by Calculated Risk on 8/21/2013 07:01:00 AM

Wednesday, August 21, 2013

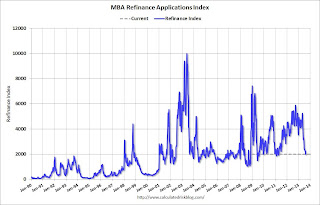

MBA: Mortgage Refinance Applications down 62% from Recent Peak

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 16, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The Refinance Index has dropped 62.1 percent from the recent peak reached during the week of May 3, 2013. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.68 percent from 4.56 percent, with points increasing to 0.42 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 13 of the last 15 weeks.

This index is down 62.1% over the last 15 weeks. The last time the index declined this far was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen a similar increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.8% today.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.