by Calculated Risk on 11/24/2008 12:00:00 PM

Monday, November 24, 2008

NAR: Re-Default Rate 50% of Modifications

Here is a video report from CNBC's Diana Olick: Existing Home Sales. Listen to the end (hat tip Hal)

"The Realtors are reporting that foreclosure sales - that is distress sales being foreclosures or short sales - have risen from what they thought was 35% to 40% of all existing home sales, now they are saying it is 45% of all existing home sales. They also are saying they are seeing further softening toward the November numbers.

And they are hearing from the Realtors they talk to that the re-default rate on a lot of these loan modifications are running at 50% - that is half those of modifications aren't working."

emphasis added

Existing Home Sales (NSA)

by Calculated Risk on 11/24/2008 10:30:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales were slightly lower in October 2008 than in October 2007 - after the first year-over-year increase in September 2008 since November 2005.

It might seem like sales have stabilized, however many of the sales this year are foreclosure resales. As an example, DataQuick reported that 51% of all sales in Socal in October were foreclosure resales as opposed to 16% in October 2007. This is probably boosting sales at the low end as investors buy properties to rent. Although foreclosure resales will stay elevated in 2009, I expect total sales to fall further.

Also, the impact of the most recent wave of the credit crisis is just beginning to impact home sales. I expect sales in November and December to be lower than in 2007.

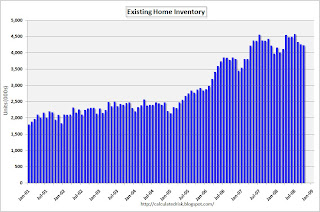

There have been 4.23 million sales so far in 2008, and sales are currently on pace for just over 4.9 million total this year - the lowest annual sales since 1997. The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for the last three months (August, September and October 2008) are slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (inventory has peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.

Existing Home Sales in October

by Calculated Risk on 11/24/2008 10:00:00 AM

From NAR: Existing-Home Sales Soften on Economic Volatility

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 3.1 percent to a seasonally adjusted annual rate1 of 4.98 million units in October from a downwardly revised pace of 5.14 million in September, and are 1.6 percent below the 5.06 million-unit level in October 2007.

...

Total housing inventory at the end of October slipped 0.9 percent to 4.23 million existing homes available for sale, which represents a 10.2-month supply at the current sales pace, up from a 10.0-month supply in September.

Click on graph for larger image in new window.

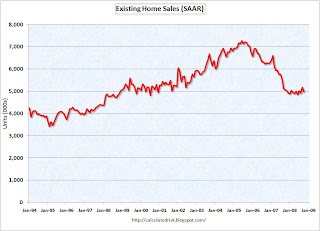

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2008 (4.98 million SAAR) were lower than in October 2007 (5.11 million SAAR) reversing the slight year-over-year increase last month.

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested last month that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 10.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon - the NAR website is having problems.

Krugman on Citigroup Bailout: "a lousy deal"

by Calculated Risk on 11/24/2008 09:16:00 AM

From Paul Krugman: Citigroup

Mark Thoma has the rundown of informed reactions. A bailout was necessary — but this bailout is an outrage: a lousy deal for the taxpayers, no accountability for management, and just to make things perfect, quite possibly inadequate, so that Citi will be back for more.

Setser: "Thrilled" with Geithner Pick for Treasury

by Calculated Risk on 11/24/2008 08:51:00 AM

Brad Setser at Follow the Money writes: A new economic team

[B]efore moving to New York I worked for Mr. Geithner at both the Treasury and the IMF. Mr. Geithner was, by the end of the 1990s, in charge of Treasury’s International Affairs division, so almost everyone who worked there — Tim Duy and Nouriel Roubini to name two — also worked for Mr. Geithner. At the IMF, Mr. Geithner encouraged the IMF to pay more attention to balance sheet vulnerabilities — and helped to push a paper I worked on with a group of talented young IMF economists through the IMF’s internal review process.Setser writes much more on Mr. Geithner including linking to a number of speeches and other resources.

It consequently is no surprise that I am thrilled that Mr. Geithner looks to be Obama’s choice for Treasury Secretary. I am also pleased that President Obama also found a way to pull Dr. Summers — a voracious consumer of economic and financial analysis, including economic and financial blogs — into the administration.

Wow. Three of my favorite bloggers all worked for Geithner. Hopefully Tim Duy (at Economist's View with Mark Thoma) and Nouriel Roubini (RGE Monitor) will also comment.

Statements by Fed, FDIC, Treasury on Citi Bailout

by Calculated Risk on 11/24/2008 12:19:00 AM

Form the Fed: Joint Statement by Treasury, Federal Reserve, and the FDIC on Citigroup

The U.S. government is committed to supporting financial market stability, which is a prerequisite to restoring vigorous economic growth. In support of this commitment, the U.S. government on Sunday entered into an agreement with Citigroup to provide a package of guarantees, liquidity access, and capital.Here is the term sheet.

