by Calculated Risk on 8/22/2013 01:12:00 PM

Thursday, August 22, 2013

Philly Fed: State Coincident Indexes increased in 34 states in July

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2013. In the past month, the indexes increased in 34 states, decreased in nine states, and remained stable in seven, for a one-month diffusion index of 50. Over the past three months, the indexes increased in 38 states, decreased in nine, and remained stable in three, for a three-month diffusion index of 58.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In July, 38 states had increasing activity, the same as in June (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are several states with declining activity again.

Kansas City Fed: Regional Manufacturing Activity "Improved Further" in August

by Calculated Risk on 8/22/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Improved Further

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved further, and producers’ expectations also edged higher after easing last month.A few industry comments from the survey:

“Although some District firms noted weakness in August associated with federal spending cuts and difficulties finding workers, we were encouraged to see another solid gain in our composite index and most of its components,” said Wilkerson

The month-over-month composite index was 8 in August, up from 6 in July and -5 in June ... production index remained solid at 21, and the new orders and order backlog indexes also rose moderately. The new orders for exports index edged higher from 2 to 4, and the employment index moved into positive territory for the first time in six months.

emphasis added

“More projects are being delayed by government-related entities.”Earlier today Markit released their Flash PMI: Manufacturing recovery gains momentum as order growth hits seven-month high

“Our defense business is down significantly.”

“Sequestration is hitting us very hard. The heavy infrastructure market is way down due to lack of federal spending.”

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) signalled the strongest improvement in manufacturing business conditions in five months during August. The flash PMI index, which is based on approximately 85% of usual monthly replies, was up slightly from July’s 53.7 to 53.9, and suggested a moderate expansion of the manufacturing sector.The Dallas and Richmond Fed regional surveys for August will be released early next week. So far the regional surveys (and the Markit Flash PMI) suggest continued expansion for manufacturing in August.

Firms received a larger volume of new orders in August, with a number of companies linking this to greater demand and new client wins. Moreover, the rate of growth was strong and, having accelerated for the fourth month running, the fastest since January.

...

Manufacturing employment increased for the second month running in August. The rate of job creation was moderate and, having quickened slightly since July, the fastest in four months. Firms that hired additional staff generally cited increased workloads.

Weekly Initial Unemployment Claims increase to 336,000, Four Week Average Lowest since November 2007

by Calculated Risk on 8/22/2013 08:30:00 AM

The DOL reports:

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 13,000 from the previous week's revised figure of 323,000. The 4-week moving average was 330,500, a decrease of 2,250 from the previous week's revised average of 332,750.

The previous week was revised up from 320,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 330,500.

The 4-week average is at the lowest level since November 2007 (before the recession started). Claims were above the 329,000 consensus forecast.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Wednesday, August 21, 2013

Thursday: Unemployment Claims

by Calculated Risk on 8/21/2013 09:13:00 PM

Probably the key sentences in the FOMC minutes released today were:

In considering the likely path for the Committee's asset purchases, members discussed the degree of improvement in the labor market outlook since the purchase program began last fall. The unemployment rate had declined considerably since then, and recent gains in payroll employment had been solid. However, other measures of labor utilization--including the labor force participation rate and the numbers of discouraged workers and those working part time for economic reasons--suggested more modest improvement, and other indicators of labor demand, such as rates of hiring and quits, remained low. While a range of views were expressed regarding the cumulative improvement in the labor market since last fall, almost all Committee members agreed that a change in the purchase program was not yet appropriate.This is a reminder that the FOMC is looking at more than improvement in the headline payroll numbers and the unemployment rate.

emphasis added

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 329 thousand from 320 thousand last week.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for August. The consensus is for an increase to 53.5 from 53.2 in July.

• Also at 9:00 AM, the FHFA House Price Index for June 2013. This was originally a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.6% increase.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5 for this survey, down from 6 in July (Above zero is expansion).

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/21/2013 06:32:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for selected cities in July.

From CR: Look at the two columns in the table for Total "Distressed" Share. The share of distressed sales is down year-over-year in every area.

Also there has been a decline in foreclosure sales in all of these areas (except Springfield, Ill).

