by Anonymous on 7/28/2007 10:10:00 AM

Saturday, July 28, 2007

Wounded Innocence 1, Seasoned Vigilance 0

by Anonymous on 7/28/2007 09:12:00 AM

Mr. Ubiquitous, Joshua Rosner, got some op-ed space in the New York Times the other day. (Perhaps he's gotten a bit impatient with merely being Gretchen Morgenson's go-to guy on this topic and wants the byline.) So open up the paper with me, and read:

FOR five months, it has been clear thatAck! Ack! Ack! (Sorry, friends, but that coffee that just came out of my nose was hot).

rising delinquencies and foreclosures, coupled with higher interest rates on adjustable mortgages and declining home price appreciation, would undermine the market for mortgage securities. Yet it took Moody’s Investors Service, Fitch Ratings and Standard & Poor’s, the three leading agencies that rate long-term debt, until this month to react to this looming financial crisis, which involves more than $1.2 trillion of subprime mortgages originated in 2005 and 2006 alone. As one investor asked during a recent S.&P. conference call, “What is it that you know today that the markets didn’t know three months ago?”The S&P analyst in my dreams replied: "Well, Bob, we knew you knew this three months ago but you bloody weren't going to sell any of it until we downgraded it, so we had a pool going in the office to see how long we could play chicken with you. Sorry you're so upset, but I won $100 off you just this morning, so this wasn't an entire waste of time. If Mr. Market is so damned much smarter than we are, why weren't you happily playing ratings arbitrage? Don't tell me you're still long? Ha ha ha ha ha--excuse me. Next question?"

The two largest credit rating agencies, Moody’s and S.&P., announced two weeks ago that they are reviewing and lowering ratings on many of the $17.2 billion in residential mortgage-backed securities. They are doing the same for the pools of these loans known as collateralized debt obligations. The effort is, to use a well-worn but apt phrase, too little, too late. But it is not too late for regulators and legislators to take steps to restore investor confidence and to ensure the future of these markets.I assume all readers of this blog understand what "restoring investor confidence" means. If you don't, would you like to buy some cheap mortgage-backed securities?

The subprime crisis has not been averted. In fact, it is still largely ahead of us. The downgrades represent only a small fraction — about 2 percent of the mortgage-backed securities rated for the year between the fourth quarters of 2005 and 2006 — of what the rating agencies suggest could be a mountain of bad debt held by investors, including pension plans, banks and insurance companies. The agencies are primarily downgrading assets with expected losses that are already working their way through the pipeline. They are not projecting future losses.Of course they're projecting future losses. That's why so many of them went on that "Watch Negative" thingie. Tanta begins to think there might be something tendentious going on here.

Nor do the downgrades apply only to lower-rated securities. Some even relate to the performance of debts that are rated AAA, meaning the agencies judged them to be of the best quality — bulletproof."Bulletproof"? The regulatory distinction is between "speculative grade" and "risk free"? Those banks and others are holding reserves and risk-based capital against their "investment grade" assets because S&P promised that the money was both "invested" and "sewn into the mattress" at the same time? I must have been watching Star Trek reruns when that news got posted on Yahoo! Finance.

The credit ratings agencies play a more important role in debt markets than stock analysts do with regard to equities. No one was told they could buy a certain stock only if, for example, an unscrupulous stock analyst said it was a “buy.” But regulators require banks, insurance companies and pension managers to purchase only high-quality debts — and the quality is judged by ratings agencies.

Fitch, Moody’s and S.&P. actively advise issuers of these securities on how to achieve their desired ratings. They appear to be helping investment banks, hedge funds and fund companies, all of which have a fiduciary obligation to investors, to develop the worst possible product that would still achieve a certain rating.Really? Tell it to the people who got an IO 2/28 with a 6.50% margin and a prepayment penalty, brother. There's a big, competitive contest for "worst possible product."

