by Calculated Risk on 12/31/2007 12:52:00 PM

Monday, December 31, 2007

More on November Existing Home Sales

For more existing home sales graphs, please see the earlier post: November Existing Home Sales

Occasionally during the housing bust, we have seen months with flat or even rising sales compared to the previous month. This brings out the bottom callers. As an example, from NAR today:

Lawrence Yun, NAR chief economist, said the market appears to be stabilizing. “Near term, existing-home sales should continue to hover in a narrow range, just as they have since September, and that’s good news because it’ll be a further sign that the housing market is stabilizing.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the seasonally adjusted annual rate of reported new and existing home sales since 1994. Since sales peaked in the summer of 2005, both new and existing home sales have fallen sharply.

Ignoring the occasional month to month increases, it is clear that sales of both new and existing homes are in free fall.

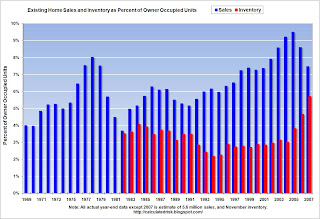

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - November sales were at a 5.0 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests sales will fall much further in 2008.

On inventory: the normal seasonal pattern is for inventory of existing homes to peak in the summer, remain fairly flat through the Fall, and then decline significantly (usually around 15%) in December. Many potential home sellers take their homes off the market during the holidays.

Then usually inventory starts increasing again in the new year. If inventory follows the normal pattern, we will probably see a decline to 3.7 million units or so in December (from 4.273 million units in November). This will bring out even more bottom callers, but it is just the normal seasonal pattern.

November Existing Home Sales

by Calculated Risk on 12/31/2007 10:00:00 AM

The NAR reports that Existing Home sales were at 5 million (SAAR) unit rate in November.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 0.4 percent to a seasonally adjusted annual rate1 of 5.00 million units in November from an upwardly revised pace of 4.98 million in October, but are 20.0 percent below the 6.25 million-unit level in November 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.

The impact of the credit crunch is obvious as sales in September, October and November declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So November sales were for contracts signed in September and October.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 4.273 million homes for sale in November.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 4.273 million homes for sale in November. Total housing inventory declined 3.6 percent at the end of November to 4.27 million existing homes available for sale, which represents a 10.3-month supply at the current sales pace, down from a 10.7-month supply in October.This is a slight decrease in the inventory level from the last few months, and the months of supply also decreased slightly to 10.3.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

The third graph shows the 'months of supply' metric for the last six years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of December 2000.

This shows sales have now fallen to the level of December 2000. More later today on existing home sales.

Gambling? In A Casino?

by Anonymous on 12/31/2007 07:01:00 AM

It's shocking. Via naked capitalism, this jewel from the WSJ on subprime lender-sponsored lobbying efforts against predatory lending regulation:

Washington lobbyist Wright Andrews and his wife, Lisa, coordinated much of the industry's lobbying. Mr. Andrews's firm, Butera & Andrews, collected at least $4 million in fees from the subprime industry from 2002 through 2006, congressional lobbying reports indicate. Mr. Andrews didn't represent Ameriquest directly. He ran three different subprime-industry trade groups: the National Home Equity Mortgage Association, of which Ameriquest was a member; the Coalition for Fair and Affordable Lending, which spent $6.3 million lobbying against state laws before it dissolved earlier this year, according to federal filings; and the Responsible Mortgage Lending Coalition.Here's a hint, Mr. Andrews. When a regulation is proposed that says lenders should adopt a certain underwriting standard, and the industry responds by saying "we already do it that way," and then pays you $4 million to stop that regulation from being enacted, you actually have some reason to believe they're pulling your leg. No, really.

In 2003, Lisa Andrews was appointed senior vice president for government affairs at Ameriquest. Her public-relations firm, Washington Communications Group Inc., claims credit on its Web site for coordinating the industry's victory in New Jersey, as well as its overall strategy at the state level. Ms. Andrews left Ameriquest in 2005 and returned to her firm. . . .

