by Calculated Risk on 7/15/2016 09:23:00 AM

Friday, July 15, 2016

Fed: Industrial Production increased 0.6% in June

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in June after declining 0.3 percent in May. For the second quarter as a whole, industrial production fell at an annual rate of 1.0 percent, its third consecutive quarterly decline. Manufacturing output moved up 0.4 percent in June, a gain largely due to an increase in motor vehicle assemblies. The output of manufactured goods other than motor vehicles and parts was unchanged. The index for utilities rose 2.4 percent as a result of warmer weather than is typical for June boosting demand for air conditioning. The output of mining moved up 0.2 percent for its second consecutive small monthly increase following eight straight months of decline. At 104.1 percent of its 2012 average, total industrial production in June was 0.7 percent lower than its year-earlier level. Capacity utilization for the industrial sector increased 0.5 percentage point in June to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.4% is 4.6% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.6% in June to 104.1. This is 19.1% above the recession low, and 1.5% below the pre-recession peak.

This was above expectations of a 0.4% increase.

Retail Sales increased 0.6% in June

by Calculated Risk on 7/15/2016 08:41:00 AM

On a monthly basis, retail sales were up 0.6% from May to June (seasonally adjusted), and sales were up 2.7% from June 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $457.0 billion, an increase of 0.6 percent from the previous month, and 2.7 percent above June 2015. ... The April 2016 to May 2016 percent change was revised from up 0.5 percent to up 0.2 percent.

Click on graph for larger image.

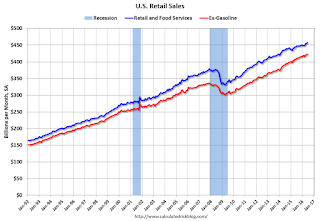

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.9% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.9% on a YoY basis.The increase in June was way above expectations for the month, however retail sales for April and May were revised down. Overall a decent report.

Thursday, July 14, 2016

Friday: Retail Sales, CPI, Industrial Production and More

by Calculated Risk on 7/14/2016 06:46:00 PM

Friday:

• At 8:30 AM ET, The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Retail sales for June will be released. The consensus is for retail sales to increase 0.1% in June.

• Also at 8:30 AM, the New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 5.0, down from 6.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 75.0%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for a 0.1% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 93.5, unchanged from 93.5 in June.

Looking back 7 Years Ago: The Sluggish Recovery Began

by Calculated Risk on 7/14/2016 01:31:00 PM

Note: This is the 12th year I've been writing this blog. Sometimes it is fun to look back, especially at turning points. Starting in January 2005, I was very bearish on housing - and in early 2007, I predicted a recession.

However in 2009 I became more optimistic. Here are a couple of posts I wrote 7 years ago on July 15, 2009:

Is the Recession Over?

Show me the Engines of Growth

Back in February I pointed out that I expected to see some economic rays of sunshine this year. But I never expected an immaculate recovery forecast from the FOMC.I also noted - because the recovery would be sluggish, and jobless at first - that I'd expect the NBER to wait some time before dating the recession. The NBER finally dated the end of the recession in September 2010:

Although I've argued repeatedly that a "Great Depression 2" was extremely unlikely, I think the other extreme - an immaculate recovery - is also unlikely.

CAMBRIDGE September 20, 2010 - The Business Cycle Dating Committee of the National Bureau of Economic Research met yesterday by conference call. At its meeting, the committee determined that a trough in business activity occurred in the U.S. economy in June 2009. The trough marks the end of the recession that began in December 2007 and the beginning of an expansion. The recession lasted 18 months, which makes it the longest of any recession since World War II.Currently I'm still positive on the economy, and - as I noted in The Endless Parade of Recession Calls last year:

Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). Someday I'll make another recession call, but I'm not even on recession watch now.I'm still not a recession watch.

Sacramento Housing in June: Sales up 1.8%, Active Inventory down 12% YoY

by Calculated Risk on 7/14/2016 11:21:00 AM

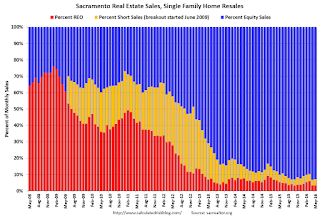

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June, total sales were up 1.8% from June 2015, and conventional equity sales were up 6.2% compared to the same month last year.

