by Calculated Risk on 5/03/2008 06:11:00 PM

Saturday, May 03, 2008

Orange County, CA Prices: From Front Page to Short Sale

Update: Since I posted, the price has been slashed to $439K (hat tip DeathtoSpeculators). This is even a little below the February price according to Case-Shiller, but is still well above the likely eventual price.

This is an update to the story posted yesterday: From Front Page (in 2005) to Short Sale.

That house was featured on the front page of the O.C. Register - as a median priced home - when the median crossed $600,000 back in 2005. The same house is now offered for sale as a short sale.

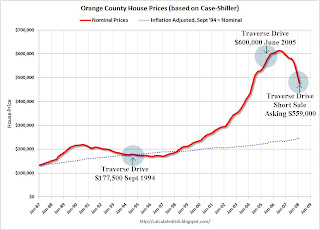

There is no Case-Shiller index for Orange County alone (update: LA includes Orange County - hat tip sanity clause), for this graph I averaged the Los Angeles and San Diego indices: Click on graph for larger image.

Click on graph for larger image.

This graph shows the nominal prices for Orange County using the prices for the Traverse Drive house in 1994 as a reference.

Note: click here for front page story of Traverse Drive house in the July 19, 2005 O.C. Register.

It appears the price for the Traverse Drive house followed the Case-Shiller index pretty closely. It is now being offered as a short sale for $559 thousand, well above the $475 thousand that the Case-Shiller index would suggest for February 2008.

The dashed line shows the inflation adjusted prices, based on the Sept 1994 sales price. To reach the inflation adjusted price, the Traverse Drive house price would have to decline to $246 thousand - almost another 50% from the current Case-Shiller indicated price!

For areas with limited land and zoning restrictions (like Orange County), house prices might rise faster than inflation (depending on income growth). Even with a real annual price increase of 1% to 2% (on top of inflation), the Traverse Drive house would still only be selling for $280 to $320 thousand today (based on the '94 price)

Yes, nominal prices in Orange County are off about 22% from the peak, and real prices (inflation adjusted) are off about 26% from the peak - but prices will probably fall significantly from here.