And short sales are now declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly staying steady or declining slightly. The all cash share will probably decline as investors decrease their buying.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | |

| Las Vegas | 28.0% | 40.0% | 8.0% | 20.7% | 36.0% | 60.7% | 54.5% | 54.8% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 11.5% | 29.5% | 9.4% | 14.6% | 20.8% | 44.1% | 35.8% | 44.9% |

| Sacramento | 19.7% | 31.0% | 7.3% | 23.2% | 27.0% | 54.2% | 25.5% | 31.1% |

| Minneapolis | 5.6% | 9.3% | 15.0% | 24.5% | 20.6% | 33.8% | ||

| Mid-Atlantic | 7.2% | 11.3% | 6.6% | 8.7% | 13.8% | 20.0% | 16.1% | 17.9% |

| Orlando | 12.8% | 28.2% | 17.3% | 23.4% | 30.1% | 51.6% | 47.6% | 49.7% |

| California (DQ)* | 14.6% | 26.0% | 8.4% | 21.7% | 23.0% | 47.7% | ||

| Bay Area CA (DQ)* | 10.0% | 23.7% | 4.8% | 15.1% | 14.8% | 38.8% | 24.0% | 27.6% |

| So. California (DQ)* | 14.5% | 26.2% | 7.8% | 20.7% | 22.3% | 46.9% | 29.4% | 31.8% |

| Florida SF | 13.8% | 21.6% | 15.9% | 17.5% | 29.7% | 39.2% | 42.5% | 42.8% |

| Florida C/TH | 11.0% | 19.2% | 15.4% | 17.5% | 26.5% | 36.8% | 70.0% | 72.9% |

| Miami MSA SF | 17.4% | 23.0% | 12.6% | 16.5% | 30.0% | 39.5% | 44.0% | 43.1% |

| Miami MSA C/TH | 12.8% | 20.5% | 17.5% | 19.6% | 30.3% | 40.1% | 75.5% | 78.3% |

| Northeast Florida | 32.5% | 42.6% | ||||||

| Chicago | 29.0% | 36.0% | ||||||

| Rhode Island | 13.9% | 24.7% | ||||||

| Charlotte | 9.5% | 13.8% | ||||||

| Toledo | 35.0% | 36.5% | ||||||

| Wichita | 24.1% | 25.3% | ||||||

| Knoxville | 25.7% | 26.5% | ||||||

| Des Moines | 15.1% | 18.0% | ||||||

| Peoria | 18.6% | 20.7% | ||||||

| Tucson | 29.1% | 33.1% | ||||||

| Omaha | 15.9% | 15.6% | ||||||

| Pensacola | 30.0% | 31.2% | ||||||

| Akron | 25.5% | 30.0% | ||||||

| Houston | 7.8% | 16.3% | ||||||

| Memphis* | 16.7% | 26.9% | ||||||

| Birmingham AL | 17.2% | 27.2% | ||||||

| Springfield IL | 13.1% | 13.0% | ||||||

| *share of existing home sales, based on property records | ||||||||

AIA: "Positive Trend Continues for Architecture Billings Index" in July

by Calculated Risk on 8/21/2013 04:18:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Positive Trend Continues for Architecture Billings Index

The Architecture Billings Index (ABI) saw a jump of more than a full point last month, indicating acceleration in the growth of design activity nationally. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 52.7, up from a mark of 51.6 in June. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 66.7, up dramatically from the reading of 62.6 the previous month.

"There continues to be encouraging signs that the design and construction industry continues to improve,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But we also hear a wide mix of business conditions all over the country, ranging from outstanding and booming to slowly improving to flat. In fact, plenty of architecture firms are reporting very weak business conditions as well, so it is premature to declare the entire sector has entered an expansion phase.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.7 in July, up from 51.6 in June. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 11 of the last 12 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The increases in this index over the past year suggest some increase in CRE investment in the second half of 2013.

FOMC Minutes: "Almost all Committee members agreed that a change in the purchase program was not yet appropriate"

by Calculated Risk on 8/21/2013 02:00:00 PM

The start of tapering is still contingent on incoming employment data. The July employment report was released a few days after this FOMC meeting, and the report was disappointing (although the unemployment rate declined to 7.4%). There is only one more employment report before the September FOMC meeting. Clearly the Fed is getting ready to start reducing their asset purchases soon, but they are not ready yet.

From the Fed: Minutes of the Federal Open Market Committee, July 30-31, 2013 . A few excerpts on asset purchases:

In their discussion of monetary policy for the period ahead, members judged that a highly accommodative stance of monetary policy was warranted in order to foster a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability. In considering the likely path for the Committee's asset purchases, members discussed the degree of improvement in the labor market outlook since the purchase program began last fall. The unemployment rate had declined considerably since then, and recent gains in payroll employment had been solid. However, other measures of labor utilization--including the labor force participation rate and the numbers of discouraged workers and those working part time for economic reasons--suggested more modest improvement, and other indicators of labor demand, such as rates of hiring and quits, remained low. While a range of views were expressed regarding the cumulative improvement in the labor market since last fall, almost all Committee members agreed that a change in the purchase program was not yet appropriate. However, in the view of the one member who dissented from the policy statement, the improvement in the labor market was an important reason for calling for a more explicit statement from the Committee that asset purchases would be reduced in the near future. A few members emphasized the importance of being patient and evaluating additional information on the economy before deciding on any changes to the pace of asset purchases. At the same time, a few others pointed to the contingent plan that had been articulated on behalf of the Committee the previous month, and suggested that it might soon be time to slow somewhat the pace of purchases as outlined in that plan. At the conclusion of its discussion, the Committee decided to continue adding policy accommodation by purchasing additional MBS at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month and to maintain its existing reinvestment policies. In addition, the Committee reaffirmed its intention to keep the target federal funds rate at 0 to 1/4 percent and retained its forward guidance that it anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.

