by Calculated Risk on 3/12/2009 08:30:00 AM

Thursday, March 12, 2009

Retail Sales: Some Possible Stabilization

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

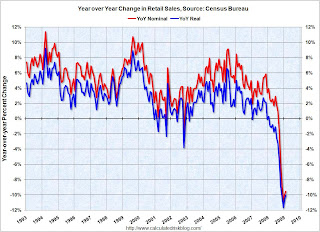

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (February PCE prices were estimated as the same as January).

Although the Census Bureau reported that nominal retail sales decreased 9.5% year-over-year (retail and food services decreased 8.6%), real retail sales declined by 10.0% (on a YoY basis). The YoY change decreased slightly from last month. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been stable the last three months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $346.8 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.6 percent (±0.7%) below February 2008. Total sales for the December 2008 through February 2009 period were down 9.4 percent (±0.5%) from the same period a year ago. The December 2008 to January 2009 percent change was revised from +1.0 percent (±0.5%) to +1.8 percent (±0.2%).All things considered, this is a decent retail sales report. Q1 retail sales are still about 1.4% below sales in Q4, but it appears that sales might have stabilized - especially ex-auto.

It now appears that Q1 GDP will be very weak - because investment is falling off a cliff and there is a significant inventory correction in progress - but Q1 PCE might only be slightly negative.

Note: February is typically the weakest retail month of the year, so the seasonal adjustment is the largest - and during periods of rapid change this can distort the data a little.