by Calculated Risk on 4/23/2009 08:49:00 AM

Thursday, April 23, 2009

Unemployment Claims: Continued Claims at Record

The DOL reports on weekly unemployment insurance claims:

In the week ending April 18, the advance figure for seasonally adjusted initial claims was 640,000, an increase of 27,000 from the previous week's revised figure of 613,000. The 4-week moving average was 646,750, a decrease of 4,250 from the previous week's unrevised average of 651,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 11 was 6,137,000, an increase of 93,000 from the preceding week's revised level of 6,044,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 646,750.

Continued claims are now at 6.14 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Wednesday, April 22, 2009

Chysler Pier Loan Negotiations

by Calculated Risk on 4/22/2009 11:16:00 PM

I'm surprised this is playing out in public ...

First the government offered $1.0 billion, and no equity interest in the new Chrysler, to a consortium of debtholders (mostly banks with pier loans: JPMorgan Chase, Goldman Sachs, Morgan Stanley and Citigroup).

The banks countered with $4.5 billion, and a 40% equity interest.

From CNBC: Treasury Raises Offer to Chrysler Lenders

Treasury has offered the lenders $1.5 billion of first-lien debt and a 5 percent equity stake in a restructured Chrysler ...It will be interesting to see if the banks budge (and by how much). They claim they can get more than 65 cents on the dollar in liquidation - or $4.5 billion. Just 7 more days ...

Stress Test: Capital Needs May be Disclosed

by Calculated Risk on 4/22/2009 06:53:00 PM

From Bloomberg: U.S. May Reveal Each Bank’s Capital Needs After Tests

The Obama administration may direct banks that are judged to be short of capital after stress tests to disclose how they are going to get additional funds when the government reveals the results on May 4, according to a person familiar with the matter.It only makes sense for banks short of capital to explain how they will raise the additional funds. The answer will probably be more money from the TARP!

The government would release a bank-by-bank assessment, while the lenders would say how they plan to shore up their finances ...

Regulators conducting the stress tests are increasingly focusing on the quality of loans banks made after finding wide variations in underwriting standards...

On the variations in quality of loans, just look at the DataQuick delinquency report earlier today - even when you account for subprime vs. prime lenders, there was a clearly a wide disparity in underwriting standards. Hopefully this wasn't a surprise to the regulators.

Housing Bust and Geographical Mobility

by Calculated Risk on 4/22/2009 05:55:00 PM

From the Census Bureau: Residential Mover Rate in U.S. is Lowest Since Census Bureau Began Tracking in 1948

The U.S. Census Bureau announced today that the national mover rate declined from 13.2 percent in 2007 to 11.9 percent in 2008 — the lowest rate since the bureau began tracking these data in 1948.

In 2008, 35.2 million people 1 year and older changed residences in the U.S. within the past year, representing a decrease from 38.7 million in 2007 and the smallest number of residents to move since 1962.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of people that moved to a different county - in the same states or to another state.

Note: data is missing for a few years in the mid-70s.

The recent collapse is probably related to the housing bust. It is very difficult for homeowners with negative equity to move.

From the NY Times today: As Housing Market Dips, More in U.S. Are Staying Put

The declines appeared to be directly related to the housing slump and the recession.For a few earlier posts on the housing bust and mobility:

“It represents a perfect storm halting migration at all levels, since it involves deterrents in local housing-related moves and longer distance employment-related moves,” said William H. Frey, a demographer with the Brookings Institution.

More on the Housing Bust and Labor Mobility June 2008

Research: Housing Busts and Household Mobility October 2008

Northern Trust's Kasriel: Are we there yet?

by Calculated Risk on 4/22/2009 03:56:00 PM

From Paul Kasriel and Asha Bangalore at Northern Trust: Are We There Yet?