In the wake of the collapse of the subprime market, Mr. Andrews's subprime lobbying business has withered. The three trade groups he ran are gone, and most of his subprime clients have stopped lobbying.

"I certainly was not aware of the degree to which many in the industry clearly failed to follow proper underwriting standards -- the standards which they represented they were following to those of us who were lobbying," Mr. Andrews says.

Sunday, December 30, 2007

Shiller: America could plunge into recession

by Calculated Risk on 12/30/2007 08:13:00 PM

From The Times: Top economist says America could plunge into recession

Robert Shiller, Professor of Economics at Yale University, predicted that there was a very real possibility that the US would be plunged into a Japan-style slump, with house prices declining for years.We have to distinguish between various measures of house prices. Shiller is using the Case-Shiller National index to derive the $1 trillion in lost real estate values. Total household real estate assets were over $20 trillion at the peak, so a decline of $1 trillion is about 5%. (The S&P Case-Shiller national index showed a decline of 5% from the peak through Q3).

Professor Shiller, co-founder of the respected S&P Case/Shiller house-price index, said: “American real estate values have already lost around $1 trillion [£503 billion]. That could easily increase threefold over the next few years. This is a much bigger issue than sub-prime. We are talking trillions of dollars’ worth of losses.”

Click on graph for larger image.

Click on graph for larger image.This graph, from an earlier post, compares the S&P/Case-Shiller index with the OFHEO index.

The Fed Flow of Funds report is more closely tied to the OFHEO index. The most recent Fed report showed a decline of $67.2B in existing household real estate assets in Q3.

We also have to distinguish between lender / investor mortgage related losses (see the previous post on Merrill) and household real estate value losses. The former impacts the credit crunch directly, the later will probably impact consumer spending and the ability of homeowners to withdraw equity from their homes.

As Shiller notes, we could easily be talking about several trillion in lost real estate values. A 15% average decline in prices, would mean $3 trillion in losses. A 30% price decline would mean a decline of around $6 trillion in U.S. household real estate assets.

Report: Merrill Seeks More Money

by Calculated Risk on 12/30/2007 08:08:00 PM

From the Observer: Merrill seeks more funds to avoid crisis (hat tip AllenM)

John Thain, the new chief executive of Merrill Lynch, is this weekend in talks with Chinese and Middle Eastern sovereign wealth funds that could lead to the sale of another big stake in the US bank in a desperate bid to raise capital, according to sources in London and New York.Just a rumor at this point ...

...

Sources close to Merrill Lynch say that Thain has cancelled New Year leave among his top lieutenants and that his team is working around the clock on various 'scenarios' that could be employed to save the bank if problems related to the credit crunch continue to worsen.

...

Fears are mounting that Merrill Lynch will be forced to write down between $10bn and $15bn worth of assets related to CDOs ... when it reports financial results next month.

GSE Tightening Starts to Hit Home

by Calculated Risk on 12/30/2007 12:42:00 PM

Back in November, Tanta discussed the details of the new GSE loan pricing: GSEs Tighten Up Loan Pricing. The new rules are for loans delivered on or after March 1, 2008, however, as Tanta noted:

... these March deadlines are for loans delivered to the GSEs on that date, not loans made on that date. Therefore, these pricing adjustments will be made to lender rate sheets signficantly before March.These changes have just started to impact borrowers. From the Boston Globe: Preapproved and ready to move? Not so fast

Justin Moore had done his research when he set out to buy a condo. The 25-year-old said it even seemed easy when he got preapproved for a loan, found the perfect condo in Beacon Hill this fall, and readied for his December move.This is just the beginning of those pricing adjustments:

But just one week before his scheduled closing, the mortgage company that for weeks had assured him he was all set told him there were problems.

"Most of our customers have been unscathed at this point," said Rosemary O'Neil, vice president of Conway Financial Services in Norwell and past president of the Massachusetts Mortgage Association. "But after the first of the year, that changes across the board."This will lead to another ratchet down in demand for housing, starting in January. For the details of the pricing changes, see Tanta's earlier post.

In January, most companies will have adopted new standards set by Fannie Mae and Freddie Mac, two government-sponsored enterprises that serve as the largest sources of funding for US home mortgages.

