by Calculated Risk on 3/06/2009 03:06:00 PM

Friday, March 06, 2009

Consumer Credit

Consumer credit tends to lag the economy, so I don't follow it very closely.

The Fed reported on Consumer Credit for January:

Consumer credit increased at an annual rate of 3/4 percent in January 2009. Revolving credit increased at an annual rate of 1-1/4 percent, and nonrevolving credit increased at an annual rate of 1/2 percent.The small increase in January followed three months of sharp declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 3-month change (to remove noise) in consumer credit on an annual basis.

This suggests that consumer credit tends to lag the economy.

The current decline in consumer credit isn't as sharp as in the mid'70s and early '80s, probably because in recent years consumers relied more on their homes for borrowing (with HELOCs and cash out mortgage refi's), instead of their credit cards or other consumer credit. Of course there is still time for further declines.

Fed's Hoenig: 'Too Big has Failed'

by Calculated Risk on 3/06/2009 01:06:00 PM

This seems like a break in the ranks ...

From Kansas City Fed President Thomas Hoenig: Too Big has Failed

We have been slow to face up to the fundamental problems in our financial system and reluctant to take decisive action with respect to failing institutions. ... We have been quick to provide liquidity and public capital, but we have not defined a consistent plan and not addressed the basic shortcomings and, in some cases, the insolvent position of these institutions.Update: More excerpts (ht Josh):

We understandably would prefer not to "nationalize" these businesses, but in reacting as we are, we nevertheless are drifting into a situation where institutions are being nationalized piecemeal with no resolution of the crisis.

[T]here are several lessons we can draw from these past experiences.That is a call for temporary nationalization.

• First, the losses in the financial system won’t go away – they will only fester and increase while impeding our chances for a recovery.

• Second, we must take a consistent, timely, and specific approach to major institutions and their problems if we are to reduce market uncertainty and bring in private investors and market funding.

• Third, if institutions -- no matter what their size -- have lost market confidence and can’t survive on their own, we must be willing to write down their losses, bring in capable management, sell off and reorganize misaligned activities and businesses, and begin the process of restoring them to private ownership.

emphasis added

How would nationalization work?

How should we structure this resolution process? While a number of details would need to be worked out, let me provide a broad outline of how it might be done. First, public authorities would be directed to declare any financial institution insolvent whenever its capital level falls too low to support its ongoing operations and the claims against it, or whenever the market loses confidence in the firm and refuses to provide funding and capital. This directive should be clearly stated and consistently adhered to for all financial institutions that are part of the intermediation process or payments system. ...And Hoenig concludes:

Next, public authorities should use receivership, conservatorship or “bridge bank” powers to take over the failing institution and continue its operations under new management. Following what we have done with banks, a receiver would then take out all or a portion of the bad assets and either sell the remaining operations to one or more sound financial institutions or arrange for the operations to continue on a bridge basis under new management and professional oversight. In the case of larger institutions with complex operations, such bridge operations would need to continue until a plan can be carried out for cleaning up and restructuring the firm and then reprivatizing it. Shareholders would be forced to bear the full risk of the positions they have taken and suffer the resulting losses.

While hardly painless and with much complexity itself, this approach to addressing “too big to fail” strikes me as constructive and as having a proven track record. Moreover, the current path is beset by ad hoc decision making and the potential for much political interference, including efforts to force problem institutions to lend if they accept public funds; operate under other imposed controls; and limit management pay, bonuses and severance. If an institution’s management has failed the test of the marketplace, these managers should be replaced. They should not be given public funds and then micro-managed, as we are now doing under TARP, with a set of political strings attached. Many are now beginning to criticize the idea of public authorities taking over large institutions on the grounds that we would be “nationalizing” our financial system. I believe that this is a misnomer, as we are taking a temporary step that is aimed at cleaning up a limited number of failed institutions and returning them to private ownership as soon as possible. This is something that the banking agencies have done many times before with smaller institutions and, in selected cases, with very large institutions. In many ways, it is also similar to what is typically done in a bankruptcy court, but with an emphasis on ensuring a continuity of services. In contrast, what we have been doing so far is every bit a process that results in a protracted nationalization of “too big to fail” institutions.This strikes me as a break in the ranks, and although Hoenig is speaking for himself (not the Fed), this might indicate a change in direction.

