by Calculated Risk on 2/11/2010 08:43:00 PM

Thursday, February 11, 2010

Short Sales: Arm’s Length Transactions

One of the key problems with a short sale is making sure the buyer is an unrelated party; "an arm’s length transaction".

I'm aware of a property being offered as a short sale in SoCal where the agent is the wife of the owner, and she has been, uh, unhelpful to some prospective buyers. I just heard last night that the lender has reached a short sale agreement with a buyer who just happens to be a close friend of the agent. Why am I not surprised? Perhaps this is the best deal for the lender, but I have my doubts.

Jim the Realtor has a "rant" about another agent who apparently took a short sale listing, never put it in the MLS, and then - apparently after getting a short sale agreement - put the listing in the MLS for a few minutes because the lender required a copy of the listing ... I have more doubts about this being the best deal for the lender.

I don't think either of the above deals meets the HAFA requirements. Of course both of the transactions above are not HAFA short sales.

And remember Jillayne's discussion of the Short Sale Negotiator? Under HAFA, those fees have to come out of the real estate commission:

The amount of the real estate commission that may be paid, not to exceed 6% of the contract sales price, and notification if any portion of the commission must be paid to a contractor of the servicer that has been retained to assist the listing broker with the transaction.Finally, I'd suggest HAFA go a step further and have the lender hire the real estate agent for short sales and deed-in-lieu transactions, not the owner. I think there is too much incentive for under-the-table payments to the current homeowner, aka short sale fraud.

Thursday, February 04, 2010

Short Sales: The Negotiator

by Calculated Risk on 2/04/2010 07:42:00 PM

Short sales are a hot topic, and Jillayne Schlicke has an interesting post: Predatory Short Sale Negotiators

I received a call the other day from a consumer who was in the process of purchasing a short sale home. The homeowner has defaulted on her mortgage and the trustee sale auction has been postponed a few times now that this buyer’s firm offer has finally reached the lender’s loss mitigation decision-maker. Once the offer was accepted by the seller, the homebuyer was surprised to learn that there’s a third party involved, a “Short Sale Negotiator” who is charging an additional $9,000 fee on top of the real estate commissions paid to both the agent for the seller and the agent for the buyer. The Short Sale Negotiator is demanding that the homebuyer sign an agreement that the homebuyer will be responsible for paying the $9,000 fee. The homebuyer emailed me asking what I thought of this additional fee and could I offer some advice.Jillayne walks us through the details of this deal and the regulations regarding a "short sales negotiator", as an example, in Washington, the "negotiator" has to be a "licensed real estate agent ... a licensed loan originator or otherwise exempt from licensing such as an attorney".

There is value to the buyer in having someone with experience negotiate with the banks. If the listing and selling agents don't have the necessary experience and contacts, using another agent (or lawyer) to negotiate the deal makes sense. However I'd suggest the agents pay for the "negotiator" since negotiating the deal is usually part of the agent's responsibilities.

If the agents won't pay, Jillayne suggests: "Ask for the negotiator’s [fee] to be put on the HUD I Settlement Statement as a seller’s closing cost. There’s a chance the lender will pay it." If not, the buyer has to decide if the house is worth the additional fee. But one thing is clear - no fee should be paid outside of the settlement statement so that all parties are aware of all the details.

Monday, February 01, 2010

"Short Sales Soar"

by Calculated Risk on 2/01/2010 10:58:00 PM

From the Las Vegas Sun: Short sales soar while foreclosure sales slacken (ht sportsfan)

Short sales averaged about 7 percent to 8 percent of total [Las Vegas] existing-home closings in early 2009, but averaged 22 percent of the market by the end of the year and in early January ...As I've noted, I think short sales will be the story of 2010. It is probably the best solution for many homeowners and lenders.

“We have seen a decrease in foreclosure activity in Las Vegas, which was puzzling to us,” said Daren Bloomquist, marketing manager for California-based RealtyTrac, which monitors foreclosures in Nevada. “Maybe Las Vegas has become somewhat of a test ground for streamlining short sales. It sounds like it could have an impact in Las Vegas.”

...

Dennis Smith, president of Home Builders Research, said short sales will be the “story of the year” because of the effect they will have on the housing market.

...

John Mechem, a spokesman for the Mortgage Bankers Association, said what is happening in Las Vegas is occurring across the country. It is costly for lenders to go through the legal process of foreclosing, and he added that homes can be damaged over time. The return is better on short sale, he said.