Is the economic recovery at hand? No, we still are mired in a recession that is going to be of the longest duration in the post-WWII era (the previous record was 16 months) and is likely to involve the largest annual average contraction in real GDP for a single year (the record to beat is a decline of 1.9%, which occurred in 1982). But there is a good chance that the worst for the U.S. economy in terms of quarterly contractions in real GDP is behind us, occurring in the fourth quarter of 2008. We currently are forecasting an annualized rate of contraction in real GDP of 3.8% in the first quarter of this year vs. the annualized rate of contraction of 6.3% in the fourth quarter of 2008. So, economic activity still is descending, but our forecast has the rate of descent moderating. We do not expect any growth in real GDP until the fourth quarter of this year.See the research note for much more.

I'm surprised Kasriel has revised up his Q1 GDP forecast all the way to minus 3.8% (from -4.9%). It appears PCE will probably be flat or even slightly positive in Q1, the investment slump in Q1 will be stunning (See Q1 GDP will be Ugly). Also, it appears the inventory correction in Q1 was significant, however trade might be a little more positive than I expected earlier.

Note: Kasriel has revised down his GDP estimate for Q2 (now -3.3% and -1.0% respectively).

DataQuick: Mortgage Defaults Hit Record in California

by Calculated Risk on 4/22/2009 01:38:00 PM

From DataQuick: Golden State Mortgage Defaults Jump to Record High

Lenders filed a record number of mortgage default notices against California homeowners during the first three months of this year, the result of the recession and of lenders playing catch-up after a temporary lull in foreclosure activity ...There is a lot of interesting data in this report. A few key points:

A total of 135,431 default notices were sent out during the January- to-March period. That was up 80.0 percent from 75,230 for the prior quarter and up 19.0 percent from 113,809 in first quarter 2008, according to MDA DataQuick.

Last quarter's total was an all-time high for any quarter in DataQuick's statistics, which for defaults go back to 1992. There were 121,673 default notices filed in second quarter 2008 and 94,240 in third quarter 2008, during which a new state law took effect requiring lenders to take added steps aimed at keeping troubled borrowers in their homes.

"The nastiest batch of California home loans appears to have been made in mid to late 2006 and the foreclosure process is working its way through those. Back then different risk factors were getting piled on top of each other. Adjustable-rate mortgages can be good loans. So can low- down-payment loans, interest-only loans, stated-income loans, etcetera. But if you combine these elements into one loan, it's toxic," said John Walsh, DataQuick president.

The median origination month for last quarter's defaulted loans was July 2006. That's only four months later than the median origination month for defaulted loans a year ago, in first quarter 2008. That suggests a period where underwriting criteria were particularly lax.

Of the 3.7 million home loans made in 2004, less than 1 percent have since resulted in a lender filing a default notice. Of the 3.7 million loans originated in 2005, 4.9 percent have triggered a default notice so far. Of the 3 million in 2006, 8.5 percent have so far resulted in default. A particularly toxic period appears to have been August through November 2006 which had more than a 9 percent default rate. Of the 2.1 million loans made in 2007, it's 4.6 percent - a percentage that's likely to rise significantly during the rest of this year.

The lending institutions with the highest default rates for loans originated in August to November 2006 include ResMAE Mortgage (69.9 percent of loans resulting in a default notice), Master Financial (64.6 percent) and Ownit Mortgage Solutions (63.6 percent). Of the major lenders, IndyMac has a default rate on those loans of 18.9 percent, World Savings 8.0 percent, Countrywide 7.7 percent, Washington Mutual 6.3 percent and Wells Fargo 3.4 percent. Less than 1 percent of the home loans originated in late 2006 by Citibank and Bank of America have since gone into default.

...

While most first quarter 2009 foreclosure activity was still concentrated in affordable inland communities, there are signs that the problem is slowly migrating into other areas. The affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for more than 52.0 percent of all default activity in 2008. Last quarter it fell to 47.5 percent.

emphasis added

Click on graph for larger image in new window.

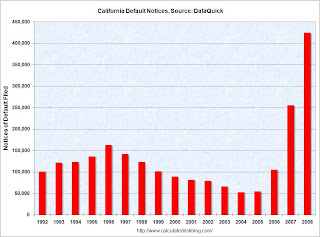

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 2008 in California from DataQuick.

