by Calculated Risk on 1/18/2008 03:44:00 PM

Friday, January 18, 2008

Housing: Seasonal Inventory

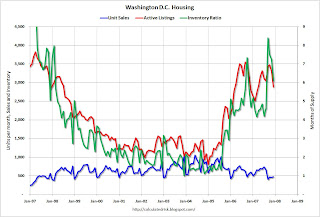

To illustrate the seasonal pattern for housing, here is some housing data (through December) for Washington D.C. sent to me by reader dc1000. The data shows a 13% decline in inventory, from 3,307 units in November to 2,880 units in December. Sales for December were at the lowest level since dc1000 has been keeping statistics, starting in '97. Click on graph for larger image.

Click on graph for larger image.

This graph shows the sales, inventory and months of supply for Washington, D.C.

Note the sharp decline in inventory in December (and months of supply).

Inventory and "months of supply" are not seasonally adjusted in this calculation. The normal seasonal pattern (nationally) is for inventory to decline about 15% in December as sellers remove their homes from the market for the holidays.

Remember this when the National Association of Realtors (NAR) announces that inventory declined in December!

Note: in this case both sales and inventory are NSA (not seasonally adjusted). So "months of supply" is also not seasonally adjusted. The NAR seasonally adjusts sales, but not inventory. So the NAR "months of supply" calculation is a little weird; a seasonally adjusted number being compared with a non-seasonally adjusted number. For new homes sales, the Census Bureau seasonally adjusts both sales and inventory.

Fitch cuts Ambac rating to AA

by Calculated Risk on 1/18/2008 02:46:00 PM

From MarketWatch: Fitch cuts Ambac rating to AA from AAA

This will probably mean some more write-downs from the banks.

Added: For a discussion of the possible implications, see Alistair Barr's piece at MarketWatch: Bond-insurer woes may trigger more write-downs (hat tip Barley)

Just when you thought it was over, trouble in the $2.3 trillion bond-insurance business could trigger another wave of big write-downs from banks and brokerage firms, experts said Friday.

...

Bond insurers agree to pay principal and interest when due in a timely manner in the event of a default -- a $2.3 trillion business that offers a credit-rating boost to municipalities and other issuers that don't have AAA ratings. Without those top ratings, their business models may be imperiled.

...

The destruction of the bond insurers would likely bring write-downs at major banks and financial institutions that would put current write-downs to shame," Tamara Kravec, an analyst at Banc of America Securities, wrote in a note Friday.

MBA Report On Workouts

by Anonymous on 1/18/2008 12:15:00 PM

The MBA has a report out on foreclosure and workout data from the third quarter of 2007 (thanks, Clyde!). The data is in tabular form that's a bit unwieldy, but here's part of the summary:

[D]uring the third quarter the approximately 54 thousand loan modifications done and 183 thousand repayment plans put into place exceeded the number of foreclosures started, excluding those cases where the borrower was an investor/speculator, where the borrower could not be located or would not respond to mortgage servicers, and when the borrower failed to perform under a plan or modification already in place.What jumps out at me:

Of the foreclosure actions started in the third quarter of 2007, 18percent were on properties that were not occupied by the owners, 23 percent were in cases where the borrower did not respond or could not be located, and 29 percent were cases where the borrower defaulted despite already having a repayment plan or loan modification in place. . . . the degree to which invest investor-owned properties drove foreclosures in the third quarter differed widely by state and by loan type. They ranged from a high of 35 percent of prime ARM foreclosures in Montana to a low of 6 percent of prime fixed-rate foreclosures in South Dakota. For the nation, investor loans comprised 18 percent of subprime ARM foreclosures, 28 percent of subprime fixed-rate foreclosures, 18 percent of prime ARM foreclosures and 14 percent of prime fixed-rate foreclosures. Table 6 shows, for example, that while 11 percent of foreclosures on prime ARM and prime fixed-rate loans were on non-owner occupied properties, the percentages for subprime loans were almost double that — 19 percent for subprime ARMs and 20 percent for subprime fixed-rate. In Ohio, a state that has had some of the highest foreclosure rates in the nation, investor owned properties accounted for 21 percent of subprime ARM foreclosures and 34 percent of subprime fixed-rate foreclosures, versus 18 percent of prime ARM and 14 percent of prime fixed-rate foreclosures. Nevada had among the highest investor-owned share of foreclosures, with investors accounting for 36 percent of subprime fixed-rate foreclosures, 18 percent of subprime ARM foreclosures, 24 percent of prime ARM foreclosures and 14 percent of prime fixed-rate foreclosures.

