by Calculated Risk on 10/07/2008 05:36:00 PM

Tuesday, October 07, 2008

UK: Government to Invest in Banks

From The Times: British taxpayer to be tied into £50bn bank bailout

Britain’s taxpayers will tomorrow be committed to spending more than £50 billion to bail out the high-street banks in a bid to avert a cataclysmic failure of confidence, The Times learnt tonight.That is 2:30 AM ET.

...

The taxpayer will take a stake in banks that seek assistance through the purchase of preference shares ... Holders of preference shares are first in line for payout of dividends but they do not carry voting rights. The bail-out is expected to be structured so that the Government also receives rights to ordinary bank shares at low prices, holding out the prospect of profits if and when banks recover.

...

The part-nationalisation of the banks [will be called] “recapitalisation” ... the term used by Mr Darling ...

Mr Darling confirmed that he would be making a statement before the London Stock Markets opened tomorrow and another in the Commons later. It is believed the first will come at around 7.30 am.

This is the type of plan supported by most economists in the U.S. (as opposed to Paulson's TARP). Krugman notes: Britain leads the way?

Unlike the Paulson plan, this sounds as if it makes sense. However, given the strong financial linkages among the world’s economies, I wonder how much Britain can do on its own. Let’s see what the plan actually looks like; if it’s good, it can be a model for US emulation, and for the eurozone too if they can get their act together.

Spain Tries a TARP, UK to Announce "Dramatic Rescue Package"

by Calculated Risk on 10/07/2008 04:11:00 PM

Spain tries a TARP. From the Financial Times: Spain announces emergency fund

Spain on Tuesday became the latest European nation to take unilateral measures to deal with the world’s deepening financial crisis, announcing a €30-50bn emergency fund to provide liquidity to the financial system by buying Spanish bank assets.And in the UK, from The Mail: Rescue package for Britain's banks agreed at crisis summit after shares go into freefall

...

The fund, whose details will be fleshed out during the regular cabinet meeting on Friday, will be managed by the Spanish treasury to buy the assets of financial institutions.

The Government will tomorrow unveil a dramatic rescue package aimed at easing the crisis engulfing Britain's banks.

Gordon Brown tonight held a crisis summit with the governor of the Bank of England and the chairman of the Financial Services Authority as pressure mounted on ministers to take immediate action.

...

It is believed the package will include a proposal to inject capital into the banks to shore up their balance sheets.

emphasis added

Office Vacancy Rate Rises Sharply

by Calculated Risk on 10/07/2008 02:29:00 PM

From Bloomberg: New York's Top Office Vacancies Jump 43% on Layoffs

Vacancies for Class A space rose to 7.7 percent in Manhattan, up from 6.9 percent in the second quarter and 5.4 percent a year ago. There's 18.5 million square feet for rent, up from 12.9million feet a year ago, according to Cushman statistics.The CRE slump is here.

...

Nationwide, the office vacancy rate reached 13.6 percent in the third quarter from 13.1 percent in the second quarter, according to a report released Monday by Reis, Inc. a New York- based provider of real estate data.

Bernanke: Economic Outlook "has worsened"

by Calculated Risk on 10/07/2008 01:14:00 PM

From Fed Chairman Bernanke: Current Economic and Financial Conditions

Considerable experience in both industrialized and emerging economies has shown that severe financial instability, together with the associated declines in asset prices and disruptions in credit markets, can take a heavy toll on the broader economy if left unchecked.Short version: the ecomomic outlook is grim - expect a rate cut.

...

By potentially restricting future flows of credit to households and businesses, the developments in financial markets pose a significant threat to economic growth.

...

Economic activity had shown signs of decelerating even before the recent upsurge in financial-market tensions. As has been the case for some time, the housing market continues to be a primary source of weakness in the real economy as well as in the financial markets. However, the slowdown in economic activity has spread outside the housing sector. Private payrolls have continued to contract, and the declines in employment, together with earlier increases in food and energy prices, have eroded the purchasing power of households. This sluggishness of real incomes, together with tighter credit and declining household wealth, is now showing through more clearly to consumer spending. Indeed, since May, real consumer outlays have contracted significantly. Meanwhile, in the business sector, worsening sales prospects and a heightened sense of uncertainty have begun to weigh more heavily on investment spending as well.

