by Calculated Risk on 6/08/2007 10:59:00 AM

Friday, June 08, 2007

April Trade Deficit, MEW and Interest Rates

The Census Bureau reported today for April 2007:

"in a goods and services deficit of $58.5 billion, $3.9 billion less than the $62.4 billion in March"

Click on graph for larger image.

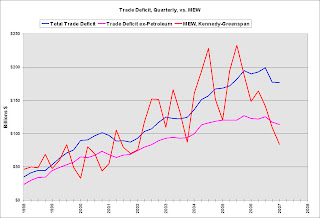

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

Looking at the trade balance, excluding petroleum products, it appears the deficit has peaked and has been declining since the second half of 2005.

The trade deficit, ex-petroleum, appears to have peaked at about the same time as Mortgage Equity Withdrawal in the U.S.

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Feb, 2005

The second graph shows the quarterly trade deficit, with and without petroleum, and quarterly mortgage equity withdrawal.

The second graph shows the quarterly trade deficit, with and without petroleum, and quarterly mortgage equity withdrawal.Declining MEW is one of the reasons I forecast the trade deficit to decline in '07. And a declining trade deficit also has possible implications for U.S. interest rates; as the trade deficit declines, rates may rise in the U.S. because foreign CBs will have less to invest in the U.S.. This is why I forecast rates to rise in '07.

And rising rates have negative implications for housing and will probably lead to less MEW. This could lead to a vicious cycle for a short time - less MEW leading to a lower trade deficit, followed by rising rates, follow by less MEW, and repeat.

Thursday, June 07, 2007

Kennedy-Greenspan: Equity Extraction Declines in Q1 2007

by Calculated Risk on 6/07/2007 02:50:00 PM

Here are the Kennedy-Greenspan estimates of home equity extraction for Q1 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q1 2007, Dr. Kennedy has calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI). Note that equity extraction for Q4 2006 has been revised upwards to $109.1 Billion.

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Percentage of Household Equity Falls to Record Low

by Calculated Risk on 6/07/2007 01:03:00 PM

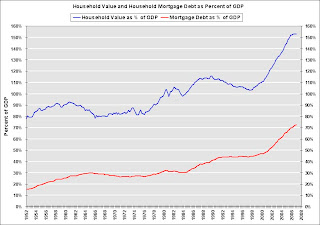

The Fed reports that the value of household real estate increased to $20,771.92 Billion in Q1 2007. This puts the percent household equity at an all time low of 52.7% - despite the recent significant increase in valuations.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent equity of U.S. households. Note that the scale doesn't start at zero.

Despite the significant increase in valuations in recent years, the percent equity has been dropping - and is now at an all time low of 52.7%. With housing prices falling, the percent of equity will probably continue to fall - even if MEW declines significantly. The second graph shows the value of U.S. household real estate and mortgage debt as a percent of GDP. The value of household real estate will probably start to fall as a percent of GDP, just like in the early '90s.

The second graph shows the value of U.S. household real estate and mortgage debt as a percent of GDP. The value of household real estate will probably start to fall as a percent of GDP, just like in the early '90s.

Mortgage debt as a percent of GDP will probably level out (like in the '90s).

As a reminder, about 1/3 of all households have no mortgage debt. Update: About 1/3 of all owner occupied households have no mortgage debt (their homes are paid off). This comment has nothing to do with renters. However you can't do a direct substraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. I just added this comment, because even though the average household has 52% equity in their homes that includes the 1/3 that have 100% equity.

Fed: Mortgage Debt Increased $127.6 Billion in Q1

by Calculated Risk on 6/07/2007 12:32:00 PM

The Federal Reserve released the Flow of Funds report for Q1 2007 today. The report shows mortgage debt increased $127.6 Billion to $9,832.3 Billion in Q1 2007, the slowest increase since Q1 2002.

