by Calculated Risk on 11/21/2008 06:50:00 PM

Friday, November 21, 2008

Bank Failure #20: Community Bank, Loganville, Georgia

From the FDIC: Bank of Essex, Tappahannock, Virginia Acquires All the Deposits of The Community Bank, Loganville, GA

The Community Bank, Loganville, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of Essex, to assume all of the deposits of The Community Bank.One down today ...

...

As of October 17, 2008, The Community Bank had total assets of $681.0 million and total deposits of $611.4 million. Bank of Essex purchased approximately $84.4 million of The Community Bank's assets, and did pay the FDIC a premium of $3.2 million for the right to assume the failed bank's deposits. The FDIC will retain the remaining assets for later disposition.

...

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be between $200 million and $240 million. The Community Bank is the twentieth FDIC-insured institution to be closed nationwide, and the third in Georgia, this year.

Bank Failure Friday: Downey Edition?

by Calculated Risk on 11/21/2008 04:06:00 PM

From the LA Times: Downey Financial could be next bank casualty

Reeling from mortgage loan losses, Downey Financial Corp. warned last week that its choices were stark: Raise capital or risk a government takeover.Other possibilities mentioned (the usual suspects):

It's still waiting for that capital. And since today is Friday, the day when bank takeovers generally occur, industry observers will be watching again to see whether Downey turns the keys to its executive suite over to the Federal Deposit Insurance Corp.

The Inland Empire's PFF Bancorp, Vineyard National Bancorp and Temecula Valley Bancorp, for example, have seen their stocks punished especially hard by investors worried that their heavy emphasis on home construction loans will make it impossible to raise new capital or sell themselves.

Geithner Picked as Treasury Secretary

by Calculated Risk on 11/21/2008 03:19:00 PM

From the WSJ: Obama to Pick Geithner as Treasury Secretary

Mr. Obama plans to introduce his entire economic team early next week, hoping to sooth the roiling financial markets and answer rising pressure on the president-elect to become more involved.For more on NY Fed President Tim Geithner, see (from Feb 2007): Calm Before and During a Storm

BTW, Brad Setser at Follow the Money worked for Geithner at both the IMF and the Treasury. I'll be interested in his comments.

I think Geithner is a great choice.

California Unemployment Rate Hits 8.2%

by Calculated Risk on 11/21/2008 02:56:00 PM

From the LA Times: California unemployment jumps to 8.2%, third-highest in the U.S.

California's unemployment rate rose dramatically in October to 8.2%, its highest level in 14 yearsIt is grim here in California ...

...

The slowdown in the state's economy worsened in October as job losses spread from the hard-hit construction, real estate and financial services areas to retail sales, said Howard Roth, chief economist for the California Department of Finance. ...

"It looks like the grinch is stealing Christmas here," he said

Buffett: Unemployment will hit "New Heights"

by Calculated Risk on 11/21/2008 01:48:00 PM

Here are some excerpts, via the U.S. News & World Report, of a Fox News interview with Warren Buffett to be aired this afternoon.

On unemployment:

“There are going to be more people unemployed ... Five months from now ... it will be considerably higher ... It will happen eventually [surpassing 8%], and we will go on to new heights, but it will not turn around by mid-year next year.”On the potential auto bailout:

“I would drive a deal like I would drive myself if I were buying a business. And I think, I would say there's plan A or plan B. And if you don't want to do it this way, you know, then...take bankruptcy.

I would make the CEOs buy in. I would say, you know, the United States government is willing to put in X dollars, but we're going to have you put in a certain percentage of your net worth right along with us. We'll give you more upside, but you're going to lose if we lose.”

