by Calculated Risk on 7/26/2016 03:25:00 PM

Tuesday, July 26, 2016

Real Prices and Price-to-Rent Ratio in May

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.0% year-over-year in May

The year-over-year increase in prices is mostly moving sideways now around 5%. In May, the index was up 5.0% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 2.8% below the bubble peak. However, in real terms, the National index is still about 17.1% below the bubble peak.

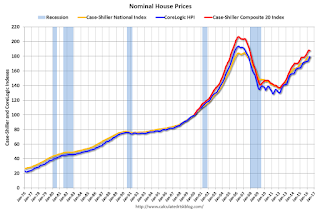

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

CPI less Shelter has declined over the last two years pushing up real house prices.

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to October 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

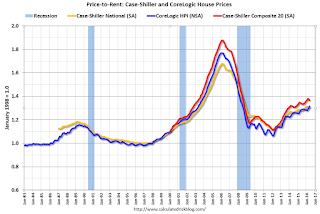

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back toMay 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

A few Comments on June New Home Sales

by Calculated Risk on 7/26/2016 11:52:00 AM

The new home sales report for June was strong at 592,000 on a seasonally adjusted annual rate basis (SAAR) - the highest since early 2008 - and combined sales for March, April and May were revised up by 22 thousand SAAR.

Sales were up 25.4% year-over-year (YoY) compared to June 2015. And sales are up 10.1% year-to-date compared to the same period in 2015.

Earlier: New Home Sales increased to 592,000 Annual Rate in June, Highest since 2008.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 10.1% year-over-year, mostly because of the solid growth in Q2.

There will probably be solid year-over-year growth in Q3 this year too.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 592,000 Annual Rate in June, Highest since 2008

by Calculated Risk on 7/26/2016 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised up by a total of 22 thousand (SAAR).

"Sales of new single-family houses in June 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised May rate of 572,000 and is 25.4 percent above the June 2015 estimate of 472,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in June to 4.9 months.

The months of supply decreased in June to 4.9 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of June was 244,000. This represents a supply of 4.9 months at the current sales rate."

On inventory, according to the Census Bureau:

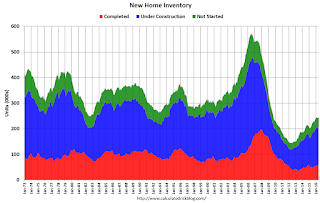

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2016 (red column), 54 thousand new homes were sold (NSA). Last year 44 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for May was 28 thousand in June 2010 and June 2011.

This was above expectations of 562,000 sales SAAR in June, and prior months were revised up. A solid report. I'll have more later today.

Case-Shiller: National House Price Index increased 5.0% year-over-year in May

by Calculated Risk on 7/26/2016 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Increases Ease in May According to the S&P Corelogic Case-Shiller Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in May, the same as the prior month. The 10-City Composite posted a 4.4% annual increase, down from 4.7% the previous month. The 20-City Composite reported a year-over-year gain of 5.2%, down from 5.4% in April.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.2% in May. The 10-City Composite recorded a 0.8% month-over-month increase, while the 20-City Composite posted a 0.9% increase in May. After seasonal adjustment, the National Index recorded a 0.2% month-over month increase, the 10-City Composite posted a 0.2% decrease, and the 20-City Composite reported a 0.1% month-over-month decrease. After seasonal adjustment, 12 cities saw prices rise, two cities were unchanged, and six cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.9% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 9.0% from the peak, and down 0.1% (SA) in May.

The National index is off 2.8% from the peak, and up 0.2% (SA) in May. The National index is up 31.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.4% compared to May 2015.

The Composite 20 SA is up 5.2% year-over-year..

The National index SA is up 5.0% year-over-year.

Note: According to the data, prices increased in 12 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Black Knight's First Look at June Mortgage Data

by Calculated Risk on 7/26/2016 08:21:00 AM

From Black Knight: Black Knight Financial Services’ First Look at June Mortgage Data: Foreclosure Starts Up for Second Consecutive Month; Prepays Rise on Historically Low Rates

• Despite June’s increase, first-time foreclosure starts in Q2 2016 were at their lowest level in over 16 yearsAccording to Black Knight's First Look report for June, the percent of loans delinquent increased 1.3% in June compared to May, and declined 10.0% year-over-year.