The calculation of Mortgage Equity Withdrawal (MEW) will probably be available in the next few days, however it appears MEW actually increased slightly in Q1. This is because a significant portion of the lower increase in mortgage debt was due to fewer new home sales

Interest Rates Rising

by Calculated Risk on 6/07/2007 11:22:00 AM

From Dow Jones:

Freddie Mac said that the benchmark 30-year fixed rate mortgage average rose in the week ending Thursday to 6.53% from 6.42% last week.The 30 year fixed rate peaked at 6.76% last July (average for month).

Meanwhile, from the AP: 10-Year Treasury Yield Passes 5 Percent

The 10-year yield broke through 5 percent mark overnight and rose as high as 5.07 percent in mid-morning trading in New York, reaching its highest point since late July.The 10-Year yield peaked at 5.24% last July. I'd expect mortgage rates to rise again next week.

Modifications, Buybacks, True Sales, and Puzzlement

by Anonymous on 6/07/2007 08:38:00 AM

Yes, friends, Tanta is even more puzzled than usual when the subject is hedge funds. May I beg our readers who have more familiarity with this part of the financial markets to help us out here?

The Financial Times and a number of other sources have reported lately that hedge funds are accusing the investment banks--Bear Stearns specifically--of "market manipulation" by modifying deliquent or soon-to-be delinquent securitized mortgages. The hedgies' interest in all this, it appears, is not that they own these bonds--although that is hardly clear to me--but that they have been on the other side of some credit default swaps which means they will lose if the bonds perform better than anticipated.

Reuters reports that the WSJ reports that the issue is "purchases":

NEW YORK (Reuters) - Hedge fund managers are accusing Bear Stearns Cos. of trying to manipulate the market in securities based on subprime mortgages, the Wall Street Journal reported in its online edition.

The confrontation provides a rare look into the complex trading in the mammoth U.S. mortgage market, which played a critical role in financing the housing boom, and the complicated relationships between hedge funds and investment banks, the paper said.

Hedge funds that had sold short such securities made profits when an index tied to a basket of subprime bonds was falling. But the index has recovered in recent weeks, leading to howls of protest from hedge funds, according to the report.

The chief critic, John Paulson of Paulson & Co., a $12 billion fund, says Bear Stearns wanted to prop up faltering mortgages-backed securities by purchasing individual mortgages that were rapidly losing value to avoid doling out billions in swap payments, the Journal reported.

I am not a subscriber to the Wall Street Journal; perhaps someone who read the original article can help us understand this.

Whatever do they mean by "had sold short such securities"? Are we really talking about a CDS trade? No doubt the "index" in question is the ABX, but can anyone help me decipher the actual trade here?

Furthermore, what could "purchasing individual mortgages that were rapidly losing value" possibly mean in this context? Are we talking about repurchases (EPDs and other rep/warranty failures)? Bear would presumably be the "purchaser" in this case if it had originated the loan (or at least sold it to the security trustee), which would make Bear responsible for taking it back (and, in turn, forcing it back onto whatever hapless originator sold it to Bear in the first place).

Much ink has been spilled on the subject of Bear (and other IBs, particularly Merrill) forcing loans back to originators to the extent of forcing originators into bankruptcy. The implication of the Reuters piece is that Bear, specifically, is accused of doing this not to clean up the security (remove the defective loans at a full payoff of principal and accrued interest to the bondholder) but to avoid having to pay out to the hedge counterparties.

If that's what we're talking about--and feel free to correct me if I'm wrong--then we have a nice can of worms here. Contractual buyback provisions are supposed to protect bondholders from defective loan collateral that can sneak into those securities precisely because the loans are sold on a rep and warranty basis. You can do limited (define that any way you choose) due diligence on the loan collateral itself, relying on the data tapes (the specific "representations" supplied by the loan originator) plus a custodian's report on the presence and acceptability of the note and mortgage documents, because the contract allows you to put back anything that violates those reps.

In addition, these contracts almost always specify that a loan is repurchased at par (the price is the unpaid principal balance plus any interest adjustment for the sale timing). That can easily mean that the original buyer bought the loan for 102 and is putting it back at 100. It almost always means that the originator is buying it back at 100 and going to have to sell it for a lot less than that. The idea is that nobody wins, particularly, in this situation.