Saturday, December 29, 2007

Let the Short Sale Scams Begin

by Anonymous on 12/29/2007 08:35:00 PM

Thanks to reader Brad, who sent me the link to this Broker Outpost thread. I suggest reading the replies, too.

I got an agreement of sale today from a realtor looking for a prequal on a shortsale , the buyer lives next door , he has a current mortgage for $800,000 on a home he purchase in 2005 with no money down , the home he has under contact is right across the street from his present home , the offer is for $500,000 and it looks like the bank will accept it

The borrower plans to buy it as a primary , once he moves in , they will stop making payments on the $800,000 loan that they have with CW

He qualifies full doc and has a 770 FICO , he figues letting his credit tank is not a big deal when he is lowering his mortgage debt by $300,000 .

I told him the new bank may deny the deal based on occupancy , tried to convince him to go NOO but he does not want the higher rate .

What do you think ? anyone had this scenario yet , I sure it will be happening more and more especially in CA and FL

Looking back at 2007 Housing Predictions

by Calculated Risk on 12/29/2007 04:54:00 PM

At the end of 2006, I offered some predictions for housing in 2007. Looking back it's hard to believe these predictions were out of the mainstream.

My overall view for the 2007 housing market was "falling prices, falling sales, falling residential construction employment, falling starts, falling MEW, falling percentage of equity, and rising foreclosures".

I expected that "existing home sales will "surprise" to the downside, perhaps in the 5.6 to 5.8 million unit range". It now looks like existing home sales will be close to 5.6 million.

I expected prices to fall "1% to 3% nationwide" as measured by OFHEO. OFHEO reports that the Purchase Only index are up 1.1% for the first three quarters, with prices falling in Q3. It now looks like OFHEO prices will be about flat for the year. Another index, S&P / Case-Shiller, shows prices down 3.7% through the first three quarters of 2007.

I also argued "Foreclosures will be approaching record levels in some states." If anything, I was too optimistic on foreclosures. In California, Notice of Default activity is well above previous record levels.

And my biggest error was on residential construction employment. I argued:

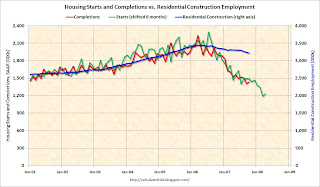

"We will see record residential construction job losses in 2007.According to the BLS, residential construction employment has only fallen 222K in 2007. I've been showing this graph all year:

... the loss of 400K to 600K residential construction employment jobs over the next 6 months."

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.There are many reasons why the BLS reported employment hasn't fallen as far as expected (blue line). Some of the possible explanations include: the BLS has not correctly accounted for illegal immigrants working in the construction industry, the BLS Birth/Death model might have missed the turning point in residential construction employment, many workers have moved to commercial work, and many workers (subcontractors) are underemployed.

There is some merit to to all of these arguments, and I think the answer will be some combination of these explanations. The concern now is that if commercial construction spending slows, as appears likely from the recent Fed loan survey, then workers that have moved to commercial construction will have no work opportunities.

This was the concern expressed by the director of forecasting of the NAHB in August. From Reuters: Construction job losses could top 1 million

"The ability of nonresidential to continue absorbing additional workers is going to be limited, and that's going to put downward pressure on construction employment overall," [Bernard Markstein, director of forecasting at the National Association of Home Builders] said, adding that cuts may be deeper than in the 1990s.Whatever the reason, I was too pessimistic on residential construction employment in 2007.

And finally, for amusement, Jon Lansner at the O.C. Register interviews local economist Mark Schniepp: Economist eyes home sales pickup in ‘08. This is an amazing quote:

A year ago, we didn’t know what a subprime loan was, nor did anyone expect the likelihood of a “credit crunch.”Oh yeah.

Economist Mark Schniepp, Dec 29, 2007

Tanta and I have been writing about subprime loans for as long as this blog has existed. And as far as a credit crunch, back in January I mentioned the possibility of "a credit crunch based on bad loans in the RE sector (and possibly in CRE and C&D too)".

