by Calculated Risk on 9/26/2015 09:13:00 AM

Saturday, September 26, 2015

Schedule for Week of September 27, 2015

Special Note: If Congress shuts down the government on Wednesday, the employment report will not be released on Friday.

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing index and September vehicle sales, both on Thursday.

There are several Federal Reserve speakers this week.

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for September.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the June 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 4.6% year-over-year in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in September, the same as in August.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 53.6, down from 54.4 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, up from 267 thousand the previous week.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.1% in August. The employment index was at 51.2%, and the new orders index was at 51.6%.

10:00 AM: Construction Spending for August. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

8:30 AM: Employment Report for September. The consensus is for an increase of 203,000 non-farm payroll jobs added in September, up from the 173,000 non-farm payroll jobs added in August.

The consensus is for the unemployment rate to be unchanged at 5.1%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is a 1.3% decrease in orders.

Friday, September 25, 2015

Vehicle Sales Forecast for September: Over 17 Million Annual Rate Again

by Calculated Risk on 9/25/2015 08:19:00 PM

The automakers will report September vehicle sales on Thursday, Oct 1. Sales in August were at 17.7 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in September will be over 17 million SAAR again.

Note: There were 25 selling days in September, up from 24 in September 2014 (Also note: Labor Day was included in September this year). Here are several forecasts:

From WardsAuto: Forecast: U.S. Automakers to Record Best September in Ten Years

A WardsAuto forecast calls for U.S. automakers to deliver 1.42 million light vehicles in September, an 11-year high for the month. The report puts the seasonally adjusted annual rate of sales for the month at 17.8 million units, slightly above last month’s 17.7 million SAAR and well ahead of the year-to-date SAAR through August (17.1 million).From J.D. Power: Labor Day Propels New-Vehicle Retail Sales’ Strongest Growth So Far in 2015

Benefitting from an anomaly on the calendar, new-vehicle sales are headed to double-digit growth in September, with retail sales on pace for the strongest selling rate of any month in more than a decade, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.From Kelley Blue Book: Double-Digit New-Car Sales Growth Expected In September 2015, According To Kelley Blue Book

For the first time since 2012, Labor Day weekend falls in the industry’s September sales month instead of August. Labor Day weekend is traditionally the biggest new-vehicle sales weekend of the year, as consumers take advantage of the holiday and model year-end sales promotions, as well as the availability of the new model-year vehicles arriving in showrooms. [17.7 million SAAR]

emphasis added

New-vehicle sales are expected to increase 12 percent year-over-year to a total of 1.39 million units in September 2015, resulting in an estimated 17.5 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another solid month for auto sales, however Volkswagen sales might have fallen off a cliff at the end of the month.

"While the Volkswagen scandal will have a negative impact on sales, the affected models represent less than a quarter of their portfolio, and some dealers have already depleted their stock of those units," said Alec Gutierrez, senior analyst for Kelley Blue Book. "The larger issue is the hit the automaker's brand image and perceived trustworthiness, which may affect sales of their other models. We think the effects on September sales won't be too bad for Volkswagen Group's combined sales, but October and beyond could be another story."

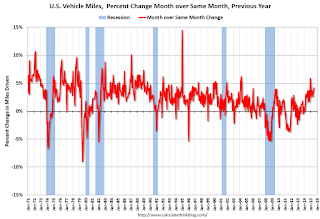

DOT: Vehicle Miles Driven increased 4.2% year-over-year in July, Rolling 12 Months at All Time High

by Calculated Risk on 9/25/2015 03:01:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 4.2% (11.4 billion vehicle miles) for July 2015 as compared with July 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 283.7 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for July 2015 is 264.4 billion miles, a 3.9% (9.9 billion vehicle miles) increase over July 2014. It also represents a 0.8% change (2.1 billion vehicle miles) compared with June 2015.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In July 2015, gasoline averaged of $2.88 per gallon according to the EIA. That was down significantly from July 2014 when prices averaged $3.69 per gallon.

In July 2015, gasoline averaged of $2.88 per gallon according to the EIA. That was down significantly from July 2014 when prices averaged $3.69 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is setting new highs each month.

Black Knight's First Look at August: Mortgage "Delinquency Rate Sees Largest 12-Month Decline in Four Years"

by Calculated Risk on 9/25/2015 11:59:00 AM

From Black Knight: Black Knight Financial Services' First Look at August Mortgage Data: Despite Monthly Rise, Delinquency Rate Sees Largest 12-Month Decline in Four Years

According to Black Knight's First Look report for August, the percent of loans delinquent increased 2.5% in August compared to July, and declined 18.2% year-over-year.