As the story mentions, Treasury has started pushing Short Sale and Deed-in-Lieu of Foreclosure as an alternative to modifications.

The Treasury Department is offering incentives on short sales by providing a $2,500 subsidy, $1,000 to the servicer and $1,500 to the seller for moving expenses. In addition, investors can get $1,000 by allowing subordinate lenders to get $3,000 in proceeds from the sale. The program is effective April 5, but servicers can implement it earlier.This is better than "walking away" for the lender - the losses are less than for a foreclosure. And this is better for the homeowner too because Treasury requires that "the borrower will be released from all liability for repayment of the first mortgage debt", although the borrower will still take a credit hit.

Tuesday, January 19, 2010

Short Sale 'Fraud', SoCal Home Sales, FHA to Tighten Standards

by Calculated Risk on 1/19/2010 04:30:00 PM

A few articles of interest ...

This alleged activity by banks - paying 2nd lien holders without proper disclosure - appears outrageous. Based on Olick's reporting, this practice appears to be widespread. Kudos to Olick and hopefully the regulators are reading.

Southern California home sales in December remained above year-ago levels for the 18th consecutive month, bolstered by gains in many mid- to high-end communities. \The market is still mostly first time homebuyers and investors.

...

The December sales tally was the highest for that month since 24,209 homes sold in December 2006, but it was still 11.2 percent below the average for a December – 25,143 sales – over the past 22 years.

...

December’s foreclosure resales remained well below peak levels but were still a large force in the market, edging higher than the prior month for the first time since last February. Foreclosure resales – houses and condos sold in December that had been foreclosed on in the prior 12 months – were 39.6 percent of resales, up from 39.0 percent in November but down from 53.5 percent in December 2008. They hit a high of 56.7 percent last February, then tapered or leveled off month-to-month until last month’s uptick.

...

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 39.6 percent of all home purchase mortgages in December.

Absentee buyers – mostly investors and some second-home purchasers – bought 19.2 percent of the homes sold in December. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 24.9 percent of December sales, based on an analysis of public records.

And the high percentage of FHA buyers is a good lead into the third story ...

Souring FHA-insured mortgages are threatening the agency's finances. Congress is pressuring [FHA commissioner, Mr. Stevens] to tighten the easy-money standards that once helped people like him, and he is expected to announce revisions as early as this week.

Monday, January 11, 2010

Distressed Sales: Sacramento as an Example

by Calculated Risk on 1/11/2010 04:56:00 PM

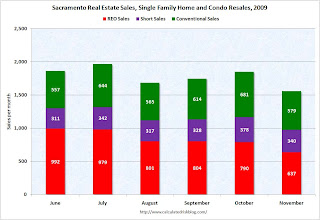

NOTE: I expect the use of short sales to increase nationwide in 2010. Since the Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the December data.

They started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. About 66 percent of all resales (single family homes and condos) were distressed sales in December. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

When the trial modification period ends, the REO sales will probably increase. Also, I expect short sales to be higher in 2010 than in 2009 (there is more emphasis on short sales and deed-in-lieu of foreclosure now).

Total sales in December were off 14.3% compared to December 2008; the seventh month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (27.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Saturday, December 12, 2009

Distressed Sales: Sacramento Market as an Example

by Calculated Risk on 12/12/2009 08:52:00 AM

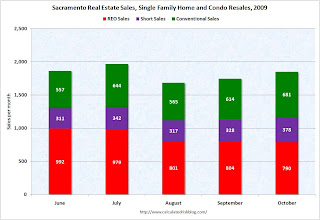

Note: The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the November data.

They started breaking out REO sales last year, but this is only the sixth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in November. The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

Total sales in November were off 16.1% compared to November 2008; the sixth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.4%) or FHA loans (31.4%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in severe distress.

Monday, November 09, 2009

Distressed Sales: Sacramento as Example

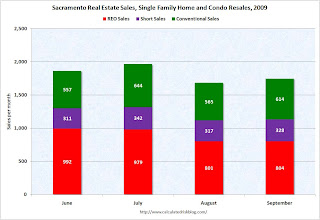

by Calculated Risk on 11/09/2009 03:19:00 PM

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

UPDATE: percentages corrected.

Here is the October data.

They started breaking out REO sales last year, but this is only the fifth monthly report with short sales. About 63.2 percent of all resales (single family homes and condos) were distressed sales in October. The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

Total sales in October were off 17.5% compared to October 2008; the fifth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (28.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in distress.