S.&P. has stated that it now has reason to “call into question the accuracy of some of the initial data provided to us.” This suggests that S.&P. may have chosen either to merely accept the data offered it by issuers without doing its own due diligence. Or worse, S.&P. could have ignored other information because it might have hurt revenues by reducing the number of assets it could have rated.Those data tapes had doc type codes on them, dude, which did appear in your prospectus. Which part of "stated income" has you confused? What exact kind of "due diligence" did you think was going to help with that problem? ("Let's see . . . originator claims the borrower's income is unverified and unverifiable. Hmmm . . . well, that looks right to me. Next file!")

The Securities and Exchange Commission, working with Congress if necessary, should require the credit rating agencies to regularly review and re-rate debt securities. Rating agencies are typically paid by issuers and only for initial ratings, which leads to much of the shoddy analysis and questionable timing in the re-rating of securities.Don't get me wrong. I'm all in favor of investors having to shell out money for due diligence. I have this idea that increasing the up-front cost of risk-taking (rather than leaving it all "back-loaded") might introduce a tad bit of market discipline. I could also work up some enthusiasm for stock analysts who stop punishing mortgage originators for having too much of that "operational expense" like Quality Control analysts who haven't been laid off yet. And simply licensing mortgage brokers and forcing them to have basic fiduciary requirements would warm the cockles of my disgusted little heart.

Training and qualification standards for ratings analysts should also be required to help create consistent, objective, transparent and replicable methods. Moreover, rating agencies should put in place automated and objective systems, based on the changing value of underlying assets, to continuously re-rate debt structures.

Lastly, many accountants and government officials endure a “cooling off” period before they can work for a client. A similar delay for ratings analysts would greatly enhance the integrity and independence of the rating process. Right now, nothing stops a ratings analyst from taking a lucrative job at a bank whose deal he has just rated.

Each of these actions would serve the interest of investors large and small, public and private. Unless the government acts, the credit ratings agencies will stand on the sidelines of the coming crisis, doing nothing until it’s already happened.

It is possible that after all that, I could get talked into shedding a few precious, glistening tears for hedge fund investors who do not themselves wish to be regulated, but who wish the rating agencies to be regulated, so that they can chase yield with no risk. But, you know, before I get behind any regulatory policy that "protects" these guys from the for-profit rating agencies onto which they happily off-load the unglamorous parts of being a Big Money Investor, I want to know what they're holding, and how those hedges are doin'. Open kimono for me, open kimono for you.

Ed. Note: I wrote this the other day* but forgot to publish it. As Mad-Eye Moody** would say, "Constant vigilance!"

*Hat tip, AS!

**No relation to the rating agency

Commercial Real Estate Delinquencies Rise

by Calculated Risk on 7/28/2007 02:31:00 AM

From the WSJ: Hints of Broader Problems Arise in Real-Estate Loans

Delinquencies on loans that back commercial mortgage-backed securities rose for the first time since 2003 in the second quarter, potentially a sign that real-estate problems are broadening to the commercial sector.The AHM story will get the buzz (previous post), but this actually might be more important for the overall economy.

CMBS delinquencies rose 13% in the second quarter to $1.65 billion from $1.46 billion in the first quarter, according to a new report by Standard & Poor's, which attributes the rise to overaggressive loans made in 2006, as well as increased problems in the retail sector.

American Home Mortgage Delays Dividend

by Calculated Risk on 7/28/2007 02:06:00 AM

Press Release: American Home Mortgage Investment Corp. Delays Payment Dividends (hat tip barely)

American Home Mortgage Investment Corp. announced today that its Board of Directors has decided to delay payment of its quarterly cash dividend ... in order to preserve liquidity until it obtains a better understanding of the impact that current market conditions in the mortgage industry and the broader credit market will have on the Company's balance sheet and overall liquidity. The disruption in the credit markets in the past few weeks has been unprecedented in the Company's experience and has caused major write-downs of its loan and security portfolios and consequently has caused significant margin calls with respect to its credit facilities.I can't recall a declared dividend being "delayed". This can't be good.