And many others were discussing these issues too.

We all make errors in forecasting - no one has a crystal ball - but I'm endlessly amused by the 'no one could have known' excuse.

On Option ARMs

by Anonymous on 12/29/2007 02:15:00 PM

This is a bonus post for those of you who use Excel (or some other software with which you can read and play with .xls files). I'm afraid that those of you who do not possess such software will have to use your imagination here. It's not especially practical to post images of big spreadsheets on the blog, so if you want to see the numbers, you'll need to download the spreadsheets.

These links will download the spreadsheets:

LIBOR-Indexed OA Projection

MTA-Indexed OA Projection

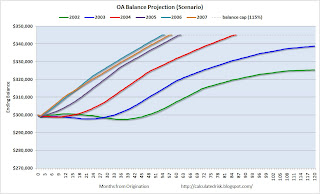

I made two of them for you to play with. Both show a to-date balance history, plus a future balance projection, for a hypothetical Option ARM with payments beginning in 2002, 2003, 2004, 2005, 2006, or 2007. The loan terms are identical for each spreadsheet with the exception of the index chosen: one uses MTA, the other 1-Month LIBOR. The terms of these scenarios are in fact derived from real loan products out there, but of course there are other ways of structuring OAs. I am not making a claim about what product structure was most common (or most likely still to be on the books), as I don't have that kind of data.

What I had in mind for this exercise is to help people see, clearly, how these things work (some folks are still, Lord love you, a bit confused about OA mechanics. That undoubtedly includes some of you who have one. Remember that if you do, your loan might not work like this because the note you signed might have different terms regarding adjustment frequency, balance cap, margin, etc.) Besides that, I wanted to make a fairly simple point about the issue of resets, payment shock, and timing on these things.

That's why the spreadsheets show multiple vintages with identical loan terms: you can see that the actual speed of negative amortization and the forecast date of recast on these loans varies quite dramatically for the vintages, because of the huge impact of the very low 2002-2003 rate cycle. Each of these scenarios assumes that the borrower always makes the minimum payment from inception of the loan, and each assumes that future index values are identical to the most recent available index value (December 2007). Yet even in those circumstances, the earlier loans (2002 and 2003, especially) negatively amortize much more slowly than the later vintages.

My gifted co-blogger has actually created some lovely charts to help make that clear:  Click on graph for larger image.

Click on graph for larger image.

If you've downloaded the spreadsheets, you can play around with them a little in terms of the future interest rates on these loans, and you can see how the recast date (the date the balance hits the balance cap and the loan payment must be recast to fully amortize over the remaining term) moves forward or back depending on what you do with the rates. This is one reason why modeling actual portfolios of OAs is such a challenge: you have to make assumptions about what will happen with the underlying index.

Of course, in actual portfolio modeling, you would also not assume that every borrower will always make the minimum payment. You would have to look at actual borrower performance to date, and calculate some "average" behavior or project each borrower's past behavior patterns into the future. I am not making the claim that all borrowers always make the minimum payment from inception; I'm trying to show what would happen, in some examples, if a borrower did that. I have heard estimates from different OA portfolios of anywhere from one-third to ninety percent of borrowers who have, historically, done that.

One other thing I wanted to make clear by providing these examples is the mechanics of payment increases for a very common OA type. The product shown in these spreadsheets allows for annual payment increases, but monthly rate increases. (That is how the potential for negative amortization gets created: the payment does not automatically adjust to match the new interest rate each month.) The eventual recast hits at the sooner of the loan reaching 115% of its original balance or 120 months. We know that a recast is nearly always a huge shock, given a low enough introductory rate. But this loan does involve payment increases of up to 7.5% each year (i.e., the next year's payment can be as much as 107.5% of the prior year's payment).

With the later vintage loans, especially, I for one have no confidence that the borrower was qualified at realistic enough original DTIs to withstand several years of payment increases, even before that nasty shock of the recast.