The intensification of financial turmoil and the further impairment of the functioning of credit markets seem likely to increase the restraint on economic activity in the period ahead. Even households with good credit histories are now facing difficulties obtaining mortgage loans or home equity lines of credit. Banks are also reducing credit card limits, and denial rates on automobile loan applications reportedly are rising. Businesses, too, are confronting diminished access to credit. For example, disruptions in the commercial paper market and tightening of bank lending standards have made it more difficult for businesses to obtain the working capital they need to meet everyday operating expenses such as payrolls and inventories.

All told, economic activity is likely to be subdued during the remainder of this year and into next year. The heightened financial turmoil that we have experienced of late may well lengthen the period of weak economic performance and further increase the risks to growth.

...

Overall, the combination of the incoming data and recent financial developments suggests that the outlook for economic growth has worsened and that the downside risks to growth have increased. At the same time, the outlook for inflation has improved somewhat, though it remains uncertain. In light of these developments, the Federal Reserve will need to consider whether the current stance of policy remains appropriate.

emphasis added

Grassley: SEC Allowed "excessively risky behavior"

by Calculated Risk on 10/07/2008 11:28:00 AM

From Bloomberg: Cox's SEC Censored Paper Showing It Ignored Bear Stearns Plunge

U.S. Securities and Exchange Commission Chairman Christopher Cox's regulators stood by as shrinking capital ratios and growing subprime holdings led to the collapse of Bear Stearns Cos., according to an unedited version of a study by the agency's inspector general.

The report by Inspector General H. David Kotz was requested by Senator Charles Grassley ... Before it was released to the public on Sept. 26, Kotz deleted 136 references, many detailing SEC memos, meetings or comments, at the request of the agency's Division of Trading and Markets that oversees investment banks.

``People can judge for themselves, but it sure looks like the SEC didn't want the public to know about the red flags it apparently ignored in allowing Bear Stearns and other investment banks to engage in excessively risky behavior,'' Grassley said in an e-mailed statement.

Federal Reserve Announces Commercial Paper Funding Facility

by Calculated Risk on 10/07/2008 09:10:00 AM

From the Fed: Board announces creation of the Commercial Paper Funding Facility (CPFF) to help provide liquidity to term funding markets

The Federal Reserve Board on Tuesday announced the creation of the Commercial Paper Funding Facility (CPFF), a facility that will complement the Federal Reserve's existing credit facilities to help provide liquidity to term funding markets. The CPFF will provide a liquidity backstop to U.S. issuers of commercial paper through a special purpose vehicle (SPV) that will purchase three-month unsecured and asset-backed commercial paper directly from eligible issuers. The Federal Reserve will provide financing to the SPV under the CPFF and will be secured by all of the assets of the SPV and, in the case of commercial paper that is not asset-backed commercial paper, by the retention of up-front fees paid by the issuers or by other forms of security acceptable to the Federal Reserve in consultation with market participants. The Treasury believes this facility is necessary to prevent substantial disruptions to the financial markets and the economy and will make a special deposit at the Federal Reserve Bank of New York in support of this facility.Commercial Paper Funding Facility (CPFF) Terms and Conditions (57 KB PDF)

The commercial paper market has been under considerable strain in recent weeks as money market mutual funds and other investors, themselves often facing liquidity pressures, have become increasingly reluctant to purchase commercial paper, especially at longer-dated maturities. As a result, the volume of outstanding commercial paper has shrunk, interest rates on longer-term commercial paper have increased significantly, and an increasingly high percentage of outstanding paper must now be refinanced each day. A large share of outstanding commercial paper is issued or sponsored by financial intermediaries, and their difficulties placing commercial paper have made it more difficult for those intermediaries to play their vital role in meeting the credit needs of businesses and households.

