by Calculated Risk on 5/17/2007 12:35:00 PM

Thursday, May 17, 2007

Weekly Unemployment Claims

From the Department of Labor:

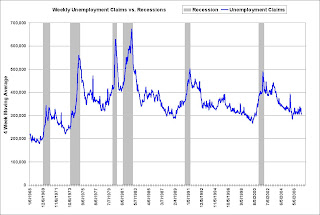

In the week ending May 12, the advance figure for seasonally adjusted initial claims was 293,000, a decrease of 5,000 from the previous week's revised figure of 298,000. The 4-week moving average was 305,500, a decrease of 12,000 from the previous week's revised average of 317,500.

Click on graph for larger image.

Click on graph for larger image.This graph shows the four moving average weekly unemployment claims since 1968. The four week moving average has been trending sideways, and the level is low and not much of a concern.

A word of caution: weekly claims is a weak leading indicator.

Note that the Conference Board uses weekly claims as one of their ten leading indicators. From the AP: Economy may slow this summer

The Conference Board said its index of leading economic indicators dropped 0.5 percent, higher than the 0.1 decline analysts were expecting. The reading is designed to forecast economic activity over the next three to six months.Another word of caution: many economists, including former Fed Chairman Greenspan, have little confidence in the Conference Board leading indicators. In 2000, Greenspan commented that he thought the Conference Board leading indicators were useless in real time:

...

"The data may be pointing to slower economic conditions this summer. With the industrial core of the economy already slow, and housing mired in a continued slump, there are some signs that these weaknesses may be beginning to soften both consumer spending and hiring this summer," said Ken Goldstein, labor economist for the Conference Board.

"As an aside, the probability distribution based on the leading indicators looks remarkably good, but my recollection is that about every three years the Conference Board revises back a series that did not work during a particular time period, so the index is accurate only retrospectively. I’m curious to know whether these are the currently officially published data or the data that were available at the time. I know the answer to the question and it is not good!" [Laughter]Update: And Northern Trust's Paul Kasriel (hat tip ac) argues that the LEI has value: When The Facts Change, I Change My Model – What Do You Do?

Bernanke: The Subprime Mortgage Market

by Calculated Risk on 5/17/2007 10:50:00 AM

Remarks by Fed Chairman Ben Bernanke: The Subprime Mortgage Market

The recent sharp increases in subprime mortgage loan delinquencies and in the number of homes entering foreclosure raise important economic, social, and regulatory issues. Today I will address a series of questions related to these developments. Why have delinquencies and initiations of foreclosure proceedings risen so sharply? How have subprime mortgage markets adjusted? How have Federal Reserve and other policymakers responded, and what additional actions might be considered? How might the problems in the market for subprime mortgages affect housing markets and the economy more broadly?Short answer according to Bernanke: everything will be fine. See Bernanke's speech for his longer answers.

Tanta provides the translation (from the comments):

CR quoted the first paragraph. Here's how the rest of it goes:

2. Technology lets us find more subprime borrowers faster.

3. Securitization lets us find more bagholders faster.

4. We made a lot more loans this way.

5. Ownershipsocietyminoritypoorpeoplehelpedfeelgood.

6. Somehow, subprime borrowers still default more than prime borrowers do.

7. Number 6 is a recent problem.

8. ARMs have rates that go up, and home prices don't always rise. This is new, too.

9. Some of that loan underwriting was also kind of sucky.

10. It paid to make junk loans if you didn't have to own them.

11. Apparently some borrowers didn't get the memo.

12. Hedgies are bailing out the CDOs, so there's still some party left in the punchbowl. So far the banks can pass a breath test.

13. Even though this isn't a bank problem, the Fed is working with banks to help solve it.

14. We think someone should buy out those crappy securities and start modifyin', baby.

15. For some reason these borrowers think the lenders want to foreclose. Sure, it looked that way when the loan was made, but it's different now. Please call your lender, it's ready to make nice.