Tuesday, October 13, 2009

JPMorgan Proposes More 'Extend and Pretend' for Mortgage Modifications

by Calculated Risk on 10/13/2009 03:15:00 PM

From an article by Jody Shenn and Dawn Kopecki on Bloomberg: JPMorgan Pitches Interest-Only Mortgages to Boost Obama Plan

Banks will push the Obama administration to expand its mortgage-modification program to allow interest-only periods on reworked loans ... while recognizing concern that it may only postpone defaults, according to JPMorgan Chase & Co.This is simply more extend and pretend, and only postpones defaults.

“We’re working with our peers to develop a proposal to present,” Douglas Potolsky, a senior vice president at JPMorgan’s Chase home-loan unit, said yesterday at a Mortgage Bankers Association conference in San Diego.

The article also has some comments from Laurie Anne Maggiano, director of the Treasury’s policy office for homeownership preservation. Maggiano acknowleges that only "a couple thousand" modification are now permanent, and she notes that the trial period has been extended an extra two months (I guess a disappointing number of trial modifications are becoming permanent).

The key numbers to track going forward will be the number of permanent modificatons, and the redefault rate for permanent modifications. So far it is "a couple thousand" and too early to say.

The article also quotes Maggiano on the short sale initiative that should be announced next week. Housing Wire has more: Treasury to Announce New Program to Avoid Foreclosure

The Chief of the Homeowner Preservation Office at the Treasury, Laurie Maggiano, released information on the Home Affordable Foreclosure Alternatives (HAFA) while speaking at the MBA’s 96th Annual Convention going on in San Diego. The official launch is expected in the next week or so.

...

Maggiano adds that HAFA will offer financial incentives to both servicers and borrowers, and associated secondary investors, in order to facilitate a short sale or deed in lieu of the property.

Monday, October 12, 2009

Distressed Sales: Sacramento as Example

by Calculated Risk on 10/12/2009 10:12:00 AM

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series (as an example) to see changes in the mix.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the September data.

They started breaking out REO sales last year, but this is only the fourth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in September. The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

Total sales in September were off 18% compared to September 2008; the fourth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (25.2%) or FHA loans (27.6%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Thursday, September 10, 2009

Report: Treasury to Announce Short Sale Incentives this Month

by Calculated Risk on 9/10/2009 11:02:00 AM

From Diana Golobay at Housing Wire: Federal Incentives Coming for Short Sales, Deeds-in-Lieu

US Treasury Department sources confirmed to HousingWire the Treasury expects to issue details on the short sale and deed-in-lieu program later this month.This program is aimed at borrowers who would be "generally eligible for a MHA modification", but are probably too far underwater ... or owe too much.

...

[Federal Housing Administration (FHA) commissioner David Stevens said, in prepared remarks, at a House Financial Services subcommittee hearing yesterday:] “Because we know that the MHA program will not reach every at-risk homeowner or prevent all foreclosures, on May 14th the Administration announced the Foreclosure Alternatives program that will provide incentives for, and encourage, servicers and borrowers to pursue short sales and deeds-in-lieu (DIL) of foreclosure in cases where the borrower is generally eligible for a MHA modification but does not qualify or is unable to complete the process.”

He said the program will simplify the process of pursuing short sales and deeds-in-lieu, which will encourage more servicers and borrowers to participate in the program. The program will standardize the process, documentation and short performance timeframes.

“These options eliminate the need for potentially lengthy and expensive foreclosure proceedings, preserve the physical condition and value of the property by reducing the time a property is vacant, and allows the homeowners to transition with dignity to more affordable housing,” Stevens added.

emphasis added

Friday, July 10, 2009

Short Sellers Beware

by Calculated Risk on 7/10/2009 04:53:00 PM

From the San Francisco Business Times: Sellers owe balances after short sales (ht Michael, SocketSite)

The rising tide of “short sales” by troubled home owners facing foreclosure is prompting lenders to become more aggressive in their attempts to pursue former homeowners for their loan losses in a short sale. In a short sale, a house is sold, with a lender’s approval, for an amount that won’t pay off the mortgages on the property.This is nothing new. Zach Fox (when he was still at the NC Times) reported in April: Lawyers say lenders set stage to collect on 'short sales'

Often, the troubled home owner assumes the loss will be eaten by the lender. But Bank of America and Chase have quietly added language in their short-sale agreements that require the borrower to sign a promissory note for the shortfall.

A spokesman for the American Bankers Association said this week that he wasn’t aware of the practice, suggesting how little attention has been paid so far to collection of these notes from troubled borrowers.

