by Calculated Risk on 5/17/2007 12:35:00 PM

Thursday, May 17, 2007

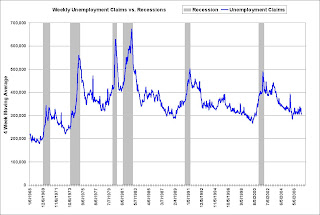

Weekly Unemployment Claims

From the Department of Labor:

In the week ending May 12, the advance figure for seasonally adjusted initial claims was 293,000, a decrease of 5,000 from the previous week's revised figure of 298,000. The 4-week moving average was 305,500, a decrease of 12,000 from the previous week's revised average of 317,500.

Click on graph for larger image.

Click on graph for larger image.This graph shows the four moving average weekly unemployment claims since 1968. The four week moving average has been trending sideways, and the level is low and not much of a concern.

A word of caution: weekly claims is a weak leading indicator.

Note that the Conference Board uses weekly claims as one of their ten leading indicators. From the AP: Economy may slow this summer

The Conference Board said its index of leading economic indicators dropped 0.5 percent, higher than the 0.1 decline analysts were expecting. The reading is designed to forecast economic activity over the next three to six months.Another word of caution: many economists, including former Fed Chairman Greenspan, have little confidence in the Conference Board leading indicators. In 2000, Greenspan commented that he thought the Conference Board leading indicators were useless in real time:

...

"The data may be pointing to slower economic conditions this summer. With the industrial core of the economy already slow, and housing mired in a continued slump, there are some signs that these weaknesses may be beginning to soften both consumer spending and hiring this summer," said Ken Goldstein, labor economist for the Conference Board.

"As an aside, the probability distribution based on the leading indicators looks remarkably good, but my recollection is that about every three years the Conference Board revises back a series that did not work during a particular time period, so the index is accurate only retrospectively. I’m curious to know whether these are the currently officially published data or the data that were available at the time. I know the answer to the question and it is not good!" [Laughter]Update: And Northern Trust's Paul Kasriel (hat tip ac) argues that the LEI has value: When The Facts Change, I Change My Model – What Do You Do?