by Anonymous on 9/18/2007 07:38:00 AM

Tuesday, September 18, 2007

PHH Sale Problems: Update Your Scorecard

Bloomberg reports:

MT. LAUREL, N.J. - PHH Corp., the mortgage lender that agreed to be bought by General Electric Co. and Blackstone Group LP, said the $1.8 billion sale could unravel as lenders back away from some leveraged buyouts.In case you happen to be curious about it, PHH was once an independent company that got sucked into the Cendant conglomeration of "affiliated businesses," mixing mortgages and real estate sales and all kinds of other stuff. Then after the spectacular accounting fraud at Cendant, PHH got "spun back" to being an independent company, until GE saw

JPMorgan Chase & Co. and Lehman Brothers Holdings Inc. told Blackstone they might fall $750 million short in funding its part of the deal, PHH said Monday. GE, which plans to keep the company's vehicle-leasing unit, might pull out if Blackstone can't get financing. . . .

PHH is the second company in a week to warn that an LBO could be derailed as banks seek to renege on lending commitments for smaller buyouts while sticking with big deals such as Kohlberg Kravis Roberts & Co.'s $26 billion takeover of First Data Corp. Reddy Ice Holdings Inc. said last week that Morgan Stanley might back out of selling debt for GSO Capital Partners LP's purchase of the company.

"There will be some deals that won't get done, but it won't be the big names," said billionaire financier Wilbur Ross, whose New York-based WL Ross & Co. invests in distressed companies. "Some of the smaller deals have better escape hatches." . . .

"We continue to hope that Blackstone will succeed in arranging its financing so the merger can be completed," said Stephen White, a spokesman for Fairfield, Conn.-based GE. "But if Blackstone is unable to complete its purchase, GE will not be obligated to complete the merger."

In March, GE agreed to buy PHH and resell the mortgage unit to New York-based Blackstone, manager of the biggest buyout fund. PHH said Monday it told GE that it expects the company to "fulfill its obligations under the merger agreement."

PHH is a big mortgage originator, although you might not realize that because a huge chunk of its business is "private label outsourcing" of one kind or another. Lots of smaller banks and credit unions, for instance, and a few larger financial firms like AmEx use PHH to originate and service loans under a "private label" arrangement that is opaque to the consumer. PHH will, for instance, issue a separate phone number to Little Dog Bank's "mortgage department," which will be given to Little Dog's customers. When they call, the PHH reps answer "Little Dog Bank, how may I help you?" or words to that effect. So a lot of what goes on that looks like "retail" lending is actually running through PHH's fee-for-service outsourcing operations. So is a lot of "direct lending," insofar as PHH's private label clients offer their own customers a "loan by phone" option that involves calling PHH-in-drag. There can be loans brokered to Little Dog that are really closed by PHH pretending to be Little Dog Wholesale. You would need Visio more than you would need Excel.

The whole point of this, besides making it less expensive for a Little Dog or a financial services company like AmEx that doesn't primarily originate mortgages to "originate" mortgages, is the "branding" part, which involves either "seamless customer service" or "endless opportunities to sell you more stuff," depending on which PR you are reading. For a lot of outfits, the mortgage loan itself isn't the "profit center": it's the other accounts or insurance policies or what have you that can be "cross-sold" to people with mortgage loans. Alternately, the ability to offer these "private label" mortgages is a way to hang onto depositors or other account-holders who want all their accounts, including their mortgage, at one place. Of course they aren't all at one place; they look like they're all at one place. Which is why putting it all at GE, which once apparently made lightbulbs and has been in and out of the mortgage business more times than the set changes at Phantom of the Opera, makes perfect sense. If only the credit markets saw it that way.

Monday, September 17, 2007

BofA Warns of "unprecedented dislocations'"

by Calculated Risk on 9/17/2007 05:29:00 PM

From Bloomberg: Bank of America Sees `Meaningful Impact' From Turmoil (hat tip ShortCourage)

Bank of America Corp., the second- biggest U.S. bank, said ``unprecedented dislocations'' in credit markets will have a ``meaningful impact'' on third-quarter results at its corporate and investment bank.The confessional is now open.

Trading and other areas of Bank of America's capital markets and advisory services unit are ``being adversely affected by all of these conditions,'' Chief Financial Officer Joe Price told investors at a conference in San Francisco today. He cited stress on subprime mortgages and in the commercial paper market as being especially severe.

``These are quite challenging financial times, and I cannot remember when credit markets in particular have been as volatile and unpredictable as they have been for the last few months,'' Price said.

E*Trade Warns of Mortgage Fallout

by Calculated Risk on 9/17/2007 04:57:00 PM

From the WSJ: E*Trade Warns of Mortgage Fallout (hat tip Mike - he has more specifics)

E*Trade Financial Corp. ... this afternoon warned investors that it has been badly stung by the recent fallout in the mortgage market.This will be an interesting week. Heck, tomorrow alone will be an interesting day: the Fed meeting, Lehman reports, and the homebuilders index will be released.