Nobody is supposed to win. The traditional "par repurchase" is supposed to mitigate certain kinds of moral hazard. In any case, a par repurchase has exactly the same effect on the bondholder as a refinance (full return of principal). In terms of the reported credit quality of the security, it removes a delinquent loan or a loan that looks like it's going to become delinquent or (in the case of certain kinds of fraud) a loan that looks like it will be hard to recover anything from in foreclosure. Some investors are willing to give the benefit of the doubt on some kinds of loan defects; no one (sane) does anything with a loan that has title or legal mortgage problems except put it back. We have been reading about lenders who suddenly find they cannot foreclose or take possession because of sloppy loan closing or mortgage assignment practices. This threat is real.

The problem appears to be the identity of interest issue: the security sponsor owes the investors the duty of selling defective loans back to the originator at par. This is supposed to be expensive for all parties (think of what you "saved" by not doing your due diligence), but less so than not doing it (the same logic applies to modifications). However, the hedgies seem to be alleging that Bear will also either profit or avoid losses on its CDS trades by forcing these buybacks. I don't know about you all, but it sounds to me like time to clarify how many hats Bear is wearing here: does it own any classes of any of these securities? Is it the sponsor, the servicer, and/or the originator of these loans? Is it buying or selling credit protection? Whose position is it hedging?

Whether we are talking about modifications or repurchases or both, all of this raises some ugly accounting issues, it seems. Reuters, again:

FAS 140 governs whether a bank can treat assets held in various asset-backed securities as sales or secured financing. If the asset is treated as a sale, it allows banks to keep it off their balance sheets.

Banks say the standard prevents them from helping borrowers modify loans easily. But market experts have said the complications are also a legal issue related to the terms set out at the time a mortgage-backed security is created.

The board has revisited FAS 140 several times since it was approved in 2000, but Seidman said on Wednesday it has not gotten any easier.

"What has become clear to me is that, when we look at the way investors and analysts treat securities transactions, if there hasn't been a free and clear sale, they are unwinding the accounting and putting assets and liabilities back on the books," Seidman said. "I've come to the conclusion that ... we're going in the wrong direction -- trying to maintain a standard that's taking assets off the books when investors view it as economically still associated with the seller."

Some more clarity on this issue would certainly be helpful. If I am reading this correctly, the issue is whether the sale of the underlying mortgage loans to the security trust is a "true sale" or not. If it is, the securitization is truly "off balance sheet." If it isn't, the securitization is on-balance sheet financing of the originator's mortgage loans.

That, in turn, has something to do with how the securitizer books gain (or loss) on the securitization transaction, but for our present purposes it seems the issue is how much a "true sale" a transaction treated as off-balance sheet can be if the securitizer can, in essence, "control" the collateral (by modifying it or by forcing the trustee to sell loans back to the issuer). Traditionally, when there is "recourse" in a sale, it generally has to be treated as a financing rather than a true sale, since the seller retains not just an obligation for performance of the collateral but presumably then some rights to make good on that obligation in ways (substitute loans, repurchases, mods) that may benefit the seller as much as the buyer. My guess here--I'm just reading the news, folks, so it's a guess--is that the Financial Accounting Standards Board is fixin' to possibly decide that some of these "nonrecourse" transactions are, actually, recourse transactions, and not true sales, and therefore not on the right balance sheet, and ugly ugly ugly.

So, if I'm following all this, a torrent of buybacks which has already forced a lot of originators into bankruptcy and evaporated a lot of market cap at the same time it has weakened some servicers to the point that nobody's even sure about getting payments collected on the remaining performing loans, not to mention accomplishing those foreclosures for the ones the security couldn't get out from under, has now called into question the accounting basis of the whole deal, which means potentially evil ugly nasty restatements for anyone still in a position (this side of BK) to restate, and at the same time it has dragged the curtain away from this "all risk has been hedged" mantra to show that behind that curtain, the transactions supposed to protect investors' interests are in fact so riddled with conflicts of interest that the liability those who thought they were purchasing "credit protection" may have to the unhappy campers who were providing that credit protection could more than overwhelm the benefit of the insurance.