BofA says its intention is to protect investors holding the mortgages.

Lenders appear to be inserting language into short sale contracts that allow them to sue for any "deficiency," or the amount lost by a bank by selling a home for less than the mortgage ---- opening the door to collection agencies and court judgments that can run into the hundreds of thousands of dollars for some North County homeowners.It sounds like the banks will remove the language if asked. I'd suggest having a lawyer review the contract, and make sure "all loans are extinguished and debts forgiven".

...

One real estate agent who specializes in short sales, Chris Mackey of Carmel Valley, said about 50 percent of the short sale contracts he has seen include the language before he requests its removal. Banks generally have removed the language, he said.

... the North County Times obtained a short sale contract issued by Countrywide Financial Corp ... The contract warned the homeowner, who owned a house in El Cajon, that Countrywide "may pursue a deficiency judgment for the difference in the payment received and the total balance due ... "

Sunday, June 07, 2009

The Psychology of Short Sales by Tanta, April 2008

by Calculated Risk on 6/07/2009 12:24:00 AM

Note: The following is an article that Tanta wrote for our April 2008 newsletter. This has not appeared on the blog before (ht Jillayne for reminding me of this).

As CR mentions in his essay on housing supply in this issue, plenty of markets are seeing very large segments of for-sale inventory coming in the form of short sale listings. Yet completed short sales remain a small segment of actual “distressed sales” or final dispositions of “worked out” loans. It is difficult to get reliable current data on short sales completed; the MBA reported in its first major analysis of workout data back in Q3 2007 that in that quarter, there were around 384,000 foreclosure starts and about 9,000 short sales completed. Certainly we have a lot of anecdotal evidence in the mainstream news media and from real estate agent reports suggesting that while short sales were never especially easy to accomplish, they are getting less so as time goes on.

Because so many observers of the scene express endless frustration that short sales have not been embraced by lenders as a “solution” to the foreclosure crisis—and no doubt because many potential real estate investors may be thinking that buying in a short sale is a good way to find a bargain—I thought it would be worthwhile to examine some of the reasons why they just don’t happen as often as one might expect. Part of the problem is overwhelmed servicers dealing with securitization documents that give them limited negotiating room, but that isn’t all of it. There is, I think, a certain psychological issue with two of the important participants in a short sale scenario other than the servicer, namely the current owner and the potential buyer, and this issue is causing short sale proposals that just don’t pass muster with servicers.

We should start by reviewing why it is that a servicer might be inclined to accept a short sale: the idea is that the loss incurred is less than the loss that would be incurred in a foreclosure. To start, then, the servicer must have some model it can use to project likely losses in foreclosure. A good deal of the data going into that model involves not just a projection of the likely sales price of the eventual REO, but also the servicer’s estimates of the costs and expenses of foreclosure, which the short sale is supposed to be minimizing or eliminating. This modeling is dynamic: as a local RE market changes (prices fall, inventory mounts, timelines for foreclosure extend), the model has to keep updating its loss projections.

There is no particular “rule of thumb” for what loss severity in a foreclosure is in any market, but one can start with a fairly simple example of where the losses come from by looking at some aggregated national data prepared by two Freddie Mac economists, Amy Crews Cutts and William A. Merrill, in a recent paper entitled “Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs” (available for download at www. freddiemac.com). The authors estimate the “breakout” of foreclosure losses on Freddie Mac (conforming dollar, prime or near-prime credit quality mortgages) in the period up to the third quarter of 2007 as follows:

• 20% Principal loss (the difference between the unpaid principal balance or UPB of the loan and the REO sales price, or the amount of the borrower’s “negative equity”)

• 37% Pre-Foreclosure Expenses (24% interest expense, 4% legal fees, 8% property costs such as taxes, insurance, assessments and utilities)

• 43% Post-Foreclosure Expenses (21% sales commission/concessions, 2% legal fees, 20% property costs and maintenance/repair

To take a simple example, then, in a market which is currently experiencing a “loss severity” of 40% (of the unpaid principal balance or UPB of the loan), the breakout would look something like this on average (using a smaller than “average” loan balance just to simplify the math):

| Loan Amount | 100,000 |

| REO Sales Price | 92,000 |

| UPB Loss | 8,000 |

| Pre-FC Expense | 14,800 |

| Post-FC Expense | 17,200 |

| Total Loss | 40,000 |

| Loss Severity | 40% |

A short sale, then, would be of interest to the servicer only if it could result in a loss severity less than 40%. Of course, we do not necessarily expect the buyer in a short sale scenario to be offering $92,000 in this example, because that is not, in the buyer’s mind, a “discount” from the price the property would fetch as REO. The idea is that the servicer can be brought to accept a lower price for the property today than it could (potentially) get for the REO, because the short sale saves on the “foreclosure expenses.” Much frustration is being expressed by certain market participants or buyers who are nonplussed by servicers who apparently don’t want to “save” this money by accepting low-ball offers.