By eliminating much of the risk that eligible issuers will not be able to repay investors by rolling over their maturing commercial paper obligations, this facility should encourage investors to once again engage in term lending in the commercial paper market. Added investor demand should lower commercial paper rates from their current elevated levels and foster issuance of longer-term commercial paper. An improved commercial paper market will enhance the ability of financial intermediaries to accommodate the credit needs of businesses and households.

Credit Crisis: LIBOR Rate Increases

by Calculated Risk on 10/07/2008 08:29:00 AM

From Bloomberg: Libor for Overnight Dollar Loans Jumps as Credit Freeze Deepens

The London interbank offered rate, or Libor, that banks charge each other for such loans rose 157 basis points to 3.94 percent today, the British Bankers' Association said. The corresponding rate for euros climbed 22 basis points to 4.27 percent, the highest in four days. The Tokyo interbank rate stayed at the highest level this year and the Libor-OIS spread, a gauge of cash scarcity among banks, widened to a record.However the TED spread, difference between the LIBOR interest rate and the three month T-bill, has declined slightly to 3.69.

Also, Dow Jones is reporting that the commercial paper (CP) market "dislocation worsens" as CP rates continue to rise.

Monday, October 06, 2008

Possible G8 and Fed Action

by Calculated Risk on 10/06/2008 09:24:00 PM

MarketWatch is reporting: France said to seek emergency G8 meeting

France is proposing through diplomatic channels that the Group of Eight industrialized nations hold an emergency summit to contain the U.S.-triggered financial crisis, according to a published report.Also Reuters reported: Fed, Treasury mulling commercial paper support

In an unsourced article dated Tuesday, Japanese business daily Nikkei reported on its Web site from Tokyo that the Group of Seven finance ministers and central bankers are likely to talk about holding an emergency meeting when they meet in Washington as early as Friday.

Among steps under consideration would be funding a special purpose vehicle as opposed to outright purchase of commercial paper ... Aiding the commercial paper market may test the limits of the Fed's authority because of the possibility of losses.Apparently CNBC's Steve Leisman reported (I didn't see it) that the Fed might announce tomorrow morning some sort of program to buy commercial paper.

The Impact of Less Equity Withdrawal on Consumption

by Calculated Risk on 10/06/2008 08:13:00 PM

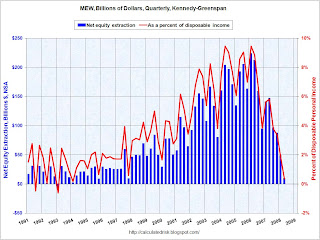

Earlier today I posted the Q2 2008 home equity extraction data provided by the Fed's Dr. James Kennedy. This shows that equity withdrawal has fallen almost to zero as of Q2. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2008, Dr. Kennedy has calculated Net Equity Extraction as $9.5 billion, or 0.3% of Disposable Personal Income (DPI).

Note: This data is based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

Equity extraction was close to $700 billion per year in 2004, 2005 and 2006, before declining to $471 billion last year and will probably be less than $100 billion in 2008.

The questions are: how much will this impact consumption? And over what period?

Unfortunately there is no clear answer. Fed Chairman Bernanke has argued that falling house prices, not equity extraction, impacts consumption (from the WSJ in 2007):

"Our sense ... is that consumers respond to changes in the value of their home essentially because there’s a change in their wealth, not because there’s a change in their access to liquid assets."Others place more weight on MEW. Since equity withdrawal is a somewhat recent development, and there are many factors that impact consumption, it is hard to develop a predictive model on the impact of MEW on consumption. Equity withdrawal probably started in earnest with the Tax Reform Act of 1986 that eliminated the interest deduction for credit cards and consumer loans.

...

Mr. Bernanke went on to reiterate it’s the price of homes, not MEW or financial contagion that represents the biggest risk of spillover from the housing slump. ... [H]e said a hit to consumer spending could be expected on the order of “4 cents and 9 cents on the dollar” of lost home wealth.

In an Economic Letter in 2006, Fed economist John V. Duca wrote:

We can think of the overall impact of home prices on consumption as the combination of two parts—the traditional wealth effect and the relatively new and growing phenomenon of mortgage equity withdrawal (MEW). In recent years, U.S. households have been extracting housing wealth through home-equity loans, cash-out mortgage refinancings or by not fully rolling over capital gains from sales into down payments on subsequent home purchases. Because home-equity loans and mortgages are collateralized, they usually carry lower interest rates than unsecured loans; thus, homeowners can borrow more cheaply. Also, by making housing wealth more accessible, financial innovations have opened new avenues for families to act more quickly on their consumption preferences.Duca didn't mention the impact of falling house prices.

Consistent with a growing liquidity, or MEW effect, some new studies have found wealth effects are now greater than earlier research suggested. One estimates that a $100 rise in housing wealth leads to a $9 increase in spending. Another finds that increases in housing wealth generate three times the spending from stock-price gains. Neither study, however, directly examines whether housing wealth has a greater impact on consumption today because of the greater ease of accessing home equity.

...

The limited U.S. econometric evidence indicates that the strong pace of MEW may have boosted annual consumption growth by 1 to 3 percentage points in the first half of the present decade. This implies that a slowing of home-price appreciation into the low single digits might shave 1 to 2 percentage points off consumption growth and 0.75 to 1.5 percentage points from GDP growth for a few years.

While these estimates provide an idea of housing’s potential economic impact, considerable uncertainty exists about how much a slowdown in MEW might restrain consumption growth.

As far as when the impact occurs, on the wealth effrect, Carroll, Otsuka, and Slacalek, How Large Is the Housing Wealth Effect? A New Approach October 18, 2006 suggested that the impact would be over several quarters:

[W]e estimate that the immediate (next-quarter) marginal propensity to consume from a $1 change in housing wealth is about 2 cents, with a final long run effect around 9 cents.For MEW, it is also uncertain. Kennedy and Greenspan tried to quantify the data in Sources and Uses of Equity Extracted from Homes, however:

Our results do not provide an estimate of the [marginal propensity to consume (MPC)] out of housing wealth; nor do they address the question as to whether extraction of housing wealth has an effect on PCE in addition to the standard wealth effect.My guess is that the MEW effect lasts over several quarters (only a guess). Greenspan estimated that approximately 50% of MEW is consumed, and in interviews he suggested it is probably consumed over several quarters. Since MEW was $471 billion in 2007, and will probably be under $100 billion in 2008, we can estimate that half of the $400 billion or so decline in MEW (or $200 billion) is the drag on PCE in 2008 from less MEW.

That is a big number, but to put that in perspective, PCE increased over $500 billion from 2007 to 2008. So nominal PCE will increase in 2008, although consumption will probably slow sharply.

PCE will also be impacted by lost jobs and changes in consumer psychology (all the scary news will probably lead to less consumer spending).

Nearly six out of ten Americans believe another economic depression is likely, according to a poll released Monday.So once again it will be difficult to separate out the various factors impacting consumption. This will probably be an area of significant econometric research over the next few years.

The CNN/Opinion Research Corp. poll, which surveyed more than 1,000 Americans over the weekend, cited common measures of the economic pain of the 1930s:25% unemployment rate; widespread bank failures; and millions of Americans homeless and unable to feed their families.

It does appear that real personal consumption expenditures declined in Q3 2008 for the first time since 1991. And some of that decline is probably related to the decline in MEW.

Gross to Fed: Cut Rates to 1%, Buy Commercial Paper

by Calculated Risk on 10/06/2008 06:51:00 PM

From PIMCO's Bill Gross: Nothing to Fear but McFear Itself

[The Fed] must also take another bold step: outright purchases of commercial paper. They should also cut interest rates to 1%, because we are experiencing asset deflation, and the threat of headline inflation is long past.