The quarterly cash dividend of $0.70 per share on the Company's common stock had been declared on June 15, 2007 and was to be paid on July 27, 2007 to all shareholders of record as of July 9, 2007. The Series A Preferred Stock dividend and Series B Preferred Stock dividend had been declared on June 15, 2007 and are payable on July 31, 2007, to shareholders of record as of July 9, 2007.

emphasis added

Friday, July 27, 2007

Census Bureau: Vacancy Rates Decline Slightly in Q2

by Calculated Risk on 7/27/2007 10:20:00 PM

From the Census Bureau on Residential Vacancies and Homeownership

National vacancy rates in the second quarter 2007 were 9.5 (+/- 0.4) percent for rental housing and 2.6 (+/- 0.1) percent for homeowner housing, the Department of Commerce’s Census Bureau announced today. The Census Bureau said the rental vacancy rate was not statistically different from the second quarter rate last year (9.6 percent), but was lower than the rate last quarter (10.1 percent). For homeowner vacancies, the current rate was higher than a year ago (2.2 percent), and lower than the rate last quarter (2.8 percent). The homeownership rate at 68.2 (+ 0.5) percent for the current quarter was lower than the second quarter 2006 rate (68.7 percent), but was not statistically different from the rate last quarter (68.4 percent).

Click on graph for larger image.

Click on graph for larger image.The first graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the decline in Q2 was statistically significant.

This small decline in Q2 leaves the homeowner vacancy rate almost 1% above normal, or about 750 thousand excess homes.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. This would suggest there are about 600 thousand excess rental units in the U.S. that need to be absorbed.

More on this when I finish my mid-year housing update.

BEA: Q2 Mortgage Debt Increase

by Calculated Risk on 7/27/2007 06:46:00 PM

Note: This is an estimate of the total increase in household mortgage debt, not to be confused with MEW (Mortgage Equity Withdrawal or extraction). MEW is a subset of this amount. The gold standard for net equity extraction is the Kennedy-Greenspan data usually available, courtesy of Dr. Kennedy, a few days after the Fed's Flow of Funds report is released. For Q2 2007, the Flow of Funds report is scheduled to be released on September 17, 2007.

As a supplement to the advance GDP report (released today), the BEA provides an estimate of mortgage interest paid for the quarter, and the effective mortgage interest rate. With a little work, an estimate of the total increase in mortgage debt for the quarter can be derived. Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly increase in household mortgage debt based on the Fed's Flow of Funds report compared to the BEA derived increase in mortgage debt. Note that the BEA data is Seasonally Adjusted (SA) and the Flow of Funds data is Not Seasonally Adjusted (NSA).

NOTE: It is difficult to compare NSA vs. SA data. In this case, the current quarter (Q2) appears to have the least seasonal adjustment. Use with caution: my confidence in this analysis for any single quarter is not high.

The BEA data suggests that total household mortgage debt increased by $188 Billion in Q2. If this estimate is close, this suggests that MEW increased in Q2 - possibly boosting consumer spending. If this advance estimate is correct, this will be a surprise - an understatement - and raise even more concerns about consumer spending later this year.

GDP and Fixed Investment

by Calculated Risk on 7/27/2007 09:49:00 AM

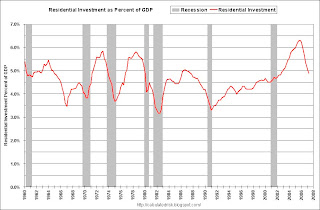

The first graph shows Residential Investment (RI) as a percent of GDP since 1960. Click on graph for larger image

Click on graph for larger image

Residential investment, as a percent of GDP, has fallen to 4.88% in Q2 2007. The median for the last 50 years is 4.58%.