The company says it expects profits to come in 31% below the most recent guidance it had given analysts -- partly due to its exposure to the mortgage business.

The news, weeks ahead of its scheduled third-quarter earnings report, provided Wall Street with a glimpse of what may be in store tomorrow when the country's biggest brokerages, beginning with Lehman Brothers Holdings Inc., start reporting third quarter earnings.

Government Guarantees All Deposits at Northern Rock

by Calculated Risk on 9/17/2007 02:37:00 PM

Note: Video of the Day (bottom of posts) is an interview with customers in a Northern Rock queue this morning.

From the Guardian: Government guarantees Northern Rock deposits

The chancellor of the exchequer, Alistair Darling, this evening promised that the government will guarantee all savings deposits at Northern Rock amid concern that Britain is plunging into its worst banking crisis in decades.These are stunning developments in the UK. Clearly there is concern that the run at Northern Rock will spread to other institutions (like Alliance & Leicester).

The move follows a dramatic last-minute collapse in the share price of Alliance & Leicester, which fell 32% in late trading this afternoon, and sparked fears of "contagion" from Northern Rock to other financial institutions.

Mr Darling said: "I can announce today that following the discussions with the Governor (of the Bank of England) and the Chairman of the FSA, should it be necessary, we, with the Bank of England would put in place arrangements that would guarantee all the existing deposits in Northern Rock during the current instability."

This evening queues were still stretching out of the door at branches of Northern Rock across the country, with more than £2bn already taken out by anxious savers. The value of Northern Rock shares fell sharply again today, down by 35%, but in late trading it was overtaken by a startling drop in the share price of Alliance & Leicester, Britain's seventh largest bank.

...

Northern Rock, in a formal statement issued after the Mr Darlling spoke, said that "The Chancellor's statement makes it clear beyond any doubt that all savings in Northern Rock are safe and secure. Consequently anybody who is in a queue outside a branch, or who is trying to access an online account can be fully reassured that there is no cause for concern whatsoever."

It also promised to refund any penalties that savers may have paid when they withdrew their funds from the bank - so long as they put the money back in by October 5. "Any customer who paid a penalty to withdraw their funds from Northern Rock, due to concern over the current situation, will have the penalty refunded if they reinvest those funds in the same type of account with Northern Rock by 5 October 2007," it said.

The UK version of FDIC insurance actually motivates many depositors to remove their bank deposits. Only the first 2000 pounds is 100% guaranteed, and the next 30,000 (or so) is 90% guaranteed. No one wants a 10% haircut, so it makes sense to remove any deposits over 2000 pounds.

This new guarantee should calm depositor's fears.

Fed Flow of Funds for Q2

by Calculated Risk on 9/17/2007 01:27:00 PM

The Federal Reserve released the Q2 Flow of Funds report today.

Household mortgage borrowing increased to $195.4 Billion in Q2 (up from $176.3B in Q1, and $178.6B in Q4 2006). The mortgage equity withdrawal numbers will probably show an increase in Q2, before plummeting in the current quarter.

The amount withdrawn from homes was more than total home values increased (including the addition of new homes), so the total homeowner equity fell for the first time since 1994. This was not due to falling prices, rather homeowner equity declined because of the large amount of equity extracted from homes in Q2.

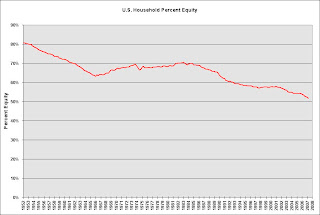

Household percent equity was at an all time low of 51.7%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

For more, see Rex Nutting's article at MarketWatch: Homeowners' equity falls for 1st time in 13 years

Hovnanian "Deal of the Century" Called Successful

by Calculated Risk on 9/17/2007 12:29:00 PM

From Hovnanian: Hovnanian Enterprises Announces Successful Preliminary Sales Results for the 'Deal of the Century' Nationwide Sales Campaign

Over the course of the three-day event, the Company reported more than 2,100 gross sales including more than 1,700 contracts and more than 400 sales deposits. Due to the overwhelming number of customers who visited our communities during the 72 hour sales event and strong demand for our homes, our sales staff in some of our community locations only had enough time to take deposits from our customers rather than completing the more extensive process of taking contracts.According to Bloomberg, Hovnanian had hoped "to sell 1,000 homes this weekend".

Northern Rock Bank Run Returns

by Calculated Risk on 9/17/2007 10:47:00 AM

| From Paul in London. Northern Rock branch in Hounsditch, City of London on Monday. |  |

| From Paul in London. Northern Rock branch in Hounsditch, City of London last Friday at 3 PM. |  |

From Bloomberg: Lending Rates Surge as Northern Rock Concern Deepens

Photo: Northern Rock customers queue from the banks entrance,left, onto the pavement outside the branch in Golders Green, London, on Sept. 17, 2007. Photographer: Will Wintercross/Bloomberg News

MMI: Looks Like a Flotation Device is in Order Here

by Anonymous on 9/17/2007 10:11:00 AM

Today we reflect on the age-old question: if a business reporter is not contributing to the success of the tribe, can we put it on an ice floe and let it float out to sea?