Borrowers who could not be located or who would not respond to repeated attempts by lenders to contact them accounted for 23 percent of all foreclosures in the third quarter, 21 percent of subprime ARM foreclosures, 21 percent of subprime ARM [sic; FRM?] foreclosures, 17 percent of prime ARM foreclosures and 33 percent of prime fixed-rate foreclosures. Thus, as a percent of foreclosures, the inability to get a borrower to respond to a mortgage servicer is a much bigger problem for prime-fixed rate borrowers than for subprime borrowers. Again the results differed widely by state and loan type. The highest was 69 percent for prime fixed-rate foreclosures in Oklahoma versus a low of 7 percent of prime ARM foreclosures in Wisconsin. Table 7 shows that in Ohio and Michigan, 25 and 26 percent respectively of all foreclosures started in those states were for borrowers who would not respond to repeated attempts to contact them or could not be located.

Borrowers who had worked with their lenders and established loan modification or formal repayment plans, and then failed to perform according to those plans, accounted for 29 percent of all foreclosures in the third quarter. The inability of borrowers to meet the terms of their repayment plans or loan modifications accounted for 40 percent of subprime ARM foreclosures, 37 percent of subprime fixed foreclosures, 17 percent of prime ARM foreclosures and 14 percent of prime fixed foreclosures. Table 8 shows that the states of Vermont, North Dakota, New Mexico and Arkansas, with little else in common, had the highest shares of foreclosures due to the inability of borrowers to live up to prior plans.

During the third quarter, mortgage servicers put in place approximately 183 thousand repayment plans and modified the rates or terms on approximately 54 thousand loans. Lenders modified approximately 13 thousand subprime ARM loans, 15 thousand subprime fixed rate loans, 4 thousand prime ARM loans and 21 thousand prime fixed-rate loans. In addition, servicers negotiated formal repayment plans with approximately 91 thousand subprime ARM borrowers, 30 thousand subprime fixed-rate borrowers, 37 thousand prime ARM borrowers and 25 thousand prime fixed-rate borrowers.

During this period the industry did approximately one thousand deed in lieu transactions and nine thousand short sales.

In an effort to put these numbers into context, Tables 9 through 13 also provide a comparison with the repayment plan and loan modification numbers. They show a breakdown of the number of foreclosures started net of those that clearly could not be helped due to reasons already discussed — investor-owned, borrower would not respond or could not be located, or borrower failed to live up to an agreement already in place. As previously discussed, the

percentages were adjusted downward to eliminate double counting for those borrowers who fell into more than one category. Therefore, while an estimated 166 thousand subprime ARM foreclosures were started during the third quarter, only 50 thousand did not fall into one of those three categories. In comparison, about 90 thousand repayment plans were renegotiated and 13 thousand loan modifications were done, for a total of 103 thousand.

Of the net 50 thousand foreclosures, many of these likely occurred due to the traditional reasons for default, loss of job, divorce, illness or excessive debt burden relative to income, not just the impact of rate resets, thus eliminating any possible benefit of a rate freeze.

1. For the purpose of this study, servicers identified "investor-owned" loans as those with a billing address different from the property address. This is a much better measure than the occupancy code the databases carry, since it is based on the declarations made by the borrower at loan closing, and we know how reliable some of those were. There would be no distinction here between a property that was never occupied by the owner and one that was occupied originally but subsequently rented.