... [S]ome are now claiming that public authorities do not have the expertise and capacity to take over and run a “too big to fail” institution. They contend that such takeovers would destroy a firm’s inherent value, give talented employees a reason to leave, cause further financial panic and require many years for the restructuring process. We should ask, though, why would anyone assume we are better off leaving an institution under the control of failing managers, dealing with the large volume of “toxic” assets they created and coping with a raft of politically imposed controls that would be placed on their operations? In contrast, a firm resolution process could be placed under the oversight of independent regulatory agencies whenever possible and ideally would be funded through a combination of Treasury and financial industry funds. Furthermore, the experience of the banking agencies in dealing with significant failures indicates that financial regulators are capable of bringing in qualified management and specialized expertise to restore failing institutions to sound health. This rebuilding process thus provides a means of restoring value to an institution, while creating the type of stable environment necessary to maintain and attract talented employees. Regulatory agencies also have a proven track record in handling large volumes of problem assets – a record that helps to ensure that resolutions are handled in a way that best protects public funds. Finally, I would argue that creating a framework that can handle the failure of institutions of any size will restore an important element of market discipline to our financial system, limit moral hazard concerns, and assure the fairness of treatment from the smallest to the largest organizations that that is the hallmark of our economic system.

Part Time for Economic Reasons Hits 8.6 Million

by Calculated Risk on 3/06/2009 11:43:00 AM

One more stunning graph from the employment report ...

From the BLS report:

In February, the number of persons who worked part time for economic reasons (sometimes referred to as involuntary part-time workers) rose by 787,000, reaching 8.6 million. The number of such workers rose by 3.7 million over the past 12 months. This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs.

Click on graph for larger image.

Click on graph for larger image.Not only has the unemployment rate risen sharply to 8.1%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 8.6 million.

Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record - yet - but the rapid increase is stunning.

More on Job Losses: Comparing Recessions, Diffusion Indices

by Calculated Risk on 3/06/2009 09:43:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of employment and declines in GDP).

Howver job losses have really picked up in recent months (red line cliff diving on the graph), and the current recession is now the worst recession in percentage terms since the 1950s - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to larger percentage losses. For the current recession, the job losses are more widespread.

In February, job losses were large and widespread across nearly all major industry sectors.Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, February Employment Report

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.UPDATE: The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct. From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 7.2 to 15.1) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has only recovered slightly since then (23.8 in February).

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 7.2 in January 2009. The manufacturing index recovered to 15.1 in February.

If there is a sliver of good news in this employment report, it is that the diffusion indices have inched up a little.

Employment Report: 651K Jobs Lost, 8.1% Unemployment Rate

by Calculated Risk on 3/06/2009 08:54:00 AM

From the BLS:

Nonfarm payroll employment continued to fall sharply in February (-651,000), and the unemployment rate rose from 7.6 to 8.1 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment has declined by 2.6 million in the past 4 months. In February, job losses were large and widespread across nearly all major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 651,000 in February. The economy has lost almost 2.6 million jobs over the last 4 months!

The unemployment rate rose to 8.1 percent; the highest level since June 1983.

Year over year employment is strongly negative (there were 4.2 million fewer Americans employed in Feb 2009 than in Feb 2008). This is another extremely weak employment report ...

Thursday, March 05, 2009

Senate Bill Seeks $500 Billion for FDIC

by Calculated Risk on 3/05/2009 10:51:00 PM

From the WSJ: Bill Seeks $500 Billion for FDIC Fund

Senate Banking Committee Chairman Christopher Dodd is moving to allow the Federal Deposit Insurance Corp. to temporarily borrow as much as $500 billion from the Treasury Department.It was just last September that the FDIC disputed a story by David Evans at Bloomberg:

...

The FDIC would be able to borrow as much as $500 billion until the end of 2010 if the FDIC, Fed, Treasury secretary and White House agree such money is warranted.

...

The FDIC's deposit-insurance fund has fallen precipitously with 25 bank failures in 2008 and 16 so far in 2009.