• Prepayment speeds (historically a good indicator of refinance activity) jumped to a 12-month high, mirroring an overall rise in refinance activity driven by historically low interest rates

• Early-stage delinquencies saw a seasonal increase in June, while 90-day delinquencies and foreclosure inventories continued to decline

The percent of loans in the foreclosure process declined 2.6% in June and were down 29.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.31% in June, up from 4.25% in May.

The percent of loans in the foreclosure process declined in June to 1.10%.

The number of delinquent properties, but not in foreclosure, is down 237,000 properties year-over-year, and the number of properties in the foreclosure process is down 231,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for June in early August.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2016 | May 2016 | June 2015 | June 2014 | |

| Delinquent | 4.31% | 4.25% | 4.79% | 5.71% |

| In Foreclosure | 1.10% | 1.13% | 1.56% | 2.00% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,178,000 | 2,153,000 | 2,415,000 | 2,876,000 |

| Number of properties in foreclosure pre-sale inventory: | 558,000 | 574,000 | 789,000 | 1,006,000 |

| Total Properties | 2,736,000 | 2,727,000 | 3,204,000 | 3,882,000 |

Monday, July 25, 2016

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 7/25/2016 08:54:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for May. The Zillow forecast is for the National Index to increase 5.0% year-over-year in May.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 562 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 551 thousand in May.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Sideways Slide Ahead of Fed

Mortgage rates were unchanged again today, making three out of the past 4 days where rates haven't budged and 6 out of the past 7 days where rates moved by 0.01% or less, on average. That's an exceptionally narrow range, and it speaks to indecision in financial markets ahead of this week's major central bank announcements. That's where the Fed and the Bank of Japan give the official word on their monetary policy, which includes setting short term rates and spelling out various stimulus efforts.Here is a table from Mortgage News Daily:

The Fed isn't expected to hike rates this week, but chances increase as the year progresses. As such, it wouldn't be a surprise to see this week's announcement telegraph their intentions for the coming announcements. Although the Fed's policy rate does not directly control mortgage rates, there is typically upward pressure on all interest rates if Fed rate hike expectations increase.

In terms of specific levels, the average conventional 30yr fixed quote moved up to 3.5% for top tier scenarios late last week. Quite a few lenders are still quoting 3.375%, while just a few are up to 3.625%. Keep in mind, "top tier" means there are absolutely no "hits" to loan pricing (i.e. 25% equity, 760+ credit score, etc). Most loans in the real world have some hits (or adjustments to the 'perfect' pricing), meaning that a lot of 3.625-3.75% rates are being quoted. We track the top tier rate because that's the easiest way to capture the true day-over-day movement (especially considering the effect of certain adjustments has varied over time, and to some extent, between lenders).

emphasis added

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in June

by Calculated Risk on 7/25/2016 02:50:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in June.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | June- 2016 | June- 2015 | |