Part of the difficulty here is coming to terms with what the components of a servicer’s expenses are, and also what a difference it makes whether the current owner is delinquent (and cash-strapped) or not. It simply isn’t clear to me that everyone who is listing a property as a short sale these days is, actually, delinquent yet. That certainly makes a difference to a servicer’s willingness to negotiate, but it also makes a big difference in terms of what the cost comparisons are.

We also need to consider questions of timing. We looked in last month’s newsletter at some comparative foreclosure timeline numbers, making the point that they are dependent on the state’s laws as much if not more so that the servicer’s capacity or efficiency, although the latter is certainly significant. A short sale, more or less by definition, needs to be a “quick sale.” Delinquent borrowers do not have time to “expose” the property to “typically motivated” buyers for long enough to get the “optimum” price for the property; that’s why they’re facing foreclosure. Non-delinquent borrowers, presumably, can. However, they don’t want to deal with the extraordinarily extended “exposure” time required in a thorough-going RE bust, which moves from a matter of months to, apparently, a matter of years. Short sales offered by non-delinquent sellers fall into this odd sort of time-continuum: not as “quick” as a distressed borrower, but much “quicker” than a borrower seeking at least his loan amount. This no doubt accounts for a lot of the “failure to communicate” between non-delinquent borrower and servicer that we’re hearing about these days.

Let’s look at a theoretical set of alternative transactions based on the average numbers I laid out above. Please note that what I’m trying to capture here is the “mathematics of psychology,” not precisely the mathematics of “reality.” That will, I hope, be clearer after we look at some numbers:

| Foreclosure With 40% Loss Severity | Short Sale with Delinquent Owner | Short Sale with Non-Delinquent Owner | |||

|---|---|---|---|---|---|

| Deal Fails | Deal Passes | "Typical" Exposure | "Quick Sale" | ||

| Loan Amount | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| "Gross" Sales Price | 92,000 | 80,000 | 84,000 | 80,000 | 80,000 |

| Sales Expense to Buyer | - | 8,400 | 8,400 | - | 21,200 |

| "Net" Sales Price | 92,000 | 71,600 | 75,600 | 80,000 | 58,800 |

| UPB Loss | 8,000 | 28,400 | 24,400 | 20,000 | 41,200 |

| Pre-FC Legal & Property | 5,200 | 5,200 | 5,200 | 2,000 | 2,000 |

| Pre-FC Interest Expense | 9,600 | 9,600 | 9,600 | - | - |

| Post FC Legal & Property | 8,800 | - | - | - | - |

| Post-FC Sales Expense | 8,400 | - | - | - | - |

| Total Loss: | 40,000 | 43,200 | 39,200 | 22,000 | 43,200 |

| "Discount" From REO Price | - | 22% | 18% | 13% | 36% |

| Post-FC Sales Expense to Owner | - | - | - | 8,400 | - |

| Pre-FC Interest Expense to Owner | - | - | - | 9,600 | - |

| Pre-FC Property Expense to Owner | - | - | - | 3,200 | - |

In the foreclosure scenario, all costs to maintain the property, as well as cover interest payments on the outstanding loan balance due to the investor, are carried by the servicer and reimbursed from liquidation proceeds. This includes the “post-FC” costs of sales commissions and typical sales concessions (such as paying all or part of a buyer’s closing costs).

In our first example of a short sale with a delinquent owner, the buyer offers $80,000 for the property. However, we are going to assume a cash-strapped seller who is unable to cover the $8,400 in commissions/ concessions that would, in the foreclosure, have been paid by the servicer, and so we will assume that these costs are “passed on” to the buyer of the home, resulting in a net sales price of $71,600, or a 22% “discount” from the assumed REO price of $92,000. I don’t think it’s unreasonable to believe there might be buyers out there telling themselves that surely a servicer would rather lose 22% than 40%.

