by Calculated Risk on 1/17/2008 05:07:00 PM

Thursday, January 17, 2008

Cliff Diving

Plenty of sites are covering the stock market, so I'll bring you the cliff diving for the ABX and CMBX indices, Commercial paper spread, and MBIA surplus notes.

From Reuters: MBIA's surplus notes plunge to 80 cents on dollar. So much for that 14% yield!

| Click on graph for larger image. This chart is the ABX-HE-AAA- 07-2 close today. Many of the ABX series are back to their record lows set in October and November. |

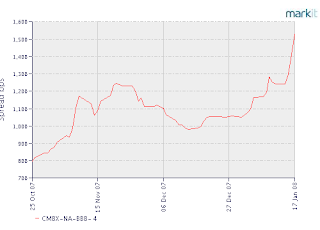

| All but one of the CMBX indices set new records today. Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down. The second graph is the CMBX-NA-BBB-4 close today. |

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies for commercial real estate is probably impacting the CMBX.

And finally, from the Federal Reserve: Commercial Paper Rates and Outstanding

The A2P2 spread is up to 85 bps (just one day, not the 5 day average). The spread is almost as high as in August, but still well below the peak at the end of the year.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).