural loan defaults.

So far prices have only fallen for one quarter, but the delinquency and charge-offs rates are already starting to increase.

Looking at the collapse in farm prices in the early '80s, it is not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985.

Shiller: Possible Double Dip Recession in U.K.

by Calculated Risk on 5/23/2009 09:12:00 AM

From The Times: Professor Robert Shiller warns Britain may suffer a double recession

One of the world's most influential economists warns today that Britain faces the prospect of two recessions in quick succession.Shiller is talking about the British economy, but the U.S. economy has many of the same problems.

Robert Shiller, Professor of Economics at Yale University, said that the recent stock market bounce should be treated with caution.

...

The apparent upturn could soon go into reverse, he told The Times, marking a repeat of economic patterns in the 1930s and the 1980s. Such a double-dip slowdown has been nicknamed by economists a “W-shaped” recession, where recovery is so fragile, the country could be plunged into another slowdown as soon as it emerged from the last.

...

Last week Alistair Darling, the Chancellor, brushed aside doubts that his Budget forecasts had been overoptimistic and predicted that the recession would be over by Christmas. Many economists in the City believe that Britain will stagnate until the end of 2010 and that unemployment will continue to rise well after that.

... he warned that “there is a real possiblity of another recession. We may well see more bad news. It is a real failure of the imagination to think otherwise.”

He said that there were a number of issues that threatened any long-term recovery for the British economy - rising unemployment, mortgage defaults, and another wave of new company failures that “could surprise us yet”.

Professor Shiller also said that the banks were still harbouring large portfolios of troubled assets.

...

He added: “In 1931 in the US, President Hoover unveiled his recovery plan - there was a huge stock market rally — the market improved but it didn't hold because bad news kept coming in. Increased confidence can be a self-fulfilling prophecy but it doesn't always hold.”

Professor Shiller said, however, that he believed another likely scenario to be one where Britain would face a continuous decline with house prices falling for a number of years, drawing comparisons with the decade of misery in Japan in the 1990s.