The percent of loans in the foreclosure process declined 2% in August and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.83% in August, up from 4.71% in July.

The percent of loans in the foreclosure process declined in August to 1.37%. This was the lowest level of foreclosure inventory since 2007.

The number of delinquent properties, but not in foreclosure, is down 548,000 properties year-over-year, and the number of properties in the foreclosure process is down 217,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for August in early October.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2015 | July 2015 | Aug 2014 | Aug 2013 | |

| Delinquent | 4.83% | 4.71% | 5.90% | 6.20% |

| In Foreclosure | 1.37% | 1.40% | 1.80% | 2.66% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,582,000 | 1,503,000 | 1,852000 | 1,836,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 865,000 | 886,000 | 1,143,000 | 1,288,000 |

| Number of properties in foreclosure pre-sale inventory: | 696,000 | 711,000 | 913,000 | 1,341,000 |

| Total Properties | 3,142,000 | 3,100,000 | 3,908,000 | 4,465,000 |

Final September Consumer Sentiment at 87.2

by Calculated Risk on 9/25/2015 10:02:00 AM

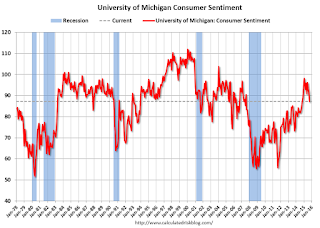

The final University of Michigan consumer sentiment index for September was at 87.2, up from the preliminary reading of 85.7, and down from 91.9 in August.

This was at the consensus forecast of 87.1.

Q2 GDP Revised Up to 3.9% Annual Rate

by Calculated Risk on 9/25/2015 08:35:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 3.9 percent in the second quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.6 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 3.1% to 3.6%. Residential investment was revised up from 7.8% to 9.3%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.7 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE) and nonresidential fixed investment increased more than previously estimated ...

emphasis added

Thursday, September 24, 2015

Friday: Q2 GDP (3rd estimate), Consumer Sentiment

by Calculated Risk on 9/24/2015 07:21:00 PM

During her post FOMC press conference, Dr. Yellen declined to say whether she thought a rate hike was likely this year. However, in her speech today, Dr. Yellen included herself:

"Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter."Barring a significant economic change, it seems likely there will be a rate hike in October, or more likely, December.

emphasis added

From Jon Hilsenrath and Ben Leubsdorf at the WSJ: Janet Yellen Says Fed Interest Rate Increase Still Likely This Year

Federal Reserve Chairwoman Janet Yellen laid out her most detailed case yet for the central bank to begin raising short-term interest rates later this year ...Friday:

Ms. Yellen made her case like a prosecutor making a courtroom closing argument. She presented it in a 40-page speech at the University of Massachusetts in Amherst, including 40 academic citations, 35 footnotes, nine graphs and an appendix.

Central to her argument was a belief that slack in the economy has diminished to a point where inflation pressures should start to gradually build in the coming years.

Those pressures aren’t asserting themselves yet, she argued, because a strong dollar and falling oil and import prices are placing temporary downward pressure on consumer prices. As those headwinds diminish, she predicted, inflation will gradually rise.

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2015 (third estimate). The consensus is that real GDP increased 3.7% annualized in Q2, the same as the second estimate.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 87.1, up from the preliminary reading of 85.7.

Yellen: Anticipates Raising Fed Funds Rate this Year

by Calculated Risk on 9/24/2015 05:05:00 PM

From Fed Chair Janet Yellen: Inflation Dynamics and Monetary Policy

Assuming that my reading of the data is correct and long-run inflation expectations are in fact anchored near their pre-recession levels, what implications does the preceding description of inflation dynamics have for the inflation outlook and for monetary policy?

This framework suggests, first, that much of the recent shortfall of inflation from our 2 percent objective is attributable to special factors whose effects are likely to prove transitory. As the solid black line in figure 8 indicates, PCE inflation has run noticeably below our 2 percent objective on average since 2008, with the shortfall approaching about 1 percentage point in both 2013 and 2014 and more than 1-1/2 percentage points this year. The stacked bars in the figure give the contributions of various factors to these deviations from 2 percent, computed using an estimated version of the simple inflation model I just discussed. As the solid blue portion of the bars shows, falling consumer energy prices explain about half of this year's shortfall and a sizable portion of the 2013 and 2014 shortfalls as well. Another important source of downward pressure this year has been a decline in import prices, the portion with orange checkerboard pattern, which is largely attributable to the 15 percent appreciation in the dollar's exchange value over the past year. In contrast, the restraint imposed by economic slack, the green dotted portion, has diminished steadily over time as the economy has recovered and is now estimated to be relatively modest.31 Finally, a similarly small portion of the current shortfall of inflation from 2 percent is explained by other factors (which include changes in food prices); importantly, the effects of these other factors are transitory and often switch sign from year to year.