Have I got that right? Anyone who can straighten me out in the comments (or via email) is cordially invited to do so.

Wednesday, June 06, 2007

California: State Senate Passes Bill to Tighten Lending Standards

by Calculated Risk on 6/06/2007 09:57:00 PM

Mathew Padilla notes: State Senate passes bill on tougher loan underwriting

SB 385, passed on a 33-1 vote, requires all state-licensed lenders and brokers to follow federal guidelines issued on Sept. 29, 2006. The bill still must face the Assembly and governor.Here are the key passages from SB 385:

SB 385 does the following:emphasis added

1) directs the DFI to apply the nontraditional mortgage product risk guidance issued by the federal government to state-regulated financial institutions,

2) directs the DOC to apply the risk guidance issued by the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators (CSBS/AARMR) to licensed finance lenders and residential mortgage lenders,

3) directs the DRE to apply the risk guidance of CSBS/AARMR to real estate brokers,

4) authorizes all three commissioners to adopt emergency regulations and final regulations to clarify the application of the applicable guidance documents to their licensees as soon as possible,

5) directs all affected licensees to develop policies and procedures to achieve the objectives set forth in the guidance, and

6) requires the Secretary of BT&H toensure that all three commissioners coordinate theirpolicymaking and rulemaking efforts.

Additionally, amendments were added in the Senate Banking, Finance and Insurance Committee to expand the definition of real estate brokers to include a person who engages as a principal in the business of making loans, and makes 8 or more specified loans to the public from the person's own funds. The bill also now provides the Commissioner of DRE with clearer statutory authority to compel brokers to provide more information on their renewal forms relating to the types of licensed activities they had engaged in since their last renewal.

The intent of this bill is to ensure that all mortgage lenders and brokers, regardless of their regulator, are subject to the federal guidance on nontraditional mortgage product risks.

The CSBS reports 35 agencies have adopted the CSBS/AARMR Guidance on Nontraditional Mortgage Product Risks. California is about to join the list.

Meritage Homes Revises Outlook

by Calculated Risk on 6/06/2007 05:06:00 PM

Via CNN Money: Weaker Trends in Home Sales Cause Meritage Homes to Revise Its Outlook for 2007 (hat tip Brian)

Meritage Homes Corporation ... reported today that April and May home sales have been weaker than expected, as reported by other leading homebuilders, and lower than the Company's first quarter order rates. Preliminary net sales for the first two months of the second quarter were approximately 21% lower than the same period last year, and cancellations increased to a rate of 36% of gross orders, from 27% reported in the first quarter 2007.Orders down. Cancellations up. Hope gone.

"We were encouraged by sales and cancellation rates that improved each month of the first quarter, leading us to anticipate relatively stronger second quarter sales results," said Steven J. Hilton, chairman and CEO of Meritage. "But these positive trends ended at the beginning of April, as demand slowed and cancellations rose. The weaker conditions we noted in April when we reported our first quarter results, continued through May. Order cancellations increased after widely-reported concerns over credit tightening and difficulties in the subprime markets, which appeared to dampen consumers' confidence and demand for homes."emphasis added

...

"In light of weaker conditions and reduced expectations, we are reviewing our operating plans for the remainder of the year, as we continue to focus on protecting our balance sheet and maximizing our flexibility through this downturn."

Housing is taking the next expected downturn. Well, expected by some, but a complete surprise to others.

NAR Cuts Housing Forecast

by Calculated Risk on 6/06/2007 11:18:00 AM

The National Association of Realtors (NAR) has cut their 2007 forecast - again. From the NAR: Home Sales Projected to Fluctuate Narrowly With a Gradual Upturn

Existing-home sales are projected to total 6.18 million in 2007.In February the NAR forecast sales would fall to 6.44 million. In April they revised their forecast to 6.34 million (a decline of 2.2% from 2006). Their new forecast is a decline of 4.6%. Still too high, but I suppose if they revise their forecast down 2% every couple of months, they might be close by the end of the year!