| Las Vegas | 4.4% | 6.7% | 5.9% | 7.6% | 10.3% | 14.3% | 27.0% | 28.4% |

| Reno** | 3.0% | 5.0% | 2.0% | 3.0% | 5.0% | 8.0% | ||

| Phoenix | 1.6% | 2.8% | 1.9% | 3.6% | 3.4% | 6.4% | 20.9% | 23.1% |

| Sacramento | 2.8% | 5.8% | 2.6% | 4.6% | 5.4% | 10.4% | 16.1% | 17.8% |

| Minneapolis | 1.2% | 2.0% | 3.8% | 5.7% | 5.0% | 7.7% | 10.9% | 12.1% |

| Mid-Atlantic | 2.7% | 3.1% | 8.1% | 8.7% | 10.8% | 11.7% | 14.4% | 15.2% |

| Florida SF | 2.2% | 3.5% | 8.0% | 16.6% | 10.2% | 20.1% | 27.2% | 33.3% |

| Florida C/TH | 1.4% | 2.4% | 7.1% | 14.8% | 8.6% | 17.2% | 54.5% | 60.9% |

| Miami MSA SF | 3.2% | 6.0% | 9.5% | 17.2% | 12.7% | 23.3% | 28.8% | 34.8% |

| Miami MSA C/TH | 1.8% | 2.9% | 10.3% | 19.3% | 12.1% | 22.2% | 58.8% | 62.9% |

| So. California* | 5.3% | 6.9% | ||||||

| Bay Area CA* | 2.2% | 4.3% | ||||||

| Chicago (city) | 9.8% | 12.4% | ||||||

| Spokane | 7.6% | 10.8% | ||||||

| Rhode Island | 9.2% | 10.4% | ||||||

| Northeast Florida | 15.1% | 25.4% | ||||||

| Orlando | 27.9% | 35.8% | ||||||

| Tucson | 23.1% | 26.5% | ||||||

| Toledo | 23.2% | 27.0% | ||||||

| S.C. Wisconsin | 14.1% | 14.3% | ||||||

| Knoxville | 18.9% | 18.9% | ||||||

| Peoria | 15.6% | 16.1% | ||||||

| Georgia*** | 18.1% | 20.3% | ||||||

| Omaha | 15.1% | 14.6% | ||||||

| Pensacola | 25.3% | 31.6% | ||||||

| Richmond VA | 5.6% | 7.6% | 13.5% | 13.8% | ||||

| Memphis | 9.0% | 11.4% | ||||||

| Springfield IL** | 4.7% | 5.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FOMC Preview: No Rate Hike, Possibly Preparing for September Rate Hike

by Calculated Risk on 7/25/2016 12:23:00 PM

The FOMC will meet on Tuesday and Wednesday, and no change to policy is expected.

There will no economic projections released at this meeting, and there is no scheduled press conference by Fed Chair Janet Yellen (in the unlikely event there is a change to policy, Yellen will probably hold a press conference).

So the focus will be on the FOMC statement.

Here is the first paragraph from the April FOMC statement:

Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed. Growth in household spending has moderated, although households' real income has risen at a solid rate and consumer sentiment remains high. Since the beginning of the year, the housing sector has improved further but business fixed investment and net exports have been soft. A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and falling prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.And the first paragraph from the June FOMC statement:

emphasis added

Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up. Although the unemployment rate has declined, job gains have diminished. Growth in household spending has strengthened. Since the beginning of the year, the housing sector has continued to improve and the drag from net exports appears to have lessened, but business fixed investment has been soft. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.Since the June meeting, the economic data has been mostly positive, and the June employment report showed a gain of 287,000 jobs. The Q2 GDP report will be released on Friday, and is expected to show real GDP growth picked up in the second quarter.

The key for a possible September rate hike is if the first paragraph in the FOMC statement is more positive than in June. If the first sentence is changed to something like "Information received since the Federal Open Market Committee met in June indicates that labor market conditions have improved and growth in economic activity appears to have picked up", then the FOMC is probably preparing - if the improved data flow continues - to raise rates in September.

Dallas Fed: Regional Manufacturing Activity "Stabilizes" in July

by Calculated Risk on 7/25/2016 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Activity Stabilizes

Texas factory activity held steady in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in near zero after two months of negative readings, suggesting output stopped falling this month.Still difficult conditions in the Dallas region, but a little better than previous months. The impact of lower oil prices is still impacting manufacturing.

Some other measures of current manufacturing activity also reflected stabilization, and demand declines abated somewhat. The capacity utilization and shipments indexes posted near-zero readings, up from negative territory in May and June. The new orders index rose six points to –8.0, while the growth rate of orders index rose nine points to –9.7.

Perceptions of broader business conditions were notably less pessimistic. While the general business activity index remained negative for a nineteenth month in a row, it jumped 17 points to –1.3 in July. The company outlook index also remained negative but rose, climbing from –11 to –2.3.

Labor market measures indicated slight employment declines and stable workweek length. The employment index came in at –2.6, up from a post-recession low of –11.5 last month. ...

emphasis added

Black Knight: House Price Index up 1.1% in May, Up 5.4% year-over-year

by Calculated Risk on 7/25/2016 08:01:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: May 2016 Transactions, U.S. Home Prices Up 1.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• U.S. home prices were up 1.1% for the month, and 5.4% from a year agoThe year-over-year increase in this index has been about the same for the last year.

• At $263K, the U.S. HPI is up nearly 32% from the bottom of the market at the start of 2012 and is now just 1.8% off its June 2006 peak

• 15 of the 40 largest metros hit new peaks:

◦Austin, TX ($303K)

◦Boston, MA ($424K)

◦Charlotte, NC ($209K)

◦Columbus, OH ($183K)

◦Dallas, TX ($234K)

◦Denver, CO ($357K)

◦Houston, TX ($227K)

◦Kansas City, MO ($182K)

◦Nashville, TN ($235K)

◦Pittsburgh, PA ($194K)

◦Portland, OR ($352K)

◦San Antonio, TX ($202K)

◦San Francisco, CA ($771K)

◦San Jose, CA ($920K)

◦Seattle, WA ($405K)