16. We're snorting a fine line here.

17-22. The best solution is to disclose to the borrower that these loans rarely make sense. It would be bad to ban them entirely, because they often do make sense.

23-24. We are also guiding the underwriting of the banks that aren't the ones making these loans.

25-26. None of this will affect the home market unduly, because jobs and wages will go up.

27-28. The market will correct any problem we can't mop up with disclosure requirements.

Why I Am Not An Analyst

by Anonymous on 5/17/2007 07:19:00 AM

On the way to my Yahoo! mailbox, I caught this headline, "Subprime Shakeout: Where Do We Go From Here?" That demanded to be read.

New Century had a 5-star Morningstar Rating for stocks during its collapse. Why? Good question. Admittedly, the company was risky, hence our above-average risk rating. Indeed, we even recognized that delinquencies would rise. In fact, we had assumptions of increasing charge-offs built into our New Century valuation model. But we underestimated two things.The implication that if New Century had been borrowing operating cash instead of lending capital, it wouldn't have gone bankrupt may not be the funniest thing you read today, but it has its charm. Yes, I'm aware that this is a reductio of the point really being made, which is that if New Century hadn't been using a warehouse line of credit to fund and carry its new held-for-sale loans (borrow short and lend long while you produce enough loans to securitize), and had instead used long-term investors' funds to sell those loans right out of the factory door (borrow long and lend long, really really fast), things would have been different. They surely would have.

First, we missed the risk that early payment defaults posed. As we stated, early payment defaults had never been an issue before, and we just did not see that risk on the horizon until it was too late. The risk we saw was loans defaulting as they reset from the "teaser" rate to a fully adjusted rate--the interest rate borrowers will ultimately have to pay after their low teaser rate expires--after two years.

Second, we didn't recognize how quickly the company's financing would disappear. New Century had been a darling of Wall Street, supplying banks with loans to package into new collateralized mortgage obligations. However, once the first problems arose, the very firms that had benefited from the flow of loans were the first to turn off New Century's financing spigot, demanding their money back and effectively killing New Century. The firm was out of cash, could not fund many loans already being processed, and was eventually forced to file for bankruptcy.

Arguably, if New Century had relied upon long-term debt instead of short-term financing, the company would probably still be alive today. No doubt, it would be struggling, as early payment defaults, high delinquency rates, and a reduced number of buyers of subprime mortgages would be taking its toll. But, we believe that with access to cash, New Century might have lived to see another day and maybe even stabilization in the market.

What does startle me is the failure to connect the two dots: the EPD problem and the financing problem. My contention is that we have seen unprecedented numbers of EPDs because we were not, actually, lending long, we were pretending to lend long. (This is my Bridge Loan theory about Alt-A and subprime: a loan structure that forces you to refinance in two years or face financial ruin is not a long-term loan, regardless of what the technical final maturity date is).

Traditionally, the "early" in "early payment default" is in reference to a pretty long loan life; the "traditional" average life of a 30-year mortgage just before the boom got underway after 2001 was about 7-10 years, so defaults in the first 90 days were weird and rare. There is, however, something odd about understanding a third-payment delinquency on a 2/28 "exploding ARM" made to a speculator as particularly "early." I mean, how many payments did we expect to take?

Something starts to suggest that we were just borrowing short and lending short, until of course those EPD rates hosed up the liquidity of the loans in the warehouse and we were suddenly borrowing long in real dollars and lending short in Monopoly money. You could see that as an issue of a lack of access to cash, even if like me you think the missing cash is repayments from borrowers rather than loans from investors. In any case I'm still struggling with the idea of how you live to fight another day by soldiering on with a neutral or negative carry. Presumably that would have been solved by the fall-off in loans originated: you can always make it up on lack of volume. So where do we go from here? Those of us who assumed the point was to make money making loans, rather than just make loans, can go back to bed. Everybody else should buy stock.

In other news, I received an email containing some color on current Alt-A and subprime trades, that contained this gem: "Sellers continue to look to product development to figure out ways to originate higher LTV product without subordinate financing."

