by Calculated Risk on 5/11/2009 11:31:00 PM

Monday, May 11, 2009

Vacant Retail Space: Advertising Bonanza!

From the NY Times: As Storefronts Become Vacant, Ads Arrive

Almost every category of advertising is declining precipitously in this economy, but there is one that is thriving. ...Yeah ... "much easier to acquire locations". I bet!

Taking advantage of all the abandoned retail spaces in urban areas, marketers are leasing them at cut-rate prices and filling them with their ads.

...

“In the last year and a half, it’s been much easier to acquire locations,” said [Ray Lee, the managing director of ... a company that creates storefront advertisements].

Thursday, April 16, 2009

General Growth Properties Files Bankruptcy

by Calculated Risk on 4/16/2009 08:13:00 AM

From the WSJ: Mall Titan Enters Chapter 11

Mall owner General Growth Properties Inc. sought bankruptcy protection early Thursday in one of the largest real-estate failures in U.S. history ...The Mall is Flattened ...

The bankruptcy will have far-reaching implications for the mall industry, including putting pressure on already declining property values of U.S. malls ...

Tuesday, April 14, 2009

Retail Sales Decline in March

by Calculated Risk on 4/14/2009 08:30:00 AM

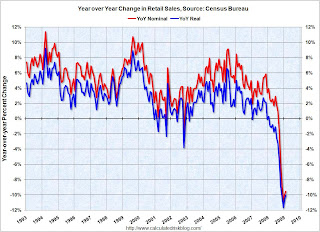

On a monthly basis, retail sales decreased 1.1% from February to March (seasonally adjusted), but sales are off 10.7% from March 2008 (retail and food services decreased 9.4%). Automobile and parts sales declined 2.3% in March (compared to February), but excluding autos, all other sales declined -0.9%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (March PCE prices were estimated as the same increase from January to February).

Although the Census Bureau reported that nominal retail sales decreased 10.7% year-over-year (retail and food services decreased 9.4%), real retail sales declined by 11.6% (on a YoY basis).  The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been somewhat stable the last four months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.4 billion, a decrease of 1.1 percent (±0.5%) from the previous month and 9.4 percent (±0.7%) below March 2008. Total sales for the January through March 2009 period were down 8.8 percent (±0.5%) from the same period a year ago. The January 2009 to February 2009 percent change was revised from -0.1 percent (±0.5%)* to +0.3 percent (±0.3%).Seasonally adjusted Q1 retail sales are still about 1.5% below sales in Q4, but have been at about the same level since December.

Gasoline stations sales were down 34.0 percent (±1.5%) from March 2008 and motor vehicle and parts dealers sales were down 23.5 percent (±2.3%) from last year.

Although Q1 GDP will be very weak - because investment fell off a cliff and there was apparently a significant inventory correction - Q1 PCE will probably be close to neutral.

Wednesday, April 08, 2009

Mall Vacancy Rate Increases Sharply in Q1

by Calculated Risk on 4/08/2009 12:32:00 AM

From Bloomberg: Vacancies at U.S. Retail Centers Hit 10-Year High, Reis Says

Retail vacancies at shopping centers were the highest since Reis began publishing quarterly data in 1999 and reflected a net decrease in occupied space of 8.7 million square feet, the biggest drop for a single quarter and more than the 8.65 million square feet given back during all of 2008.

Rents paid by tenants fell 1.8 percent from the previous quarter and 2.9 percent from a year ago ...

The vacancy rate at neighborhood and community shopping centers rose to 9.5 percent from 8.9 percent the previous quarter and 7.7 percent a year ago ...

Vacancies at regional malls and super-regional malls ... climbed to 7.9 percent from 7.1 percent in the fourth quarter and 5.9 percent a year earlier ...

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007.

Double digits, here we come ...

More from Reuters: Vacancies soar at US strip and regional malls-Reis

Barring a significant economic change, Reis does not expect vacancies to stabilize until sometime in the middle of 2012 if an overall U.S. economic recovery appears next year.