Bloomberg reporter David Evans' piece ("FDIC May Need $150 Billion Bailout as Local Bank Failures Mount," Sept. 25) does a serious disservice to your organization and your readers by painting a skewed picture of the FDIC insurance fund. Let me be clear: The insurance fund is in a strong financial position to weather a significant upsurge in bank failures. The FDIC has all the tools and resources necessary to meet our commitment to insured depositors, which we view as sacred. I do not foresee – as Mr. Evans suggests – that taxpayers may have to foot the bill for a "bailout."I guess the proposed $500 billion is just a loan and not a bailout.

Summary and Discussion

by Calculated Risk on 3/05/2009 07:33:00 PM

Another busy day. And I'm still struggling with the comments (I'm receiving many complaints). First the news, and then a chat room.

Comment System

The comment system has problems. I'm receiving numerous complaints of lost comments, comments being reordered, slow loading and no comments appearing. I'm talking with JS-Kit about the problem. Unfortunately I need their help to switch back to Haloscan. For now, I've changed back to the inline version of JS-Kit (no pop-up). I apologize for the inconvenience, and I'm working to resolve the problem.

Meanwhile here is a chat room that might be fun to try for discussion.

NOTE: I've removed the chatroom for now. I think we overwhelmed them!

More on Negative Equity

by Calculated Risk on 3/05/2009 06:18:00 PM

The First American CoreLogic Negative Equity Report for December 2008 is available on line (ht Ilya, Brian). You have to sign up to read the report.

A few key points:

Going forward, the largest increases in the share of negative equity will most likely occur in states that have not yet experienced deep declines. The reason: the boom/bust states already have very high negative equity shares and incremental declines in home prices will result in smaller negative equity share increases relative to other states given the same decline in prices. This means that as prices continue to decline in 2009, the rise in the negative equity share of states outside the boom/bust regions will begin to accelerate more quickly relative to the boom/bust states.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of households with mortgages underwater by state (and near negative equity defined as with less than 5% equity). As noted above, the largest increases in negative equity going forward will be in states other than California, Nevada, Arizona and Florida.

UPDATE: States with no data from CoreLogic: Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia, Wyoming.

Stock Market: Cliff Diving

by Calculated Risk on 3/05/2009 04:00:00 PM

More cliff diving today ... the good news is the market can lose 5% per day and never hit zero!

Joke of the Day (ht BR): "McDonalds adds Citigroup stock to its $1 menu!"

DOW off 4.1%

S&P 500 off 4.2%

NASDAQ off 4.0% Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes).

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

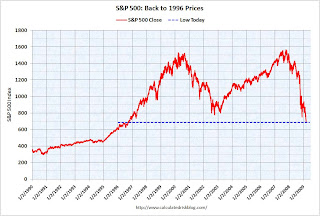

The graph has been extended back to 1990.

The low in 1996 was 598.48.

Another 85 points or so to get back to 1995 prices.

Bankruptcy Filings Up 31% in 2008

by Calculated Risk on 3/05/2009 03:30:00 PM

The Administrative Office of the U.S. Courts reports: Bankruptcy Filings Up In Calendar Year 2008

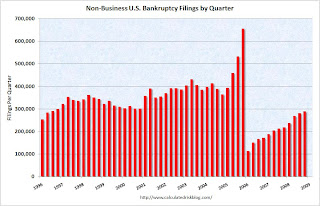

Bankruptcy filings in the federal courts rose 31 percent in calendar year 2008, according to data released today by the Administrative Office of the U.S. Courts. The number of bankruptcies filed in the twelve-month period ending December 31, 2008, totaled 1,117,771, up from 850,912 bankruptcies filed in CY 2007. Filings have grown since CY 2006 when bankruptcy filings totaled 617,660, in the first full 12-month period after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. An historic high in the number of bankruptcy filings was seen in calendar year 2005, when over 2 million bankruptcies were filed.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Even though bankruptcy filings are up 31% in 2008 (from 2007), the number of bankruptcy filings is still below the levels prior to the 2005 law change.

With a much weaker economy in 2009, bankruptcy filings will probably increase sharply. Plus the mortgage cram-down legislation might lead to more filings.

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |