by Calculated Risk on 3/19/2008 12:50:00 PM

Wednesday, March 19, 2008

Video of Volcker with Charlie Rose

"The Federal Reserve has taken extraordinary emergency measures in response to the current financial turmoil. Tonight, I spoke with Paul Volcker, former Fed chairman and one of the most respected figures on the economy, in an exclusive interview. Here is what he had to say about the collapse of Bear Stearns and the role the central bank has played."

Charlie Rose, March 18, 2008

The entire interview is here.

Financial Crisis: Third Wave Still Growing

by Calculated Risk on 3/19/2008 10:52:00 AM

Here are two charts to track the progress of the Fed's recent liquidity initiatives.

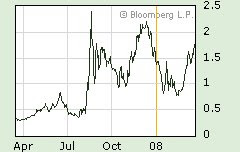

The first is the TED Spread from Bloomberg:

| For more on the TED spread, see Professor Krugman: My friend TED |

| The second graph is the A2P2 spread from the Fed's Commercial Paper report. This also shows the building 3rd wave of the financial crisis. |  |

The third wave appears to be still growing.

Architecture Index Points to Downturn in Commercial Construction

by Calculated Risk on 3/19/2008 09:48:00 AM

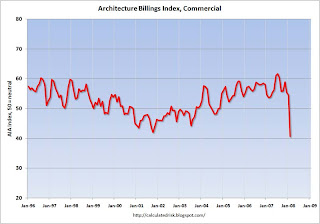

From the American Institute of Architects: Architecture Billings Index Points to Major Downturn in Commercial Construction  Click on graph for larger image.

Click on graph for larger image.

Added graph of index (hat tip smalltown guy)

[T]he Architecture Billings Index (ABI) tumbled almost nine points in February. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI rating fell to 41.8, its lowest level since October 2001, and down dramatically from the 50.7 mark in January.Commercial construction has been one of the bright spots for the economy, and this slowdown in construction spending will probably impact construction employment significantly.

...

"This is a clear indication that there could be tougher times ahead for design firms and a noticeable slowdown in commercial construction projects coming online in the foreseeable future," said AIA Chief Economist Kermit Baker, Ph.D., Hon. AIA. "Interestingly enough, we have also had some survey members reporting that their business is in great shape from a billings and demand standpoint. The one bright spot continues to be the institutional sector with continued positive conditions for construction projects such as schools, hospitals and government buildings."

The normal historical pattern is for residential investment (housing) to lead non-residential structure investment (commercial) by 5 to 8 quarters - both up and down. So this commercial construction slump is right on schedule.

OFHEO on Fannie, Freddie

by Calculated Risk on 3/19/2008 09:34:00 AM

Press Release: OFHEO, FANNIE MAE AND FREDDIE MAC Announce initiative to increase mortgage market liquidity

OFHEO, Fannie Mae and Freddie Mac today announced a major initiative to increase liquidity in support of the U.S. mortgage market. The initiative is expected to provide up to $200 billion of immediate liquidity to the mortgage-backed securities market.

OFHEO estimates that Fannie Mae’s and Freddie Mac’s existing capabilities, combined with this new initiative and the release of the portfolio caps announced in February, should allow the GSEs to purchase or guarantee about $2 trillion in mortgages this year. This capacity will permit them to do more in the jumbo temporary conforming market, subprime refinancing and loan modifications areas.

To support growth and further restore market liquidity, OFHEO announced that it would begin to permit a significant portion of the GSEs’ 30 percent OFHEO-directed capital surplus to be invested in mortgages and MBS. As a key part of this initiative, both companies announced that they will begin the process to raise significant capital. Both companies also said they would maintain overall capital levels well in excess of requirements while the mortgage market recovers in order to ensure market confidence and fulfill their public mission.

OFHEO announced that Fannie Mae is in full compliance with its Consent Order and that Freddie Mac has one remaining requirement relating to the separation of the Chairman and CEO positions. OFHEO expects to lift these Consent Orders in the near term. In view of this progress, the public purpose of the two companies, and ongoing market conditions, OFHEO concludes that it is appropriate to reduce immediately the existing 30 percent OFHEO-directed capital requirement to a 20 percent level, and will consider further reductions in the future.

Tuesday, March 18, 2008

Volcker on Fed Intervention

by Calculated Risk on 3/18/2008 11:49:00 PM

Former Fed Chairman Paul Volcker was interviewed by Charlie Rose tonight. Greg Ip at the WSJ has some excerpts:

Volcker: We’ve seen the Federal Reserve take more extreme measures in some respects than any that have been taken in the past to deal with a financial crisis, which raises some real questions about not only for the Federal Reserve and its authorities, but for the structure of the financial system. ...And on the economy:

Rose: Has [the economy] bottomed out, or have we seen the worst?

Volcker: Look. The basic economy is not irretrievably damaged in any way, shape, or form. We had to go through an adjustment, which is tough. It’s happening much quicker. You’d rather have it happen gradually. But I’m optimistic that, okay, we’ve got to get the consumption down, we got to get spending in line with our capacity to produce. I think that’s going on. And that process is going to take a while. If we can stabilize the financial market, we ought to come out of this. Then we’ve got a lot of work to do about what we do with the regulatory system, the supervisory system, what the role of the Federal Reserve is, what the role of the Treasury and the government is, because this is a different financial market.

OFHEO to Announce Change in Fannie, Freddie Capital Requirements

by Calculated Risk on 3/18/2008 10:12:00 PM

From the WSJ: Fannie, Freddie Regulator Plans Capital Announcement

Ofheo for the past several years has required Fannie and Freddie to hold 30% more capital than their usual minimum while they have worked to resolve lapses in their accounting and internal risk controls, a process now viewed as largely complete. Ofheo is expected to reduce that capital "surcharge" initially to 20%.It wasn't that long ago when Fannie and Freddie were the problem, now they are the solution. The press conference is Wednesday at 9 AM.

The move should reduce Freddie's capital requirement by about $2.6 billion and Fannie's by $3.2 billion.

Housing Starts, New Home Sales and Cancellations

by Calculated Risk on 3/18/2008 04:58:00 PM

It appears starts of single family homes (built for sale) have fallen below the current new home sales rate. This would imply that the inventory for new homes has started to decline (my quick estimate is that new home inventory is currently declining at about a 100 thousand annual rate).

But how high is inventory? Click on graph for larger image.

Click on graph for larger image.

This graph shows the inventory level as reported by the Census Bureau. The Census Bureau reported there were 482,000 units in inventory at the end of January.

From the graph, it appears that inventory has already been falling. However, inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again near record levels. Actual New Home inventories are probably much higher than reported - my estimate is about 108 thousand higher. The second graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders.

The second graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders.

This suggests that inventory levels have been declining slightly (as of Q4 2007), but are still near record levels. Unfortunately this number can only be calculated on a quarterly basis, and not until the homebuilders file their quarterly reports with the SEC.

Also note that most condominiums are not included in new home inventory (or new home sales) from the Census Bureau. Areas with significant condominium developments probably have higher levels of inventory. Another method of looking at inventory is to consider the "months of supply". This graphs shows the month of supply based on the data from the Census Bureau (does not include cancellation adjustment). At the end of January, the months of supply was 9.9 months; significantly above the normal range of 4 to 6 months.

Another method of looking at inventory is to consider the "months of supply". This graphs shows the month of supply based on the data from the Census Bureau (does not include cancellation adjustment). At the end of January, the months of supply was 9.9 months; significantly above the normal range of 4 to 6 months.

If sales hold at steady at 600 thousand Seasonally Adjusted Annual Rate (SAAR), a six months supply would be an inventory of 300 thousand units. Based on the Census Bureau reported inventory level, this would mean a decline of 182 thousand units. (Based on the cancellation adjusted levels, add another 108 thousand units or so).

So even though the homebuilders appear to be working off inventory, it is at a very slow pace compared to the number of excess units. Even if sales hold steady, starts of single family homes (built for sale) probably will decline further as builders work to reduce inventory.

Of course homebuilders are providing incentives and cutting prices to move inventory. As an example, this is from DR Horton:

Click on image to visit Horton site. (hat tip Ramsey Su)

UPTO 50% OFF. I'm sure the previous home buyers are excited to see a half off sale.

Fed cuts rate 75 bps to 2.25%

by Calculated Risk on 3/18/2008 01:58:00 PM

The Federal Open Market Committee decided today to lower its target for the federal funds rate 75 basis points to 2-1/4 percent.

Recent information indicates that the outlook for economic activity has weakened further. Growth in consumer spending has slowed and labor markets have softened. Financial markets remain under considerable stress, and the tightening of credit conditions and the deepening of the housing contraction are likely to weigh on economic growth over the next few quarters.

Inflation has been elevated, and some indicators of inflation expectations have risen. The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization. Still, uncertainty about the inflation outlook has increased. It will be necessary to continue to monitor inflation developments carefully.

Today’s policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will act in a timely manner as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred less aggressive action at this meeting.

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 2-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, and San Francisco.

More on Housing Starts

by Calculated Risk on 3/18/2008 11:20:00 AM

It appears from the Census Bureau's Housing Starts report released this morning that the home builders are finally starting fewer homes than they are selling. If correct, the inventory of new homes for sale will start to decline.

A couple key points:

1) if sales fall further, then obviously starts will have to fall further too.

2) The huge overhang of existing home inventory, especially distressed sales, will pressure new home sales for some time.

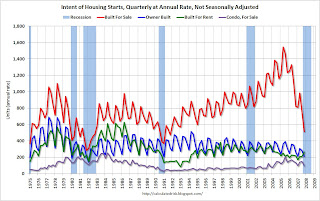

It is difficult to compare starts directly to sales. Starts includes apartments, owner built units and condos that are not included in the new home sales report. However, every quarter, the Census Bureau releases Starts by Intent, and it is possible to compare "Single Family Starts, Built for Sale" to New Home sales. Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly starts by intent (through Q4 2007). This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

As of Q4, Single Family starts built for sale, had declined to about 500 thousand on a non seasonally adjusted annual rate.

The second graph show starts of single family units, built for sale, on a quarterly basis (now in green) vs. new home sales (monthly). Based on the housing starts report released this morning, it appears that Single Family starts, built for sale, have fallen below 500 thousand (annual rate) in Q1 2008.

New home sales have fallen just below 600 thousand (SAAR) in February 2008. This suggests that new home inventory is currently declining at about a 100 thousand per year rate (25+ thousand unit decline in Q1).

Goldman, Lehman Report Net Income Declines

by Calculated Risk on 3/18/2008 08:57:00 AM

From the WSJ: Lehman Brothers Net Falls 57% On Weakness in Fixed Income

For the quarter ended Feb. 29, the investment bank posted net income of $489 million, or 81 cents a share, down from $1.15 billion, or $1.96 a share, a year earlier. Net revenue fell 31% to $3.51 billion.And on Goldman: Goldman Sachs Net Slides 53%

Goldman Sachs Group Inc.'s fiscal first-quarter net income dropped 53% on $2 billion in losses on residential mortgages, credit products and investments ...Although these net income declines suggest a recession, overall these are not horrible reports.

...

The biggest Wall Street investment bank by market value reported net income of $1.51 billion, or $3.23 a share, for the quarter ended Feb. 29, compared to $3.2 billion, or $6.67 a share, a year earlier.

Results included $1 billion in losses on residential mortgage loans and securities, and nearly $1 billion in losses on credit products and investment losses ...