IF you’re considering wading into the housing market as a buyer, seller or borrower, be prepared for choppy water and even an occasional rogue wave. Summer may be just about over, but hurricane season, at least in housing, continues.Don't worry, this article has some good solid consumer advice for you waders:

What are your options if you’re worried about rising rates?“If you don’t need that 30-year protection, there’s no point in paying for it." This quote appears in the same article that notes that, given the lack of ARM discounting at the moment, you actually get that 30-year protection for free, whether you "need" it or not, by taking the fixed rate. Plus, we've seen a few glitches lately with that business of being "sure" you will move before the reset fun starts. I notice we never addressed the question of why you would pay transaction costs and take god-awful price risk to buy a house you are "sure" you will only be in for a few years.

Risk-tolerant home buyers still might consider an ARM. The initial rates on these loans are often, but not always, lower than those for fixed-rate ones. On Friday the national average rate on a one-year ARM was 6.35 percent, according to HSH Associates, about the same as the rate for a 30-year conforming mortgage. Lenders also offer ARM’s with initial fixed-rate periods of one, five, seven and even 10 years.

Be aware that borrowing via an ARM means, in essence, betting either that interest rates will be steady or fall once your loan begins to adjust, or that you’ll be able to refinance.

That risk makes sense for people who are sure they will move before the adjustments begin. “If you don’t need that 30-year protection, there’s no point in paying for it,” said David C. Schneider, president of the home loans group at Washington Mutual in Seattle. “And you need to understand that you do pay for it.” Over the life of a loan, a higher interest rate can translate into tens of thousands of dollars in additional payments.

As is typically the case in financial matters, it pays to shop around when seeking a mortgage. At the moment, 30-year fixed-rate loans are a better deal than many shorter-term ARM’s, Mr. Gumbinger said.

Dudes, it's time to update the quote-bots. The old ARM quotes are inoperative. New ARM quotes have been issued. Clear your cache. Thank you for your cooperation.

Greenspan on 60 Minutes

by Calculated Risk on 9/17/2007 01:53:00 AM

Here are the videos:

Greenspan on the Housing Crisis

Greenspan on Past & Future

NOTE: From the segment: "[Greenspan] got so close to Clinton and his economic team, that he began visiting the White House as often as once a month, something his predecessors had not done."

But 60 minutes didn't note that Greenspan spent far more time with Bush. (source)

In the 1996-2000 period it was apparently necessary for the chairman to visit the White House about 12 times per year, or once per month. For no apparent reason, Mr. Greenspan's visits to the White House tripled from just 12 in 2000 to 37 in 2001, when Bush took office.Greenspan on Rising Inflation

Starting in January 2001 ... [Greenspan] visited the White House at least three times per month, with the only slowdown in June and July of that year.

What were previously monthly meetings continued to skyrocket to over one per week in both 2002 (55 meetings) and 2003 (68 meetings).

These White House meetings since 2001 were with officials at the highest level, something Mr. Greenspan did not do in 2000 or apparently since 1996 based on his monthly meetings there. For example, in 2003 he met with the President once, Vice President Cheney seven times, Condoleezza Rice six times, and Chief of Staff Andy Card three times. In March 2003 he had 14 White House meetings, and in July 2003 he met with six members of the Cabinet, including Colin Powell.

Greenspan on Mortgage Meltdown

Greenspan on Iraq

A few reviews:

From Economist's View: What Did Greenspan Say and When Did He Say It?

Sad Alan’s Lament, by Paul Krugman, Commentary, NY Times (excerpts at Economist's View and Naked Capitalism)

A more favorable view from Greg Ip at the Wall Street Journal: Checking Greenspan’s Book Against Historical Record

Sunday, September 16, 2007

Greenspan: House Prices to Fall Significantly

by Calculated Risk on 9/16/2007 05:52:00 PM

From the Financial Times: Greenspan alert on US house prices (hat tips Carlomagno houston)

US house prices are likely to fall significantly from their present levels, Alan Greenspan has told the Financial Times, admitting that there was a bubble in the US housing market.See the article for Greenspan's comments on SIVs and commercial paper. Greenspan is trying to generate interest for his memoirs, but these comments on the housing bubble and falling house prices are still note worthy.

In an interview ahead of the release on Monday of his widely-anticipated memoirs, the former chairman of the Federal Reserve said the decline in house prices “is going to be larger than most people expect”.

...

Mr Greenspan said he would expect “as a minimum, large single-digit” percentage declines in US house prices from peak to trough and added that he would not be surprised if the fall was “in double digits”.

...

As Fed chairman, Mr Greenspan had talked about “froth” in the housing sector, but never said there was a bubble in the market as a whole. His successor Ben Bernanke has also avoided the word “bubble”.

But Mr Greenspan told the FT that froth “was a euphemism for a bubble”.