Although an accounting exercise like this one is always imprecise and will depend on the specific model that is used, I think its basic message--that the current near-zero rate of inflation can mostly be attributed to the temporary effects of falling prices for energy and non-energy imports--is quite plausible. If so, the 12-month change in total PCE prices is likely to rebound to 1-1/2 percent or higher in 2016, barring a further substantial drop in crude oil prices and provided that the dollar does not appreciate noticeably further.

To be reasonably confident that inflation will return to 2 percent over the next few years, we need, in turn, to be reasonably confident that we will see continued solid economic growth and further gains in resource utilization, with longer-term inflation expectations remaining near their pre-recession level. Fortunately, prospects for the U.S. economy generally appear solid. Monthly payroll gains have averaged close to 210,000 since the start of the year and the overall economy has been expanding modestly faster than its productive potential. My colleagues and I, based on our most recent forecasts, anticipate that this pattern will continue and that labor market conditions will improve further as we head into 2016.

The labor market has achieved considerable progress over the past several years. Even so, further improvement in labor market conditions would be welcome because we are probably not yet all the way back to full employment. Although the unemployment rate may now be close to its longer-run normal level--which most FOMC participants now estimate is around 4.9 percent--this traditional metric of resource utilization almost certainly understates the actual amount of slack that currently exists: On a cyclically adjusted basis, the labor force participation rate remains low relative to its underlying trend, and an unusually large number of people are working part time but would prefer full-time employment. Consistent with this assessment is the slow pace at which hourly wages and compensation have been rising, which suggests that most firms still find it relatively easy to hire and retain employees.

Reducing slack along these other dimensions may involve a temporary decline in the unemployment rate somewhat below the level that is estimated to be consistent, in the longer run, with inflation stabilizing at 2 percent. For example, attracting discouraged workers back into the labor force may require a period of especially plentiful employment opportunities and strong hiring. Similarly, firms may be unwilling to restructure their operations to use more full-time workers until they encounter greater difficulty filling part-time positions. Beyond these considerations, a modest decline in the unemployment rate below its long-run level for a time would, by increasing resource utilization, also have the benefit of speeding the return to 2 percent inflation. Finally, albeit more speculatively, such an environment might help reverse some of the significant supply-side damage that appears to have occurred in recent years, thereby improving Americans' standard of living.

Consistent with the inflation framework I have outlined, the medians of the projections provided by FOMC participants at our recent meeting show inflation gradually moving back to 2 percent, accompanied by a temporary decline in unemployment slightly below the median estimate of the rate expected to prevail in the longer run. These projections embody two key judgments regarding the projected relationship between real activity and interest rates. First, the real federal funds rate is currently somewhat below the level that would be consistent with real GDP expanding in line with potential, which implies that the unemployment rate is likely to continue to fall in the absence of some tightening. Second, participants implicitly expect that the various headwinds to economic growth that I mentioned earlier will continue to fade, thereby boosting the economy's underlying strength. Combined, these two judgments imply that the real interest rate consistent with achieving and then maintaining full employment in the medium run should rise gradually over time. This expectation, coupled with inherent lags in the response of real activity and inflation to changes in monetary policy, are the key reasons that most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year and to continue boosting short-term rates at a gradual pace thereafter as the labor market improves further and inflation moves back to our 2 percent objective.

By itself, the precise timing of the first increase in our target for the federal funds rate should have only minor implications for financial conditions and the general economy. What matters for overall financial conditions is the entire trajectory of short-term interest rates that is anticipated by markets and the public. As I noted, most of my colleagues and I anticipate that economic conditions are likely to warrant raising short-term interest rates at a quite gradual pace over the next few years. It's important to emphasize, however, that both the timing of the first rate increase and any subsequent adjustments to our federal funds rate target will depend on how developments in the economy influence the Committee's outlook for progress toward maximum employment and 2 percent inflation.