2. The vast number of forbearances relative to modifications should give us all pause. As its name implies, forbearance is the servicer's agreement to forbear from foreclosing for a temporary, stipulated period of time, during which the borrower agrees to resume making contractual payments and make up the delinquent payments, generally in an extra monthly installment. While it is possible that a modified loan was not delinquent prior to the modification, all forbearances by definition were previously delinquent. Forbearances are faster and cheaper than modifications; servicing agreements generally give the servicer wide latitude to enter into forbearances. It is quite possible (although this issue is not addressed in the MBA report) that many forbearances are the initial stage of a modification deal: the borrower is in essence put on a "probationary" plan to catch up on payments at a temporarily reduced level, and given a permanent modification only if the borrower performs at the forbearance terms. The precise situation in which a forbearance makes sense--a borrower who occupies and is committed to homeownership and who is experiencing some temporary inability to make payments--is the precise situation in which the "Hope Now" plan makes most sense. It therefore troubles me to see no discussion of whether forbearances are being used as an initial stage of the modification process, or as a cheap, not-well-thought-out substitute that is setting repayment installments too high for borrowers to reach.

3. The data on borrowers not located or not responding merely raises the question of why that is the case. We really need to know more about this borrower group: some will be "demoralized" borrowers who simply cannot cope adequately with their distress; some will be speculators not caught with the billing address check; some will no doubt have been straw borrowers. Some will be ruthless senders of "jingle mail." But without further information, we're not able to say from this data what the best response is to this group.

Bush Calls for $145 Billion Stimulus Package

by Calculated Risk on 1/18/2008 11:50:00 AM

From AP: Bush calls for $145 billion economy plan

Apparently the proposal will be to provide tax rebates of up to $800 for individual taxpayers and $1,600 for families.

Norris: Maybe Money Would Help

by Anonymous on 1/18/2008 10:56:00 AM

Sorry to be so behind today, but I've been staring at these paragraphs of Floyd Norris's for a couple of hours. I still don't quite know what to say. But I'm sure you all do:

The ideal home buyer now — in a reverse of what was true for years — is a renter who is not burdened with a house. Such a buyer will need a down payment from somewhere, and he or she will need enough income to meet the monthly payments for the foreseeable future, including any increase in adjustable rates that seems probable.If I'm reading this correctly, the suggestion is that we could use a real economy (one that, say, provides down payments from something other than home sales and income from something other than home sales) to create first-time homebuyers who will buy existing homes from people who want to upgrade into a new home by selling the old home for a profit. Have I been drinking too much cough syrup?

But not owning a home, which may be hard to sell, is a big plus.

A year ago, having a home that had appreciated in value meant that an owner could trade up to a more expensive home. Now it means that the homeowner cannot move until the old home is sold, and that is getting more difficult.

First, the seller has to find a buyer who can get a mortgage. Second, the price has to be high enough to pay off the old mortgage and leave enough cash for the down payment on a new home. Both were taken for granted a year ago. In many markets, neither is a sure thing now.

Ambac Not Pursuing Stock Sale

by Calculated Risk on 1/18/2008 10:45:00 AM

From MarketWatch: Ambac opts against raising capital via stock sale

In a reversal on Friday, Ambac ... thought better of pursuing plans to raise about $1 billion, citing current market conditions and uncertainty that any new capital would secure its AAA credit rating.What a surprise!

The troubled bond insurer also said it would continue to evaluate its alternatives.

Employment-Population Ratio and Recessions

by Calculated Risk on 1/18/2008 01:02:00 AM

In his testimony to Congress, Chairman Bernanke argued that any fiscal stimulus package be structured to impact spending within the next twelve months, otherwise the economy would probably already be improving:

"To be useful, a fiscal stimulus package should be implemented quickly and structured so that its effects on aggregate spending are felt as much as possible within the next twelve months or so. Stimulus that comes too late will not help support economic activity in the near term, and it could be actively destabilizing if it comes at a time when growth is already improving."Professor Krugman writes Not so fast:

One assumption in Ben Bernanke’s testimony today was that if a recession happens, it will be over soon, so stimulus has to come fast or not at all. It’s by no means clear that this is right. ... both recent history and the nature of our current problem suggest that we may be in for more than a few bad months.Krugman plots the employment-population ratio, and argues that if this slowdown is like the previous two recessions, employment growth will be sluggish even after the official recession is over. Here is a long term graph of the employment-population ratio with recessions added:

Click on graph for larger image.