What this means, for you civilians, is that since we replaced mortgage insurance with borrowed down payments until the down-payment lenders got burnt to a crisp right at the time the MIs decided they wouldn't play with us even if we tied a pork chop around our necks--those things are probably connected--we're back to "product development," which is going to be a bit tricky after that "nontraditional mortgage guidance" thingy told us to quit developing products that fake their way through a lack of borrower equity. But we're willing to try something tricky again, given that the alternative, limiting high LTV loans to people who can afford them, still sucks. What we need is a way for Joe Homebuyer to borrow long and lend short . . .

Wednesday, May 16, 2007

What Home Improvement Investment Slump?

by Calculated Risk on 5/16/2007 08:59:00 PM

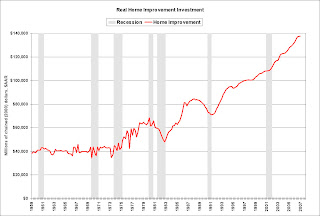

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

California Home Sales: Lowest Since '95

by Calculated Risk on 5/16/2007 08:05:00 PM

From DataQuick: California April 2007 Home Sales

A total of 34,949 new and resale houses and condos were sold statewide last month. That's down 12.2 percent from 39,811 for March, and down 28.5 percent from 48,894 for April 2006. Last month's sales made for the slowest April since 1995 when 27,625 homes were sold. April sales from 1988 to 2007 range from the 27,625 in 1995 to 66,938 in 2005. The average is 46,141. On a year-over-year basis, sales have declined the last 19 months.

Starts, Completions and Recessions

by Calculated Risk on 5/16/2007 01:13:00 PM

By popular demand, here is a graph of Starts and Completions with Recessions. Click on graph for larger image.

Click on graph for larger image.

An optimist might argue that we should already be in a recession based on previous housing slumps - so if the worst is over for this housing slump, a soft landing is very possible. Of course I think starts will fall further - perhaps to the 1.1 million SAAR level.

The WSJ housing story led with this sentence:

Home construction unexpectedly rose during April, making a surprise increase despite bloated inventories and tighter credit for subprime borrowers ...And yes, fundamentals like "bloated inventories" and less demand, do matter.

Housing Starts and Completions

by Calculated Risk on 5/16/2007 10:50:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits declined:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,429,000. This is 8.9 percent below the revised March rate of 1,569,000 and is 28.1 percent below the revised April 2006 estimate of 1,987,000.Starts rebounded:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,528,000. This is 2.5 percent above the revised March estimate of 1,491,000, but is 16.1 percent below the revised April 2006 rate of 1,821,000.And Completions declined to the level of starts:

Privately-owned housing completions in April were at a seasonally adjusted annual rate of 1,523,000. This is 5.8 percent below the revised March estimate of 1,616,000 and is 26.0 percent below the revised April 2006 rate of

2,058,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff". Completions are now at the level of starts. Starts will probably fall further (based on permits and housing fundamentals) and completions will most likely decline further too.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions used to lag Starts by about 6 months.

Both of these relationships have broken down somewhat (although completions have fallen to the level of starts). Why residential construction employment hasn't fallen further is a puzzle. Also the time between start and completion has increased recently.

This report shows builders are still starting too many projects, and that residential construction employment is still too high.

Tuesday, May 15, 2007

Commercial Real Estate: Slump Ahead?

by Calculated Risk on 5/15/2007 08:44:00 PM

With the release of the Fed Loan Survey, we can connect another dot in the possible Commercial Real Estate (CRE) slump later this year. Click on graph for larger image

Click on graph for larger image

The first graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

This is more evidence that the normal pattern will hold: nonresidential structure investment will probably follow residential investment "over the cliff".