Also from AP: Bush Administration Lowers Its Forecast for Economic Growth This Year

Under the administration's new forecast, gross domestic product, or GDP, will grow by 2.3 percent as measured from the fourth quarter of last year to the fourth quarter of this year. That's down from a previous projection of 2.9 percent.Sorry, but it is "quite clear" that housing has not bottomed yet. Of course Lazear has never demonstrated an understanding for housing. He thought the worst was over last November:

...

"So it is just not quite clear where we are in terms of the housing market, whether it has bottomed out," Edward Lazear, chairman of the White House's Council of Economic Advisers told reporters.

"The housing market, as you know, it has been hit, I think, harder than most of us had expected. Most forecasters were expecting a slower decline. What that probably signals is that the future will not be as negative as it otherwise would have been because we've probably had much of the decline that we're expecting to have."

Edward Lazear, Q&A Nov 21, 2006, chairman of the White House's Council of Economic Advisers

Tuesday, June 05, 2007

Wells Fargo: Homebuilding's lull 'unsustainably low'

by Calculated Risk on 6/05/2007 04:37:00 PM

Jon Lansner at the O.C. Register has an excerpt from Well Fargo's economist Michael Swanson on housing: Homebuilding's lull 'unsustainably low'

In 2005, the market experienced 2.1 million housing starts, which was the highest level since 1972’s 2.4 million starts.This analysis is incorrect.

...

In 1972, US population was 210 million with 66.7 million households, and the average household contained 3.2 people. In 2007, US population is an estimated 302 million with 115.6 million households. That implies that the average number of people per household had fallen to 2.6. 2005’s peak construction doesn’t hold a candle to early rates of construction. In 1972, the market started 11.3 houses per thousand of population versus 2005’s 7 houses. And, the discrepancy in houses started per hundred households is even larger with 1972’s peak of 3.5 houses dropping to 1.8 houses. Adjusted for population and household creation, 2005’s peak wasn’t particularly impressive, and the current bottom is unsustainably low.

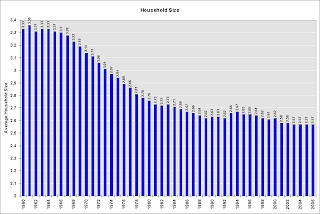

There has been a long term trend towards smaller size households in the U.S. During the '70s, there was a rapid decrease in the size of households, probably because the baby boomers were moving out on their own.

Click on graph for larger image.

Click on graph for larger image.This graph shows household size in the U.S. (Source: Census Bureau). Note that the graph starts at 2 to better show the change.

If the population had been steady during the '70s (no growth), the U.S. would still have needed to add 9 million housing units because of the shift in household sizes. However, since 2000, if the population had stayed steady, the U.S. would have only had to add 0.4 million housing units - since the average household size has barely changed.

So, unless Dr. Swanson is suggesting there will be another significant decrease in household sizes in the near future, his analysis is apples vs. oranges. The analysis should be adjusted for changes in household size, and Dr. Swanson will discover that the recent level of starts was "unsustainable".

Dr. Swanson also picked the peak year for starts; the average in the '70s was 1.75 million units per year compared to 1.83 million since 2000. This is before adjusting for changes in household size. If we subtract 900K (9 million total per decade) per year during the '70s that gives 0.85 million starts per year. If we subtract 70K (400K total for six years) per year from the '00s that gives 1.76 million per year. Those are the numbers Swanson should be comparing to population size.

The population increased 36% (average for '70s vs. average for '00s), but starts more than doubled.

Note: On the reason for the large shift in household size during the '70s, the Census Bureau provides data on the intent of housing starts: New Privately Owned Housing Units Started in the United States, by Intent and Design. Unfortunately the data doesn't start until 1974, but it appears there were significantly larger percentage of "built to rent" units in the '70s - suggesting the Baby Boomers moving explanation might be correct.