Click on graph for larger image.Note that the scale doesn't start at zero to better show the changes in the population ratio.

First, there has been a steady trend of a rising employment-population ratio since 1960. This is mostly due to more women joining the work force. It is very possible that this underlying trend is now flat, or even declining slightly, as the baby boomers start to leave the work force.

The waves on the long term trend are related to economic expansions and slowdowns. Historically the employment-population ratio bottomed out soon after a recession ended. However for the two most recent recessions, the employment-population ratio continued to decline, even after the recession ended.

After the 2001 recession, the ratio declined until almost September 2003, and for many people it seemed like the recession lingered for a couple of years. For the current slowdown (probable recession), the employment-population ratio has been declining for a year, and this is probably part of the reason so many people feel the economy has been in a recession for some time.

I suspect that even if the official recession is not severe (less than 8% unemployment and shorter than 12 months in duration), the employment effects will, once again, linger for some time.

WSJ on Counterparty Risk

by Calculated Risk on 1/18/2008 12:21:00 AM

Counterparty risk really hit the markets today.

From the WSJ: Default Fears Unnerve Markets. A few excerpts:

Today, a struggling bond insurer, ACA Financial Guaranty Corp., will ask its trading partners for more time as it scrambles to unwind more than $60 billion of insurance contracts it sold to financial firms but can't fully pay off ... The problem is that the insurer itself is teetering -- with repercussions across the financial world. ...

Yesterday Merrill Lynch & Co. wrote down $3.1 billion on debt securities it had tried to hedge through ACA insurance contracts, as part of a larger Merrill write-down. Earlier this week, Citigroup Inc. set aside reserves of $935 million to cover the likelihood that trading partners won't make good on trades in this market. ...

...

The issue is raising broader concern among regulators and investors over what Wall Street calls "counterparty risk," the danger that one party in a trade can't pay its losses.

...

Bill Gross, chief investment officer at Allianz SE's Pacific Investment Management Co, or Pimco, recently told investors that if defaults in investment-grade and junk corporate bonds this year approach historical norms of 1.25% (versus a mere 0.5% in 2007), sellers of default insurance on such bonds could face losses of $250 billion on the contracts.

Thursday, January 17, 2008

WaMu Conference Call

by Calculated Risk on 1/17/2008 08:59:00 PM

Here is some info from the Washington Mutual conference call, and a spreadsheet of WaMu credit risk (courtesy of Brian):

Although we are not seeing significant changes in early stage delinquencies, once a borrower is delinquent, it is difficult for them to cure their home because many prices in the country are not only deteriorating, but homes are also taking longer to sell. In addition, liquidity for consumers has decreased, with far fewer refinancing opportunities, especially for nonconforming loans. We don't expect to see an end or reversal of this trend until the level of home inventories peaks and starts to decline.

We expect the following three groups of high risk loans to drive the majority of the credit losses going forward:

$18.6 billion in subprime loans,

$15.1 billion in home equity seconds, with combined loan to values greater than 80% that were originated in 2005 through 2007, and

$2.1 billion of prime option ARMs with loan to value greater than 80% that were originated in 2005 through 2007.

The subprime portfolio is comprised of $16.1 billion in home loans and $2.5 billion of home equity loans. You will note that this portfolio comprises 44% of our total residential loan net charge-offs, but only represents 8% of our total real estate loan portfolio. The subprime portfolio is the group of loans that is responsible for the largest increase in our allowance for loan losses in 2007. However, this portfolio is in run off mode and shrank 7% in 2007. As it was the first portfolio to experience problems, we anticipate it will be the first to see delinquencies and losses peak. There has been significant press regarding potential stress to the subprime borrower, as a result of their rates adjusting upward. We've been very proactive in working with our subprime customers to modify their loans to minimize that risk.