Kedrosky: The Option ARM Non-Bomb?

by Calculated Risk on 11/21/2008 12:14:00 PM

Paul Kedrosky writes: The Option ARM Non-Bomb? (hat tip Brett)

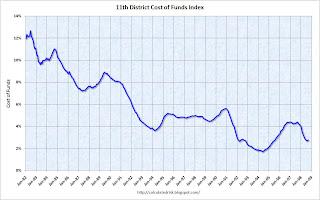

I just had someone email me something interesting today about their adjustable-rate mortgage resetting –- but to considerably lower levels. How widespread is this phenomenon? Or, asked differently, what percentage of ARMs are tied to Treasuries, as opposed to Libor, etc.?The answer from American CoreLogic, via Sue McAllister at the Mercury News, is 60% of ARMs are tied to a LIBOR index, about 25% to various treasuries, and the remaining 15% to the 11th District Cost of Funds Index (COFI -popular in California).

Click on graph for larger image.

Click on graph for larger image.This graph shows the 11th District Cost of Funds Index.

It appears ARMs tied to the COFI and treasuries will be non-bombs. The other 60% of loans tied to LIBOR might reset at a higher rate, although with the 3-month LIBOR down to 2.16% (it was 5.02% one year ago), even these 60% aren't bombs.

But we have to remember a higher interest rate is only one problem. Many of these borrowers had Option ARMs and were choosing the negatively amortizing or interest only options. When these loans recast, the borrowers will be required to pay the amortizing payment - and that could have a much larger impact on the monthly payment than the change in interest rates.

Remember "Reset" refers to a rate change. "Recast" refers to a payment change. See Tanta's Reset Vs. Recast, Or Why Charts Don't Match

Credit Crisis Indicators

by Calculated Risk on 11/21/2008 09:49:00 AM

Yesterday saw a stunning flight to treasuries across the board. The 3-month yield fell to zero. The 2 year yield was at a record low. Even the 30 year yield decreased sharply. The 3-month at zero can be explained as a flight to quality and another crisis in the credit markets, but the declines in the longer yields probably suggest deflation trades.

Here are a few indicators of credit stress once again suggesting little progress over the last few days.

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The 10-Year Treasury Note yield is also up slightly at 3.17%. The rush to treasuries of all durations was stunning yesterday!

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

For the LIBOR, the TED spread, and the two-year swap, there has been clear progress - but there is still a ways to go. For the A2P2 spread (and all treasury yields), the markets are still in crisis.

Goldman Slashes GDP forecast

by Calculated Risk on 11/21/2008 08:29:00 AM

From Bloomberg: Goldman Slashes U.S. Growth Forecasts, Says Recession Deepens

In a research note released this morning, Goldman Sachs slashed their Q4 GDP forecast from a decline of 3.5%, to a decline of 5% in Q4 (at an annual rate). They are now forecasting unemployment will reach 9% by Q4 2009.

They are also forecasting (not in Bloomberg article) that unemployment will rise to 6.8% in November with 350,000 in reported job losses.

This isn't quite the "just awful" scenario, but it is pretty close.

Singapore in Recession

by Calculated Risk on 11/21/2008 01:57:00 AM

From MarketWatch: Singapore falls into recession, cuts 2009 outlook

Singapore became the third major Asia-Pacific economy to fall into recession after data released Friday showed the economy had contracted for two straight quarters.Pretty soon it will be easier to list the countries NOT in recession ...

...

The contraction, which followed a revised 5.3% fall in the second quarter from the first, means Singapore technically follows Japan and Hong Kong into recession.

Thursday, November 20, 2008

Citigroup to Hold Unscheduled Board Meeting Friday

by Calculated Risk on 11/20/2008 08:29:00 PM

From the WSJ: Citi Weighs Its Options, Including Firm's Sale

Executives at Citigroup ... began weighing the possibility of auctioning off pieces of the financial giant or even selling the company outright ...Here is the CNBC story: Citigroup May Seek Merger as Stock Plunges Further

Citigroup's board of directors is scheduled to have a formal meeting Friday to discuss the options ... In addition to pondering a move to sell the entire company to another bank, executives have started exploring the possibility of selling off parts of the firm, including the Smith Barney retail brokerage, the global credit-card division and the transaction-services unit, which is one of Citigroup's most lucrative and fast-growing businesses, the people said.