With 135,431 default notices filed in Q1 2009 (even with the lenders playing catch-up), 2009 is clearly on pace to break the 2008 record of 424 thousand NODs.

IMF: Global Synchronized Cliff Diving

by Calculated Risk on 4/22/2009 12:37:00 PM

From the IMF report: Global Prospects and Policies

The global economy is in a severe recession inflicted by a massive financial crisis and an acute loss of confidence. Wide-ranging and often unorthodox policy responses have made some progress in stabilizing financial markets but have not yet restored confidence nor arrested negative feedback between weakening activity and intense financial strains. While the rate of contraction is expected to moderate from the second quarter onward, global activity is projected to decline by 1.3 percent in 2009 as a whole before rising modestly during the course of 2010.

These graphs from the IMF report show the synchronized global cliff diving.

These graphs from the IMF report show the synchronized global cliff diving.Click on graph for larger image in new window.

On page 11 is a note about Global Business Cycles:

In 2009, almost all the advanced economies are expected to be in recession. The degree of synchronicity of the current recession is the highest to date over the past 50 years. Although itOn page 10 are the IMF economic forecasts. For the U.S., the IMF is forecasting -2.8% real change for GDP in 2009, and 0.0% (no change) in 2010.

is clearly driven by declines in activity in the advanced economies, recessions in

a number of emerging and developing economies are contributing to its depth and synchronicity.

To summarize, the 2009 forecasts of economic activity, if realized, would qualify this year as the most severe global recession during the postwar period. Most indicators are expected to register sharper declines than in previous episodes of global recession. In addition to its severity, this global recession also qualifies as the most synchronized, as virtually all the advanced economies and many emerging and developing economies are in recession.

emphasis added

That is basically the same as the "more adverse" stress test scenario:

DOT: U.S. Vehicle Miles Off 0.9% in February

by Calculated Risk on 4/22/2009 10:24:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

[T]ravel during February 2009 on all roads and streets in the nation changed by -0.9 percent (-1.9 billion vehicle miles) resulting in estimated travel for the month at 215.8 billion vehicle-miles.Update: added the leap year adjustment.

...

NOTE: The Average Daily Travel changed by +2.7% for February 2009 as compared to February 2008

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. This comparison has been improving. As the DOT noted, miles driven in February 2009 were 0.9% less than in February 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. So the March 2009 report, to be released next month, will be very interesting.

Architecture Billings Index Increases in March

by Calculated Risk on 4/22/2009 09:08:00 AM

From Reuters: Architecture billings index jumps in March: AIA

Update: From AIA: Architecture Billings Index Shows Early Signs of Improving Business Conditions

After a series of historic lows, the Architecture Billings Index (ABI) was up more than eight points in March. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI rating was 43.7, up from the 35.3 mark in February. This was the first time since September 2008 that the index was above 40, but the score still indicates an overall decline in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry score was 56.6.

“This news should be viewed with cautious optimism,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “The fact that inquiries for new projects increased is encouraging, but it will likely be a few months before we see an improvement in overall billings. Architects continue to report a diversity of business conditions, but the majority is still seeing weak activity levels.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). So there will probably be further dramatic declines in CRE investment later this year.

PIMCO's El-Erian on Stress Tests

by Calculated Risk on 4/22/2009 08:41:00 AM

Form the Financial Times: Bank tests we should get stressed about (ht MrM)

[T]he tests suggested a concrete way to differentiate between the solid institutions that can raise private capital, and those that will (and must) feel a heavy government hand.There is more, but I think these are the two key points: Transparency is key. And the results should be announced as part of a comprehensive plan.

...

First, transparency is key. Whether the government likes it or not, hundreds of analysts around the world will reverse engineer the stress tests. The government would be well advised to assist the process through clarity ...

Second, the results of the stress tests must be part of a comprehensive, forward-looking package to resolve problems at banks. Out-performing banks should be provided with exit mechanisms from the exceptional government support that they have been receiving and, presumably, no longer need. At the other end, there must be clarity as to how capital-deficient banks that no longer have access to private capital will be handled.