The economic outlook, of course, is highly uncertain and it is conceivable, for example, that inflation could remain appreciably below our 2 percent target despite the apparent anchoring of inflation expectations. Here, Japan's recent history may be instructive: As shown in figure 9, survey measures of longer-term expected inflation in that country remained positive and stable even as that country experienced many years of persistent, mild deflation.34 The explanation for the persistent divergence between actual and expected inflation in Japan is not clear, but I believe that it illustrates a problem faced by all central banks: Economists' understanding of the dynamics of inflation is far from perfect. Reflecting that limited understanding, the predictions of our models often err, sometimes significantly so. Accordingly, inflation may rise more slowly or rapidly than the Committee currently anticipates; should such a development occur, we would need to adjust the stance of policy in response.

Considerable uncertainties also surround the outlook for economic activity. For example, we cannot be certain about the pace at which the headwinds still restraining the domestic economy will continue to fade. Moreover, net exports have served as a significant drag on growth over the past year and recent global economic and financial developments highlight the risk that a slowdown in foreign growth might restrain U.S. economic activity somewhat further. The Committee is monitoring developments abroad, but we do not currently anticipate that the effects of these recent developments on the U.S. economy will prove to be large enough to have a significant effect on the path for policy. That said, in response to surprises affecting the outlook for economic activity, as with those affecting inflation, the FOMC would need to adjust the stance of policy so that our actions remain consistent with inflation returning to our 2 percent objective over the medium term in the context of maximum employment.

Given the highly uncertain nature of the outlook, one might ask: Why not hold off raising the federal funds rate until the economy has reached full employment and inflation is actually back at 2 percent? The difficulty with this strategy is that monetary policy affects real activity and inflation with a substantial lag. If the FOMC were to delay the start of the policy normalization process for too long, we would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals. Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession. In addition, continuing to hold short-term interest rates near zero well after real activity has returned to normal and headwinds have faded could encourage excessive leverage and other forms of inappropriate risk-taking that might undermine financial stability. For these reasons, the more prudent strategy is to begin tightening in a timely fashion and at a gradual pace, adjusting policy as needed in light of incoming data.

Conclusion

To conclude, let me emphasize that, following the dual mandate established by the Congress, the Federal Reserve is committed to the achievement of maximum employment and price stability. To this end, we have maintained a highly accommodative monetary policy since the financial crisis; that policy has fostered a marked improvement in labor market conditions and helped check undesirable disinflationary pressures. However, we have not yet fully attained our objectives under the dual mandate: Some slack remains in labor markets, and the effects of this slack and the influence of lower energy prices and past dollar appreciation have been significant factors keeping inflation below our goal. But I expect that inflation will return to 2 percent over the next few years as the temporary factors that are currently weighing on inflation wane, provided that economic growth continues to be strong enough to complete the return to maximum employment and long-run inflation expectations remain well anchored. Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter. But if the economy surprises us, our judgments about appropriate monetary policy will change.

emphasis added

Comments on August New Home Sales

by Calculated Risk on 9/24/2015 11:59:00 AM

The new home sales report for August was above expectations and sales were at the highest level since early 2008. New home sales are important for jobs and the economy, and the solid increase in sales this year is a positive sign.

Earlier: New Home Sales increased to 552,000 Annual Rate in August.

The Census Bureau reported that new home sales this year, through August, were 359,000, not seasonally adjusted (NSA). That is up 21.1% from 297,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for the first eight months of 2015!

Sales were up 21.6% year-over-year in August.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain was strong through August, however I expect the year-over-year increases to slow over the remaining months - but the overall year-over-year gain should be solid in 2015.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity Declined Again in September

by Calculated Risk on 9/24/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined at a Similar Pace

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined at a similar pace as in previous months, while expectations for future activity dropped considerably.The recent decline in the Kansas City region manufacturing has probably been mostly due to lower oil prices, although respondents also blame the strong dollar.

“Survey respondents continued to blame a strong dollar and weak energy activity for declining factory activity”, said Wilkerson. “This month their future outlook also weakened after holding steady in recent months.”

...

Tenth District manufacturing activity declined at a similar pace as in previous months, while expectations for future activity dropped considerably. Producers continued to cite weak oil and gas activity along with a strong dollar as key reasons for the sluggish activity. Most price indexes fell from the previous survey.

The month-over-month composite index was -8 in September, largely unchanged from -9 in August and -7 in July ... employment index inched up from -10 to -7, and the new orders for exports index also moved slightly higher.

emphasis added