Although RI has fallen significantly from the cycle peak in 2005 (6.3% of GDP in Q3 2005), RI as a percent of GDP is still well above all the significant troughs of the last 50 year (all below 4% of GDP). Based on these past declines, RI as a percent of GDP could still decline significantly over the next year or so.

The fundamentals of supply and demand also suggest further significant declines in RI.

Non Residential Structures Investment in non-residential structures continues to be very strong, increasing at a 22% annualized rate in Q2 2007.

Investment in non-residential structures continues to be very strong, increasing at a 22% annualized rate in Q2 2007.

The second graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In a typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for five straight quarters. So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

Right now it appears the lag between RI and non-RI will be longer than 5 quarters in this cycle. Although the typical lag is about 5 quarters, the lag can range from 3 to about 8 quarters. The third graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey. Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

The third graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey. Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

This data suggests that nonresidential structure investment is likely to follow the decline in residential investment later this year.

Equipment and Software The final graph shows the typical relationship between residential investment (shifted 3 quarters) and fixed investment in equipment and software. Usually investment in equipment and software follows residential investment by about 3 quarters.

The final graph shows the typical relationship between residential investment (shifted 3 quarters) and fixed investment in equipment and software. Usually investment in equipment and software follows residential investment by about 3 quarters.

Although the YoY change in real investment in equipment and software is weak, investment picked up in Q2 at a 2.3% annual rate.

Q2 GDP: 3.4%

by Calculated Risk on 7/27/2007 08:45:00 AM

From the BEA: Gross Domestic Product

As expected, PCE (personal consumption expenditures) growth slowed sharply to 1.3% in the second quarter.

The bright spots in the report: Net exports of goods and services contributed 1.18%, and government spending contributed 0.82%, and non-residential fixed investment 0.83%.

Investment in non-residential structures increased at a 22% annualized rate!

I'll post on fixed investments later today.

Thursday, July 26, 2007

Markets Looking for a Rate Cut

by Calculated Risk on 7/26/2007 08:26:00 PM

The futures market is now pricing in a rate cut in December with some chance of a rate cut by October. From the WSJ: Futures Markets Bet Fed Will Cut Rates This Year

Trading in December fed funds contracts translates into the market giving 100% certainty that the Fed will cut rates to 5% by the Dec. 11 Fed meeting from the current 5.25% rate. That is up from about a 44% chance at Wednesday’s close. The market is pricing in roughly 50% odds that the FOMC could cut the rate as early as the September or October meetings.That doesn't quite fit with the data from the Cleveland Fed, but clearly market participants see the odds of a rate cut increasing. And yes, that is a 20% implied probability of a 50 bps rate cut by the October meeting:

There is no question what the impacted CEOs want: AutoNation CEO Urges Rate Cut To Prop Up Sagging Vehicle Sales

The chief executive of the nation's largest publicly traded auto-dealership chain is disputing suggestions that the housing slowdown is contained, attempting to drum up support for interest-rate cuts that would help sagging vehicle sales.

Mike Jackson, head of AutoNation Inc., ... took issue with Federal Reserve Chairman Ben Bernanke's recent suggestions that the housing slump won't significantly crimp economic growth over time. "Absent a rate cut, which will both have a financial impact and a psychological impact, I think it's going to take a long time to work through -- a long time," Mr. Jackson said of the housing correction. "The stress in housing is significant, the stress in automotive retail is significant."

Bear Stearns Seizes Hedge Fund Assets

by Calculated Risk on 7/26/2007 05:41:00 PM

From the WSJ: Bear Stearns Seizes Hedge Fund Assets

The parent company has assumed ownership of the remaining assets ... in the High-Grade Structured Credit Strategies Fund. Those assets will now be hedged by Bear's trading team and likely sold when their values seem more attractive, says a person close to the situation.The High-Grade fund was the less levered fund, so I suppose this means both funds are (or will be) shut-down.