As we can see, however, it is really only the “post-FC” expenses that the servicer is “saving” in this deal, because the property seller has not, we assume, been making mortgage payments in a time-frame we will, for example purposes, consider to be equivalent to an “average” pre-FC period. You can, of course, and you would reduce the servicer’s expenses if the short sale were very fast, fast enough to make a meaningful difference in the servicer’s property expenses and interest costs. We’re just trying to keep the math constant to show, exactly, that you do have to sell not just “short” but “quick” to “pass” the servicer’s test here.

The second delinquent-owner column shows that the proposed deal doesn’t “pass” the servicer’s less-loss test until the sales price gets up to $84,000. That is still a “discount” from $92,000, if you choose to think of it that way, but not anywhere near a “lowball” offer.

The last two columns show how “psychological math” changes when we have a non-delinquent seller. In the first column, we assume a “rational” seller who understands that he needs to keep paying his mortgage until the sale takes place, meaning that he carries that “interest cost” and “pre-FC property expense” that the servicer would carry in the foreclosure scenario. Also, he will have to pony up at settlement for commission and typical concessions. If he is not particularly pressed for time here—he isn’t, after all, facing imminent foreclosure—then we’ll call his situation something like a “typical” marketing time for the property, which we are for simplicity’s sake making the equivalent of the foreclosure timeline. That scenario results in what should surely be an attractive deal to the servicer: a loss of only $22,000. With the property seller “paying” most of the costs that would otherwise have been the servicer’s. (I assume for example purposes that the legal costs of pre-foreclosure ($2,000) are equivalent to the legal/administrative costs to the servicer of processing a short sale.)

The only problem with that scenario, besides the fundamental question of the servicer’s motivation to accept loss when there is no delinquency to signal probable eventual foreclosure, is that this seller is displaying a set of behaviors I suggest might not be very common: wanting to sell quickly (compared to the years you might have to wait out a bust) but not too quickly (willing to pay out of pocket for sales commissions and market-driven concessions in order to get the best possible price in listing time comparable to the average 6-9 months of a foreclosure timeline). All while considering the monthly mortgage interest, taxes, and insurance as simply an inevitable expense that he needs to carry until he is approved by the servicer and relieved of ownership of the property.

My sense is that what we are actually seeing on the ground with non-delinquent short sale offers is probably closer to the second column: the one in which the seller in essence “decides” to “pass on” the sales costs and interest expense to the new buyer, to “get out without a loss.” (Again, I’m talking a certain kind of psychology here, not what you might call realistic math.) In this case, the seller presents the servicer with a “quick” low-ball price which will, he hopes, get him out before he incurs any more expense—expense here including the mortgage payment. The result of that? A loss to the servicer that is basically identical to the loss in the “failed” delinquent owner short sale.

In reality, of course, these costs that a “buyer” is taking are really costs that the servicer/investor is taking: it’s really the investor who ends up covering the transaction costs in most of these scenarios (because of the reduced sales price). Yet I don’t think enough prospective short-sellers have that in mind. Many, many people weren’t very good negotiators—or rational cost analysts—when they first bought these homes or took out these mortgages. It’s rather bizarre to think they’ll suddenly take a different view of things now, isn’t it? Our examples suggest that the deal most attractive to the servicer—the non-delinquent “typical” exposure or adequately-marketed property—is the one least likely to be offered. The “math of reality” works on these deals, but the “math of psychology” doesn’t.

My view is that, realistically, only the short sales with delinquent owners stand much of a chance of getting “passed” by servicers, and those few are being overtaken by events, namely, such a rapidly falling price environment that it’s hard to get that $84,000 bid and make it stick long enough to close the deal. This part is where servicer inability in so many cases to “just pull the trigger and close the deal” is hampering things, that being mostly a result of securitization rules requiring servicers to get investor/trustee approval, plus the endlessly updating numbers on those “models” that the servicers are using to find the “trigger point” where a short sale makes sense.

There are no doubt some bargains to be had for real estate investors looking into short sales, but for nearly anyone except an expert in certain markets, I think I’d suggest not wasting your time. Unless, that is, the listed “short” price has already been “pre-approved” by the owner’s servicer. That does sometimes happen; the seller will in that case have a letter from the servicer indicating the minimum allowable sales price/maximum concessions. It will also help to be working with a real estate agent who knows more than a little about doing short sales. Otherwise I suspect you’ll end up waiting for Godot. I hate to spoil the plot, if you’ve never seen that play, but in the end he never arrives.

Saturday, March 21, 2009

Banks Leaving Money on the Table "All Day Long"

by Calculated Risk on 3/21/2009 10:24:00 PM

If you missed this, Zach Fox at the North County Times had an incredible story: HOUSING: Banks selling properties in bulk for cheap

For example, a unit of Citigroup, the troubled financial giant, sold a foreclosure in Temecula to an Arizona investment firm for $139,000 when comparable homes in the area were selling for $240,000 to $260,000.Citi just left $100,000 on the table.