Thursday, March 26, 2009

More Retail Space Coming

by Calculated Risk on 3/26/2009 02:51:00 PM

From Kris Hudson at the WSJ: Developers Scale Back Luxury Projects as Economy Shifts

Amid the worst retail climate in decades, a number of shopping developments are slated to open this year ...For certain retail space, the absorption rate is negative because of all the store closings and retailer bankruptcies. Vacancy rates are already climbing sharply, and this additional 78 million square feet of retail space will push up the vacancy rate even more.

Real-estate developers are expected this year to complete more than 78 million square feet of new retail space in the top 54 U.S. markets, according to real-estate-research company Property & Portfolio Research Inc. While that is down from the 144 million square feet completed last year -- the peak number this decade -- the amount expected this year probably is more than the market can absorb in its second year of a recession.

...

The situation is a reminder of the vulnerabilities of commercial real-estate development to changes in the economy. Because it can take years to get a project from conception to completion, projects that sounded like a great idea a few years ago are fast becoming problematic for developers.

Thursday, March 12, 2009

Retail Sales: Some Possible Stabilization

by Calculated Risk on 3/12/2009 08:30:00 AM

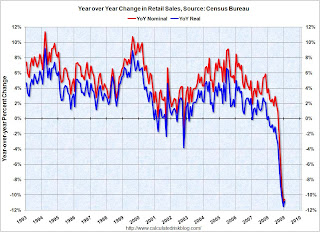

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (February PCE prices were estimated as the same as January).

Although the Census Bureau reported that nominal retail sales decreased 9.5% year-over-year (retail and food services decreased 8.6%), real retail sales declined by 10.0% (on a YoY basis). The YoY change decreased slightly from last month. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been stable the last three months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $346.8 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.6 percent (±0.7%) below February 2008. Total sales for the December 2008 through February 2009 period were down 9.4 percent (±0.5%) from the same period a year ago. The December 2008 to January 2009 percent change was revised from +1.0 percent (±0.5%) to +1.8 percent (±0.2%).All things considered, this is a decent retail sales report. Q1 retail sales are still about 1.4% below sales in Q4, but it appears that sales might have stabilized - especially ex-auto.

It now appears that Q1 GDP will be very weak - because investment is falling off a cliff and there is a significant inventory correction in progress - but Q1 PCE might only be slightly negative.

Note: February is typically the weakest retail month of the year, so the seasonal adjustment is the largest - and during periods of rapid change this can distort the data a little.

Friday, February 13, 2009

Tough Times for Restaurants

by Calculated Risk on 2/13/2009 08:53:00 AM

From Jerry Hirsch at the LA Times: Cost-conscious customers wreaking havoc on ailing restaurants

From the corner diner to elegant Westside eateries, restaurants in Southern California are shrinking portions, slashing wine prices, cutting employee hours and reducing staff. Some chain restaurants and fast-food purveyors are shutting unprofitable branches, and experts say some may not survive.Dining out is a discretionary expense, and it no suprise that many restaurants are getting hit hard. We can see this in the Restaurant Performance Index from the National Restaurant Association (NRA). Low end chains however might do OK as consumers move to inferior goods; McDonald's same-store sales rose 7.1% in January!

Many large dinner-house chains are reporting some of the largest drops in same-store sales -- an important measure of a retailer's financial health -- in recent history.

After the stock market closed Thursday, Southern California chains Cheesecake Factory Inc. and California Pizza Kitchen Inc. both reported plunging same-store sales and profits.

"It is a very tough environment out there," said Richard Rosenfield, co-chief executive of CPK

...

Cheesecake Factory said ... Same-store sales decreased 7.1% ... CPK said ... Same-store sales slid 7.2%.

The WSJ has an article too: Consumers Cut Food Spending Sharply

Consumers have cut back sharply on food spending, shunning restaurants, opting for generic products over brand names, trading in lattes for home-brewed coffee and shopping for bargains. That is hurting sales and profits at many food processors, grocery chains and restaurants.More cliff diving.

...

In 2008's fourth quarter, consumer spending on food fell at an inflation-adjusted 3.7% from the third quarter, according to data from the Commerce Department's Bureau of Economic Analysis. That is the steepest decline in the 62 years the government has compiled the figure.