The second group of loans comes from our home equity portfolio. At year end, only 30%, or 17.8 billion of our home equity loans were second lien and had original LTVs greater than 80%. Of that amount, 15.1 billion of those loans were originated between 2005 and 2007, when home values were near their peak. We have broken these out and identified them as being high risk group. In the fourth quarter, that group of loans comprised 26% of our total net residential loan charge-offs, but only 8% of our total real estate loan portfolio. Over the past two quarters, we have seen the number of losses from this portfolio as well as the severity of losses increased as home values have decreased. One additional important fact is this only 6% of our home equity loans were originated through our wholesale channel, as the majority were originated through our retail channels.

The last category is option ARMS. Option ARM loans with original LTV> 80% totaled $3.4 billion, or 6% of the total option ARM portfolio. Approximately two thirds or $2.1billion of these were originated between 2005 and 2007. As you can see, we don't originate many option ARM loans at LTVs above 80%. However, one of the key credit events in the life of an option ARM is when the loan recasts and minimum payments can increase dramatically. You can see on the chart that we have approximately $4.8 billion, or only 8% of the portfolio that will be impacted by recasts in 2008. As a result of recent declines in CMT rates, the MTA index used for most of our option ARM portfolio has declined, which is also taking pressure off these borrowers. The average LTV at origination of our option ARM portfolio was 72% and current average FICOs of 694. As a result, as has been the case historically, many of these borrowers may refinance their loans before the loan is recast.

The $2.1 billion of high risk loans had an average LTV at origination of 90%, which is why we've broken them out for you. During the fourth quarter, these high risk loans collectively accounted for approximately 70% of our total real estate loan net charge-offs, representing only 19% of our total real estate loan portfolio at year end. When you exclude this group of loans, the remaining first lien loans have a weighted average LTV at origination of 66%, and a current average FICO of 718. In the second lien loans have an averaged combined LTV at origination of 66% and a current average FICO of 740. For the remaining portfolio has a solid customer profile with equity cushion to withstand declines in home values

Our credit provision guidance is unchanged from what we stated in early December. We expect net charge-offs in the first quarter to be up 20 to 30% and the provision to be in the range of 1.8 to $2 billion. While difficult to predict, we expect the quarterly loan loss provision for each of the remaining quarters of 2008 to be at a similar level. If actual charge-offs differ from this expectation

Q&A, Fox Pitt:I'm wondering if you can tell us on the loans that are charging off in your first lien and home equity portfolios what is the loss severity that you are experiencing, and how has that changed versus a year ago? On your credit card portfolio, can you tell us what percentage of your portfolio is newer vintages and what percentage is California?Wamu:With regard to severities what we're seeing on prime and home equity, you know, clearly severity rates are clearly up year-over-year. We weren't even talking about severity rates a year ago. Given home price declines in key states like California , Florida , the severity rates for home equity can approach 100%, for example. In the, in the prime space, those are more like 25 to 30% type range and that obviously depends on the underlying collateral, how much capital -- how much equity's in the home, and how the individual area has performed in the environment. With regard to your questions about card, just give you some perspective. At the end of the year about 19% of our total outstandings are in California , and we haven't seen any differentiation as far as charge-offs as a percentage of our portfolio. It's pretty consistent based on the weighting in California.

Cliff Diving

by Calculated Risk on 1/17/2008 05:07:00 PM

Plenty of sites are covering the stock market, so I'll bring you the cliff diving for the ABX and CMBX indices, Commercial paper spread, and MBIA surplus notes.

From Reuters: MBIA's surplus notes plunge to 80 cents on dollar. So much for that 14% yield!

| Click on graph for larger image. This chart is the ABX-HE-AAA- 07-2 close today. Many of the ABX series are back to their record lows set in October and November. |

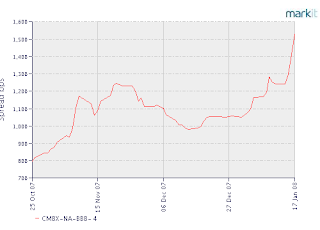

| All but one of the CMBX indices set new records today. Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down. The second graph is the CMBX-NA-BBB-4 close today. |

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies for commercial real estate is probably impacting the CMBX.

And finally, from the Federal Reserve: Commercial Paper Rates and Outstanding

The A2P2 spread is up to 85 bps (just one day, not the 5 day average). The spread is almost as high as in August, but still well below the peak at the end of the year.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).