As part of the agreement, Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $306 billion of loans and securities backed by residential and commercial real estate and other such assets, which will remain on Citigroup's balance sheet. As a fee for this arrangement, Citigroup will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Citigroup from the Troubled Asset Relief Program in exchange for preferred stock with an 8% dividend to the Treasury. Citigroup will comply with enhanced executive compensation restrictions and implement the FDIC's mortgage modification program.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy.

We will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks. The following principles guide our efforts:We will work to support a healthy resumption of credit flows to households and businesses. We will exercise prudent stewardship of taxpayer resources. We will carefully circumscribe the involvement of government in the financial sector. We will bolster the efforts of financial institutions to attract private capital.

Sunday, November 23, 2008

WSJ: Government to Guarantee $300 Billion in Citigroup Assets

by Calculated Risk on 11/23/2008 11:33:00 PM

From the WSJ: U.S. Agrees to Citigroup Bailout

Treasury has agreed to inject an additional $20 billion in capital into Citigroup under terms of the deal hashed out between the bank, the Treasury Department, the Federal Reserve, and the Federal Deposit Insurance Corp. ...

In addition to the capital, Citigroup will have an extremely unusual arrangement in which the government agrees to backstop a roughly $300 billion pool of its assets, containing mortgage-backed securities among other things. Citigroup must absorb the first $37 billion to $40 billion in losses from these assets. If losses extend beyond that level, Treasury will absorb the next $5 billion in losses, followed by the FDIC taking on the next $10 billion in losses. Any losses on these assets beyond that level would be taken by the Fed.

CNBC: Expect Citi Bailout Announcement Soon

by Calculated Risk on 11/23/2008 08:51:00 PM

UPDATE: CNBC reports at 9:30PM ET that members of Congress are being consulted about an additional capital infusion for Citi. No details yet ... the situation is still fluid. $10 to $20 Billion capital infusion - and some possible capping of losses - something to be announced tonight ...

From CNBC: Citi, Government Working Feverishly on Rescue Plan

The U.S. government and Citigroup are working feverishly to hammer out a rescue plan for the beleaguered bank. If all goes according to plan, there will likely be an announcement of some type of plan in a couple of hours.Soon ...

WSJ: Citigroup, U.S. Near Agreement on Bad Assets

by Calculated Risk on 11/23/2008 05:32:00 PM

UPDATE2: CNBC reports: Government Now Said To Have Cold Feet

From the WSJ: Citigroup, U.S. in Talks to Create 'Bad Bank'

Citigroup Inc. is nearing agreement with U.S. government officials to create a structure that would house some of the financial giant's risky assets ...The announcement is expected tonight.

... talks were progressing Sunday toward creation of what would essentially be a "bad bank." ... The bad bank also might absorb assets from Citigroup's off-balance-sheet entities, which hold $1.23 trillion. ...

Under the terms being discussed, Citigroup would agree to absorb losses on assets covered by the agreement up to a certain threshold. ... After weekend discussions between Citigroup executives and officials at the Federal Reserve and Treasury Department, the parties are hoping to unveil an agreement Sunday evening, the people said.

Hey, I thought Citi WAS the bad bank!

UPDATE: Here is a story from Bloomberg: Citigroup, Fed Said to Weigh Plan to Limit Losses on Bad Assets

And from the NY Times: Plan Begins to Emerge to Rescue Citigroup

Under the proposal, the government would shoulder losses at Citigroup if those losses exceeded certain levels, ...

If the government should have to take on the bigger losses, it would receive a stake in Citigroup.

CNBC Reports Government could buy $100+ Billion in Citigroup Assets

by Calculated Risk on 11/23/2008 03:57:00 PM

From CNBC: Citigroup Update: Government Looking To Buy Assets

The government is looking to buy substantial amount of assets from Citi like a good bank, bad bank structure. The Government will absorb much of the losses for citi if there are losses and Citi would issue preferred stock to the government. The government could buy more than $100 billion in the bad assets if the plans go throughThe BBC is reporting that an announcement is expected before the markets open Monday.

UPDATE: Financial Times: Citigroup board in crisis talks (hat tip Dwight)

Citigroup's board was on Sunday locked in crisis talks ... the board is considering all options ...

Representatives of the New York Federal Reserve, as well as Treasury officials, are also monitoring developments.

... Citi is in no danger of bankruptcy. It recently received a $25bn investment from the Treasury and its credit is backed by the Fed. Its counterparties are not scrambling to put their business elsewhere, as was the case with Bear Stearns and Lehman. ... the Fed ... has taken a more hands-off approach ...