Thursday, February 12, 2009

Retail Sales Increase Slightly in January

by Calculated Risk on 2/12/2009 08:30:00 AM

On a monthly basis, retail sales increased slightly from December to January (seasonally adjusted), but sales are off 10.6% from January 2008 (retail and food services decreased 9.7%).

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (January PCE prices were estimated as the same as December).

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.6 billion, an increase of 1.0 percent (±0.5%) from the previous month, but 9.7 percent (±0.7%) below January 2008. Total sales for the November 2008 through January 2009 period were down 9.5 percent (±0.5%) from the same period a year ago. The November to December 2008 percent change was revised from –2.7 percent (±0.5%) to –3.0 percent (±0.2%).One month does not make a trend change, and January retail sales are still over 2% below sales in Q4 - suggesting a further decline in Q1 PCE.

Monday, February 02, 2009

Macy's Cut 7,000 Jobs, Reduces Capital Spending Plans Again

by Calculated Risk on 2/02/2009 01:30:00 PM

From MarketWatch: Macy's cutting 4% of workforce, quarterly dividend

Macy's ... said Monday ... it will slash 7,000 jobs [and] reduced its 2009 capital expenditures budget to about $450 million ...It was just last November that Macy's cut their 2009 capital spending plans from $1 billion to $550 to $600 million. From an 8-K SEC filing in November 2008:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."

Terry J. Lundgren, Macy's, Nov 12, 2008

Sunday, February 01, 2009

Falling Retail Rents in New York

by Calculated Risk on 2/01/2009 05:19:00 PM

From the NY Times: Recession Has Landlords of Retail Tenants Extending Discounts of Their Own

“There are an awful lot of empty stores, but what is more damaging for the landlords is that most of the other stores are empty — not empty physically, but people aren’t shopping,” [Mayor] Bloomberg said.The problems are just beginning for New York.

...

[M]any landlords find themselves in a bind because they paid stiff prices for property in recent years and need to cover hefty mortgage payments. On average, Manhattan landlords paid $3,348 per square foot for retail properties in 2008, compared with $538 per square foot in 2004, according to the brokerage Cushman & Wakefield.

...

While New York City’s retail vacancy rate has remained relatively low at 4.7 percent, it grew faster than in any other major city between the third quarter of 2007 and the third quarter of 2008, according to Marcus & Millichap Research Services.

And rents have started to drop even on busier shopping districts like Madison Avenue, where a Grubb & Ellis report issued last month predicted that rents could fall by as much as 30 percent this year.

Wednesday, January 14, 2009

More Retailer Bankruptcies

by Calculated Risk on 1/14/2009 01:46:00 PM

From Bloomberg: Gottschalks, Goody’s Seek Bankruptcy as Sales Slump

Gottschalks Inc., the owner of department stores in six western states, and Goody’s LLC, a clothing chain serving towns in the southern and central U.S., sought bankruptcy protection after sales slumped.Goody's was founded in 1953. These are long term retailers.

Gottschalks, founded in 1904 in Fresno, California, is looking for a buyer. Goody’s, based in Knoxville, Tennessee, plans to liquidate ...

Away from retail, Nortel filed bankruptcy today too.

Retail Sales Collapse in December

by Calculated Risk on 1/14/2009 08:32:00 AM

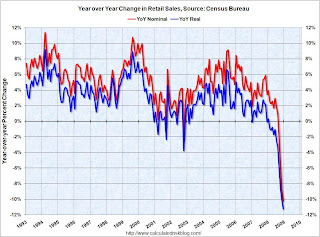

The following graph shows the year-over-year change in nominal and real retail sales since 1993.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (December PCE prices was estimated as the same as November).

Although the Census Bureau reported that nominal retail sales decreased 10.2% year-over-year (retail and food services decreased 9.8%), real retail sales declined by 11.3% (on a YoY basis). This is the largest YoY decline since the Census Bureau started keeping data.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $343.2 billion, a decrease of 2.7 percent (±0.5%) from the previous month and 9.8 percent (±0.7%) below December 2007. Total sales for the 12 months of 2008 were down 0.1 percent (±0.4%)* from 2007. Total sales for the October through December 2008 period were down 7.7 percent (±0.5%) from the same period a year ago. The October to November 2008 percent change was revised from -1.8 percent (±0.5%) to -2.1 percent (±0.3%).