The firm listed the home for $249,000, received multiple offers and the property has entered escrow, said Amber Schlieder, the real estate agent who handled the listing.

I hear stories like this all the time.

Here is a short video from KCET with a couple more examples (these are short sales):

Clearly the banks are overwhelmed and the process is broken. Maybe there is an opportunity here for added transparency ...

Saturday, May 03, 2008

Orange County, CA Prices: From Front Page to Short Sale

by Calculated Risk on 5/03/2008 06:11:00 PM

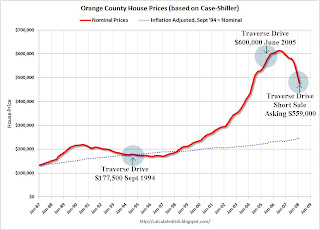

Update: Since I posted, the price has been slashed to $439K (hat tip DeathtoSpeculators). This is even a little below the February price according to Case-Shiller, but is still well above the likely eventual price.

This is an update to the story posted yesterday: From Front Page (in 2005) to Short Sale.

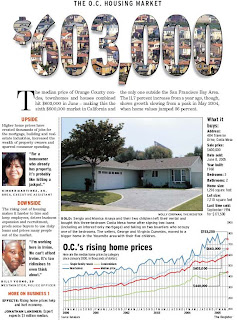

That house was featured on the front page of the O.C. Register - as a median priced home - when the median crossed $600,000 back in 2005. The same house is now offered for sale as a short sale.

There is no Case-Shiller index for Orange County alone (update: LA includes Orange County - hat tip sanity clause), for this graph I averaged the Los Angeles and San Diego indices: Click on graph for larger image.

Click on graph for larger image.

This graph shows the nominal prices for Orange County using the prices for the Traverse Drive house in 1994 as a reference.

Note: click here for front page story of Traverse Drive house in the July 19, 2005 O.C. Register.

It appears the price for the Traverse Drive house followed the Case-Shiller index pretty closely. It is now being offered as a short sale for $559 thousand, well above the $475 thousand that the Case-Shiller index would suggest for February 2008.

The dashed line shows the inflation adjusted prices, based on the Sept 1994 sales price. To reach the inflation adjusted price, the Traverse Drive house price would have to decline to $246 thousand - almost another 50% from the current Case-Shiller indicated price!

For areas with limited land and zoning restrictions (like Orange County), house prices might rise faster than inflation (depending on income growth). Even with a real annual price increase of 1% to 2% (on top of inflation), the Traverse Drive house would still only be selling for $280 to $320 thousand today (based on the '94 price)

Yes, nominal prices in Orange County are off about 22% from the peak, and real prices (inflation adjusted) are off about 26% from the peak - but prices will probably fall significantly from here.

Friday, May 02, 2008

Stuff of Memories: From Front Page (in 2005) to Short Sale

by Calculated Risk on 5/02/2008 05:36:00 PM

The following image is of the front page of the O.C. Register from July 19, 2005. The featured house sold for $600K in July 2005, and is now listed on RedFin as a short sale for $559K (good luck!). (hat tip ID)  Click on photo for larger image.

Click on photo for larger image.

Click here for PDF of entire front page. The caption read:

SOLD: Sergio and Monica Anaya and their two children left their rental and bought this three-bedroom Costa Mesa home after signing two loans (including an interest-only mortgage) and taking on two boarders who occupy one of the bedrooms.Anyone surprised that didn't work out? The house previously sold in September 1994 for $177,500.

Using the Case-Shiller Home Price Indices for Los Angeles and San Diego (there is no index for Orange County), with typical appreciation for the area, the house should have sold for $567K to $592K in July 2005 based on the Sept '94 price. Pretty close.

Using the February 2008 Case-Shiller HPI, the house should now sell for $455K to $494K, well below the short sale asking price (once again based on the 1994 price).

One of the headlines in the Register is "Stuff of Memories", hence the title for this post. Another headline is "Expert expects $1 million median". Very funny.

Note that the 405 Freeway is directly behind the house (see freeway sign in photo).