In June, 5.0% of all resales were distressed sales. This was down from 7.0% last month, and down from 10.6% in June 2015, and the lowest level since Sacramento started tracking distressed sales.

The percentage of REOs was at 2.5% in June, and the percentage of short sales was 2.5%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 12.1% year-over-year (YoY) in June. This was the fourteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.9% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying - but limited inventory.

Weekly Initial Unemployment Claims unchanged at 254,000

by Calculated Risk on 7/14/2016 08:33:00 AM

The DOL reported:

In the week ending July 9, the advance figure for seasonally adjusted initial claims was 254,000, unchanged from the previous week's unrevised level of 254,000. The 4-week moving average was 259,000, a decrease of 5,750 from the previous week's unrevised average of 264,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 71 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 259,000.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, July 13, 2016

Update: "Scariest jobs chart ever"

by Calculated Risk on 7/13/2016 06:31:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 254 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I was asked if I could post an update to the graph, and here it is through the June 2016 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 4.1% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Fed's Beige Book: "Economic activity continued to expand at a modest pace" in most Districts

by Calculated Risk on 7/13/2016 03:40:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of St. Louis and based on information collected on or before July 1, 2016."

Reports from the twelve Federal Reserve Districts indicate that economic activity continued to expand at a modest pace across most regions from mid-May through the end of June. Business contacts in Cleveland reported a steady level of activity, while Minneapolis reported that activity increased at a moderate pace. Labor market conditions remained stable as employment continued to grow modestly since the previous report and wage pressures remained modest to moderate. Price pressures remained slight. Consumer spending was generally positive but with some signs of softening. Manufacturing activity was mixed but generally improved across Districts. Real estate activity continued to strengthen, and banks reported overall increases in loan demand. Agricultural activity was mixed but generally improving. The natural resources and energy sector has remained weak. The outlook was generally positive across broad segments of the economy including retail sales, manufacturing, and real estate. Districts reporting on overall growth expect it to remain modest.And on real estate:

Residential real estate activity continued to strengthen since the previous period. Single-family home sales increased at a moderate pace overall, with Boston, Cleveland, and St. Louis reporting strong growth. Many Districts indicated that inventories continue to be low. Despite this persistent inventory issue, Boston, Atlanta, Kansas City, and Dallas all report that contacts have a positive outlook for the market in the next few months. Districts generally reported that house prices increased. Residential construction activity was mostly positive across Districts. Cleveland and Kansas City indicated strong growth in housing starts. Conversely, New York reported that single-family construction tapered off through most of the District, and Chicago reported little change in residential construction activity. Philadelphia, Richmond, St. Louis, and San Francisco noted a lack of available lots to build on.Decent Real Estate growth in most districts ...

Commercial sales and leasing activity remained stable or improved in almost all Districts. Absorption rate and rent increases were documented in Atlanta and Kansas City. Improving industrial real estate markets were noted in New York, Richmond, and Dallas. Several contacts in Richmond also reported robust retail leasing activity. Office market conditions were mixed among reporting Districts. Commercial construction activity grew modestly from the previous reporting period. Construction activity picked up in New York, and Cleveland continued to report project pipelines are strong. Reports on multifamily construction were mixed in Richmond, Atlanta, and Dallas. New York noted that multifamily construction has tapered off through most of the District.

emphasis added

Q2 GDP Forecasts

by Calculated Risk on 7/13/2016 12:31:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2016 is 2.3 percent on July 12, down from 2.4 percent on July 6.From the NY Fed Nowcasting Report

The FRBNY Staff Nowcast stands at 2.1% and 2.3% for 2016:Q2 and 2016:Q3, respectively.From Merrill Lynch:

Wholesale inventories increased 0.1% mom in May, down from a 0.7% mom increase in the prior month (revised from 0.6% mom initially) and lower than consensus expectations of a 0.2% mom change. The data were a bit above our own expectations, which added 0.2pp to our GDP tracking estimate for 2Q, bringing us to 2.8% qoq saar.CR Note: Looks like real GDP growth in the 2% to 2.5% range.

Update: Framing Lumber Prices Up Slightly Year-over-year

by Calculated Risk on 7/13/2016 09:55:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices are now up slightly year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early July 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up slightly from a year ago, and CME futures are up about 9% year-over-year.