Retail trade sales were down 2.7 percent (±0.5%) from November 2008 and were 10.8 percent (±0.7%) below last year. Gasoline stations sales were down 35.5 percent (±1.5%) from December 2007 and motor vehicle and parts dealers sales were down 22.4 percent (±2.3%) from last year.

Retail sales are a key portion of consumer spending and real retail sales have fallen off a cliff.

Monday, January 12, 2009

Retail Bankruptcy: Shane Jewelry

by Calculated Risk on 1/12/2009 05:18:00 PM

These will become too common to list them all ... the story also notes ShopperTrak is predicting that retail sales will likely drop 4 percent in the first quarter.

From Bloomberg: Shane Co., U.S. Jewelry Retailer, Seeks Bankruptcy

Shane Co., the family-owned jewelry retailer with 23 stores in 14 states, sought bankruptcy court protection blaming “disappointing” holiday sales and a “grim” outlook on the deepening U.S. recession.Note: The Census Bureau will release Q4 retail sales on Wednesday, and those numbers are guaranteed to be UGLY.

The 38-year-old company, based in Centennial, Colorado, listed both assets and debt of $100 million to $500 million in Chapter 11 documents filed today in U.S. Bankruptcy Court in Denver.

Sunday, January 11, 2009

Retailer Bankruptcy Filings Expected

by Calculated Risk on 1/11/2009 08:24:00 PM

From the WSJ: Wave of Bankruptcy Filings Expected From Retailers in Wake of Holidays

... U.S. retailers are expected to begin a wave of post-holiday bankruptcy filings, altering the landscape at malls and on main streets across the country.Poor sales, too much debt and tighter lending standards ... the BK attorneys will probably be busy!

Retailers are particularly vulnerable in the current downturn after a decade of buoyant consumer spending, which encouraged them to overexpand and overborrow. Now, the banks and private investors who financed the boom are pulling back.

Several of the industry's biggest lenders, including General Electric Co.'s GE Capital, CIT Group Inc. and Wachovia Corp., are tightening lending terms and reducing exposure to retailers.

Their tougher terms are making it harder for retailers to find capital to reorganize under bankruptcy-court protection, as they were able to do in the past, meaning there are likely to be more liquidations.

Thursday, January 08, 2009

Wal-Mart Reports Disappointing Sales

by Calculated Risk on 1/08/2009 09:25:00 AM

From the WSJ: U.S. Retailers Post Weak Same-Store Sales

Wal-Mart reported its U.S. same-store-sales, excluding gasoline, grew 1.7% amid a 1.9% increase at its namesake chain and 0.1% rise at Sam's Club.Wal-Mart sales had held up pretty well as consumers switched to inferior goods, but now it appears December was especially weak. This is more evidence of a sharp slow down last month.

Vice Chairman Eduardo Castro-Wright said the company, which last month projected growth at the higher end of the quarter's predicted 1% to 3% advance, said Thursday the holidays were more challenging than expected for retailers because of the economy and "severe winter weather" in some parts of the country."

Wednesday, January 07, 2009

Marks & Spencer CEO: "the sharpest downturn in the shortest time"

by Calculated Risk on 1/07/2009 06:03:00 PM

From the Guardian: M&S chief pleads for government help after sales slump

Marks & Spencer chief Sir Stuart Rose today called on the government to do all it could to restore consumer confidence as the high street giant unveiled dire Christmas trading, the closure of 27 stores and confirmed more than 1,200 staff were to be axed in a bid to cut costs.I suspect December retail sales will be very ugly (worse than October and November).

...

The 125-year-old retailer, which has 600 outlets, said like-for-like sales were down 7.1% in the 13 weeks to 27 December, despite holding two one-day pre-Christmas sales, when 20% was slashed off the price of all goods. Like-for-like sales of general merchandise – clothing and homewares – were down nearly 9% and food sales declined 5.2% from 2007 levels.

...

Rose said the looming recession was "the sharpest downturn in the shortest time" he had witnessed in 38 years in the retail business, and the outlook remained challenging.

Friday, December 26, 2008

WSJ: Retailers Brace for Major Change

by Calculated Risk on 12/26/2008 08:55:00 PM

From the WSJ: Retailers Brace for Major Change a few excerpts:

More Bankruptcies: Corporate-turnaround experts and bankruptcy lawyers are predicting a wave of retailer bankruptcies early next year, after being contacted by big and small retailers either preparing to file for Chapter 11 bankruptcy protection or scrambling to avoid that fate.January is usually the busiest month for retailer bankruptcies ... and 2009 will probably be especially busy.

Analysts estimate that from about 10% to 26% of all retailers are in financial distress and in danger of filing for Chapter 11. AlixPartners LLP, a Michigan-based turnaround consulting firm, estimates that 25.8% of 182 large retailers it tracks are at significant risk of filing for bankruptcy or facing financial distress in 2009 or 2010. In the previous two years, the firm had estimated 4% to 7% of retailers then tracked were at a high risk for filing.

...

Store Closings: The International Council of Shopping Centers estimates that 148,000 stores will close in 2008, the most since 2001, and it predicts that there will be an additional 73,000 closures in the first half of 2009.

Note:light posting for the next few days. Best to all.

Thursday, December 25, 2008

More Bad News for Retail Sales

by Calculated Risk on 12/25/2008 09:45:00 PM

From the WSJ: Retail Sales Plummet

[T]otal retail sales, excluding automobiles, fell over the year-earlier period by 5.5% in November and 8% in December through Christmas Eve, according to MasterCard Inc.'s SpendingPulse unit.These preliminary numbers suggest that retail sales in December were even weaker than in October and November.

When gasoline sales are excluded, the fall in overall retail sales is more modest: a 2.5% drop in November and a 4% decline in December.

"This will go down as the one of the worst holiday sales seasons on record," said Mary Delk, a director in the retail practice at consulting firm Deloitte LLP.

Sunday, December 21, 2008

UK: Up to 15 national retail chains expected to go BK in January

by Calculated Risk on 12/21/2008 12:19:00 PM

From The Times: High street braced for Christmas sales carnage

UP to 15 national retail chains are predicted to go bust before the middle of January, forcing thousands more shopworkers onto the dole.The pattern will probably be similar in the U.S. with a number of retailers filing for bankruptcy in January (usually the worst month of the year for retail BKs), with more retail layoffs, and even more empty retail stores (see: Retail Space to be Vacated from some retail numbers from reader wc)

The prediction came from insolvency expert Begbies Traynor as well-known retail chains clamour to sell enough goods to meet their quarterly rent payments on Christmas Day. Nick Hood, partner at Begbies Traynor ... refused to name specific store groups, but this weekend it emerged that The Officers Club, a 150-strong national menswear chain, had been put up for distressed sale through KPMG, while the specialist tea retailer, Whittards, and music store Zavvi remained on the critical list.

...

Rupert Eastell, head of retail at BDO Stoy Hayward, said: “From tomorrow until mid-January, it’s going to be the worst three weeks for retailers in 20 years.”

Tuesday, December 16, 2008

Best Buy Cites "Historic Slowdown", cuts Capital Spending Plans in Half

by Calculated Risk on 12/16/2008 09:00:00 AM

Press Release:

“The historic slowdown in the economy and its effect on our business over the past 90 days have been the most challenging consumer environment our company has ever faced,” said Brad Anderson, vice chairman and CEO of Best Buy. “We believe that there has been a dramatic and potentially long-lasting change in consumer behavior as people adjust to the new realities of the marketplace."Company after company is announcing reduced capital spending plans, and this means non-residential investment will decline sharply next year.

...

"[B]ased on the recent changes we’ve seen in consumer behavior and the potential for worsening consumer spending, we need to prepare our organization to operate in a wide range of potential macro economic scenarios in the coming year. Additional prudent actions will be taken to prepare the business, such as reducing our capital spending by approximately 50 percent next year, including a substantial reduction in new store openings in the United States, Canada and China."

emphasis added