Members also discussed the wording of the policy statement to be issued following the meeting. In addition to updating its description of the state of the economy, the Committee decided to underline its concern about recent shortfalls of inflation from its longer-run goal by including in the statement an indication that it recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, while also noting that it continues to anticipate that inflation will move back toward its objective over the medium term. The Committee also considered whether to add more information concerning the contingent outlook for asset purchases to the policy statement, but judged that doing so might prompt an unwarranted shift in market expectations regarding asset purchases. The Committee decided to indicate in the statement that it "reaffirmed its view"--rather than simply "expects"--that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens.

emphasis added

Comments on Existing Home Sales: Too early to see impact of higher mortgage rates, Inventory has Bottomed

by Calculated Risk on 8/21/2013 11:20:00 AM

First, the headline sales number was no surprise (see Lawler: Early Look at Existing Home Sales in July).

Second, the strong sales rate in July is not a sign that higher mortgage rates have had no impact on sales. The NAR reports CLOSED sales, and the usual escrow period is 45 to 60 days. Mortgage rates didn't start increasing sharply until the 2nd half of May (see Freddie Mac Weekly Primary Mortgage Market Survey®), so buyers could have locked in rates in May - and pushed to close in July. My guess is sales will be down in August reflecting higher mortgage rates.

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased 5.6% in July from June, and is only down 5.0% from July 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of July since 2002, but this is also the smallest year-over-year decline since March 2011. The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

When will the NAR report a year-over-year increase in inventory? Soon. Right now I'm guessing inventory will be up year-over-year in September.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 17.2% from July 2012, but conventional sales are probably up close to 30% from July 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 15 percent of July sales, the same as in June and matching the lowest share since monthly tracking began in October 2008; they were 24 percent in July 2012.Although this survey isn't perfect, if total sales were up 17.2% from July 2012, and distressed sales declined to 15% of total sales (15% of 5.39 million) from 24% (24% of 4.60 million in July 2012), this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in July (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report, but it is too early to tell about the impact of higher mortgage rates on sales. Inventory is still low, but the year-over-year decline in inventory is decreasing - and will turn positive soon (indicating inventory bottomed earlier this year).

Earlier:

• Existing Home Sales in July: 5.39 million SAAR, 5.1 months of supply

Existing Home Sales in July: 5.39 million SAAR, 5.1 months of supply

by Calculated Risk on 8/21/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Spike in July

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 6.5 percent to a seasonally adjusted annual rate of 5.39 million in July from a downwardly revised 5.06 million in June, and are 17.2 percent above the 4.60 million-unit pace in July 2012; sales have remained above year-ago levels for 25 months.

Total housing inventory at the end of July rose 5.6 percent to 2.28 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace, unchanged from June. Listed inventory is 5.0 percent below a year ago, when there was a 6.3-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2013 (5.39 million SAAR) were 6.5% higher than last month, and were 17.2% above the July 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.28 million in July up from 2.16 million in June. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.28 million in July up from 2.16 million in June. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 5.0% year-over-year in July compared to July 2012. This is the 29th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since early 2011 (I expect the YoY change in inventory to turn positive soon).

Inventory decreased 5.0% year-over-year in July compared to July 2012. This is the 29th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since early 2011 (I expect the YoY change in inventory to turn positive soon).Months of supply was at 5.1 months in July.

This was above expectations of sales of 5.13 million (but very close to economist Tom Lawler's forecast of 5.33 million). For existing home sales, the key number is inventory - and inventory is still down year-over-year, although the declines are slowing. This was another solid report. I'll have more later ...

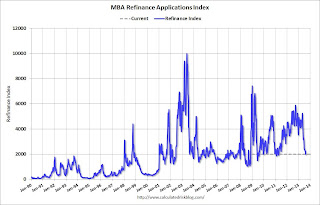

MBA: Mortgage Refinance Applications down 62% from Recent Peak

by Calculated Risk on 8/21/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 16, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The Refinance Index has dropped 62.1 percent from the recent peak reached during the week of May 3, 2013. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.68 percent from 4.56 percent, with points increasing to 0.42 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 13 of the last 15 weeks.

This index is down 62.1% over the last 15 weeks. The last time the index declined this far was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen a similar increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.8% today.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.