Here are some earlier dots:

1) Non-residential structure investment has been booming for the last few years. Commercial rents have been rising and office vacancy rates have been falling. But signs of a trend change are emerging, from the IHT on May 2nd: Alarm raised over U.S. commercial real estate lending

... signs are emerging that the office market is slowing down in the United States. Though rents continued to rise in the first quarter of this year, the average vacancy rate for 58 U.S. metropolitan markets rose to 12.6 percent from 12.5 percent, the first increase for any quarter since 2004, according to Torto Wheaton Research, a division of CB Richard Ellis.

2) This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In the typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for four straight quarters (following two minor declines). So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

2) This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In the typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for four straight quarters (following two minor declines). So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.3) The WSJ noted earlier this month that demand was "sluggish" for office space. The current office space absorption rate is about 8 to 10 million square feet per quarter, but "... developers will open 76 million square feet of new office space by the end of this year." Since supply will grow significantly faster than the absorption rate, vacancy rates will rise.

4) Many banks are over-exposed to CRE lending. With rising vacancy rates, defaults will probably start to rise for CRE loans.

And remember, non-residential investment is the great hope of the soft landing view. That is why many economists are watching non-residential investment closely.

SoCal home sales hit 12-year low

by Calculated Risk on 5/15/2007 02:54:00 PM

From the LA Times: SoCal home sales hit 12-year low

Southern California home sales plunged to a 12-year low for the month of April, dragged down by a dearth of transactions at the lower end of the market even as prices held steady ... DataQuick Information Systems reported.The changing market poses a problem with the "median price" method of tracking prices. As an example, say 100 homes sold in a certain month, 20 homes each at $300K, $400K, $500K, $600K, and $700K. The median price would be $500K.

... nearly a third fewer homes in Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura counties closed escrow last month compared to a year earlier for the worst April showing since 1995, DataQuick found.

...

Most of the erosion in sales appeared in the lower-priced markets of the Inland Empire that only a year ago still seemed to be soaring. In Riverside County, sales dropped 45.1% to 2,987 year over year, while in neighboring San Bernardino County, sales plunged 46.7% to 2,049 ...

"The falloff in starter home sales has the effect of pushing median prices up a bit, although it's still somewhat surprising prices haven't declined more," said DataQuick president Marshall Prentice.

However, during the next month, say half the homes in the two lower brackets didn't sell (only 10 each for $300K and $400K), but all the other homes sold at the same price as the month before. Sales would decrease by 20% (similar to the declines reported by DataQuick). However the median price would increase 10% to $550K! Clearly this is misleading.

The OFHEO house price index uses same home sales, so it doesn't suffer from this problem (although there are other problems with the OFHEO Index, especially for more expensive areas). The Q1 OFHEO HPI will be released on Thursday, May 31st.

Builder Confidence Slips Again In May

by Calculated Risk on 5/15/2007 01:56:00 PM

Click on graph for larger image.

Click on graph for larger image.

NAHB Press Release: Builder Confidence Slips Again In May

Ongoing concerns about subprime-related problems in the mortgage market caused builder confidence about the state of housing demand to decline three more points in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. With a current reading of 30, the HMI has now returned to the lowest level in its current cycle, which was previously hit in September of 2006.

“Builders are feeling the impacts of tighter lending standards on current home sales as well as cancellations, and they are bracing for continued challenges ahead,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif.

“The crisis in the subprime sector has infected other parts of the mortgage market as well as consumer psychology, and as a result the housing outlook has deteriorated,” added NAHB Chief Economist David Seiders. “We’re now projecting that home sales and housing production will not begin improving until late this year, and we’re expecting the early stages of the subsequent recovery to be quite sluggish. There still are tremendous uncertainties regarding our baseline forecast going forward, owing largely to the subprime crisis that is having widespread effects throughout the mortgage market.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in May. The index gauging current single-family sales slipped two points to 31, while the index gauging sales expectations for the next six months fell three points to 41 and the index gauging traffic of prospective buyers fell four points to 23.

Three out of four regions posted declines in the May HMI. The Northeast posted a six-point decline to 32, while the South posted a four-point decline to 33 and the West posted a three-point decline to 32. The Midwest eked out a one-point gain, to 23.