by Calculated Risk on 6/07/2007 01:03:00 PM

Thursday, June 07, 2007

Percentage of Household Equity Falls to Record Low

The Fed reports that the value of household real estate increased to $20,771.92 Billion in Q1 2007. This puts the percent household equity at an all time low of 52.7% - despite the recent significant increase in valuations.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent equity of U.S. households. Note that the scale doesn't start at zero.

Despite the significant increase in valuations in recent years, the percent equity has been dropping - and is now at an all time low of 52.7%. With housing prices falling, the percent of equity will probably continue to fall - even if MEW declines significantly. The second graph shows the value of U.S. household real estate and mortgage debt as a percent of GDP. The value of household real estate will probably start to fall as a percent of GDP, just like in the early '90s.

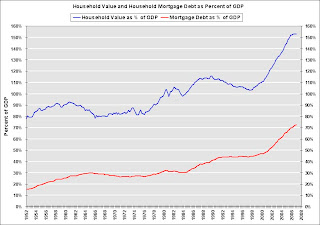

The second graph shows the value of U.S. household real estate and mortgage debt as a percent of GDP. The value of household real estate will probably start to fall as a percent of GDP, just like in the early '90s.

Mortgage debt as a percent of GDP will probably level out (like in the '90s).

As a reminder, about 1/3 of all households have no mortgage debt. Update: About 1/3 of all owner occupied households have no mortgage debt (their homes are paid off). This comment has nothing to do with renters. However you can't do a direct substraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. I just added this comment, because even though the average household has 52% equity in their homes that includes the 1/3 that have 100% equity.