You may if you like change that introductory rate on these loans--I used 1.00%. You will see that increasing that introductory rate actually slows down the negative amortization in most scenarios. (That is because it creates a higher initial first year payment, which thus creates less of a shortfall between interest accrued and payment made.) I suspect that this fact about OA is surprising to some people, who think that folks who got a 1.00% "teaser" on these things got some real deal. In reality, a borrower who was given an introductory rate several points higher than that is probably doing much better, balance-wise.

My scenarios involve the assumption that the initial payment is fixed for only one year. There are OAs out there where the first payment change is two or even up to five years from the first payment date. (They will generally involve a higher introductory rate and margin.) You can change these spreadsheets to extend the original payment out for longer than a year, if you like, and you'll see just how much faster that balance cap hits when you extend the fixed payment period. Ouch.

Finally, while I chose the repayment periods I did quite arbitrarily, you will notice that for both the MTA and LIBOR scenarios, the most recent index value (December 2007) is substantially lower than it had been for quite some time. This means that my balance forecast here just happens to have picked up a relatively low last known index to project out into the future. Had we done this exercise several months ago, the projected future index value would have been higher, and hence the future negative amortization would have been faster. It's an issue to keep in mind as we look at portfolio and security projections regarding OA recasts; those will have to be updated from time to time as rate history unfolds.

And yes, there's a pig, if that makes you want to bother downloading the spreadsheets.

Friday, December 28, 2007

Fed gives Tanta a Hat Tip

by Calculated Risk on 12/28/2007 07:00:00 PM

From Adam Ashcraft and Til Schuermann: Understanding the Securitization of Subprime Mortgage Credit

See page 13:

Several point raised in this section were first raised in a 20 February 2007 post on the blog http://calculatedrisk.blogspot.com/ entitled “Mortgage Servicing for Ubernerds.”Note: there is link in the menu bar for Tanta's UberNerd series: The Compleat UberNerd.

Here is the introduction:

How does one securitize a pool of mortgages, especially subprime mortgages? What is the process from origination of the loan or mortgage to the selling of debt instruments backed by a pool of those mortgages? What problems creep up in this process, and what are the mechanisms in place to mitigate those problems? This paper seeks to answer all of these questions. Along the way we provide an overview of the market and some of the key players, and provide an extensive discussion of the important role played by the credit rating agencies.This report is recommended reading to understand the entire securitization process. Congratulations to Tanta, and hopefully she will comment on the report.

In Section 2, we provide a broad description of the securitization process and pay special attention to seven key frictions that need to be resolved. Several of these frictions involve moral hazard, adverse selection and principal-agent problems. We show how each of these frictions is worked out, though as evidenced by the recent problems in the subprime mortgage market, some of those solutions are imperfect. In Section 3, we provide an overview of subprime mortgage credit; our focus here is on the subprime borrower and the subprime loan. We offer, as an example a pool of subprime mortgages New Century securitized in June 2006. We discuss how predatory lending and predatory borrowing (i.e. mortgage fraud) fit into the picture. Moreover, we examine subprime loan performance within this pool and the industry, speculate on the impact of payment reset, and explore the ABX and the role it plays. In Section 4, we examine subprime mortgage-backed securities, discuss the key structural features of a typical securitization, and, once again illustrate how this works with reference to the New Century securitization. We finish with an examination of the credit rating and rating monitoring process in Section 5. Along the way we reflect on differences between corporate and structured credit ratings, the potential for pro-cyclical credit enhancement to amplify the housing cycle, and document the performance of subprime ratings. Finally, in Section 6, we review the extent to which investors rely upon on credit rating agencies views, and take as a typical example of an investor: the Ohio Police & Fire Pension Fund.

We reiterate that the views presented here are our own and not those of the Federal Reserve Bank of New York or the Federal Reserve System. And, while the paper focuses on subprime mortgage credit, note that there is little qualitative difference between the securitization and ratings process for Alt-A and home equity loans. Clearly, recent problems in mortgage markets are not confined to the subprime sector.

Also note the last two sentences of the introduction: "... while the paper focuses on subprime mortgage credit, note that there is little qualitative difference between the securitization and ratings process for Alt-A and home equity loans ... recent problems in mortgage markets are not confined to the subprime sector."