by Calculated Risk on 5/23/2009 01:08:00 PM

Saturday, May 23, 2009

Agricultural Land Prices Decline Sharply in Q1

From the Chicago Fed: Farmland Values and Credit Conditions

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.

Click on graph for larger image in new window.

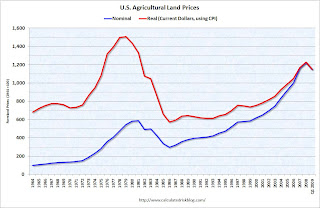

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

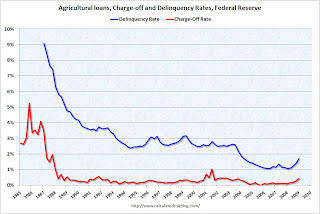

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.The charge-off data goes back to 1985, the delinquency data back to 1987.

Many farmers borrowed against the increase in land values in the '70s, and then couldn't make the payments after land prices collapsed in the early '80s; leading to higher agricultural loan defaults.

So far prices have only fallen for one quarter, but the delinquency and charge-offs rates are already starting to increase.

Looking at the collapse in farm prices in the early '80s, it is not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985.