View Larger Map

Thursday, April 24, 2008

Brokers Complain About Their Own Opinions

by Tanta on 4/24/2008 08:46:00 AM

Reuters has the news:

LIVONIA, Michigan (Reuters) - Realtors in many U.S. states say lenders are demanding excessively high prices before allowing distressed borrowers to offload their homes in "short sales," making the housing crisis worse.Below market, huh? And I thought the idea was they were trying to sell these homes at market, which unfortunately happens to be less than the loan amount. Whatever. My head is still spinning over the banks having "touted" such sales. Was I having a nap when that happened? How come nobody woke me up?

In a short sale, a borrower dumps the home at below-market value and the bank forgives the rest of the debt. The borrower's credit rating is hurt but for less time than in a foreclosure. Such sales have been touted by banks as a way out for homeowners unable to pay their mortgages.

We get one "example":

Borrowers like Judie Quinn echo that, saying their lenders have been uncooperative and have passed up solid offers.How much does Judie owe on this house? We didn't get that part. Could the fact that the home had been "on sale" for two years before Judie decided she needed to sell short imply something problematic about Judie's expectations? When did she acquire this property, anyway? And at what exact time yesterday was her Real Estate Professional born? Nobody at the bank mentioned that short sales are widely held to be "work out options" for delinquent loans? That without any indication that the lender would have to foreclose, the lender is not highly motivated to accept a short sale that is "less loss" than the foreclosure that doesn't appear to be on the table? The bank has to mention this?

Quinn, 67, is a steel industry sales representative whose home in the Detroit suburb of Belleville had been on sale since August 2005. After back surgery in 2007 left her with large medical bills and out of work for two months, she decided she could not afford the $2,200 monthly mortgage payment.

"I wanted to save my credit rating, so I tried to arrange a short sale," Quinn said at the Livonia, Michigan, office of Linda McGonagle, a Realtor at Quality GMAC Real Estate.

The loan was from Wells Fargo & Co (WFC.N: Quote, Profile, Research) and serviced through an affiliate, America's Servicing Co.

Between April and October 2007, Quinn received four offers, McGonagle said. The first offer of $289,900 -- the asking price was $299,000 -- was rejected by the lender because Quinn was not yet in loan default. "No one at the bank mentioned she had to be in default until after that offer was rejected," she said.

She said the lender ignored the third and best offer of $299,000 long after the bidder had given up. The home went into foreclosure in October.

"The lender was unresponsive and unhelpful, so Judie wasted time and money trying to do the right thing," McGonagle said. "I tell other agents to avoid short sales because you just can't win. This is a commission-based business and if you can't get deals done, you don't get paid," she added.

But I really liked this part:

Some Realtors said banks have an inflated view of what they can expect when home values in many areas have fallen sharply.Banks have inflated ideas of what these houses could sell for. How come? Because they rely on "price opinions" that are prepared by real estate brokers. Like the real estate brokers quoted in the article. Who are now claiming that it's really only the appraisers who have any clue. Because they've been "called on the carpet" and now are afraid to make stuff up.

"Some lenders harbor unrealistic expectations of what they can get in a down market," said Van Johnson, president of the Georgia Association of Realtors.

He said widespread use by lenders of "broker price opinions" -- quick, inexpensive online property assessment -- resulted in only a "simple best guess."

Andrea Gellar, a Realtor at Sudler Sotheby's in Chicago, said property appraisals there are fair because "appraisers are being called on the carpet to be accurate" after years of inflated evaluations during the property boom.

The solution seems obvious to me: welcome to the carpet, brokers. We expect your next price opinion to be somewhat more sober.

Friday, October 05, 2007

Homeowners "Too Broke to Sell"

by Calculated Risk on 10/05/2007 12:00:00 AM

From the Chicago Tribune: Here's a new one: Being too broke to sell

A survey of mortgage brokers suggests that one in three consumers who recently signed purchase contracts canceled in August -- up from just 4 percent three years ago, according to the research firm that conducted the survey for Inside Mortgage Finance, a trade journal.Actually this isn't "new"; if the seller is making the payments - and can afford the payments - the lender won't do a short sale. The only way out is for the seller to bring cash to the closing. I wrote about this in March: Escrow to Seller: "Bring Money". Tanta called this "making your downpayment after the fact."

The cancellation rate undoubtedly was fed by two scenarios playing out: Many buyers couldn't get mortgage approval because lending suddenly tightened; or, financially strained lenders yanked funding from their borrowers at the last minute.

But another factor was at work: Sellers -- not buyers -- were in trouble as their closing dates neared.

"Our office had four sales in one week that failed to close because the seller didn't have the cash," said the real estate agent, who declined to be identified because she feared office repercussions.